Top Business Loans for Women Entrepreneurs in 2025: Unlock Your Potential and Grow Your Business

Introduction

In 2025, the landscape for women entrepreneurs has evolved significantly, with a growing recognition of the unique challenges they face in securing funding. As women continue to break barriers and establish their businesses, access to financial resources becomes crucial for growth and sustainability. This article explores the top business loans tailored specifically for women entrepreneurs in 2025, providing insights into unlocking their potential and propelling their businesses forward.

The Importance of Business Loans for Women Entrepreneurs

Women entrepreneurs have made remarkable strides in various industries, contributing to economic growth and innovation. However, they often encounter systemic challenges when it comes to accessing capital. According to recent studies, women-owned businesses receive a smaller percentage of venture capital funding compared to their male counterparts. Therefore, business loans designed for women entrepreneurs play a vital role in leveling the playing field and enabling them to fulfill their dreams.

Types of Business Loans Available in 2025

In 2025, a variety of business loans are available, catering specifically to the needs of women entrepreneurs. Understanding these options can help women make informed decisions about their financing needs.

1. Microloans

Microloans are a popular option for women entrepreneurs, particularly those who are just starting or expanding their businesses. These loans are typically smaller amounts, ranging from $500 to $50,000, and are designed to help entrepreneurs cover initial costs, inventory, or operational expenses. Organizations like Kiva and Accion provide microloans with flexible repayment terms and lower interest rates, making them accessible for women-owned businesses.

2. SBA Loans

The Small Business Administration (SBA) offers several loan programs that are beneficial for women entrepreneurs. The SBA 7(a) loan is one of the most popular options, providing financing for a variety of business needs, including working capital, equipment purchases, and real estate. The SBA also has specific initiatives aimed at supporting women-owned businesses, such as the Women-Owned Small Business (WOSB) Federal Contracting Program, which allows women to access government contracts more easily.

3. Business Lines of Credit

A business line of credit provides women entrepreneurs with flexible access to funds, allowing them to withdraw money as needed up to a predetermined limit. This option is excellent for managing cash flow, covering unexpected expenses, or investing in growth opportunities. Institutions like Wells Fargo and Bank of America offer business lines of credit with competitive interest rates and terms tailored for women entrepreneurs.

4. Crowdfunding

Crowdfunding has emerged as an innovative way for women entrepreneurs to secure funding. Platforms like Kickstarter and Indiegogo allow entrepreneurs to present their ideas and attract funding from a community of supporters. This method not only provides financial support but also helps entrepreneurs validate their business concepts and build a customer base before launching their products or services.

5. Peer-to-Peer Lending

Peer-to-peer lending platforms such as Prosper and LendingClub connect borrowers directly with individual investors. This alternative financing option enables women entrepreneurs to secure loans with competitive interest rates, often without the stringent requirements typically associated with traditional banks. This model fosters a sense of community and support among borrowers and lenders.

Top Business Loan Providers for Women Entrepreneurs in 2025

With numerous lenders offering business loans specifically for women entrepreneurs, it’s essential to identify the top providers that stand out in terms of accessibility, support, and favorable terms.

1. Fundera

Fundera is a leading online marketplace that connects women entrepreneurs with various lenders and financing options. Their platform is user-friendly, allowing entrepreneurs to compare different loan products, understand the terms, and apply for loans that best suit their business needs. Fundera also offers resources and guidance specifically for women entrepreneurs, helping them navigate the lending landscape.

2. SheEO

SheEO is a unique global community of women who support and fund women-led ventures. Through their network, women entrepreneurs can apply for funding and receive mentorship and support from experienced business leaders. The SheEO model emphasizes collaboration and networking, making it an empowering choice for women seeking financing and guidance.

3. Goldman Sachs 10,000 Women Program

The Goldman Sachs 10,000 Women program is dedicated to providing women entrepreneurs with access to capital and education. This initiative offers business loans and grants, along with training programs designed to equip women with the skills needed to succeed in business. By combining financial support with education, Goldman Sachs is helping women entrepreneurs thrive in a competitive market.

