Business Liability Insurance Providers: Protecting Your Business from Risks

Every business, whether small or large, faces a variety of risks. From accidents and property damage to lawsuits and employee injuries, the potential for financial loss is always present. Business liability insurance helps protect your company from the financial burdens of these risks. However, choosing the right provider is essential to ensure comprehensive coverage and peace of mind. This article explores what business liability insurance is, the different types of coverage available, and how to choose the best provider for your needs.

What Is Business Liability Insurance?

Business liability insurance is a type of coverage that helps protect businesses from legal claims arising from injuries, accidents, or negligence that occur during the course of business operations. It typically covers the costs of legal defense, settlements, and any judgments awarded in lawsuits.

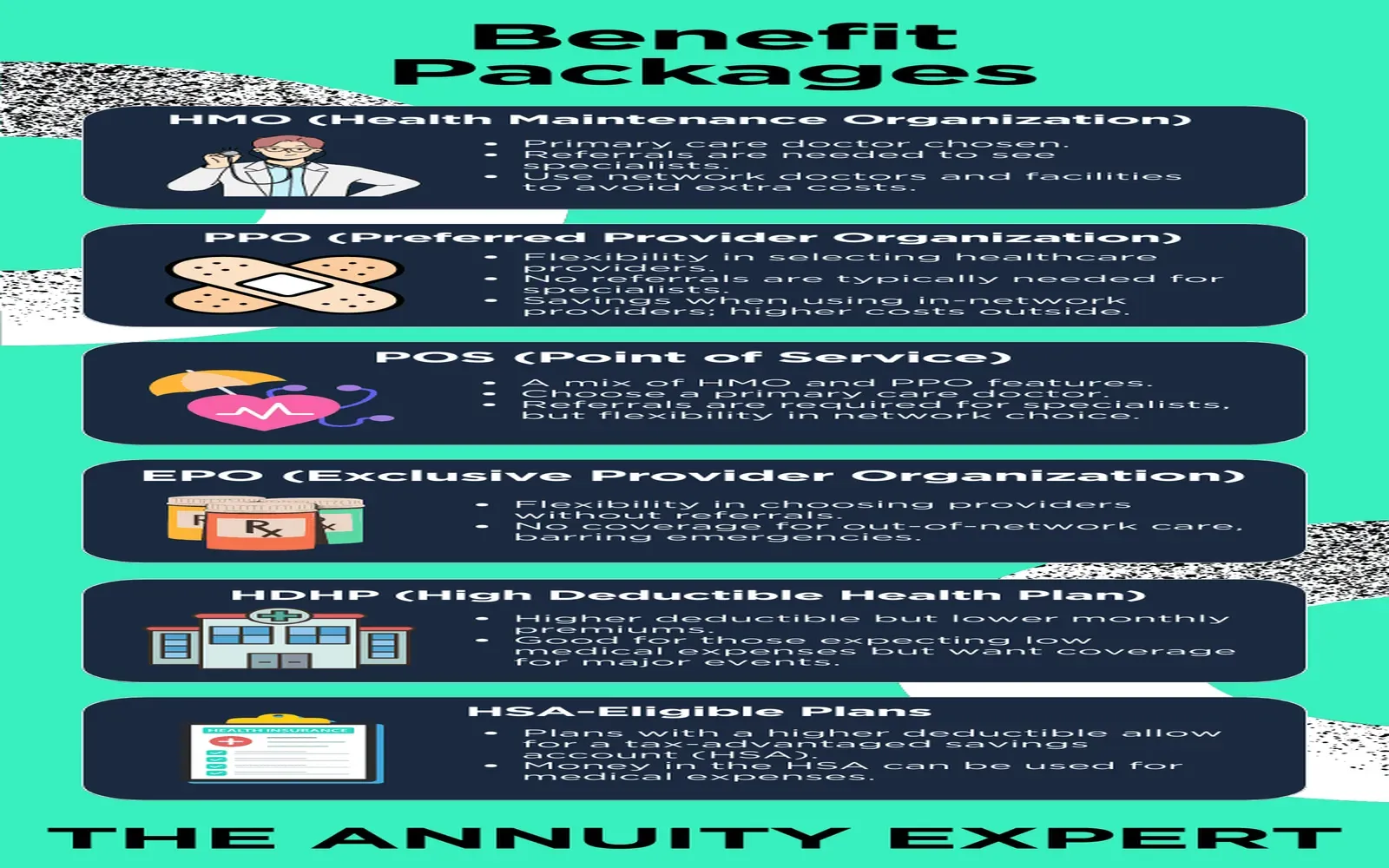

There are various types of business liability insurance, each designed to protect against different types of risks. The most common forms include:

- General Liability Insurance: Covers claims related to bodily injury, property damage, and personal injury that occur on your premises or as a result of your business operations.

