Top Home Equity Line of Credit Rates for 2025: Unlock Your Home's Value Today!

Understanding Home Equity Lines of Credit

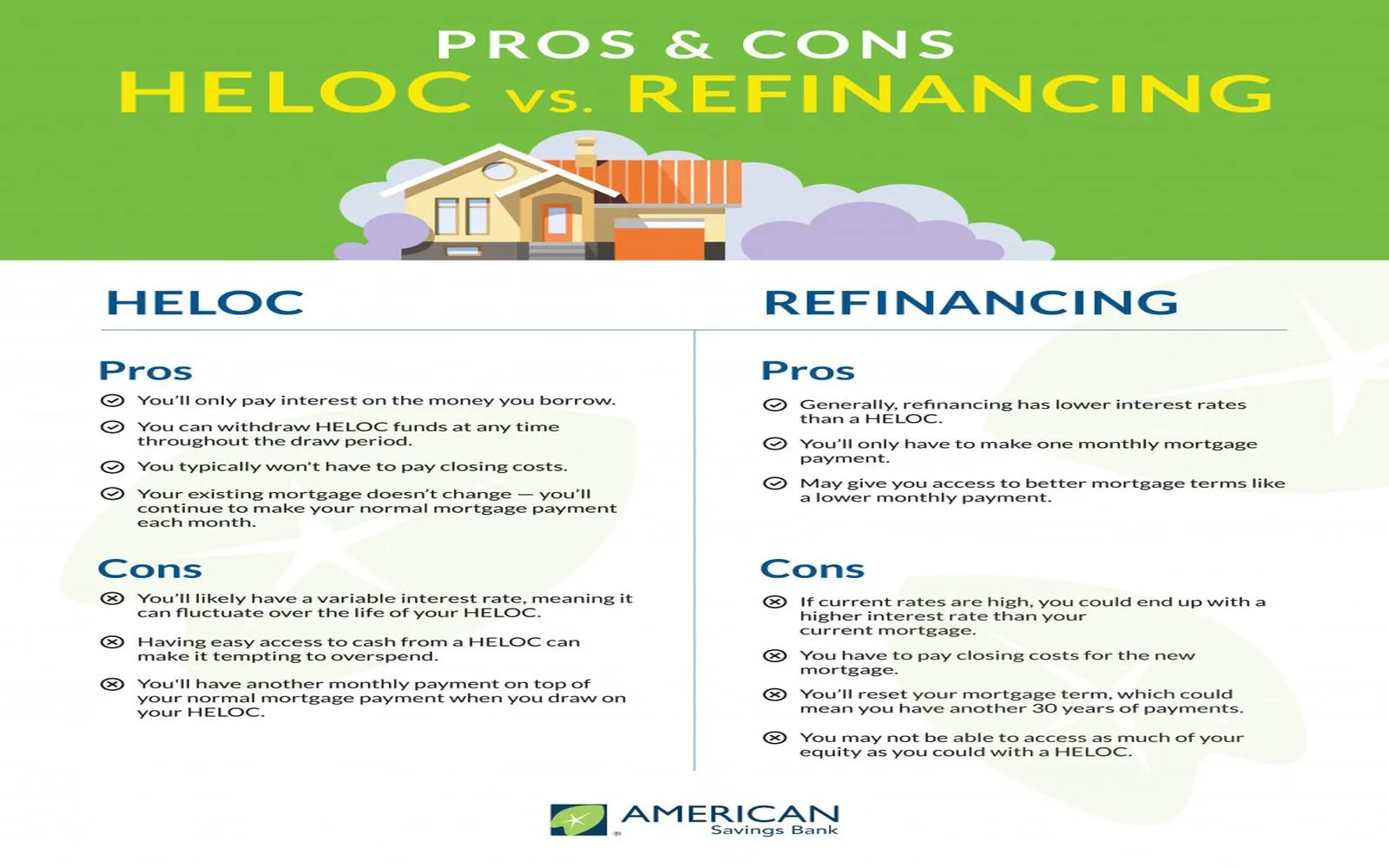

A Home Equity Line of Credit (HELOC) is a popular financial product that allows homeowners to borrow against the equity in their homes. Equity is essentially the difference between your home's current market value and the outstanding balance on your mortgage. A HELOC functions like a credit card, giving you access to a revolving line of credit that you can draw from as needed, typically at a variable interest rate. This flexibility makes HELOCs an attractive option for those looking to fund home improvements, pay for education, or consolidate debt.

Why Consider a HELOC in 2025?

As we move into 2025, many homeowners are looking to tap into their home equity due to strong property values and low interest rates. A HELOC can provide the necessary funds for various projects, whether it’s renovating your kitchen, installing energy-efficient appliances, or even paying off high-interest debts. With many experts predicting stable housing market growth, now may be the perfect time to consider unlocking your home's value.

