Top Mortgage Rates for First-Time Buyers in 2025: Unlock Your Dream Home

Introduction

As we step into 2025, the landscape of mortgage rates continues to evolve, particularly impacting first-time homebuyers eager to unlock their dream homes. Understanding the mortgage market is crucial for these buyers, as the right mortgage can significantly affect their financial future. This article will explore the top mortgage rates available for first-time buyers in 2025, offering insights into how to navigate this complex market.

Understanding Mortgage Rates

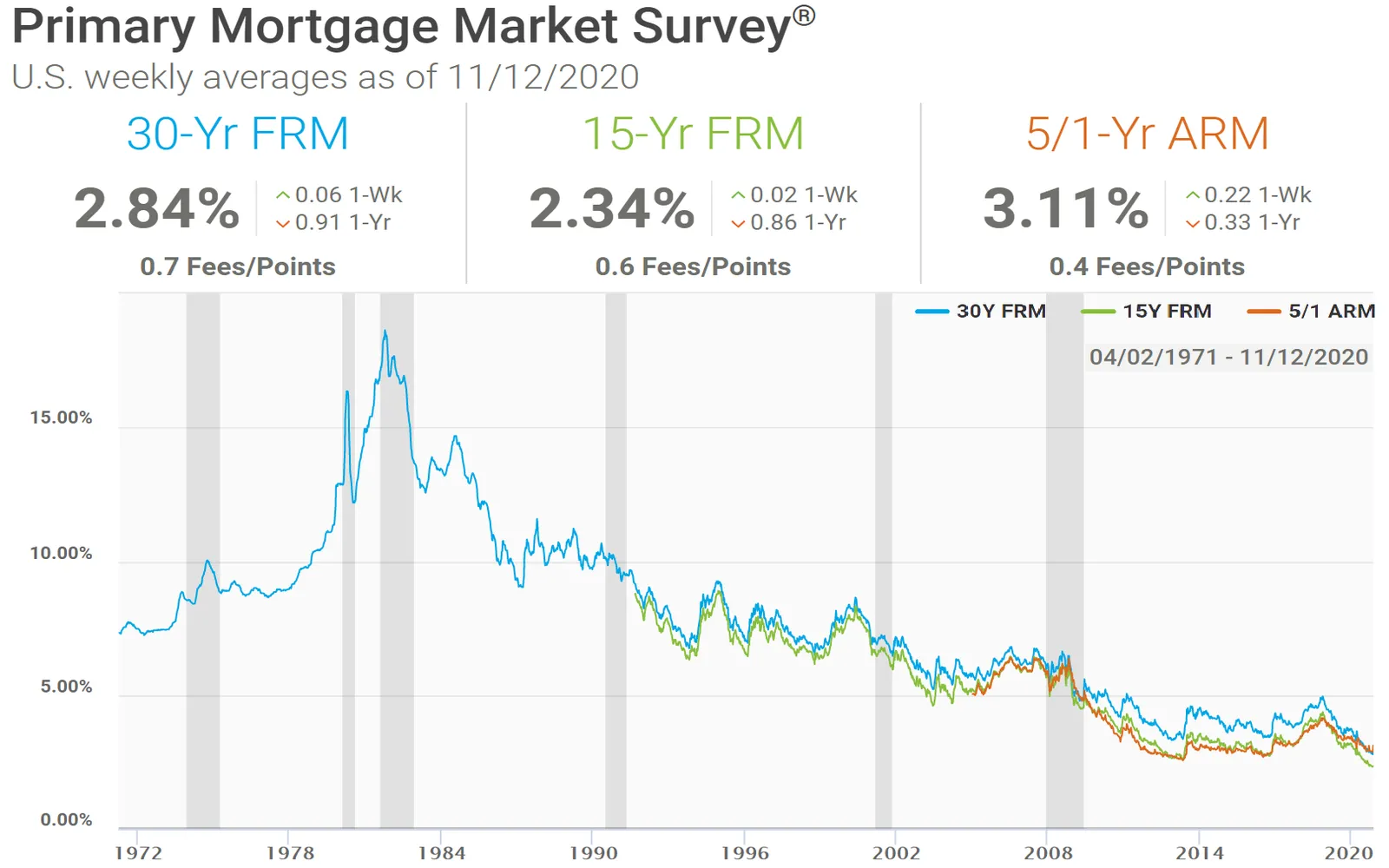

Mortgage rates represent the interest charged on a loan taken out to purchase a home. These rates can fluctuate based on various factors, including economic conditions, inflation, and the decisions made by the Federal Reserve. For first-time buyers, securing a favorable mortgage rate is essential, as even a slight difference in rates can lead to substantial savings over the life of the loan.

Current Market Overview

The mortgage market in 2025 is characterized by a mix of rising and stabilizing rates. Following several years of fluctuating rates, the Federal Reserve has indicated a commitment to maintaining a balance that supports economic growth while controlling inflation. This has resulted in a more predictable rate environment, which is advantageous for first-time buyers.

Top Mortgage Rates for First-Time Buyers in 2025

In 2025, first-time buyers can access several competitive mortgage options. Here are some of the top mortgage rates and products available:

