Elite Structured Settlement Funding Companies: What You Should Know

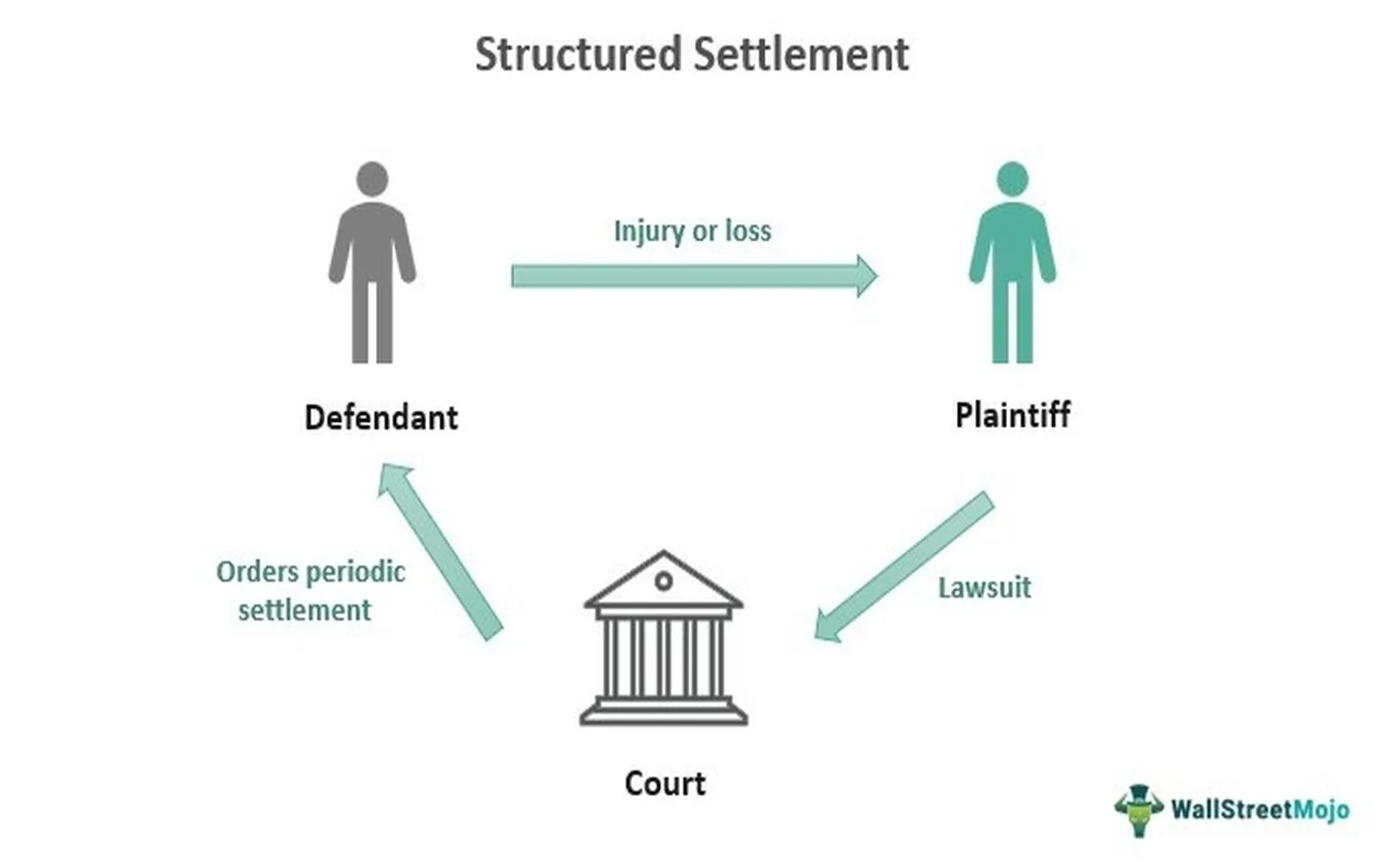

Structured settlements are a popular option for individuals who have received a settlement as part of a lawsuit or legal claim. Rather than receiving a lump sum, they receive periodic payments over time, providing financial security. However, in some cases, individuals may need access to the full value of their settlement immediately. This is where elite structured settlement funding companies come in. These companies offer specialized services to help individuals sell their structured settlements in exchange for a lump sum payment.

What Are Structured Settlements?

A structured settlement is an arrangement in which an individual receives regular payments over time rather than a lump sum settlement after a legal case. These settlements are typically structured to provide long-term financial security for the recipient, such as covering medical expenses, lost wages, or other damages. While they offer stable, tax-free income, some people may find that they need access to the full settlement amount sooner, whether due to unforeseen financial needs or life-changing events.

What is Structured Settlement Funding?

Structured settlement funding refers to the process by which individuals can sell their future structured settlement payments in exchange for a lump sum of cash. Funding companies act as intermediaries, providing the cash upfront and taking over the rights to the future payments. This process allows recipients to access a lump sum, which may be used to pay off debt, fund a business, or cover other immediate financial needs.