4. Wells Fargo’s Women’s Business Services

Wells Fargo has established a dedicated Women’s Business Services division, providing tailored financial solutions for women entrepreneurs. From business lines of credit to SBA loans, Wells Fargo offers a range of products designed to meet the unique needs of women-owned businesses. Additionally, they provide resources and networking opportunities to help women grow their businesses effectively.

5. Kiva

Kiva is a nonprofit organization that facilitates microloans for entrepreneurs around the world. Women entrepreneurs can create a profile on the Kiva platform and seek funding from individual lenders who believe in their business vision. The loans are often interest-free or have very low interest rates, making Kiva a favorable option for women seeking to start or grow their businesses.

Qualifying for Business Loans

Qualifying for a business loan can be daunting, especially for women entrepreneurs who may face additional scrutiny. However, understanding the requirements and preparing accordingly can increase the chances of approval.

1. Business Plan

A well-structured business plan is essential when applying for a loan. It should outline the business’s goals, target market, competitive analysis, and financial projections. A comprehensive business plan demonstrates to lenders that the entrepreneur has a clear vision and is prepared to manage the business effectively.

2. Credit Score

Most lenders will evaluate the entrepreneur’s credit score to assess their creditworthiness. Women entrepreneurs should aim for a credit score of 650 or higher to improve their chances of approval. If your credit score is below this threshold, consider taking steps to improve it before applying for a loan.

3. Financial Statements

Providing accurate and up-to-date financial statements is crucial for loan applications. This includes profit and loss statements, balance sheets, and cash flow statements. Lenders use these documents to evaluate the business’s financial health and ability to repay the loan.

4. Collateral

Some lenders may require collateral to secure the loan. Women entrepreneurs should be prepared to offer assets, such as property, equipment, or inventory, as collateral. Having collateral can increase the likelihood of loan approval and may result in better terms.

5. Personal Guarantee

In many cases, lenders may ask for a personal guarantee from the entrepreneur. This means that the entrepreneur agrees to be personally responsible for repaying the loan. While this can be a concern for some, it is a common requirement that lenders use to minimize risk.

Empowering Women Entrepreneurs Through Education and Resources

In addition to securing funding, women entrepreneurs in 2025 have access to various educational resources and support networks designed to empower them in their business journeys.

1. Business Incubators and Accelerators

Business incubators and accelerators provide women entrepreneurs with mentorship, resources, and funding opportunities. Programs such as the Women’s Startup Lab and the Female Founders Fund focus on nurturing women-led businesses through training, networking, and access to investors. These programs create a supportive environment for women to develop their ideas and connect with like-minded individuals.

2. Online Learning Platforms

Online learning platforms like Coursera and Udemy offer courses specifically designed for women entrepreneurs. These courses cover various topics, including marketing, finance, and leadership skills, empowering women with the knowledge they need to succeed in their ventures. Additionally, many organizations offer webinars and workshops focused on women’s entrepreneurship.

3. Networking Events and Conferences

Networking is crucial for entrepreneurs, and women-focused networking events and conferences provide valuable opportunities to connect with industry leaders, potential investors, and fellow entrepreneurs. Events like the Women’s Business Enterprise National Council (WBENC) conference and the Women Entrepreneurs Grow Global summit are excellent platforms for building relationships and gaining insights into the latest trends in business.

4. Government Initiatives and Grants

In 2025, various government initiatives aim to support women entrepreneurs through grants and funding programs. The U.S. Small Business Administration offers resources specifically for women-owned businesses, including grants and contracts. Women entrepreneurs should stay informed about these opportunities to secure funding without the burden of repayment.

Conclusion

As we move further into 2025, the business landscape for women entrepreneurs continues to flourish, thanks to the increasing availability of tailored financial resources. The top business loans outlined in this article provide women with the necessary funding to unlock their potential and drive their businesses forward. By understanding the various loan options, qualifying requirements, and available support, women entrepreneurs can confidently navigate the path to success. Empowering women through education, resources, and financial support is not just a trend but a necessity for a thriving economy, and the future looks promising for women-led businesses.

