Top Financial Advisory Services for Businesses in 2025: Unlocking Growth and Success

Introduction

In the rapidly evolving business landscape of 2025, financial advisory services have become crucial for companies aiming to navigate complexities and seize growth opportunities. As businesses face increasing competition, regulatory changes, and technological advancements, having a trusted financial advisor can make all the difference. This article explores the top financial advisory services for businesses in 2025, highlighting how they can unlock growth and success.

The Role of Financial Advisory Services

Financial advisory services encompass a broad range of activities designed to assist businesses in managing their finances effectively. These services include strategic planning, investment management, risk assessment, tax planning, and mergers and acquisitions (M&A) advisory, among others. In 2025, the role of financial advisors has expanded to include not only traditional financial management but also leveraging technology and data analytics to provide insights that drive decision-making.

1. Strategic Financial Planning

Strategic financial planning remains at the core of any robust financial advisory service. In 2025, businesses face unique challenges that require a forward-thinking approach. Financial advisors work closely with businesses to develop comprehensive financial plans that align with their long-term goals. This includes budgeting, forecasting, and scenario analysis to prepare for various market conditions. By anticipating changes and trends, businesses can position themselves for sustainable growth.

2. Investment Management

Investment management services have evolved significantly, driven by technological advancements and changing market dynamics. Financial advisors in 2025 utilize advanced tools and algorithms to optimize investment portfolios, balancing risk and return effectively. They provide businesses with insights into emerging markets, sector performance, and asset allocation strategies. By aligning investment decisions with the overall business strategy, companies can enhance their financial performance and achieve their growth objectives.

3. Risk Assessment and Management

In an increasingly volatile environment, effective risk management is essential for business success. Financial advisory services in 2025 focus on identifying, assessing, and mitigating financial risks. Advisors analyze potential risks related to market fluctuations, regulatory changes, and operational challenges. They help businesses implement risk management frameworks, ensuring that they are well-prepared to navigate uncertainties and protect their assets.

4. Tax Planning and Compliance

Tax regulations are constantly evolving, making tax planning a critical aspect of financial advisory services. In 2025, businesses must be proactive in their approach to tax compliance and strategy. Financial advisors assist companies in understanding the latest tax laws, identifying opportunities for tax savings, and ensuring compliance with regulations. By optimizing their tax strategies, businesses can enhance their cash flow and reinvest in growth initiatives.

5. Mergers and Acquisitions Advisory

The M&A landscape continues to be a key driver of growth for many businesses in 2025. Financial advisory services play a vital role in facilitating successful mergers and acquisitions. Advisors provide due diligence, valuation analysis, and negotiation support, ensuring that businesses make informed decisions throughout the M&A process. A well-executed acquisition can open new markets, diversify offerings, and enhance competitive advantage.

