Top Student Credit Cards for 2025: Unlock Financial Freedom and Build Credit Wisely

Introduction

As students embark on their academic journeys, managing finances becomes an essential skill that sets the foundation for future financial stability. One of the most effective ways to build credit and manage expenses is through a student credit card. In 2025, the landscape of student credit cards has evolved, offering various options tailored to meet the needs of young adults. This article explores the top student credit cards for 2025, highlighting their features, benefits, and how they can help students unlock financial freedom and build credit wisely.

Why Choose a Student Credit Card?

Student credit cards are designed specifically for young adults who may not yet have a credit history. These cards typically come with lower credit limits, fewer fees, and rewards tailored for students. By using a student credit card responsibly, students can establish a positive credit history, which is crucial for future financial endeavors such as applying for loans or renting an apartment.

Key Features to Look for in Student Credit Cards

When evaluating student credit cards, it's essential to consider several key features:

- No Annual Fee: Many student credit cards do not charge an annual fee, making them a cost-effective option for budget-conscious students.

- Cashback Rewards: Look for cards that offer cashback on purchases, especially in categories that align with student spending, such as dining, groceries, and textbooks.

- Building Credit: Choose cards that report to all three major credit bureaus, ensuring that your responsible use contributes to your credit score.

- Introductory Offers: Many cards provide attractive bonuses for new cardholders, such as bonus cashback or points after meeting a minimum spending requirement.

- Flexible Payment Options: Look for cards that allow you to set up automatic payments and offer mobile apps for easy account management.

Top Student Credit Cards for 2025

1. Discover it® Student Cash Back

The Discover it® Student Cash Back card is a top contender for students looking for generous rewards. This card offers 5% cashback on rotating categories, such as grocery stores, restaurants, and gas stations, and 1% on all other purchases. New cardholders also benefit from a unique feature: Discover matches all the cashback earned in the first year, effectively doubling your rewards.

Additionally, this card has no annual fee and provides a free FICO credit score, helping students track their credit-building journey. The card also offers a good student reward: a $20 statement credit each school year your GPA is 3.0 or higher.

2. Journey Student Rewards from Capital One

The Journey Student Rewards card from Capital One is an excellent option for students who want to earn rewards while building credit. This card offers 1% cashback on all purchases, which increases to 1.25% if you pay your bill on time. It has no annual fee, making it a budget-friendly choice.

Capital One also provides a flexible credit limit, which can be increased after making on-time payments. This card is ideal for students looking to enhance their credit scores through responsible use.

3. Citi Rewards+℠ Student Card

The Citi Rewards+℠ Student Card stands out for its unique rewards structure. This card offers 2x points at supermarkets and gas stations for the first $6,000 spent each year, and 1 point per dollar on all other purchases. Additionally, it rounds up to the nearest 10 points on every purchase, meaning even small transactions can yield rewards.

New cardholders can earn 15,000 bonus points after spending $1,500 in the first 3 months, redeemable for $150 in gift cards. With no annual fee and a user-friendly mobile app, this card is an attractive option for students interested in rewards.

4. Chase Freedom® Student Credit Card

The Chase Freedom® Student Credit Card is another excellent choice for students looking to build credit and earn rewards. This card offers 1% cashback on all purchases and a $50 bonus after your first purchase in the first three months. With no annual fee, it's an accessible option for students.

One of the standout features of this card is the ability to upgrade to a more advanced Chase Freedom card after demonstrating responsible credit behavior, allowing students to transition to higher rewards and benefits down the line.

5. Bank of America® Travel Rewards for Students

For students who love to travel, the Bank of America® Travel Rewards for Students card is an ideal choice. This card offers unlimited 1.5 points for every dollar spent on all purchases, with no annual fee and no foreign transaction fees, making it perfect for students studying abroad or traveling for leisure.

New cardholders can earn 25,000 online bonus points after making at least $1,000 in purchases in the first 90 days of account opening, which can be redeemed for a $250 statement credit toward travel purchases. This card not only helps students build credit but also rewards them for their travel expenses.

How to Use Student Credit Cards Wisely

While student credit cards offer numerous benefits, using them wisely is crucial to avoid debt and build a positive credit history. Here are some tips for managing student credit cards effectively:

- Pay Your Balance in Full: Always aim to pay your balance in full each month to avoid interest charges and debt accumulation.

- Make Payments on Time: Set up reminders or automatic payments to ensure you never miss a due date, as late payments can negatively impact your credit score.

- Keep Track of Spending: Use budgeting apps or tools to monitor your spending and ensure you stay within your budget.

- Use Rewards Wisely: Take advantage of rewards programs, but don’t overspend just to earn points. Focus on necessary purchases.