Explore

Unlock Your Potential with Online Master's Degree Programs: A Guide to Advancing Your Education and Career

Unlock Your Potential with an Online Business Degree: The Path to Success Starts Here

Unlock Your Potential with an Online College Degree: The Future of Education is Here

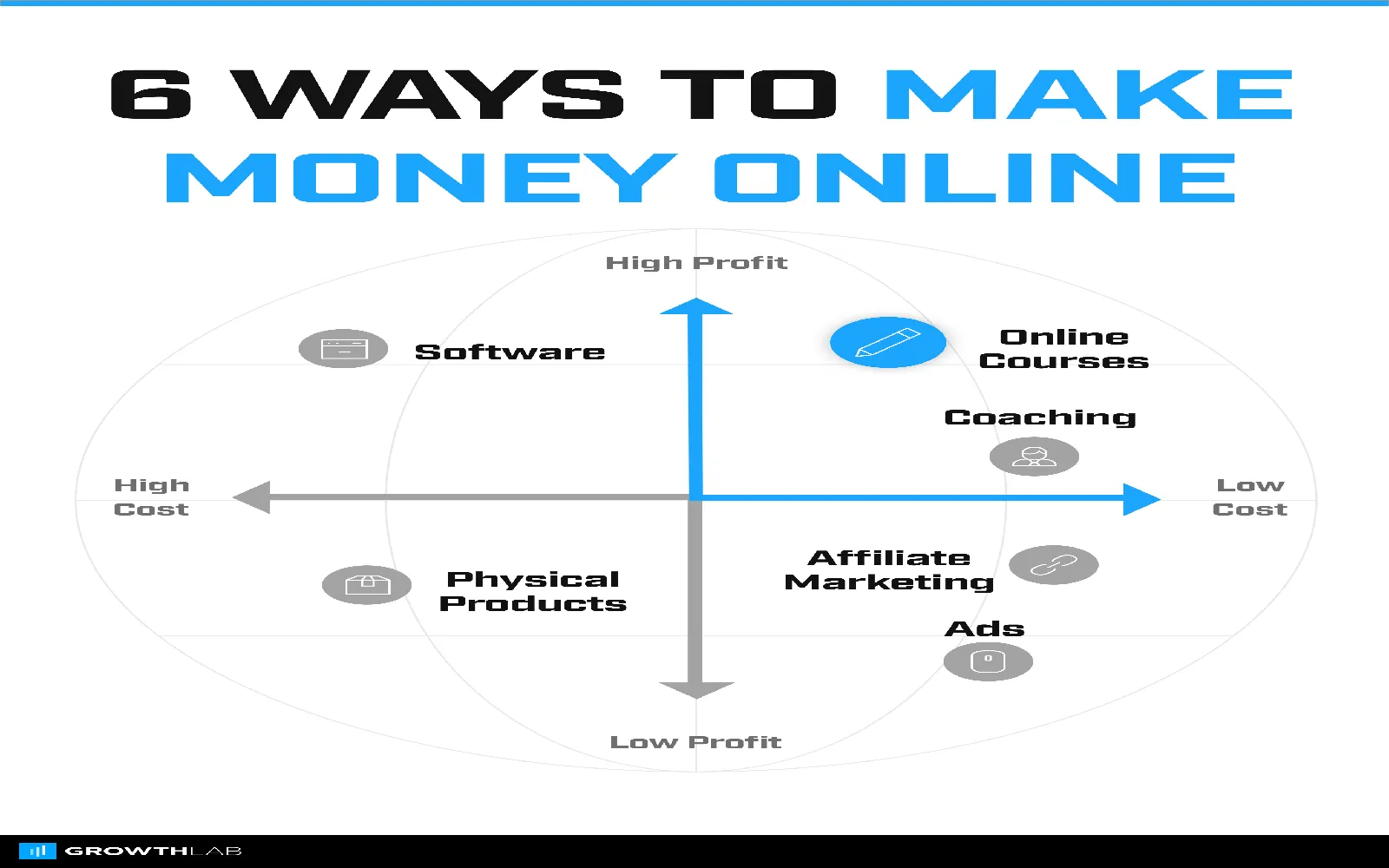

Unlocking Your Entrepreneurial Potential: A Step-by-Step Guide to Launching Your Online Business

Smart Investing in 2025: How to Start with Little Money and Grow Your Wealth

Best Passive Income Ideas to Grow Your Wealth in 2025

Unlock Your Health Potential: Explore the World of Nutrition Courses Today!