1. Fixed-Rate Mortgages

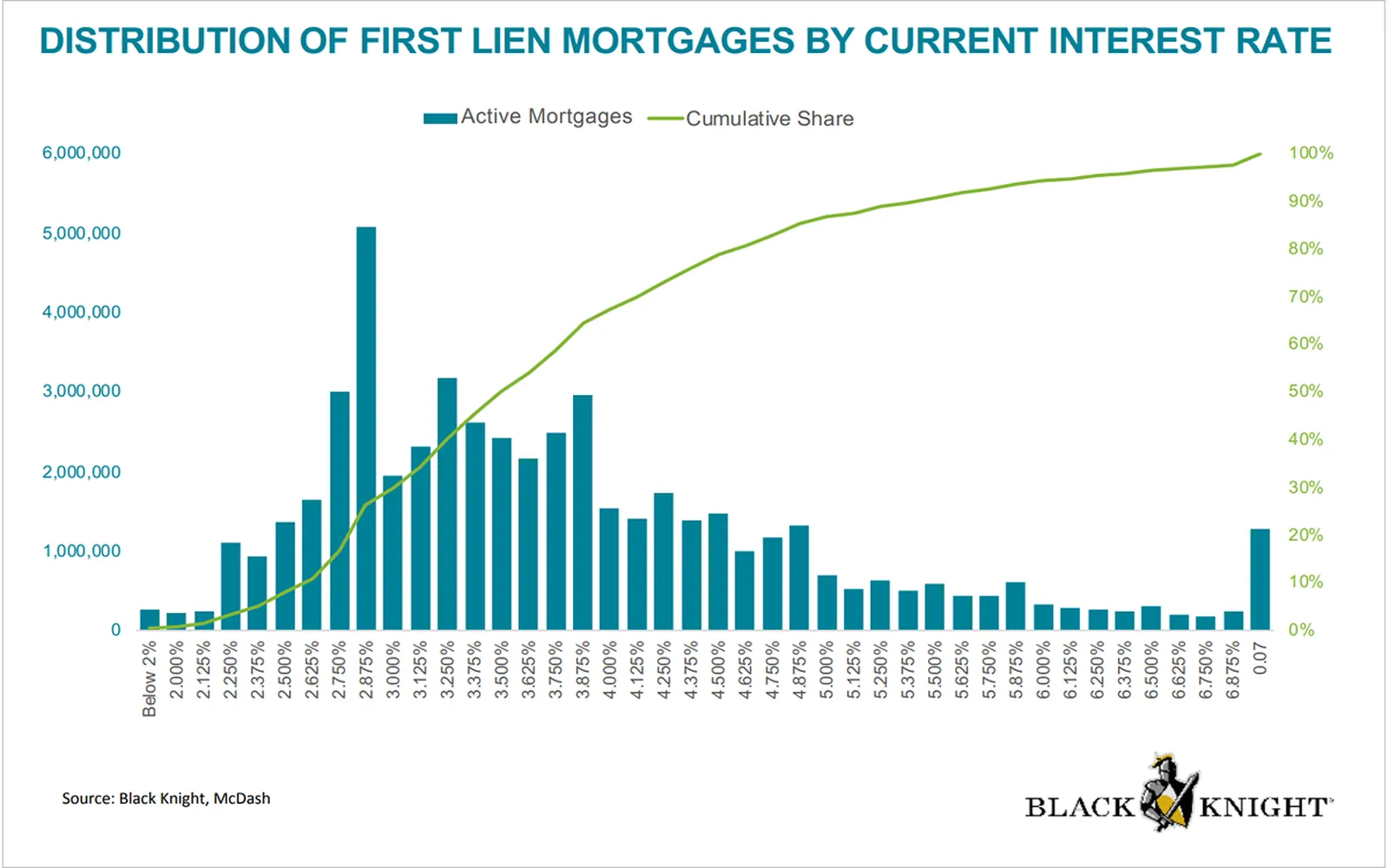

Fixed-rate mortgages remain a popular choice for first-time buyers. In 2025, the average fixed-rate mortgage is hovering around 3.5% to 4.0% for a 30-year term. These loans offer stability, as the interest rate remains constant throughout the life of the loan, making budgeting easier for new homeowners.

