How to Choose the Best Personal Loan for Your Needs in 2025

Choosing the best personal loan in 2025 requires careful consideration of several factors. Start by assessing your credit score to understand your eligibility. Compare interest rates from various lenders and look for flexible repayment terms. Additionally, evaluate any fees associated with the loan and read customer reviews to ensure you select a reliable lender that meets your financial needs.

When it comes to managing your finances, finding the right personal loan can make a significant difference. As we enter 2025, the landscape of personal loans continues to evolve, presenting borrowers with a variety of options. Here’s a comprehensive guide on how to choose the best personal loan for your needs.

Understand Your Financial Situation

Before you even start looking for a personal loan, it’s essential to assess your **financial health**. Take a close look at your income, expenses, and existing debts. This will help you determine how much you can afford to borrow and repay comfortably. Consider creating a budget that incorporates your monthly expenses and potential loan payments.

Know the Different Types of Personal Loans

There are several types of **personal loans** available in 2025, each designed to meet different needs:

- Unsecured Personal Loans: These loans do not require collateral and are based solely on your creditworthiness. They typically come with higher interest rates.

- Secured Personal Loans: These loans require collateral, such as a car or savings account, which can lower your interest rate.

- Peer-to-Peer Loans: Borrowing from individuals instead of financial institutions can sometimes offer lower rates.

- Credit Union Loans: Often have lower interest rates and fees than traditional banks.

Check Your Credit Score

Your **credit score** plays a crucial role in determining the interest rate and terms of your loan. In 2025, lenders are likely to use advanced algorithms that consider not just your credit score but also your employment history and income stability. It’s advisable to check your credit score before applying for a loan and take steps to improve it if necessary.

