Liability Insurance: Protection for Individuals and Businesses

Liability insurance provides financial protection against claims resulting from injuries, property damage, or legal costs. Whether for individuals or businesses, it helps cover unexpected expenses and lawsuits.

Types of Liability Insurance

🏢 General Liability Insurance

- Covers bodily injury, property damage, and legal fees.

- Essential for businesses, contractors, and self-employed professionals.

🚗 Auto Liability Insurance

- Covers damages if you're at fault in a car accident.

- Required by law in most states.

🏡 Homeowners Liability Insurance

- Protects against injuries on your property (e.g., slip-and-fall accidents).

- Includes coverage for dog bites and guest injuries.

🏢 Professional Liability Insurance (Errors & Omissions - E&O)

- Protects professionals (doctors, lawyers, consultants) from claims of negligence or mistakes.

- Common in legal, financial, and healthcare sectors.

💼 Product Liability Insurance

- Covers claims related to defective or harmful products.

- Essential for manufacturers and retailers.

👨💼 Employers’ Liability Insurance

- Covers workplace injuries and employee lawsuits.

- Often included in workers' compensation policies.

Why Liability Insurance is Important

✔ Covers Legal Fees – Pays for attorney fees and settlements.

✔ Protects Assets – Prevents financial ruin from lawsuits.

✔ Required by Law – Some forms (like auto liability) are mandatory.

✔ Builds Business Trust – Clients prefer insured businesses.

Cost of Liability Insurance

| Type of Insurance | Average Annual Cost |

|---|---|

| General Liability (Business) | $500 - $3,000 |

| Professional Liability | $600 - $2,500 |

| Auto Liability | $300 - $1,500 |

| Homeowners Liability | $100 - $500 |

💡 Tip: Compare quotes from multiple insurers to find the best rate.

How to Choose the Right Policy

🔹 Assess Your Risks – Identify potential liabilities in your industry or lifestyle.

🔹 Check Coverage Limits – Ensure policy limits meet your needs.

🔹 Compare Providers – Look for top-rated insurance companies.

🔹 Consider Bundling – Some insurers offer discounts for bundling multiple policies.

Conclusion

Liability insurance is essential for financial protection, whether for personal or business needs. Understanding the different types ensures you select the right coverage to safeguard against legal and financial risks.

