Affordable Business Health Insurance Plans for 2025: Save Money While Protecting Your Team

Introduction

As we approach 2025, the landscape of health insurance continues to evolve, particularly for small and medium-sized businesses. Providing health insurance for employees has become more than just a benefit; it’s an essential aspect of attracting and retaining talent. However, rising costs often deter businesses from offering comprehensive health plans. This article explores affordable business health insurance options available in 2025, helping employers save money while ensuring their teams are well-protected.

The Importance of Health Insurance for Businesses

Health insurance is critical for businesses not only to comply with legal requirements but also to foster a healthy workforce. Employees who feel secure in their health coverage are more likely to be productive and loyal. Moreover, offering a good health plan can significantly reduce turnover rates, saving companies money in recruitment and training.

Understanding Affordable Options

In 2025, several options are available for businesses looking to provide affordable health insurance. Understanding these options can help employers make informed decisions that suit both their budget and their employees' needs.

Health Maintenance Organizations (HMOs)

HMOs are a popular choice for businesses seeking cost-effective health insurance. These plans often come with lower premiums and out-of-pocket costs. Employees are required to choose a primary care physician and get referrals to see specialists. While this model limits flexibility, it promotes preventive care, which can ultimately lead to lower healthcare costs for the business.

Preferred Provider Organizations (PPOs)

PPOs offer more flexibility than HMOs, allowing employees to see any doctor without a referral. While premiums may be higher, the broader network of providers can lead to improved employee satisfaction. Businesses can negotiate with PPOs to secure lower rates, making them a viable option for those willing to invest a bit more for greater choice.

High-Deductible Health Plans (HDHPs)

High-Deductible Health Plans are becoming increasingly popular for businesses looking to save on premium costs. These plans feature lower monthly premiums but higher deductibles. Employers can pair HDHPs with Health Savings Accounts (HSAs), allowing employees to save pre-tax dollars for medical expenses. This combination encourages employees to engage more actively in their healthcare choices, which can lead to overall cost savings for the company.

Health Savings Accounts (HSAs)

HSAs are tax-advantaged savings accounts that employees can use to pay for qualifying medical expenses. By offering an HDHP alongside an HSA, employers can reduce their health insurance costs while providing employees with a tax-efficient way to save for healthcare expenses. Contributions to HSAs can be made by both employers and employees, making it a collaborative approach to managing health costs.

Small Business Health Options Program (SHOP)

The SHOP marketplace is designed specifically for small businesses looking to provide health insurance to their employees. Through SHOP, employers can compare various plans and find options that fit their budgets. Furthermore, eligible businesses may qualify for tax credits, making this a highly attractive option for small employers.

Direct Primary Care (DPC)

Direct Primary Care is an innovative model that allows businesses to contract directly with primary care providers. For a fixed monthly fee, employees receive a range of primary care services without the complexities of traditional insurance. This model can significantly cut costs and provide employees with easier access to care, though it may require a separate insurance plan for specialists and hospitalization.

Telehealth Services

As telehealth continues to gain traction, offering telehealth services as part of a health insurance package can save businesses money while providing employees with convenient access to care. Many insurance plans now include telehealth options, which can help reduce costs associated with in-person visits. Integrating telehealth services can lead to quicker consultations, reduced absenteeism, and overall enhanced employee satisfaction.

Wellness Programs

Investing in wellness programs can lead to long-term savings on health insurance premiums. Many insurers offer discounts to businesses that implement wellness initiatives, such as fitness programs, mental health resources, and preventive screenings. By promoting a culture of health, businesses can reduce healthcare costs and improve employee well-being.

Cost-Sharing Arrangements

Cost-sharing arrangements, such as offering tiered plans that allow employees to choose their level of coverage, can help manage costs. Employers can provide several options ranging from high-deductible plans to more comprehensive coverage. This flexibility allows employees to select plans that fit their financial situations while helping businesses control premium expenses.

Employee Assistance Programs (EAPs)

Employee Assistance Programs provide a range of services, including counseling and mental health support, at no extra cost to employees. By addressing mental health needs, businesses can improve workforce productivity and morale. EAPs can often be included in health insurance plans or offered as a standalone service, making them an affordable addition to employee benefits.

Evaluating Insurance Providers

When selecting a health insurance provider, it’s essential to compare multiple options. Look for providers that offer competitive rates, a wide network of healthcare professionals, and excellent customer service. Utilizing a broker can also help businesses navigate the complexities of health insurance and find the best plan tailored to their needs.

Utilizing Technology for Enrollment and Management

In 2025, many businesses are leveraging technology for health insurance enrollment and management. Online platforms allow employees to easily compare plans, enroll, and manage their benefits. These tools can streamline administrative tasks for HR departments and enhance employee engagement in their health benefits.