Current Market Trends for Home Equity Lines of Credit

The financial landscape can shift dramatically from year to year. As of 2025, several key trends are influencing HELOC rates:

- Interest Rates: The Federal Reserve's monetary policy impacts interest rates across the board, including those for HELOCs. If the Fed maintains low rates, homeowners can enjoy lower borrowing costs.

- Home Prices: With a robust housing market, home values have been steadily increasing. This growth means that homeowners have more equity to tap into, making HELOCs more appealing.

- Consumer Demand: As more homeowners become aware of their equity options, demand for HELOCs has increased, prompting lenders to offer competitive rates and terms.

Top Home Equity Line of Credit Rates for 2025

In 2025, several lenders are offering competitive rates for HELOCs. Here are some of the top options:

1. Lender A - Prime HELOC Rate

Lender A is offering a HELOC with an initial rate of 4.25%, which is indexed to the prime rate. This means if the prime rate increases or decreases, so does your interest rate. They also offer a 10-year draw period followed by a 20-year repayment period, making it a flexible option for borrowers.

2. Lender B - Fixed-Rate Option

Lender B provides an innovative HELOC that allows borrowers to convert portions of their variable-rate balance into a fixed-rate loan. Their starting rate is 4.5%, and they offer unique features like no closing costs and a 15-year draw period. This can be an excellent option for those who want the predictability of fixed payments.

3. Lender C - Low Introductory Rate

Lender C is attracting customers with an introductory rate of just 3.75% for the first year, making it one of the most appealing options on the market. After the first year, the rate adjusts based on the prime rate. This lender also offers a flexible repayment structure, allowing borrowers to pay only interest during the draw period.

4. Lender D - No Annual Fees

Lender D is notable for offering a HELOC with a 4.0% starting interest rate and no annual fees. This can save borrowers money in the long run, especially if they plan to keep the line of credit open for several years. They also provide a user-friendly online platform for managing your account.

5. Lender E - Quick Approval Process

Lender E is known for its speedy approval process, often getting funds to borrowers in less than a week. Their HELOC starts at 4.15% and includes features such as online account management and mobile app access, making it convenient for tech-savvy consumers.

Factors to Consider When Choosing a HELOC

While rates are a critical factor, there are several other considerations when selecting a HELOC:

- Fees: Look for any hidden fees, such as application fees, closing costs, and annual fees. Some lenders may advertise low rates but charge high fees that can negate your savings.

- Draw Period and Repayment Terms: Understand how long you can draw from the line of credit and what the repayment terms are afterward. A longer draw period may offer more flexibility.

- Customer Service: Research lender reviews and customer service ratings. A lender with a reputation for excellent customer service can make your borrowing experience smoother.

- Flexibility: Some lenders allow you to convert to a fixed rate or make interest-only payments during the draw period. Consider what features are most important to you.

How to Apply for a HELOC

If you decide to pursue a HELOC, here are the steps to follow:

- Check Your Credit Score: A higher credit score can qualify you for better rates. Aim for a score of 700 or higher for the best terms.

- Calculate Your Home Equity: Use an online calculator to determine how much equity you have available for a HELOC. This will guide your borrowing decisions.

- Shop Around: Compare rates and terms from multiple lenders. Don’t hesitate to negotiate for better terms if you find a competitive offer elsewhere.

- Gather Documentation: Prepare necessary documents such as proof of income, tax returns, and information about your current mortgage.

- Submit Your Application: After selecting a lender, complete their application process. This may include a credit check and property appraisal.

Using Your HELOC Wisely

Once you have access to your HELOC, it’s essential to use the funds wisely:

- Prioritize High-Interest Debt: If you’re using your HELOC to consolidate debt, focus on paying off high-interest credit cards or loans first.

- Invest in Home Improvements: Use the funds for projects that will increase your home’s value, such as kitchen remodels or energy-efficient upgrades.

- Maintain a Budget: Keep track of your spending and ensure you’re not borrowing excessively. Remember that a HELOC is a loan that requires repayment.

