High Net Worth Management Services to Explore in 2025

As we approach 2025, High Net Worth Management Services will evolve to include innovative solutions such as impact investing, personalized wealth planning, and enhanced tax strategies. Clients can expect tailored investment portfolios and advanced risk management techniques, ensuring their assets are not only preserved but also grow sustainably. Staying ahead of market trends will be crucial for effective management.

As we approach 2025, the landscape of high net worth management services is evolving rapidly due to technological advancements, regulatory changes, and shifting client expectations. Wealth managers are increasingly focusing on personalized strategies and innovative solutions that cater to the unique needs of affluent clients. Below are some of the most promising wealth management trends and services to consider in the coming year.

1. Personalized Investment Strategies

High net worth individuals (HNWIs) are demanding more personalized approaches to their investment strategies. Wealth managers are leveraging data analytics and artificial intelligence to tailor investment portfolios that align with the specific financial goals, risk tolerance, and values of their clients. This shift towards customization allows for greater diversification and performance tracking, resulting in a more satisfying client experience.

2. Sustainable and Impact Investing

The growing awareness of environmental, social, and governance (ESG) factors is shaping investment decisions for many HNWIs. In 2025, we can expect a significant increase in sustainable investment opportunities. Wealth management firms are likely to offer more ESG-compliant funds and impact investing options, allowing clients to align their investments with their personal values. This not only helps in achieving financial returns but also contributes positively to society and the environment.

3. Advanced Tax Planning Strategies

As tax laws become more complex, high net worth individuals require comprehensive tax planning services. In 2025, wealth managers will likely focus on advanced tax strategies that include the utilization of trusts, family partnerships, and charitable foundations. These strategies aim to minimize tax liabilities while maximizing wealth transfer to future generations. Furthermore, advisors will increasingly use technology to simulate tax scenarios, helping clients make informed decisions.

4. Integration of Technology in Wealth Management

The integration of technology in wealth management is not just a trend but a necessity in 2025. Digital platforms and robo-advisors are becoming more sophisticated, allowing for seamless communication between clients and advisors. Wealth managers will use advanced tools to provide real-time reporting, performance analysis, and risk assessments. This level of transparency and efficiency is expected to enhance client satisfaction and retention.

5. Family Office Services

Family offices are gaining traction among high net worth families who seek a comprehensive approach to managing wealth. By 2025, we anticipate an increase in demand for family office services that include investment management, estate planning, and philanthropic advisory. These services help families maintain their wealth across generations while also addressing their specific needs and family dynamics.

6. Health and Wellness Investments

In a world increasingly focused on holistic well-being, high net worth individuals are recognizing the value of investing in their health and wellness. By 2025, we expect to see a rise in services that encompass wellness programs, health-related startups, and innovative healthcare solutions. Wealth managers will begin to incorporate these factors into their overall investment strategies, emphasizing the importance of health as an asset.

7. Regulatory Compliance and Risk Management

As regulations continue to evolve, compliance becomes even more critical for wealth management firms. By 2025, high net worth management services will likely place a stronger emphasis on compliance and risk management. Advisors will need to stay updated on regulatory changes and implement robust reporting systems to navigate the complexities of compliance. This will ensure that clients can maintain their wealth while adhering to legal standards.

8. Chart: High Net Worth Management Services Trends for 2025

| Trend | Description |

|---|---|

| Personalized Investment Strategies | Tailored investment portfolios using data analytics and AI. |

| Sustainable and Impact Investing | Increased focus on ESG factors and socially responsible investments. |

| Advanced Tax Planning Strategies | Utilization of trusts and charitable foundations for tax optimization. |

| Integration of Technology | Use of digital platforms for real-time reporting and analysis. |

| Family Office Services | Comprehensive wealth management for families. |

| Health and Wellness Investments | Focus on wellness programs and health-related startups. |

| Regulatory Compliance | Enhanced focus on compliance and risk management. |

The Future of High Net Worth Management

As we move towards 2025, the realm of high net worth management services will be characterized by innovation and adaptability. Wealth managers who embrace these trends and prioritize client needs will not only attract new clients but also retain existing ones. By focusing on personalization, sustainability, and technology, wealth management firms can ensure their services remain relevant and effective in an ever-changing financial landscape.

Explore

High-End Luxury Private Jet Charter: Elevating Travel to New Heights

Explore Top House Cleaning Services :Discover the Best Options for a Sparkling Home 2025

Explore Top Branding and Design Services for 2025: Elevate Your Business with Innovative Solutions