Staying Informed about Regulatory Changes

The regulatory landscape surrounding health insurance is ever-changing. Staying informed about federal and state regulations, including the Affordable Care Act (ACA) and any potential changes, is vital for businesses to remain compliant and avoid penalties. Regularly reviewing these laws and consulting with legal experts can help ensure that your health insurance offerings meet all necessary requirements.

Seeking Professional Advice

Given the complexities of health insurance, many businesses benefit from seeking professional advice. Insurance brokers, financial advisors, and HR consultants can provide valuable insights and help identify the most suitable options for your organization. Investing in expert guidance can lead to significant savings and improved employee satisfaction.

Communicating Options to Employees

Once you’ve chosen a health insurance plan, it’s crucial to communicate the options clearly to your employees. Providing educational materials, hosting informational sessions, and encouraging questions can help employees make informed decisions about their healthcare. Effective communication can boost enrollment in the plan and ensure that employees fully understand the benefits available to them.

Monitoring and Adjusting Insurance Plans

Health insurance needs may change over time, and it’s essential to regularly monitor and evaluate the effectiveness of your chosen plan. Gather feedback from employees and assess utilization rates to determine if the plan meets their needs. If necessary, be open to making adjustments or exploring new options to provide the best possible coverage for your team.

Conclusion

As we move into 2025, affordable business health insurance plans are more accessible than ever. By understanding the various options available, businesses can save money while providing essential protection for their teams. Whether through traditional insurance models, innovative approaches like telehealth and DPC, or by implementing wellness programs, employers have the tools to create a comprehensive health insurance strategy that aligns with their budget and meets the needs of their workforce. Investing in health insurance is not just a financial decision; it’s an investment in the well-being and productivity of your employees, ultimately contributing to the long-term success of your business.

