Top 10 Credit Score Improvement Tips for 2025: Boost Your Financial Health Today!

Understanding Credit Scores

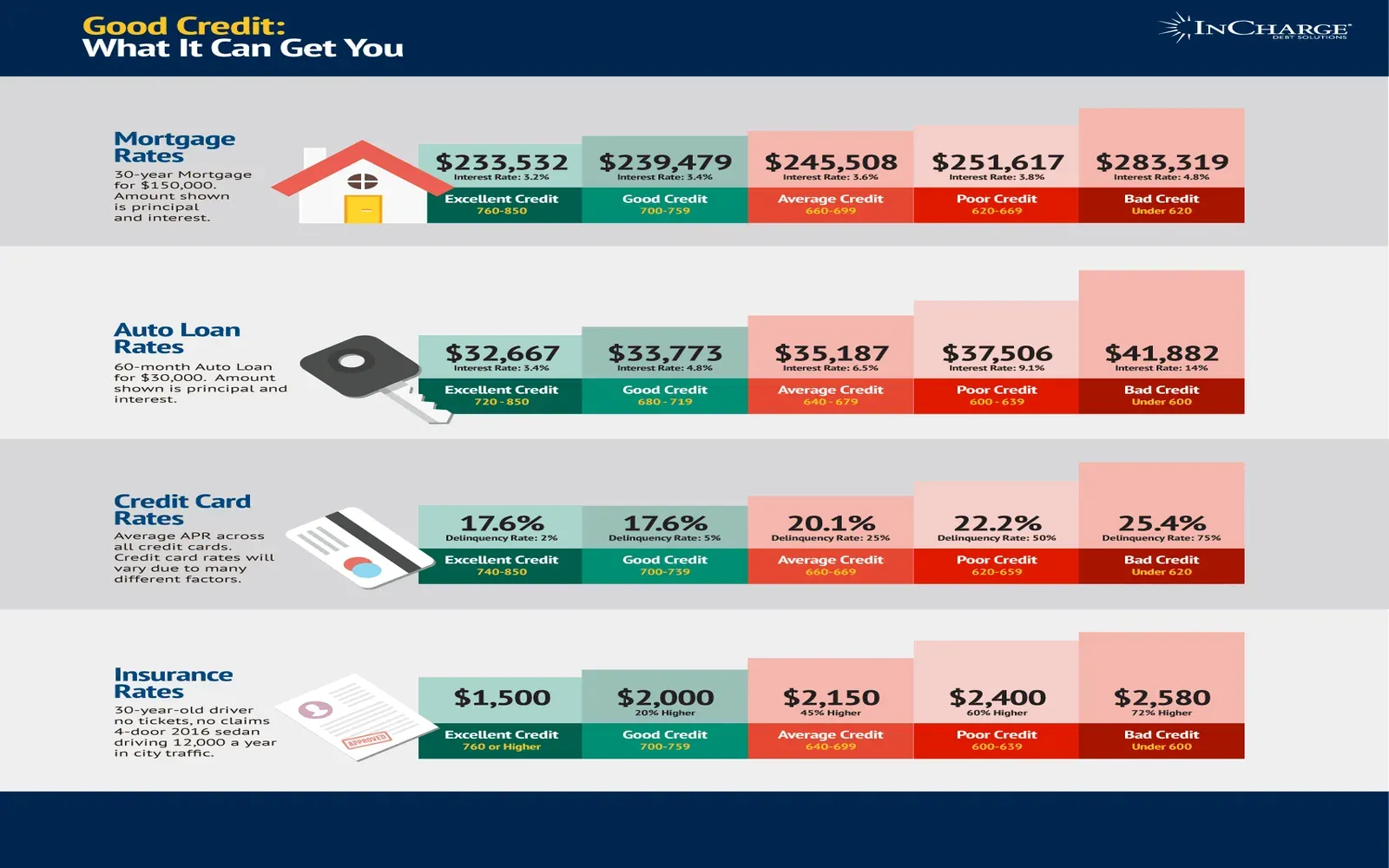

Credit scores play a significant role in our financial lives. They are numerical representations of our creditworthiness, which lenders use to evaluate the risk of lending money or extending credit. Ranging from 300 to 850, a higher score generally indicates better creditworthiness. In 2025, understanding the components of your credit score and actively working to improve it can lead to better loan terms, lower interest rates, and overall financial health.