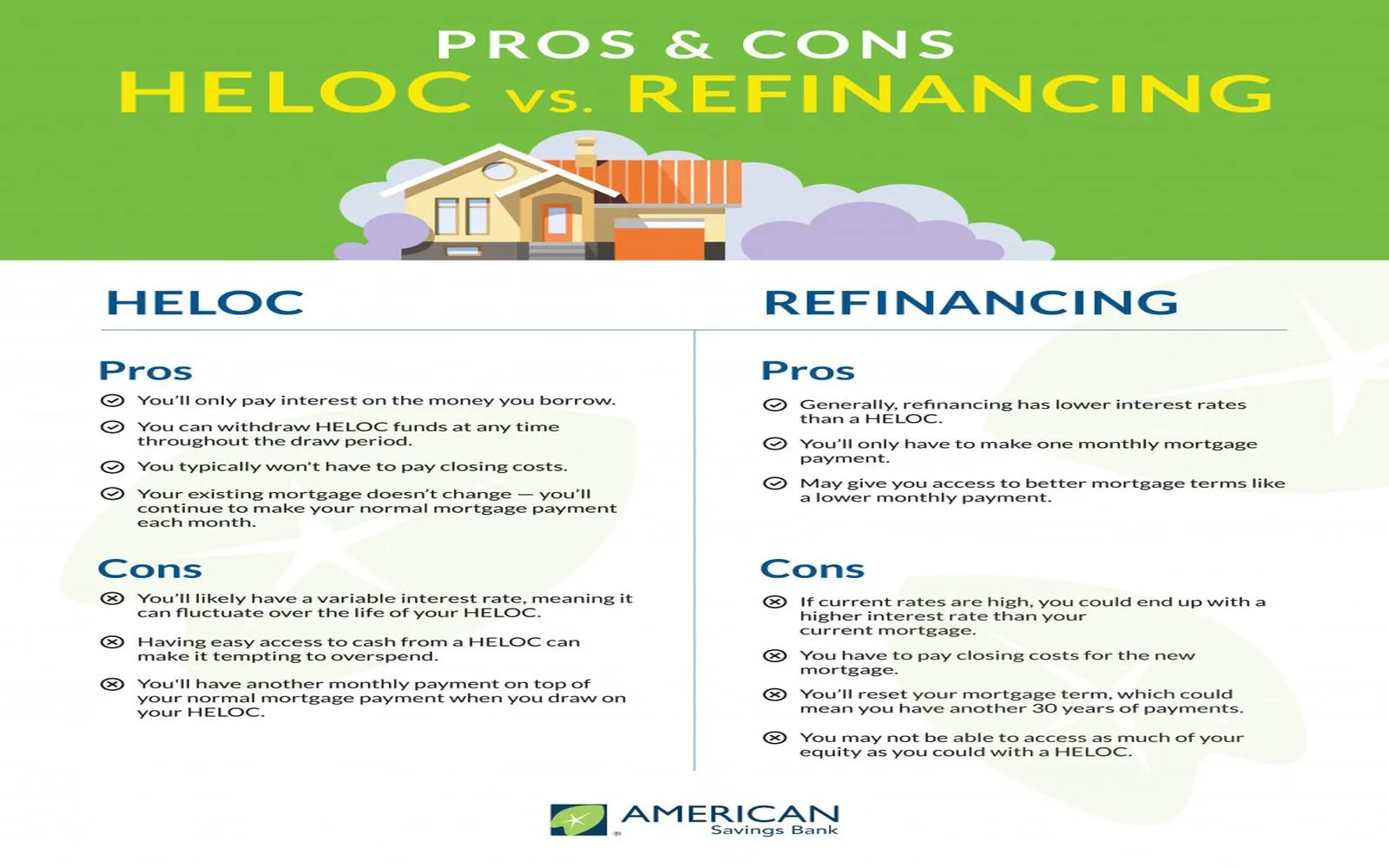

2. Adjustable-Rate Mortgages (ARMs)

For those willing to take on some risk, adjustable-rate mortgages (ARMs) can offer lower initial rates. In 2025, many ARMs start with rates as low as 2.5% for the first five years before adjusting to market rates. This option can be appealing for buyers who plan to move or refinance before the rate adjusts.

3. FHA Loans

Federal Housing Administration (FHA) loans are designed to help first-time buyers with lower credit scores or smaller down payments. In 2025, FHA loans are offering rates around 3.75%, with down payments as low as 3.5%. This makes homeownership accessible for many who might otherwise struggle to qualify for traditional mortgages.