- Limit Credit Card Applications: Avoid applying for multiple credit cards at once, as too many inquiries can negatively affect your credit score.

Building a Strong Credit History

Establishing a strong credit history during your college years can have a lasting impact on your financial future. Here’s how student credit cards can help:

- Establishing a Credit Score: Responsible use of a student credit card allows you to build a credit score, which is essential for future loans, mortgages, and rental applications.

- Learning Financial Responsibility: Using a credit card teaches valuable lessons about budgeting, managing debt, and making timely payments.

- Creating a Credit Mix: Having a credit card contributes to a healthy credit mix, which can positively impact your credit score.

Conclusion

In 2025, student credit cards offer a gateway to financial freedom and credit-building opportunities for young adults. With various options tailored to students' needs, it's crucial to choose a card that aligns with your spending habits and financial goals. By using student credit cards wisely, you can unlock rewards, establish a solid credit history, and set yourself up for future financial success. Start your journey towards financial literacy today, and embrace the benefits of being a responsible credit card holder.

Explore

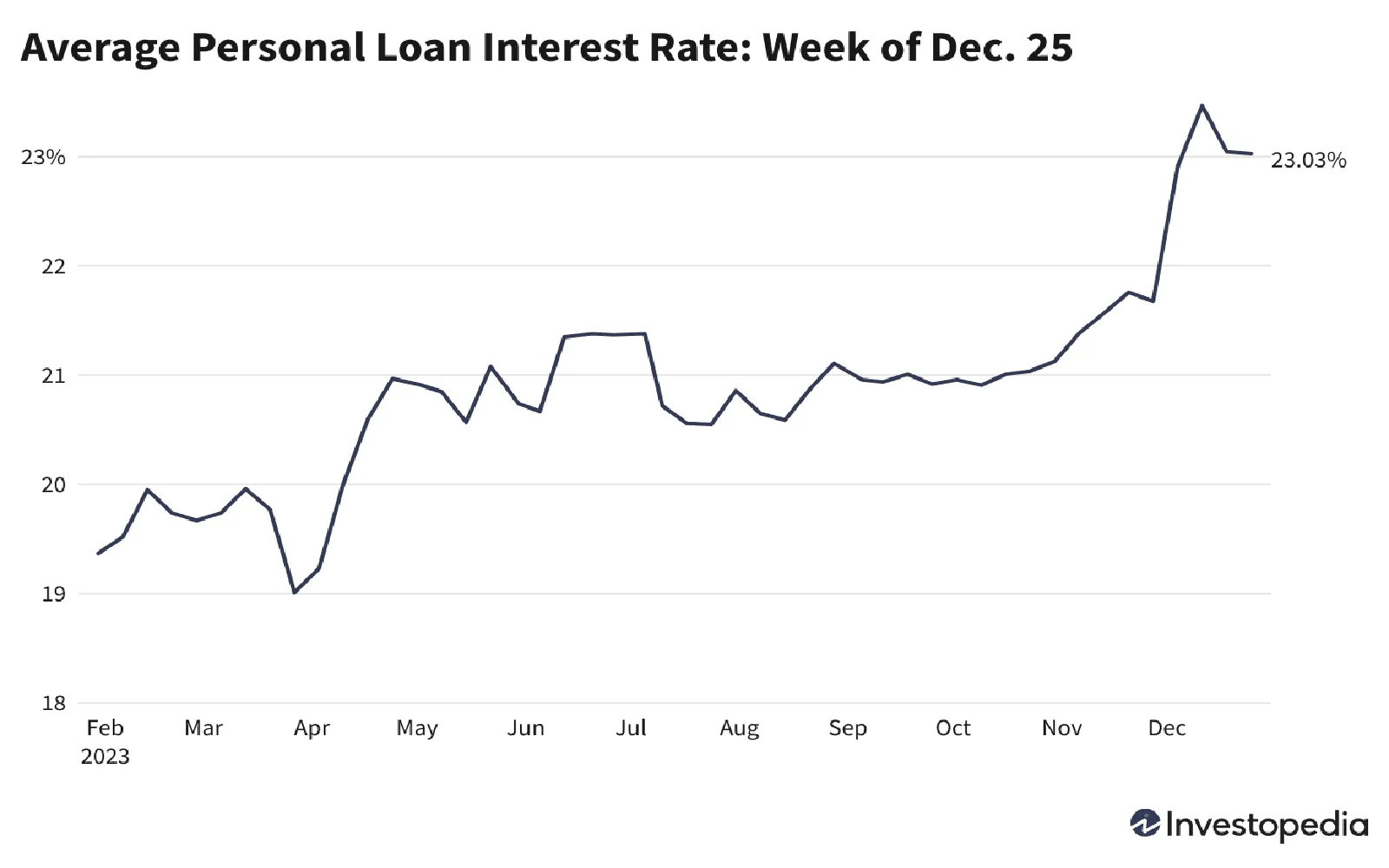

Discover the Lowest Personal Loan Interest Rates of 2025: Unlock Your Financial Freedom Today!