Explore

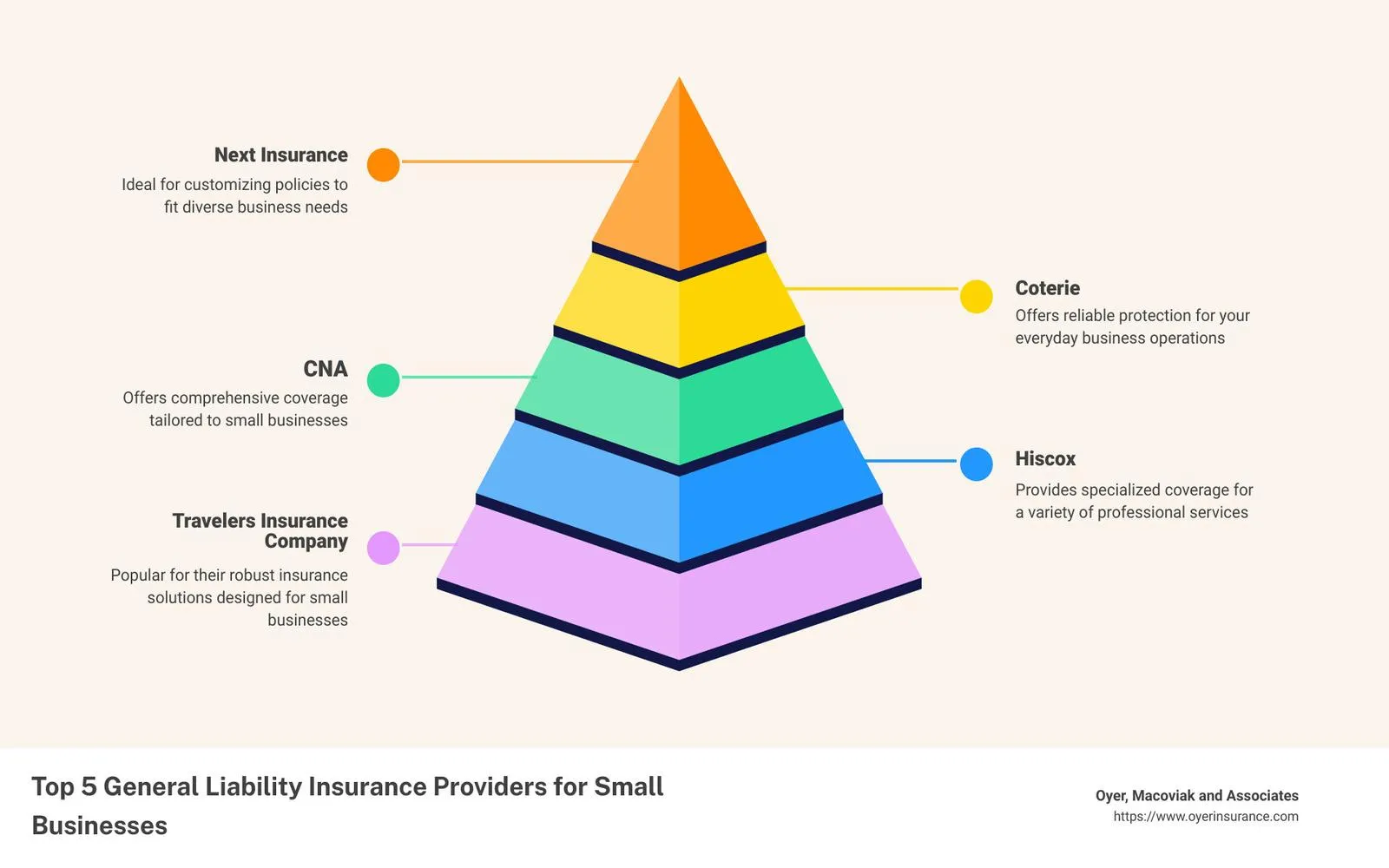

Business Liability Insurance Providers: Protecting Your Business from Risks

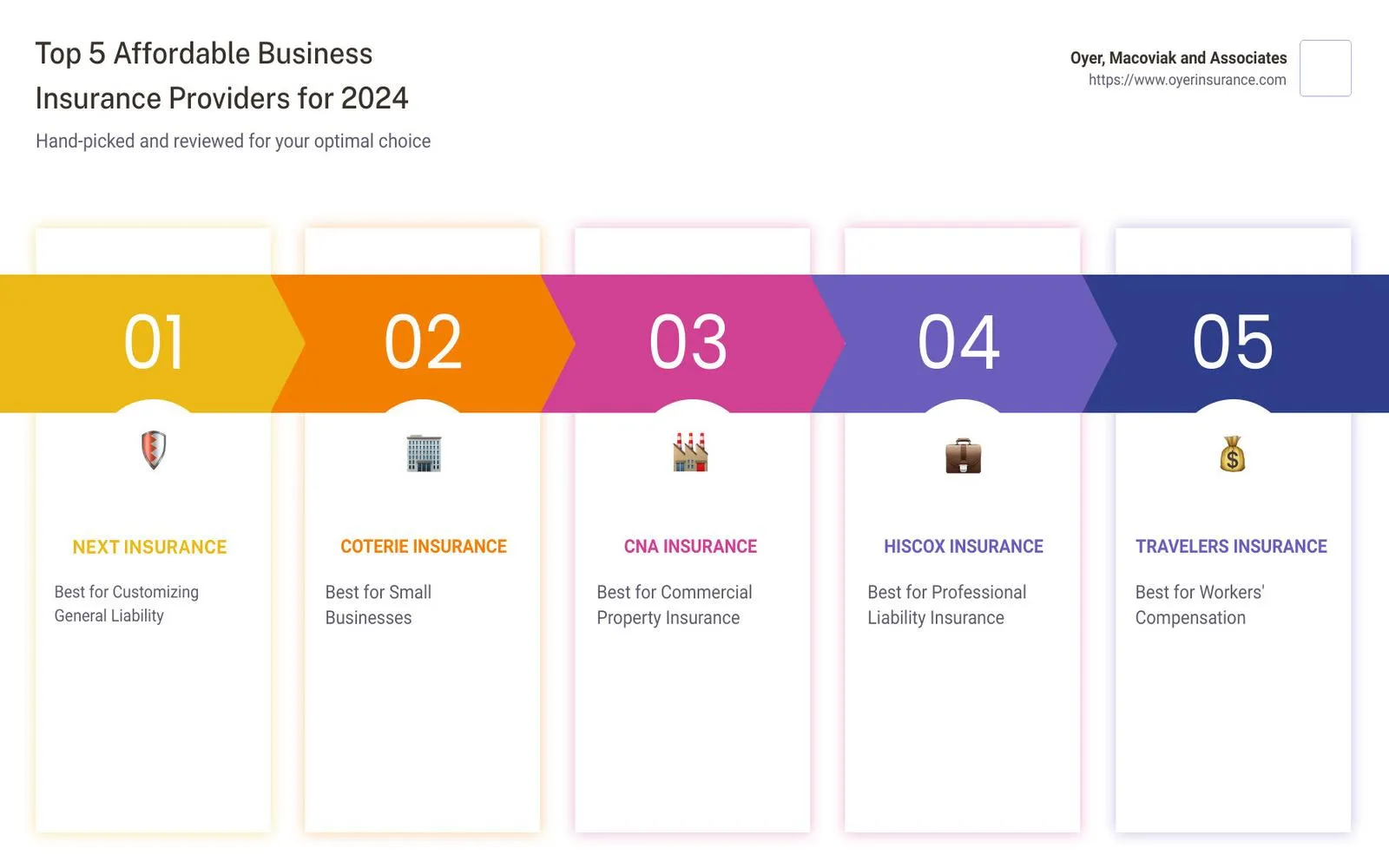

Explore Business Insurance Providers of 2025: Ensure Your Company’s Future Security