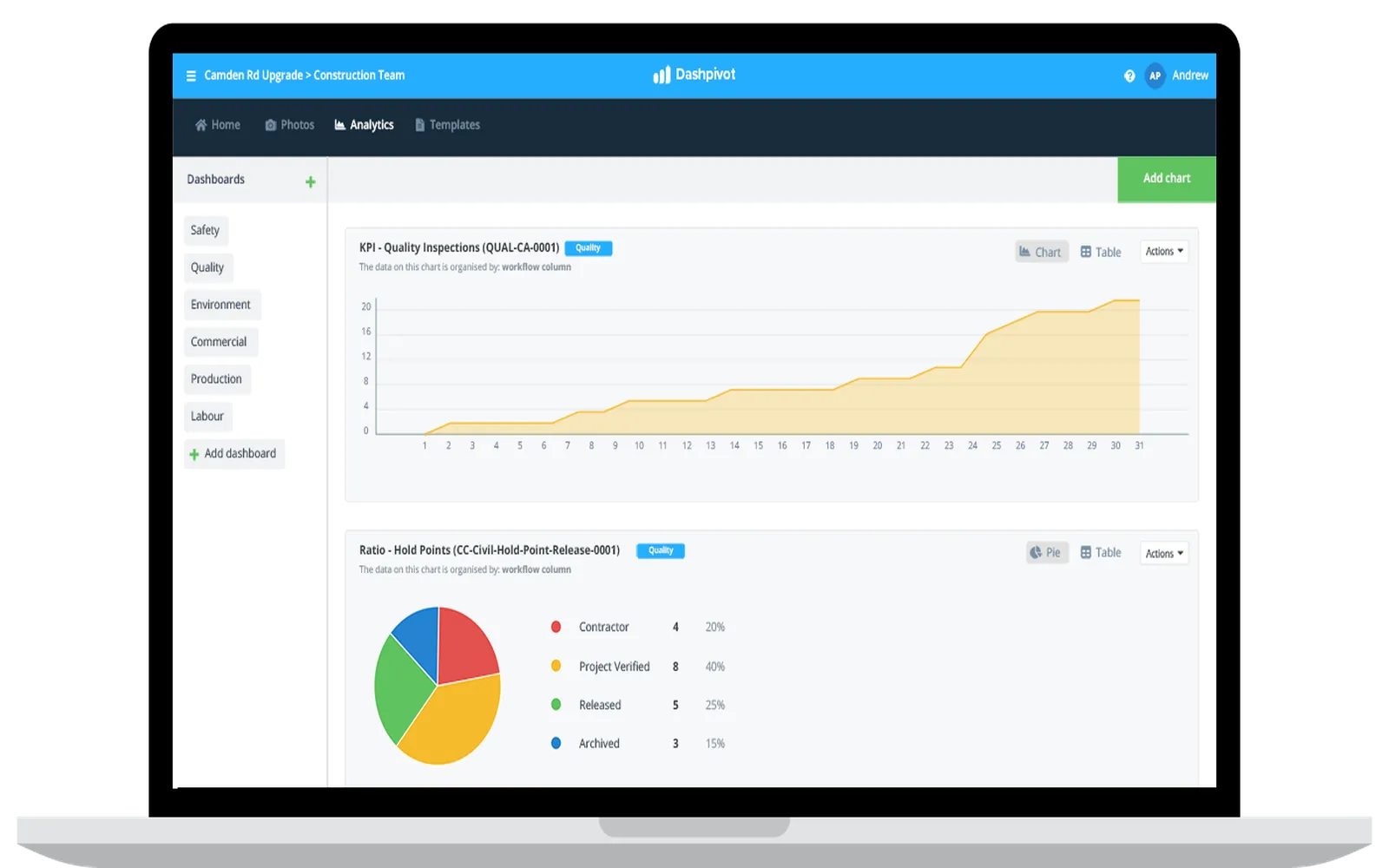

6. Technology Integration and Digital Transformation

As technology continues to reshape the financial landscape, financial advisory services have adapted to incorporate digital tools and solutions. In 2025, businesses are increasingly leveraging financial technology (FinTech) to streamline processes and enhance decision-making. Financial advisors assist companies in selecting and implementing the right technologies, from accounting software to data analytics platforms. This integration enables businesses to gain real-time insights and make data-driven decisions.

7. Sustainable Finance and ESG Advisory

Environmental, social, and governance (ESG) considerations have gained prominence in the business world, and financial advisory services are no exception. In 2025, businesses are increasingly focused on sustainability and responsible investing. Financial advisors guide companies in integrating ESG factors into their financial strategies, helping them attract socially conscious investors and enhance their reputation. Sustainable finance not only aligns with corporate values but also opens up new growth opportunities.

8. Wealth Management for Business Owners

Business owners often require specialized wealth management services to manage their personal and business finances effectively. Financial advisory services cater to this need by providing tailored solutions that address the unique financial goals of business owners. In 2025, advisors offer comprehensive wealth management strategies, including retirement planning, estate planning, and investment management, ensuring that business owners can secure their personal financial future while growing their businesses.

9. Global Market Insights and Expansion Strategies

In an interconnected world, businesses are increasingly looking beyond their borders for growth opportunities. Financial advisory services in 2025 provide valuable insights into global markets, helping companies develop expansion strategies. Advisors analyze market trends, cultural nuances, and regulatory environments to inform international growth plans. By understanding the complexities of foreign markets, businesses can mitigate risks and capitalize on new revenue streams.

10. Personalized Advisory Services

As businesses become more diverse and complex, personalized advisory services have gained traction. In 2025, financial advisors recognize that one-size-fits-all solutions are no longer effective. They take the time to understand each client's unique circumstances, goals, and challenges. By offering customized advisory services, financial advisors can deliver more meaningful insights and recommendations that align with the specific needs of the business.

Conclusion

The financial advisory landscape in 2025 is dynamic and multifaceted, offering a wealth of opportunities for businesses aiming to achieve growth and success. From strategic financial planning to sustainable finance, the right advisory services can empower businesses to navigate challenges, capitalize on opportunities, and thrive in a competitive environment. As companies increasingly recognize the value of expert guidance, investing in top financial advisory services will be essential for unlocking their full potential in the years to come.

Explore

Unlocking Success: The Power of SMS Marketing Services for Your Business

Unlocking Business Success: The Essential Role of Registered Agent Services

Unlocking Success: The Top Link Building Agencies to Elevate Your SEO Strategy

Streamlining Success: How QMS Software Empowers Small Businesses to Thrive

Top HR Services for Small Businesses in 2025: Boost Your Workforce Efficiency and Growth

Top CRM Software for Small Businesses in 2025: Boost Your Growth and Efficiency

Unlock Growth in 2025: Affordable SEO Services Tailored for Startups