Elite structured settlement funding companies offer competitive rates, fast processing, and customized solutions that ensure you get the most value out of selling your settlement. These companies are known for their professionalism, transparency, and dedication to delivering optimal outcomes for their clients.

Why Choose Elite Structured Settlement Funding Companies?

1. Reliable and Trustworthy Services

Elite structured settlement funding companies are known for their reputation and reliability. They offer transparent terms, ensuring that you fully understand the terms of the transaction before moving forward. These companies are regulated by the government, ensuring that they adhere to strict industry standards and legal requirements, providing you with peace of mind throughout the process.

2. Competitive Lump-Sum Offers

When you sell your structured settlement to a funding company, you want to ensure that you’re getting a fair value for your payments. Elite funding companies have access to extensive resources and industry knowledge, enabling them to offer competitive lump-sum payouts. They will assess your structured settlement and offer a personalized deal that reflects the current value of your future payments while ensuring that you receive a fair price.

3. Fast and Efficient Processing

Elite structured settlement funding companies understand that you may need immediate access to cash. They work with you to expedite the process, ensuring you can access your funds quickly. From initial application to final payment, these companies streamline the process, often reducing wait times and providing you with the lump sum you need faster than traditional financial routes.

4. Expertise in Complex Cases

Structured settlement agreements can vary greatly, and some may have complex terms that require expert analysis. Elite funding companies have the experience and knowledge to handle even the most complicated settlements. Whether your settlement involves annuities, multiple beneficiaries, or other unique features, these companies can offer solutions tailored to your specific situation.

5. Customer-Centric Approach

Top-tier structured settlement funding companies put the needs of their clients first. They offer personalized consultations, taking the time to explain the entire process and answering any questions you may have. They will guide you through the legal steps required to sell your structured settlement, ensuring that everything is done according to the law and with your best interests in mind.

The Process of Selling a Structured Settlement

The process of selling a structured settlement involves several steps. While the exact steps may vary depending on the funding company, the general process is as follows:

- Initial Consultation: Contact an elite structured settlement funding company to discuss your situation. The company will assess your settlement agreement, including the payment amounts, frequency, and remaining term.

- Offer and Agreement: The company will make an offer based on the value of your future payments. If you accept the offer, they will prepare a purchase agreement outlining the terms and conditions.

- Court Approval: Because structured settlements are court-approved, a judge must review and approve the transaction. The court ensures that selling your settlement is in your best interest and that the terms are fair.

- Receiving Your Funds: Once the court approves the sale, the funding company will transfer the lump sum payment to you. Depending on the company and the specifics of the sale, this process can take anywhere from a few weeks to a few months.

Factors That Affect Your Lump-Sum Offer

Several factors influence the lump sum offer you will receive when selling your structured settlement. These include:

- The Remaining Term of the Settlement: Longer-term settlements may offer more value, but the total amount of the lump sum is also influenced by how many future payments are remaining.

- The Total Value of the Structured Settlement: The more significant the total value of your future payments, the higher your lump sum offer will likely be.

- Interest Rates: Since structured settlements are often tied to annuities, prevailing interest rates can impact the present value of future payments.

- The Payout Structure: Structured settlements with irregular or customized payout structures may affect the overall valuation.

Benefits of Selling Your Structured Settlement

- Immediate Access to Cash: The most obvious benefit of selling your structured settlement is immediate access to a lump sum of cash, which can be used for emergency expenses, investment opportunities, or other financial needs.

- Debt Relief: If you’re struggling with debt or high-interest loans, selling your structured settlement can provide the funds to pay off these obligations.

- Financial Flexibility: A lump sum payment allows you to have greater flexibility in managing your finances, especially if you’re planning a major life change, like purchasing a home or starting a business.

- Avoiding Future Payment Delays: If you’re concerned about future payment delays or fluctuations in the value of your settlement, selling your payments for a lump sum ensures that you have control over your finances.

Risks to Consider

While selling your structured settlement can offer significant benefits, it’s important to weigh the risks as well:

- Less Future Income: Once you sell your structured settlement, you will no longer receive regular payments, which may affect your long-term financial security.

- Potentially Lower Payout: The lump sum you receive may be less than the total amount of future payments you would receive under the original agreement.

- Legal and Court Approval: Selling a structured settlement requires court approval, which can take time and may result in delays.

Conclusion

Elite structured settlement funding companies provide individuals with a powerful financial tool to access the full value of their structured settlements. While selling your structured settlement can provide immediate cash flow, it’s essential to carefully consider the terms and ensure that it is in your best interest. By working with a reputable and experienced funding company, you can make a well-informed decision and benefit from the flexibility and financial relief that selling your structured settlement provides.

Explore

Selling a Structured Settlement Annuity: What You Need to Know

Exploring an Online Business Analytics Degree: What You Need to Know

Unlocking Innovation: The Top App Developers Every Startup Needs to Know

What You Should Know About Local Landscaping Services

Advances in Mesothelioma Treatment: What Patients Should Know in 2025

2025 Trends in Drainage Systems Every Homeowner Should Know

Navigating Legal Waters: How Settlement Agreement Attorneys Can Secure Your Peace of Mind

Top Trends in Bank Accounts for 2025: What You Need to Know