Potential Risks of a HELOC

While HELOCs offer many benefits, they also come with risks that homeowners should consider:

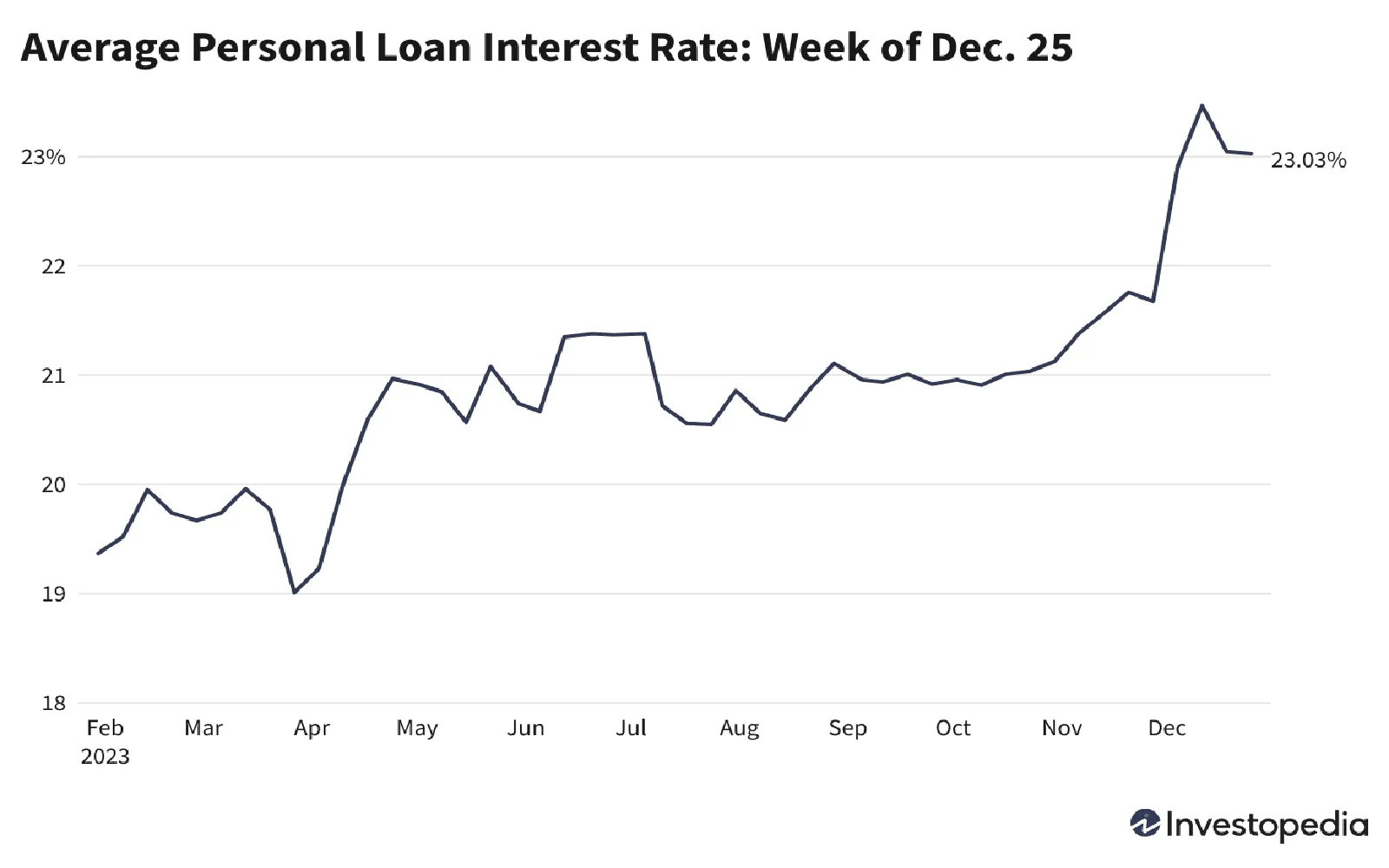

- Variable Interest Rates: Since most HELOCs have variable rates, your payments can increase if interest rates rise, potentially straining your budget.

- Risk of Foreclosure: A HELOC is secured by your home. If you’re unable to make payments, you risk losing your property.

- Over-Borrowing: The easy access to funds can lead to overspending, which may create financial difficulties in the future.

Conclusion: Unlock Your Home’s Value Today!

As we enter 2025, the opportunity to leverage your home’s equity through a HELOC is more accessible than ever. With competitive rates, rising home values, and a variety of lending options, homeowners can take advantage of this financial tool to fund their dreams and improve their financial situations. However, it’s crucial to approach a HELOC with caution and a solid plan to ensure that you’re making the best decision for your financial future. By understanding the market trends and selecting the right lender, you can unlock your home’s value today and turn it into a valuable resource for your financial goals.

Explore

Home Improvement: Transforming Your Living Space for Comfort and Value

Discover the Lowest Personal Loan Interest Rates of 2025: Unlock Your Financial Freedom Today!

Top Mortgage Rates for First-Time Buyers in 2025: Unlock Your Dream Home

2025 Mortgage Refinance Rates: Unlock Cash-Out Options for Your Financial Freedom

Top Student Credit Cards for 2025: Unlock Financial Freedom and Build Credit Wisely

Unlock Your Health Potential: Explore the World of Nutrition Courses Today!

Top 10 Credit Score Improvement Tips for 2025: Boost Your Financial Health Today!