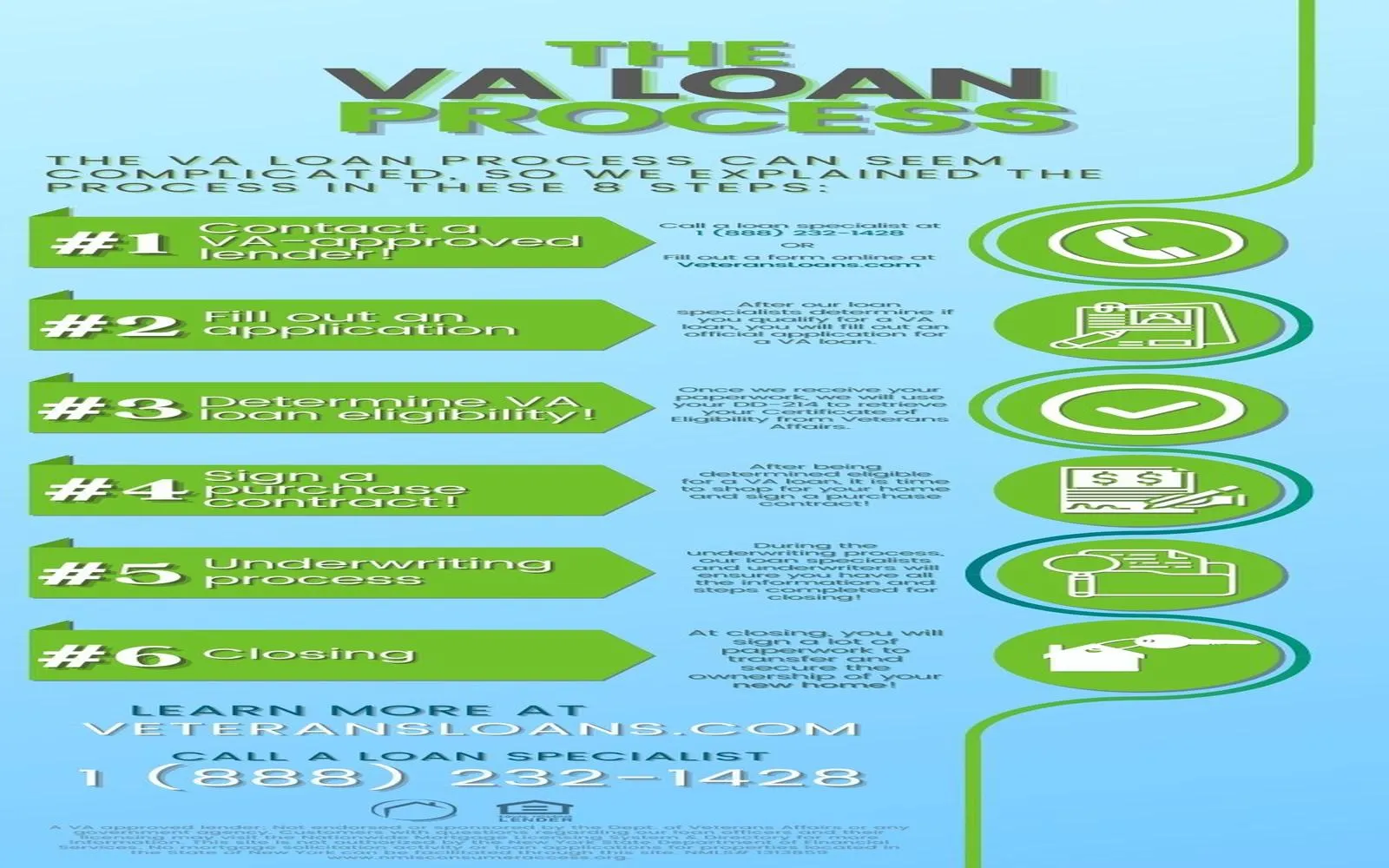

4. VA Loans

Veterans and active-duty military personnel can take advantage of VA loans, which typically offer some of the most competitive rates available. In 2025, VA loans are available at rates around 3.25% with no down payment, making them an excellent option for eligible buyers.

5. USDA Loans

For those looking to purchase homes in rural areas, USDA loans provide an excellent opportunity. With rates often around 3.5% and zero down payment options, these loans are designed to promote homeownership in less populated areas, making them ideal for first-time buyers.

Factors Influencing Mortgage Rates

Understanding the factors that influence mortgage rates can help first-time buyers make informed decisions. Key factors include:

1. Credit Score

A buyer’s credit score plays a significant role in determining the mortgage rate they will receive. Higher credit scores typically lead to lower interest rates. First-time buyers should take steps to improve their credit scores before applying for a mortgage to secure the best rates possible.