Explore

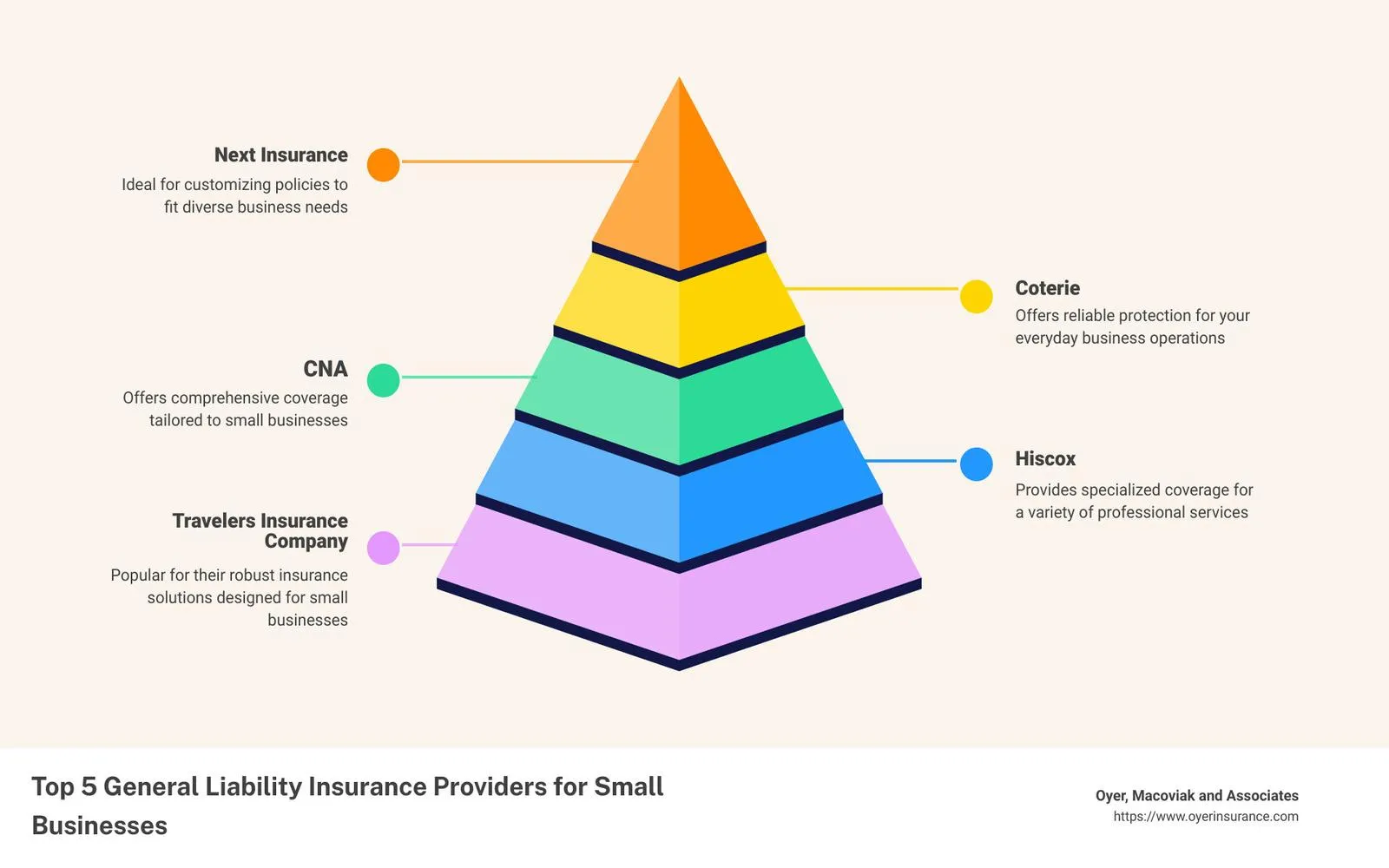

Business Liability Insurance Providers: Protecting Your Business from Risks

Guardians of Your Digital World: Discover the Best Antivirus Software for Ultimate Protection

Affordable Travel Insurance Options for 2025: Your Guide to Budget-Friendly Protection

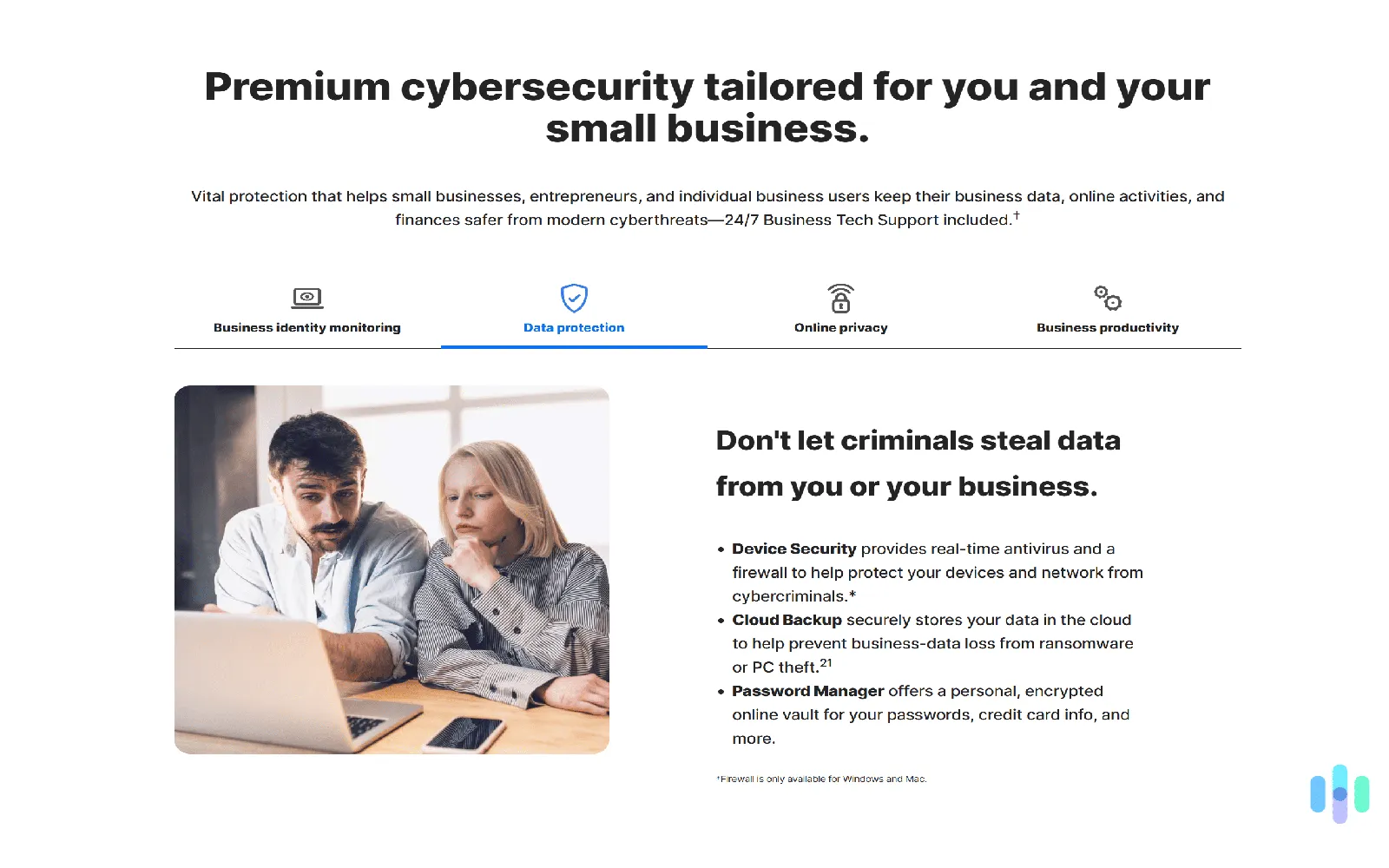

Top Security Software Solutions for Business Data Protection in 2025: Safeguard Your Sensitive Information

Top CRM Software for Small Businesses in 2025: Boost Your Growth and Efficiency

Top Cloud Storage Solutions for Businesses in 2025: Maximize Efficiency and Security

Top POS Software for Retail Businesses in 2025: Boost Your Sales and Efficiency

Top Data Analysis Software for Businesses to Leverage in 2025: Boost Your Insights and Decision-Making