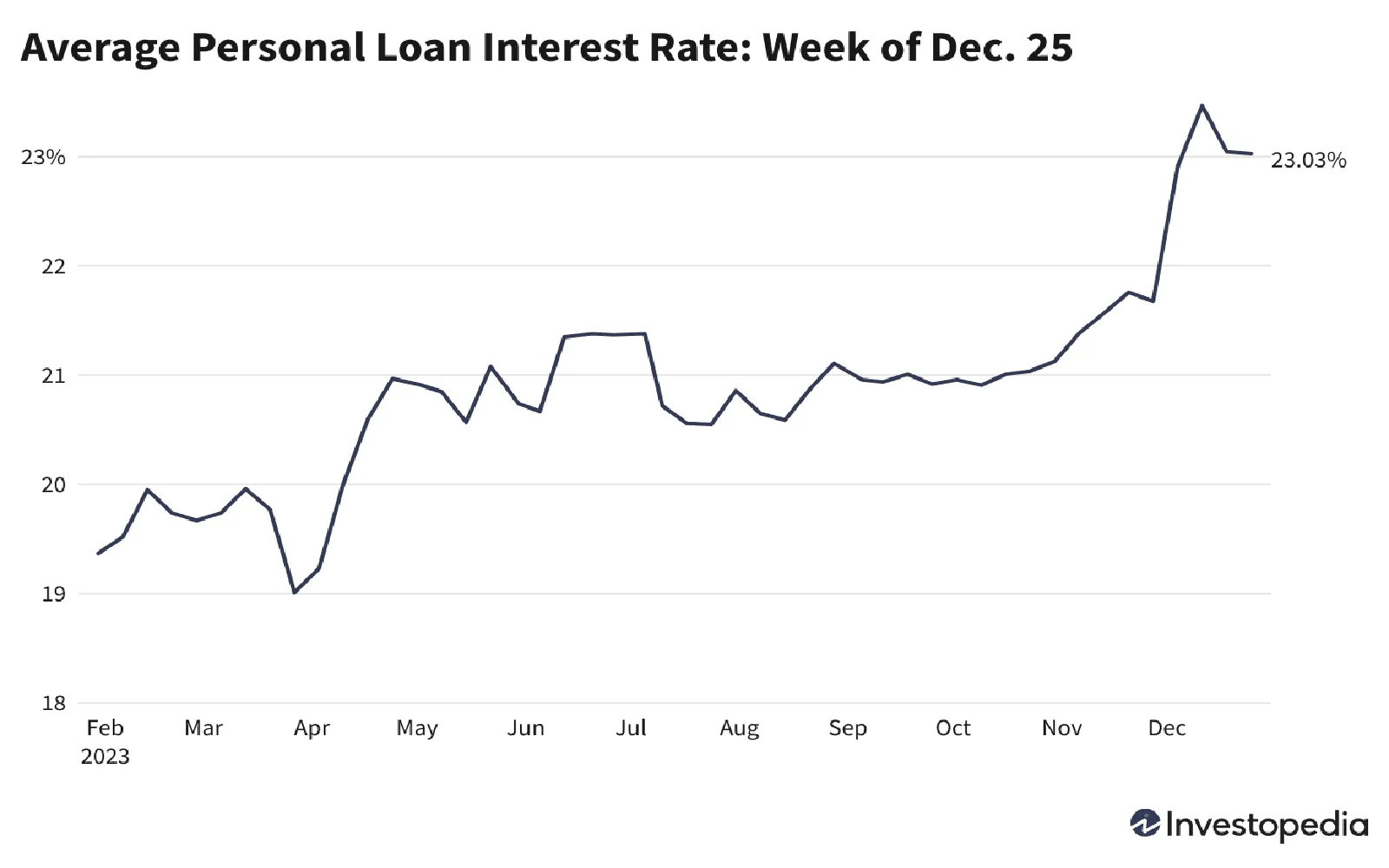

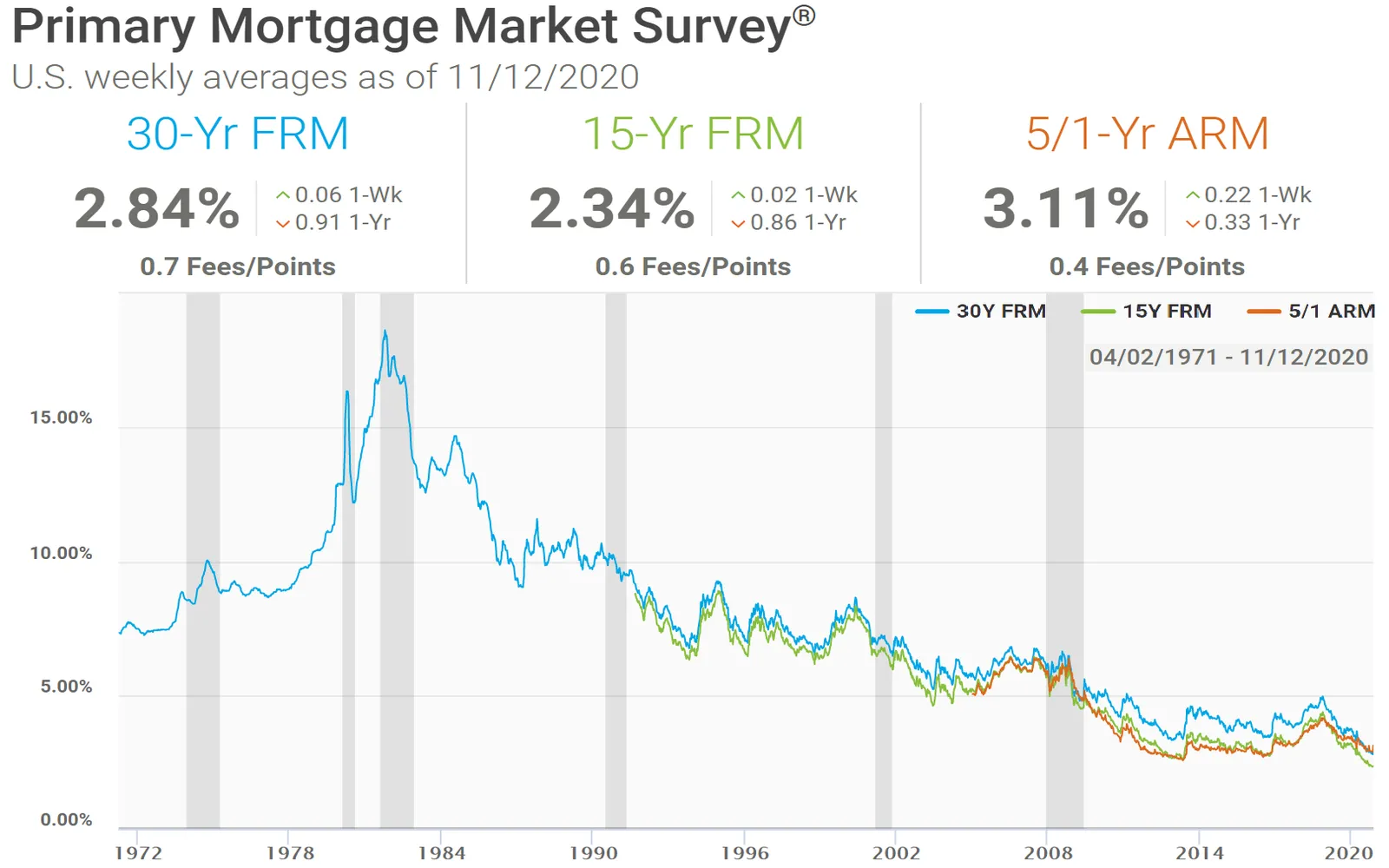

Compare Interest Rates and Fees

Interest rates can vary significantly from one lender to another. In 2025, it’s important to shop around for the best rates. Here’s a simplified chart comparing average interest rates across different types of personal loans:

| Loan Type | Average Interest Rate (%) |

|---|---|

| Unsecured Personal Loan | 10.5 - 36 |

| Secured Personal Loan | 5 - 15 |

| Peer-to-Peer Loan | 6 - 30 |

| Credit Union Loan | 7 - 20 |

Be sure to also consider any additional fees, such as origination fees, prepayment penalties, and late fees, as these can add up and make your loan more expensive.

Evaluate Loan Terms

The terms of the loan, including the repayment period, are just as important as the interest rate. A loan with a longer repayment term may offer lower monthly payments, but it can also result in paying more interest over the life of the loan. In contrast, a shorter repayment term usually means higher monthly payments but less interest overall. Think about your budget and how much you can realistically afford each month.

Read the Fine Print

Before signing any loan agreement, it’s crucial to read the fine print. Look for any hidden fees and understand the terms of the loan, including what happens if you miss a payment. In 2025, many lenders are becoming more transparent, but it’s still your responsibility to ensure you understand the terms of the loan.

Consider the Lender’s Reputation

Research the lender’s reputation by reading reviews and checking their ratings with organizations like the Better Business Bureau. A lender with a solid reputation is more likely to provide reliable customer service and fair terms. Look for lenders who are known for their transparency and have positive feedback from previous borrowers.

Pre-Approval Process

Many lenders now offer a **pre-approval** process that allows you to see what rates and terms you qualify for without affecting your credit score. This can give you a clearer idea of what to expect as you compare different options. Pre-approval can also help streamline the loan process once you’ve made your decision.

Make an Informed Decision

Finally, after gathering all the necessary information and comparing your options, it’s time to make an informed decision. Choose a loan that aligns with your financial goals and offers terms that you can manage comfortably. Remember, the best personal loan for you is the one that fits your unique financial situation.

In conclusion, finding the right personal loan in 2025 requires thorough research and careful consideration of your financial health, loan types, interest rates, fees, and lender reputation. By following these steps, you can secure a personal loan that meets your needs and helps you achieve your financial goals.

Explore

Unlocking Seamless Journeys: Discover the Top Corporate Travel Agencies for Your Business Needs

Unlocking Innovation: The Top App Developers Every Startup Needs to Know

Discover the Lowest Personal Loan Interest Rates of 2025: Unlock Your Financial Freedom Today!