Explore the Best Home Services in the US: 2025 Guide

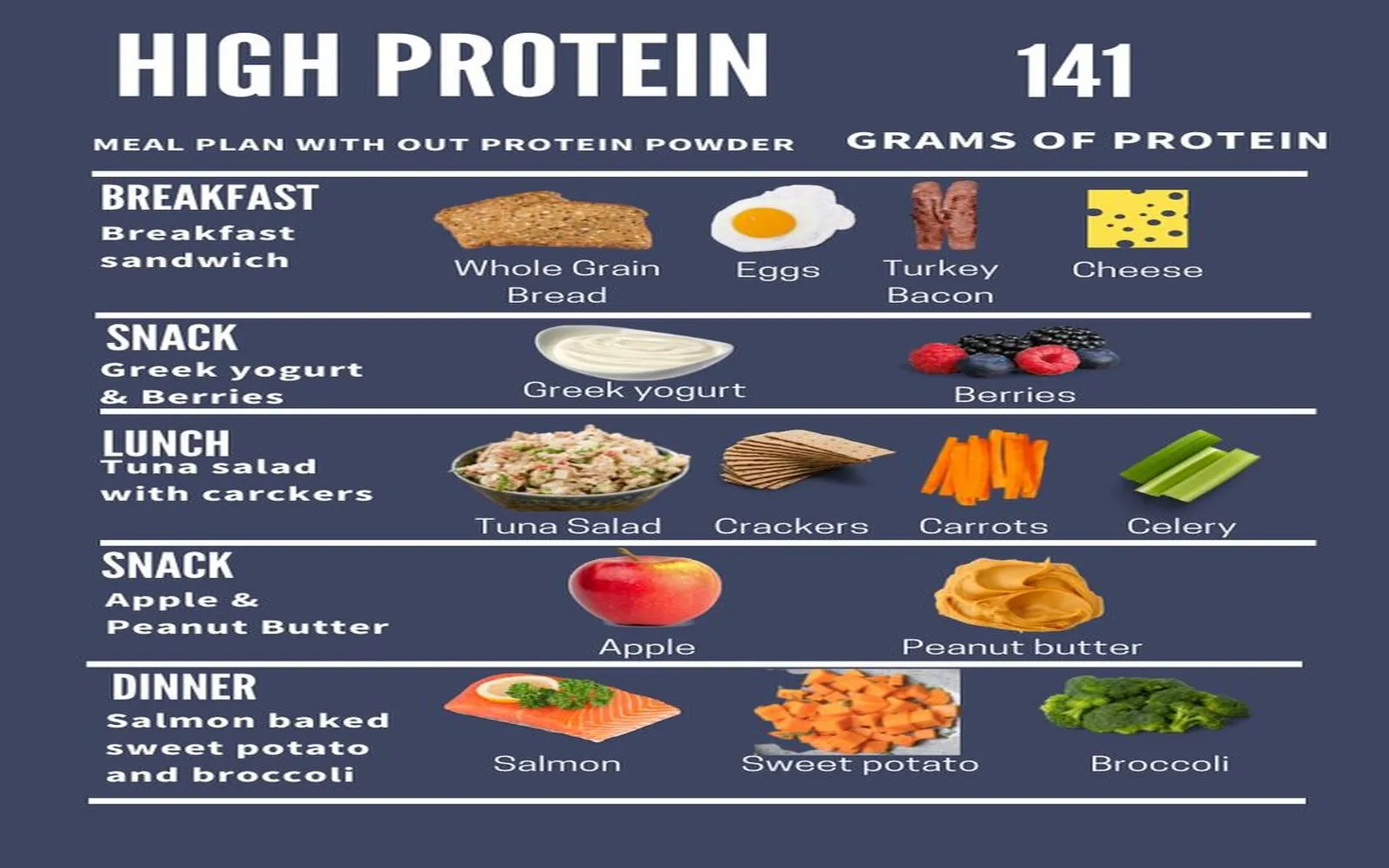

Power Up Your Plate: Discover the Best High-Protein Foods for a Healthier You

How to Get High-Paying Remote VA Jobs in 2025

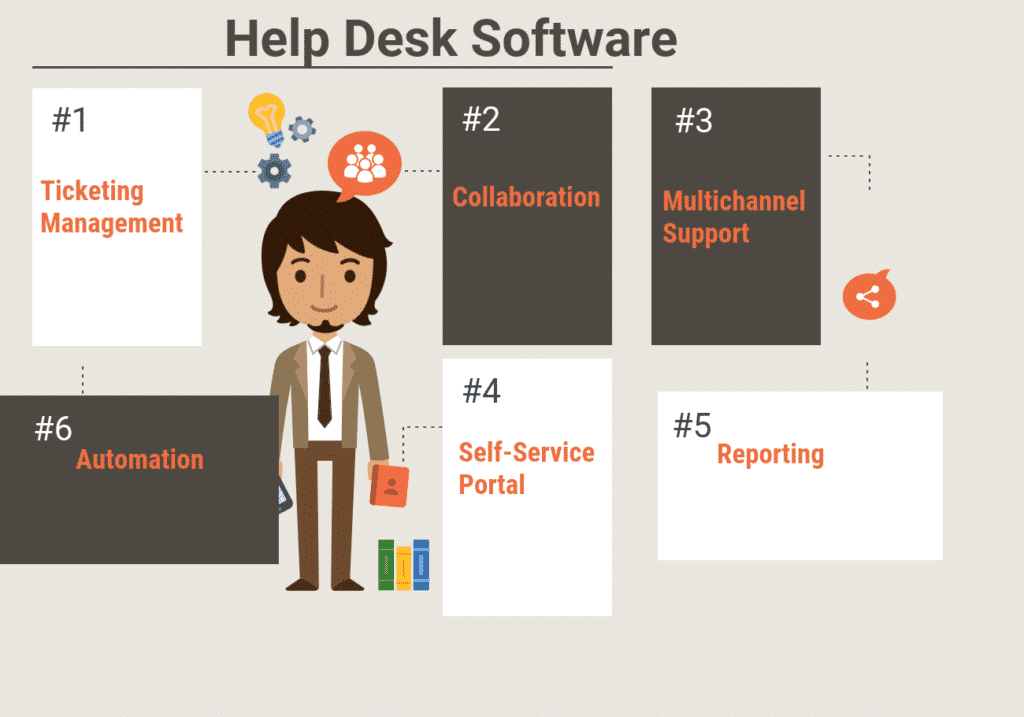

Explore the Best Help Desk Software Solutions 2025

Explore Top 10 Managed Service Providers (MSPs) for 2025