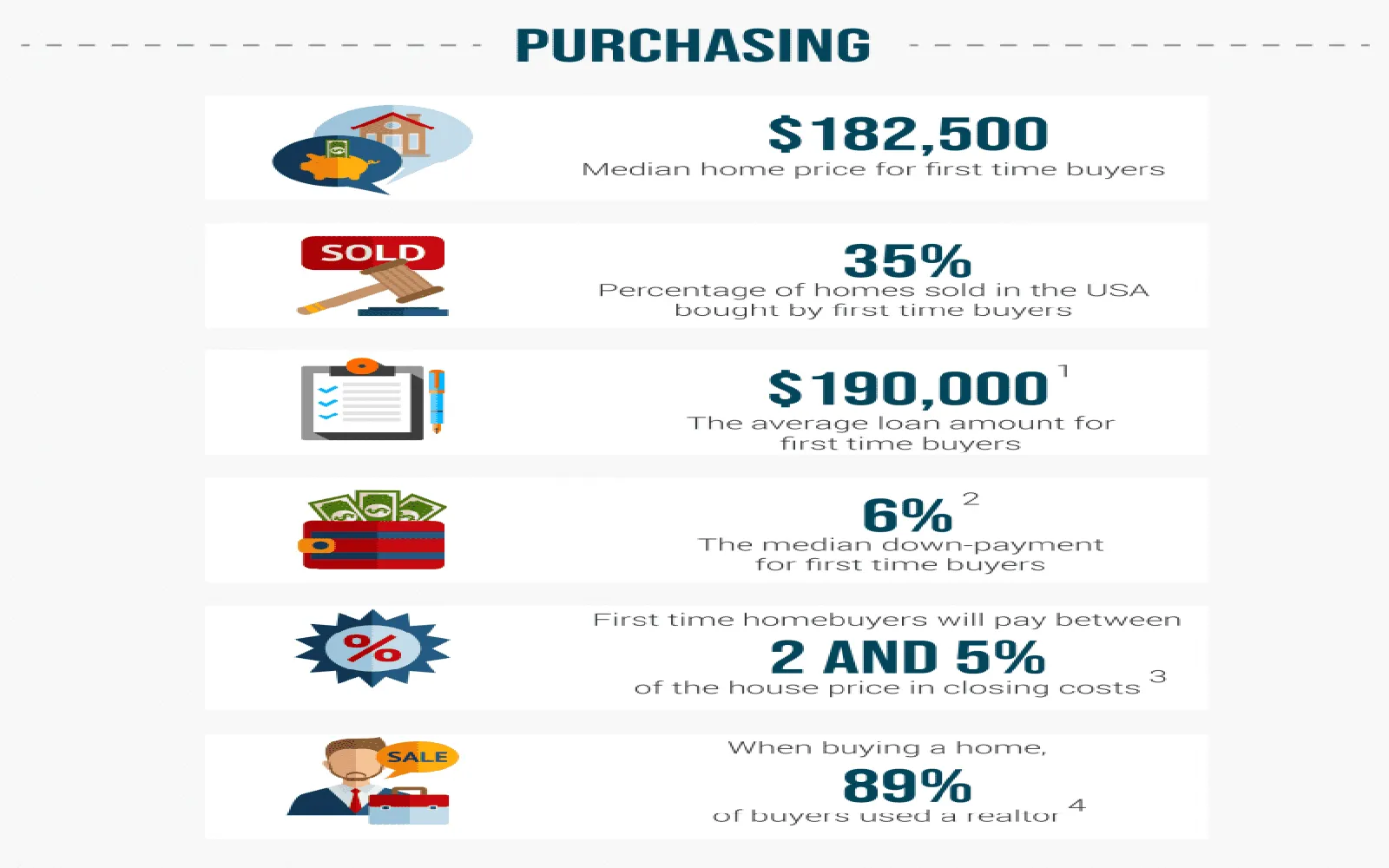

2. Down Payment

The size of the down payment can also impact mortgage rates. A larger down payment often leads to a lower interest rate, as it reduces the lender's risk. First-time buyers should aim to save as much as possible for their down payment to enhance their mortgage terms.

3. Loan Type

The type of loan selected can lead to variations in mortgage rates. Traditional fixed-rate loans tend to have higher rates compared to government-backed loans like FHA or VA loans. First-time buyers must weigh their options carefully and choose a loan type that aligns with their financial situation.

4. Economic Conditions

Broader economic factors, such as inflation rates and employment statistics, can influence mortgage rates. In periods of economic growth, rates tend to rise, while they may decrease during economic downturns. First-time buyers should keep an eye on economic trends to make timely decisions in their home-buying process.