1. Check Your Credit Report Regularly

The first step in improving your credit score is to know where you stand. In 2025, you can access your credit report for free annually from each of the three major credit bureaus: Equifax, Experian, and TransUnion. Reviewing your credit report allows you to identify any errors or discrepancies that could be negatively impacting your score. If you find inaccuracies, dispute them promptly to ensure your credit report is accurate.

2. Pay Your Bills on Time

Payment history is one of the most critical factors in determining your credit score. In 2025, make it a priority to pay all your bills on time. This includes not just your credit card bills, but also utilities, rent, and any other recurring payments. Setting up automatic payments or reminders can help you stay on track. A consistent record of on-time payments can significantly boost your credit score over time.

3. Reduce Your Credit Utilization Ratio

Your credit utilization ratio is the percentage of your available credit that you are currently using. Ideally, you should aim to keep this ratio below 30%. In 2025, if you find yourself using a significant portion of your credit limit, consider paying down existing balances or requesting a credit limit increase. This can help lower your utilization ratio and positively impact your credit score.

4. Avoid Opening New Credit Accounts Frequently

Each time you apply for new credit, a hard inquiry is made on your credit report, which can temporarily lower your score. In 2025, be strategic about opening new credit accounts. Instead of applying for multiple credit cards or loans in a short period, take the time to research and apply for credit that suits your needs. Focus on maintaining existing accounts rather than opening new ones unnecessarily.

5. Keep Old Credit Accounts Open

The length of your credit history accounts for a portion of your credit score. In 2025, consider keeping older credit accounts open, even if you’re not using them frequently. This can help lengthen your credit history and improve your score. However, be mindful of any fees associated with maintaining these accounts. If the fees outweigh the benefits, it might be worth closing an account, but always weigh the impact on your credit score.

6. Diversify Your Credit Mix

Having a diverse mix of credit types—such as credit cards, installment loans, and retail accounts—can positively influence your credit score. In 2025, consider adding different types of credit to your portfolio, if it makes sense for your financial situation. However, only take on new credit if you can manage it responsibly and ensure it aligns with your financial goals.

7. Use Credit Responsibly

Responsible credit use is essential for maintaining a good credit score. In 2025, this means not only paying your bills on time but also being cautious about how much credit you use. Avoid maxing out your credit cards and strive to keep balances low. Additionally, be aware of the terms and conditions associated with your credit accounts to avoid any surprises that could affect your credit score.

8. Set Up Alerts and Notifications

In the digital age of 2025, many banks and credit card companies offer alerts and notifications to help you manage your credit more effectively. Take advantage of these tools to receive reminders about upcoming payments, low balance alerts, or unusual spending patterns. Setting up alerts can help you stay proactive about your credit management and prevent missed payments that could harm your credit score.

9. Consider Credit Counseling

If you find yourself struggling with debt or managing your credit, consider seeking help from a credit counseling service. In 2025, many organizations offer free or low-cost counseling to help you understand your credit and develop a plan to improve it. Credit counselors can provide personalized advice and strategies tailored to your financial situation, helping you navigate your path to better credit health.

10. Be Patient and Persistent

Improving your credit score is not an overnight process. It requires time, effort, and commitment. In 2025, be patient and stay persistent in your efforts to enhance your credit score. Regularly monitor your progress and celebrate small victories along the way. Understand that building a solid credit history takes time, but with the right practices, you can achieve your financial goals.

Conclusion

In 2025, taking proactive steps to improve your credit score can lead to significant benefits for your financial health. By checking your credit report, paying bills on time, reducing your credit utilization, and following the tips outlined above, you can work towards achieving a higher credit score. Remember that credit is a key component of your overall financial picture, and investing in its improvement will pay dividends in the long run. Prioritize your credit health today to enjoy a brighter financial future tomorrow!

Explore

Top SEO Agencies Near Me: Boost Your Local Search Rankings Today!

Transform Your Space: Discover the Best Home Improvement Loans for Your Dream Renovation

Home Improvement: Transforming Your Living Space for Comfort and Value

Boost Your Credit Score Fast in 2025: Proven Strategies for Quick Improvement

Top Student Credit Cards for 2025: Unlock Financial Freedom and Build Credit Wisely

Top Home Equity Line of Credit Rates for 2025: Unlock Your Home's Value Today!

Unlock Your Health Potential: Explore the World of Nutrition Courses Today!