Top Business Insurance Providers of 2025: Secure Your Future with the Best Coverage Options

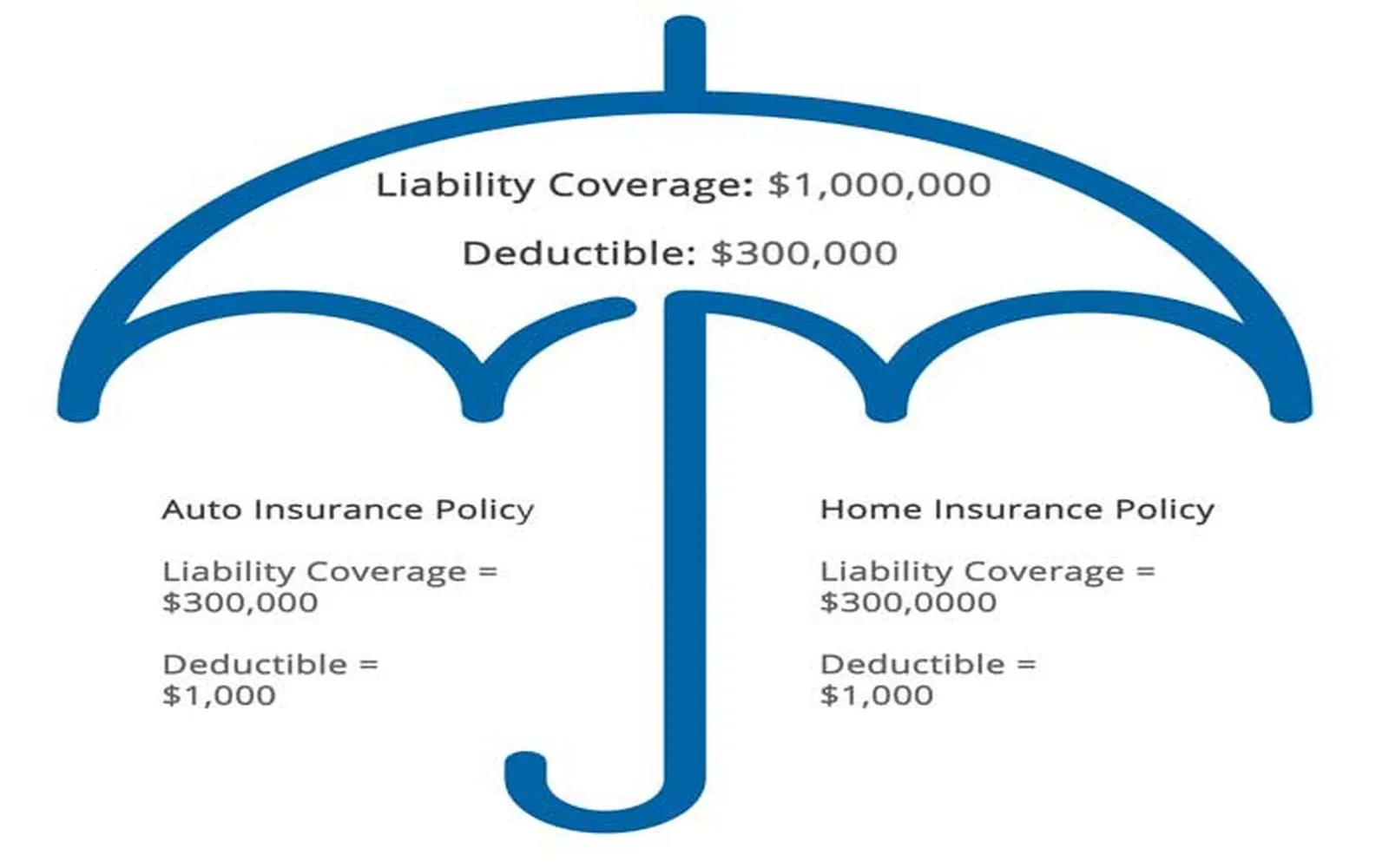

Top Umbrella Insurance Policies of 2025: Protect Your Assets and Future

Liability Insurance: Protection for Individuals and Businesses

Secure Your Small Business's Future with Comprehensive Health Insurance Coverage

Shielding Success: Unlocking the Power of Professional Indemnity Insurance

Home Warranty Insurance: Protecting Your Home's Systems and Appliances