2025 Guide: How to Qualify for a VA Home Loan and Secure Your Dream Home

Understanding VA Home Loans

The VA home loan program is a benefit provided by the United States Department of Veterans Affairs (VA) to help eligible veterans, active-duty service members, and certain members of the National Guard and Reserves secure financing for a home. These loans offer several advantages, including no down payment, no private mortgage insurance (PMI), and competitive interest rates. As we move into 2025, understanding how to qualify for a VA home loan is essential for veterans looking to purchase their dream home.

Eligibility Requirements for VA Home Loans

To qualify for a VA home loan, applicants must meet specific eligibility requirements. These requirements are primarily based on service history, which can vary depending on the time of service and the nature of the discharge. The following categories summarize the basic eligibility requirements:

Service Requirements

1. **Veterans**: Generally, veterans must have served a minimum of 90 days of active duty during wartime or 181 days during peacetime. Those who have served in the National Guard or Reserves may also qualify after six years of service.

2. **Active-Duty Service Members**: Active-duty personnel are eligible for VA loans after 90 continuous days of service.

3. **Surviving Spouses**: Certain surviving spouses of veterans who died in the line of duty or from a service-related condition may also qualify for a VA home loan.

To determine your eligibility, you can obtain a Certificate of Eligibility (COE) from the VA, which outlines your qualification for the program.

Discharge Status

The type of discharge received upon leaving the military can significantly impact eligibility. Honorable discharges generally qualify for VA loans, while those with dishonorable discharges may not be eligible. In some cases, veterans with other-than-honorable discharges may still qualify, but they will need to provide additional documentation.

How to Obtain Your Certificate of Eligibility (COE)

The COE is a crucial document that proves your eligibility for a VA home loan. There are several ways to obtain your COE:

Online Application

Veterans can apply for their COE online through the VA’s eBenefits portal. This is the quickest method and allows you to receive your certificate almost immediately if your records are available.

Mail Application

If you prefer a traditional method, you can also apply by mail. Download and complete VA Form 26-1880, then send it to the appropriate VA regional loan center. This process might take a few weeks.

Through Your Lender

Many VA-approved lenders can assist you in obtaining your COE. This option can streamline the process and provide additional guidance on your eligibility.

Credit Score and Financial Requirements

Review Your Credit Report

It’s crucial to check your credit report for any errors or discrepancies. You can obtain a free report from each of the three major credit bureaus (Experian, TransUnion, and Equifax) once a year. Correcting any inaccuracies can improve your credit score.

Improve Your Credit Score

To boost your credit score, focus on the following:

- Pay bills on time.

- Keep credit card balances low.

- Avoid opening new credit accounts before applying for a loan.

Debt-to-Income Ratio (DTI)

Your DTI ratio is another critical factor lenders consider when approving a loan. It is calculated by dividing your monthly debt payments by your gross monthly income. Most lenders prefer a DTI of 41% or lower, but some may allow higher ratios, especially for VA loans.

Choosing the Right Lender

Not all lenders are created equal, and choosing the right one can make a significant difference in your home-buying experience. Here are some tips to help you select the best lender for your VA home loan:

Look for VA-Approved Lenders

Ensure that the lender you choose is approved by the VA to originate VA loans. This ensures they are familiar with the program and can provide you with the best guidance.

Compare Interest Rates and Fees

Interest rates and fees can vary significantly between lenders. Obtain quotes from several lenders and compare them carefully. Pay attention to the Annual Percentage Rate (APR), as this provides a more accurate picture of the loan’s total cost.

Read Reviews and Testimonials

Finding Your Dream Home

Once you have your COE and have chosen a lender, it’s time to start the house-hunting process. Here are some steps to help you find your dream home:

Determine Your Budget

Before you start looking at homes, establish a budget based on your financial situation and the maximum loan amount you can afford. Consider additional costs such as property taxes, homeowners insurance, and maintenance fees.

Work with a Real Estate Agent

Enlisting the help of a real estate agent experienced in VA home loans can provide valuable insights and save you time. They can help you navigate the market, negotiate offers, and ensure a smooth closing process.

Consider Location and Amenities

Think about the location and amenities that matter most to you. Consider proximity to schools, work, public transportation, and recreational areas. Make a list of must-haves and nice-to-haves to guide your search.

Making an Offer and Closing the Deal

Once you’ve found a home you love, it’s time to make an offer. Here’s what you need to know:

Making an Offer

Your real estate agent can help you craft a competitive offer based on the home’s market value and condition. Be prepared for negotiations, as the seller may counter your offer.

Home Inspection and Appraisal

After your offer is accepted, you’ll want to schedule a home inspection to identify any potential issues. The VA also requires an appraisal to ensure the home’s value aligns with the purchase price. These steps are crucial for protecting your investment.

Closing Process

VA Loan Benefits and Considerations

VA home loans offer numerous benefits that make them an attractive option for eligible veterans and service members. Here are some key advantages:

No Down Payment

One of the most significant benefits of a VA loan is the ability to purchase a home without a down payment. This can make homeownership more accessible, especially for first-time buyers.

No PMI

Unlike conventional loans, VA loans do not require private mortgage insurance, which can save you hundreds of dollars each month.