- Professional Liability Insurance (Errors and Omissions Insurance): Protects businesses that provide services or advice against claims of negligence, errors, or omissions that cause financial harm to clients.

- Product Liability Insurance: Covers damages caused by a defective product sold by the business, including injuries or property damage caused by the product.

- Workers' Compensation Insurance: Protects businesses against claims for injuries sustained by employees during the course of their work. This is often legally required for businesses with employees.

- Commercial Auto Insurance: Covers vehicles used for business purposes in case of accidents, injuries, or property damage.

Why Do You Need Business Liability Insurance?

Business liability insurance is essential because it offers financial protection from unforeseen events. Here’s why you need it:

- Protection from Lawsuits: Even a small accident can lead to a lawsuit. If your business is found liable, you could face significant legal fees and compensation payouts. Liability insurance helps cover these costs.

- Employee Protection: Injuries that occur at work can lead to workers' compensation claims. Business liability insurance provides coverage for workplace accidents, reducing the financial burden on your business.

- Customer Safety: If a customer is injured or their property is damaged because of your business activities, liability insurance can cover the costs of compensation and legal defense.

- Reputation Management: Having insurance can show customers and partners that you take risk management seriously, enhancing your business’s reputation.

- Peace of Mind: Running a business comes with many uncertainties. Liability insurance helps alleviate the stress of potential legal challenges and financial risks.

How to Choose the Right Business Liability Insurance Provider

Choosing the right business liability insurance provider is critical to ensuring that your business is adequately protected. Here are some factors to consider when selecting a provider:

1. Assess Your Business Needs

Before shopping for liability insurance, take the time to assess the specific risks your business faces. The coverage you need will depend on factors such as:

- The size of your business

- The industry you operate in

- The number of employees

- The products or services you offer

- Whether you have a physical location or operate online

Understanding your business’s unique needs will help you find a provider that offers the appropriate coverage.

2. Reputation and Experience

Look for an insurance provider with a strong reputation and experience in providing business liability coverage. Check customer reviews, ratings, and the company’s track record with handling claims. A reliable provider should have a history of paying claims promptly and fairly.

3. Coverage Options and Flexibility

Not all businesses are the same, so it’s important to find a provider that offers customizable coverage options. Look for a provider that allows you to tailor your policy to meet the specific needs of your business. Ensure that you are covered for a wide range of risks, including property damage, employee injuries, and third-party claims.

4. Pricing and Payment Terms

Cost is always a consideration when purchasing insurance. However, the cheapest option may not always provide the most comprehensive coverage. Compare quotes from different providers, but focus on the quality of coverage and service, not just the price. Be sure to ask about payment plans, deductibles, and any hidden fees that may affect the overall cost.

5. Customer Service and Claims Support

A good business liability insurance provider should offer excellent customer service and support, especially when it comes to filing claims. Ensure that the provider offers easy access to claims assistance and has a quick, responsive claims process. It’s important to feel confident that your insurer will be there when you need them most.