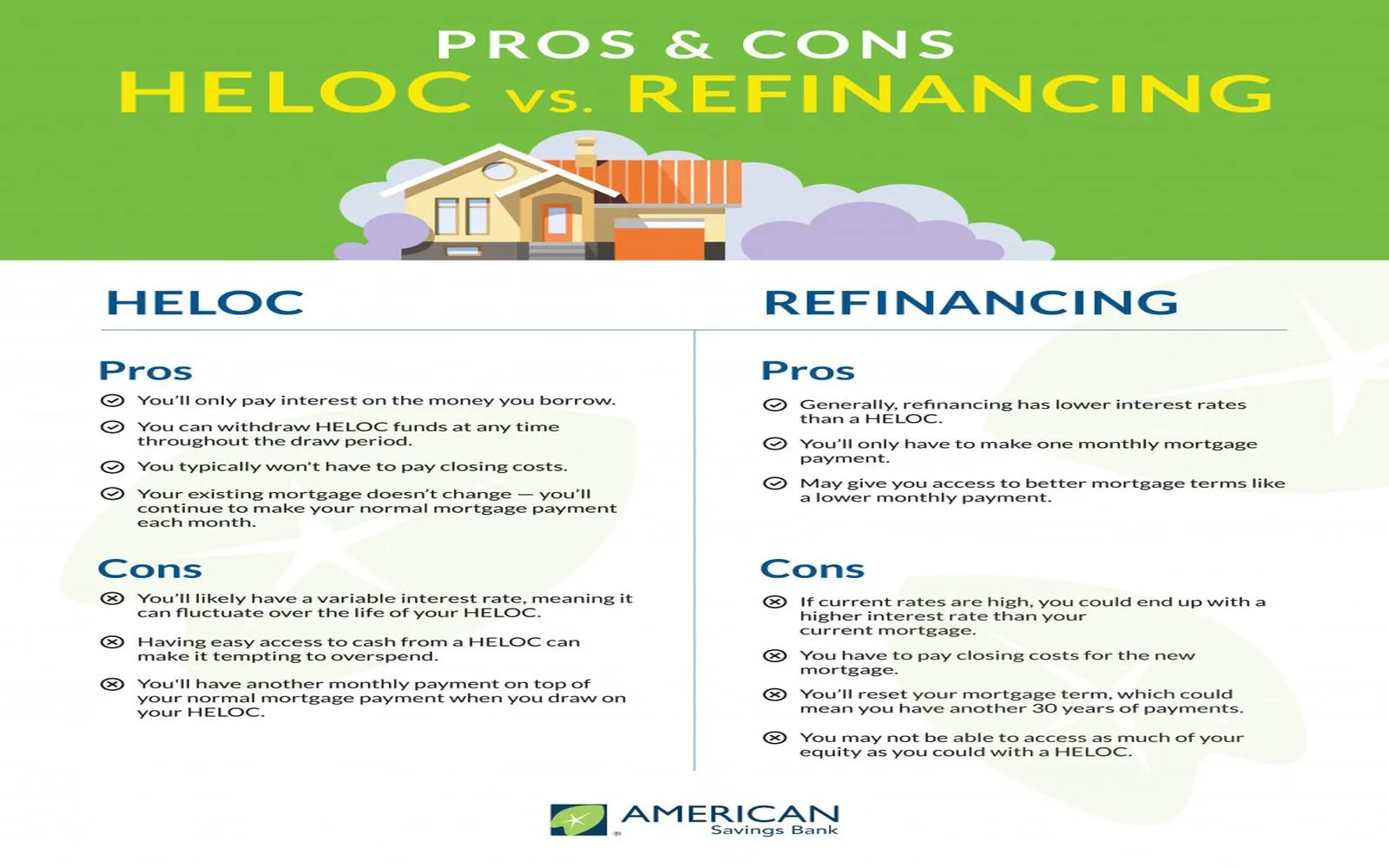

2025 Mortgage Refinance Rates: Unlock Cash-Out Options for Your Financial Freedom

Top Rewards Credit Cards of 2025: Unlock Maximum Benefits and Cash Back

Top Debt Consolidation Services of 2025: Your Ultimate Guide to Financial Freedom

A Complete Guide to Applying for Student Loans & the Best Lenders in 2025

Maximize Your Savings in 2025: The Ultimate Guide to Amazon Credit Cards

Top Small Business Credit Cards for Rewards in 2025: Maximize Your Earnings!