How to Find the Best Local Law Firm for Your Legal Needs

2025 Guide to Refinance Home Loan Rates: Compare and Save on Your Mortgage

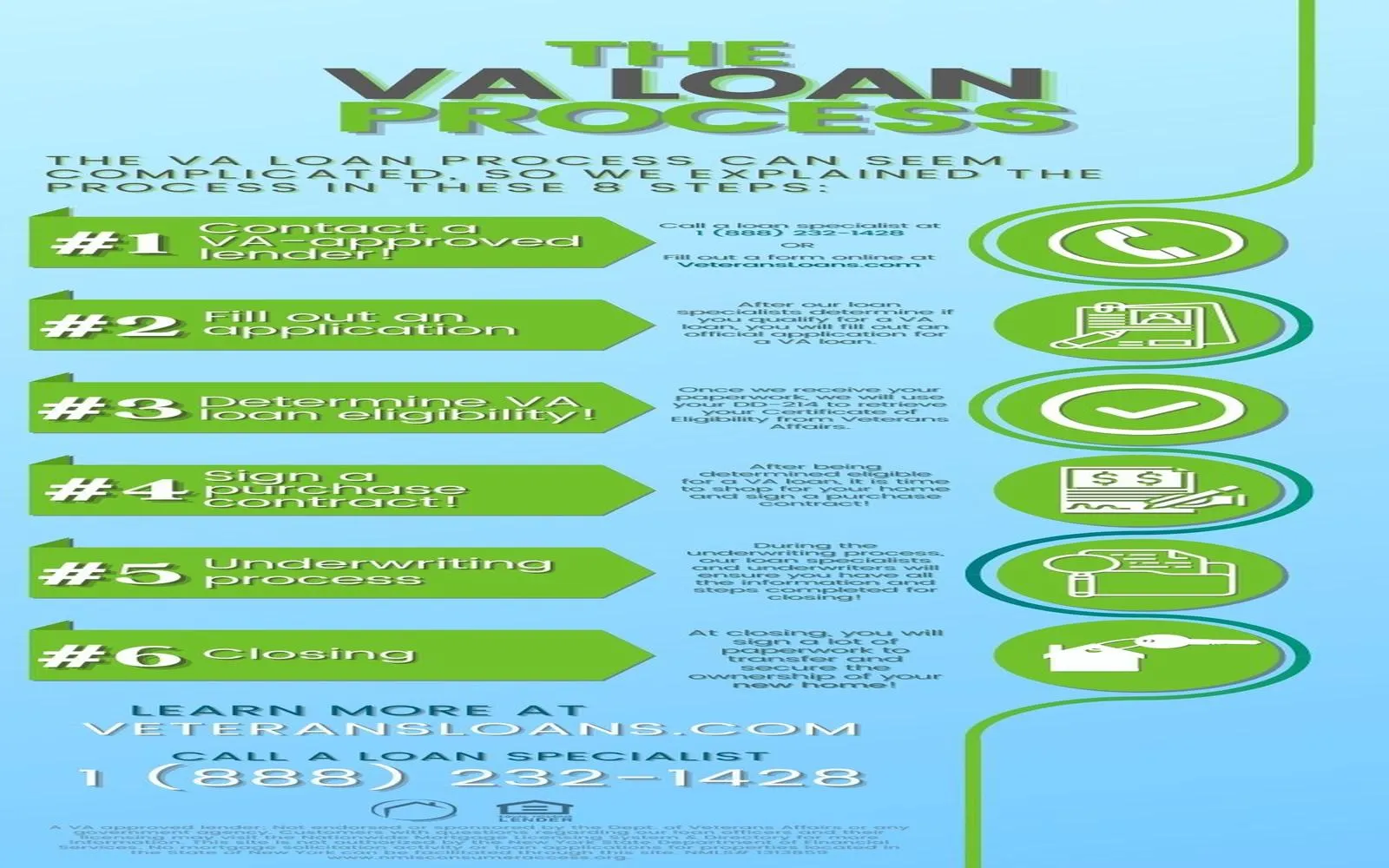

2025 Guide: How to Qualify for a VA Home Loan and Secure Your Dream Home

10 Smart Tax-Free Savings Tips Every American Needs in 2025

Ultimate Guide to Securing a Small Business Loan in 2025: Tips, Strategies, and Resources