How to Secure the Best Mortgage Rate

To navigate the mortgage market successfully and secure the best rates, first-time buyers should consider the following strategies:

1. Shop Around

It’s essential to shop around and compare rates from multiple lenders. Different lenders may offer varying rates and terms, so taking the time to explore options can lead to significant savings.

2. Get Pre-Approved

Obtaining a mortgage pre-approval can give buyers a clearer understanding of the rates they qualify for based on their financial status. This process not only helps in determining a budget but also makes buyers more competitive when making offers on homes.

3. Improve Your Credit Score

Before applying for a mortgage, first-time buyers should take steps to improve their credit scores. Paying down debts, ensuring timely payments, and disputing any inaccuracies on credit reports can lead to better rates.

4. Consider a Larger Down Payment

If possible, aiming for a larger down payment can significantly improve mortgage terms. A down payment of 20% or more can eliminate private mortgage insurance (PMI) and lead to more favorable interest rates.

5. Lock in Rates

Once a buyer finds a favorable rate, it’s wise to lock it in to protect against potential increases. Rate locks can typically last from 30 to 60 days, allowing buyers to shop for homes without worrying about rising rates.

Government Programs for First-Time Buyers

Various government programs are designed to assist first-time homebuyers, making it easier to secure affordable mortgage rates. Some notable programs include:

1. First-Time Home Buyer Tax Credit

Many states offer tax credits to first-time homebuyers, reducing their tax liability and making homeownership more affordable. First-time buyers should research available programs in their state to maximize financial benefits.

2. Down Payment Assistance Programs

Several local and state programs provide financial assistance for down payments. These programs can offer grants or low-interest loans to help cover the cost, making it easier for first-time buyers to enter the housing market.

3. HomeReady and Home Possible Programs

These programs, offered by Fannie Mae and Freddie Mac, are designed for low to moderate-income buyers, allowing for lower down payments and more flexible credit requirements. First-time buyers should explore these options to see if they qualify.

Challenges Facing First-Time Buyers in 2025

While there are many opportunities for first-time buyers in 2025, challenges still exist. Understanding these challenges can help buyers prepare and adapt their strategies accordingly.

1. Rising Home Prices

Despite favorable mortgage rates, rising home prices continue to be a significant barrier for first-time buyers. Many markets have seen substantial increases in home values, making it challenging to find affordable options.

2. Limited Housing Inventory

The inventory of homes for sale remains low in many areas, leading to increased competition among buyers. This scarcity can drive prices higher and make it more difficult for first-time buyers to secure their desired home.

3. Economic Uncertainty

Economic fluctuations, including inflation and interest rate changes, can create uncertainty in the housing market. First-time buyers must stay informed about economic conditions to make sound decisions regarding their purchases.

Final Thoughts

As we navigate the mortgage landscape in 2025, first-time buyers have access to a variety of competitive mortgage rates and programs designed to facilitate homeownership. Understanding the market, improving financial health, and leveraging available resources can empower buyers to make informed decisions and ultimately unlock their dream homes. With careful planning and a proactive approach, the journey to homeownership can be a rewarding experience for first-time buyers in 2025.

Explore

Get Your Dream Home: How to Sell Your House Fast and Move On to Your Next Adventure

Transform Your Space: Discover the Best Home Improvement Loans for Your Dream Renovation

Affordable Home Insurance for First-Time Buyers in 2025: Your Complete Guide to Savings and Coverage

2025 Mortgage Refinance Rates: Unlock Cash-Out Options for Your Financial Freedom

2025 Guide to Refinance Home Loan Rates: Compare and Save on Your Mortgage

Top Home Equity Line of Credit Rates for 2025: Unlock Your Home's Value Today!

2025 Guide: How to Qualify for a VA Home Loan and Secure Your Dream Home