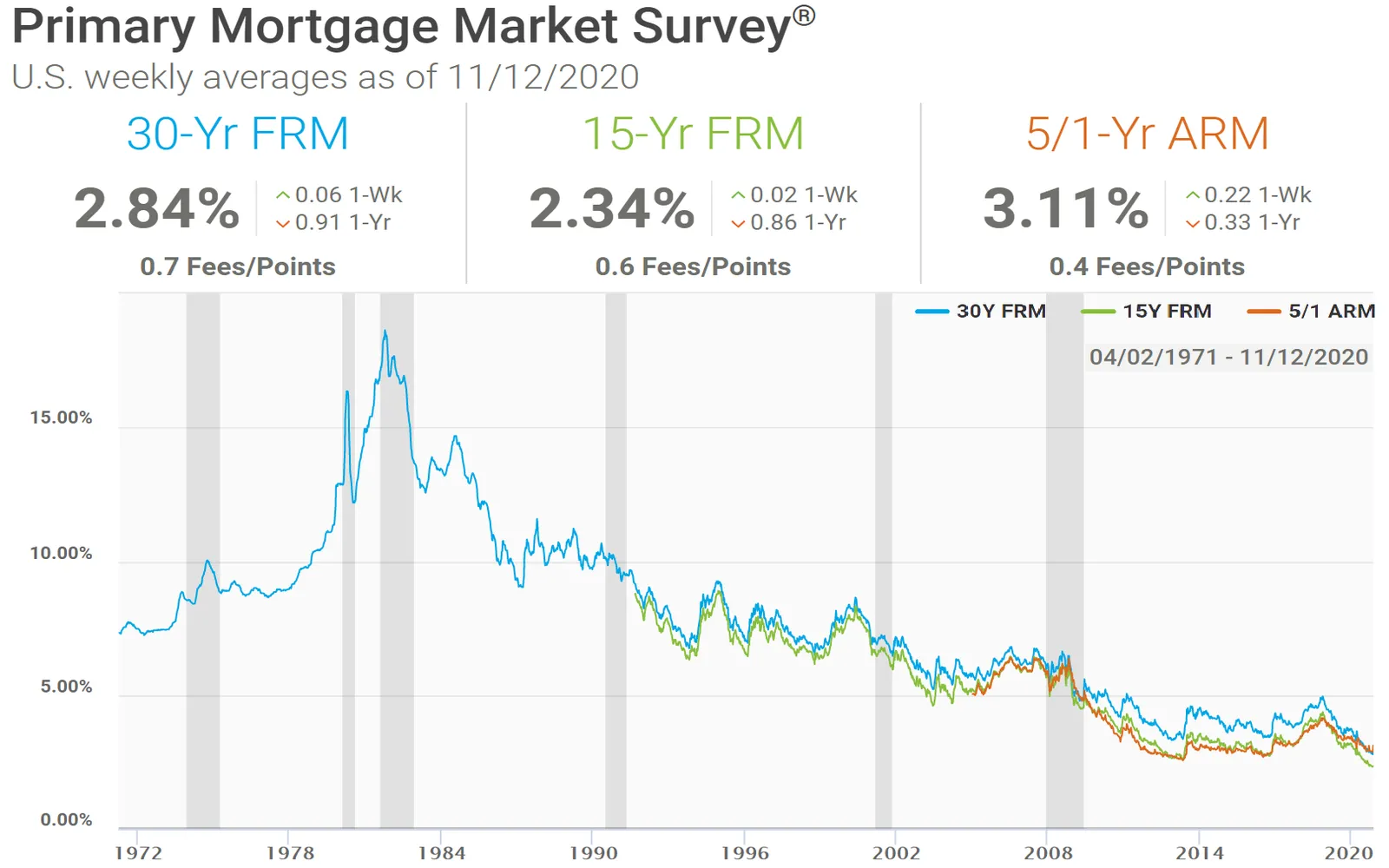

Competitive Interest Rates

VA loans typically offer lower interest rates compared to conventional loans, which can lead to significant savings over the life of the loan.

Limit on Closing Costs

The VA limits the amount lenders can charge in closing costs, ensuring that veterans are not burdened with excessive fees.

Potential Drawbacks of VA Home Loans

While VA loans offer many benefits, there are a few potential drawbacks to consider:

Funding Fee

Most VA loans require a funding fee, which helps sustain the program. This fee can vary based on your service history and whether it’s your first VA loan. However, it can be rolled into the loan amount.

Property Restrictions

VA loans are designed for primary residences only, meaning you cannot use them to purchase investment properties or vacation homes.

Final Thoughts

Qualifying for a VA home loan and securing your dream home in 2025 is entirely achievable with the right preparation and knowledge. By understanding the eligibility requirements, obtaining your COE, managing your credit, and choosing the right lender, you can navigate the process with confidence. Remember to take your time in finding the right home that meets your needs and budget. With the benefits that VA loans provide, you’re one step closer to homeownership.

Explore

Get Your Dream Home: How to Sell Your House Fast and Move On to Your Next Adventure

Transform Your Space: Discover the Best Home Improvement Loans for Your Dream Renovation

Ultimate Guide to Cloud Backup: Secure Your Data with Top Solutions in 2025

Top Mortgage Rates for First-Time Buyers in 2025: Unlock Your Dream Home

Top Travel Agencies to Plan Your Dream Trip

2025 Guide to Refinance Home Loan Rates: Compare and Save on Your Mortgage

Ultimate Guide to Securing a Small Business Loan in 2025: Tips, Strategies, and Resources