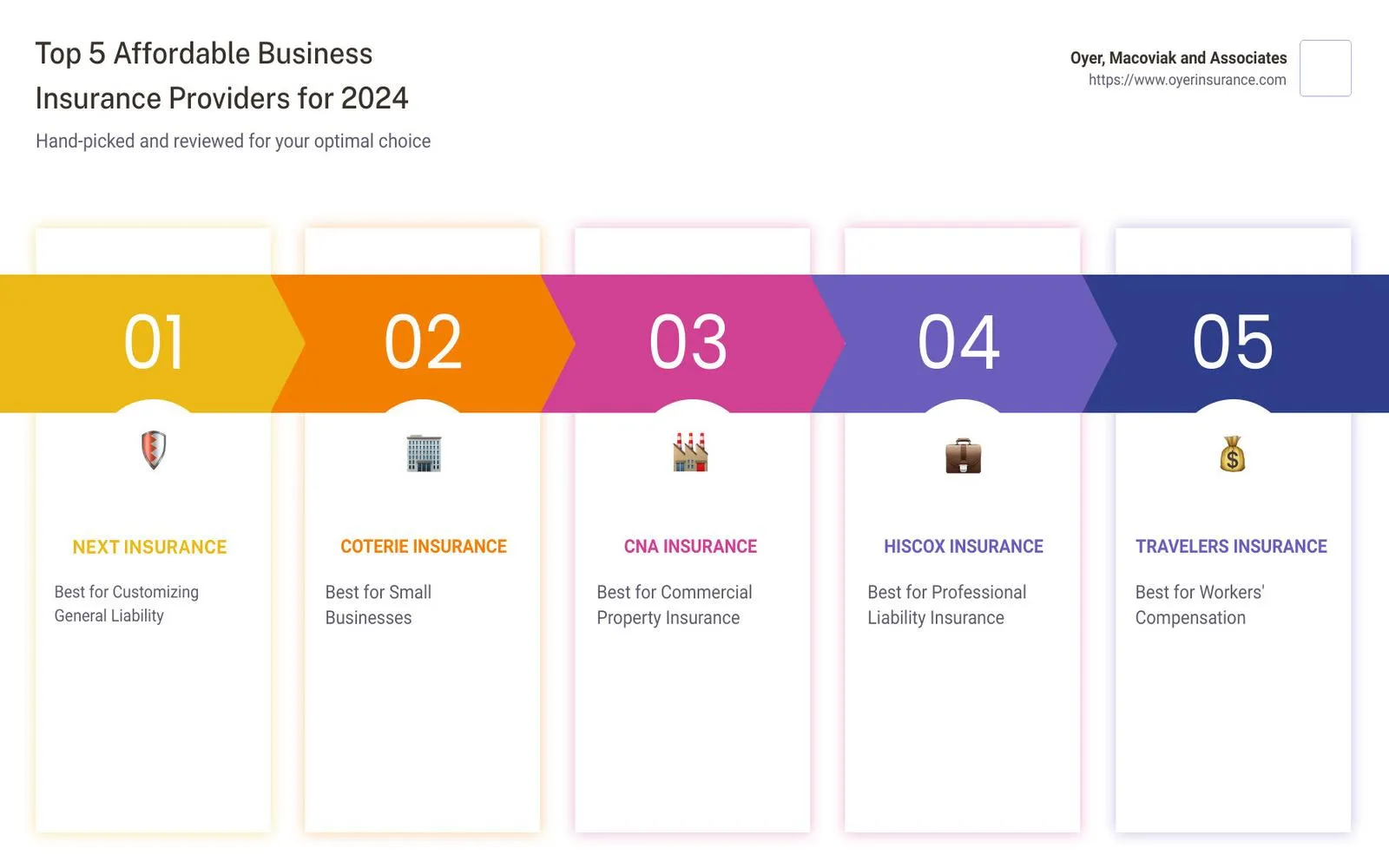

Top Business Liability Insurance Providers

Here are some well-known business liability insurance providers, each offering different coverage options:

- The HartfordSpecialties: General liability, professional liability, workers’ compensation, commercial auto insurance.Why Choose Them: The Hartford is known for its customizable coverage options and extensive experience in providing business insurance for small and medium-sized businesses. They offer a straightforward online quote process and reliable customer support.

- State FarmSpecialties: General liability, commercial property insurance, workers’ compensation, business auto insurance.Why Choose Them: State Farm has a long track record in the insurance industry and offers competitive rates for small business owners. Their wide range of coverage options and personalized service make them a popular choice.

- ProgressiveSpecialties: Commercial auto insurance, general liability, professional liability.Why Choose Them: Progressive is particularly known for its commercial auto insurance policies and offers flexible business liability coverage. Their online tools allow business owners to easily compare policies and customize their insurance plans.

- HiscoxSpecialties: Professional liability (errors and omissions), general liability, cyber liability.Why Choose Them: Hiscox is an excellent choice for small business owners and entrepreneurs, offering tailored liability coverage for industries like technology, consulting, and healthcare.

- ChubbSpecialties: General liability, product liability, workers’ compensation, cyber liability.Why Choose Them: Chubb is known for providing robust coverage for businesses of all sizes. They offer high coverage limits and specialized products for high-risk industries.

Conclusion

Business liability insurance is an essential safeguard for protecting your business from unexpected risks and legal claims. Choosing the right provider can make all the difference in securing comprehensive coverage and ensuring that your business is protected from financial loss. When evaluating business liability insurance providers, consider factors such as the types of coverage they offer, their reputation, and the level of customer service provided.

By working with a reputable insurance provider and tailoring your policy to meet the specific needs of your business, you can ensure peace of mind knowing that you’re protected from a wide range of potential liabilities.

Explore

Liability Insurance: Protection for Individuals and Businesses

Home Warranty Insurance: Protecting Your Home's Systems and Appliances

Top-Rated Pet Insurance in the USA: Protecting Your Furry Family Members

Affordable Business Health Insurance Plans for 2025: Save Money While Protecting Your Team

Top Business Insurance Providers of 2025: Secure Your Future with the Best Coverage Options

Explore Business Insurance Providers of 2025: Ensure Your Company’s Future Security

Top 2025: Cheapest Pet Insurance Providers for Affordable Coverage

Top Car Insurance Providers with the Best Quotes in 2025