Home Warranty Insurance: Protecting Your Home's Systems and Appliances

Home warranty insurance is a service contract that helps homeowners cover the repair or replacement costs of major home systems and appliances when they break down due to normal wear and tear. Unlike traditional homeowners insurance, which typically covers damages caused by disasters or accidents, home warranty insurance offers protection for everyday home maintenance issues.

What is Home Warranty Insurance?

Home warranty insurance is a policy that covers the cost of repairs and replacements for key home systems and appliances, such as:

- HVAC systems (heating, ventilation, and air conditioning)

- Plumbing

- Electrical systems

- Kitchen appliances (e.g., refrigerator, oven, dishwasher)

- Washer and dryer

This service is particularly valuable for homeowners who want to avoid unexpected out-of-pocket expenses when an essential system or appliance breaks down.

Why Should You Consider Home Warranty Insurance?

1. Budget Protection

Home repairs can be costly, especially for systems like HVAC or plumbing. With a home warranty, you pay a fixed annual premium, and your out-of-pocket costs are limited to a service call fee when repairs are needed.

2. Peace of Mind

A home warranty offers peace of mind knowing that if something goes wrong with your appliances or systems, you’re covered, reducing the stress of dealing with repair bills or replacements.

3. Convenience

Most home warranty companies work with a network of contractors and service professionals. This means you don’t need to shop around for a repair specialist or worry about vetting providers.

4. Increases Home Value

For sellers, offering a home warranty as part of a real estate deal can make your home more attractive to potential buyers. It shows that the home has been well-maintained and reduces the chance of unexpected repair costs post-purchase.

What Does Home Warranty Insurance Typically Cover?

Coverage can vary depending on the provider and the plan you choose, but it typically includes:

- Appliance Breakdown – Repair or replacement of major appliances, including refrigerators, dishwashers, and ovens.

- HVAC Systems – Coverage for heating and cooling systems, including the repair or replacement of units.

- Plumbing Systems – Repair of plumbing issues, such as leaks or broken pipes.

- Electrical Systems – Covering the repair of electrical systems, including wiring and circuit boards.

Some home warranty plans also offer optional add-ons like coverage for pools, spas, or additional appliances.

What is Not Covered by Home Warranty Insurance?

Home warranty insurance does not cover:

- Pre-existing conditions or issues that arose before the policy began

- Cosmetic damage or damage caused by neglect or misuse

- Structural issues (e.g., foundation problems)

- Items that are outside of normal wear and tear, like new appliances or systems damaged by accidents

Choosing the Right Home Warranty Plan

When selecting a home warranty provider, consider these factors:

- Plan Options – Choose a plan that covers the systems and appliances most important to you.

- Service Fees – Review the service call fees and compare the total cost of different plans.

- Reputation of the Provider – Research customer reviews and check the provider’s reputation for service quality.

- Coverage Limits – Understand the coverage limits and ensure they are sufficient for your needs.

Final Thoughts

Home warranty insurance is an excellent way to protect your home’s systems and appliances, offering financial peace of mind and convenience in the face of unexpected breakdowns. Whether you are a new homeowner or looking to extend your coverage, a home warranty can be an investment in your home’s longevity and functionality.

Explore

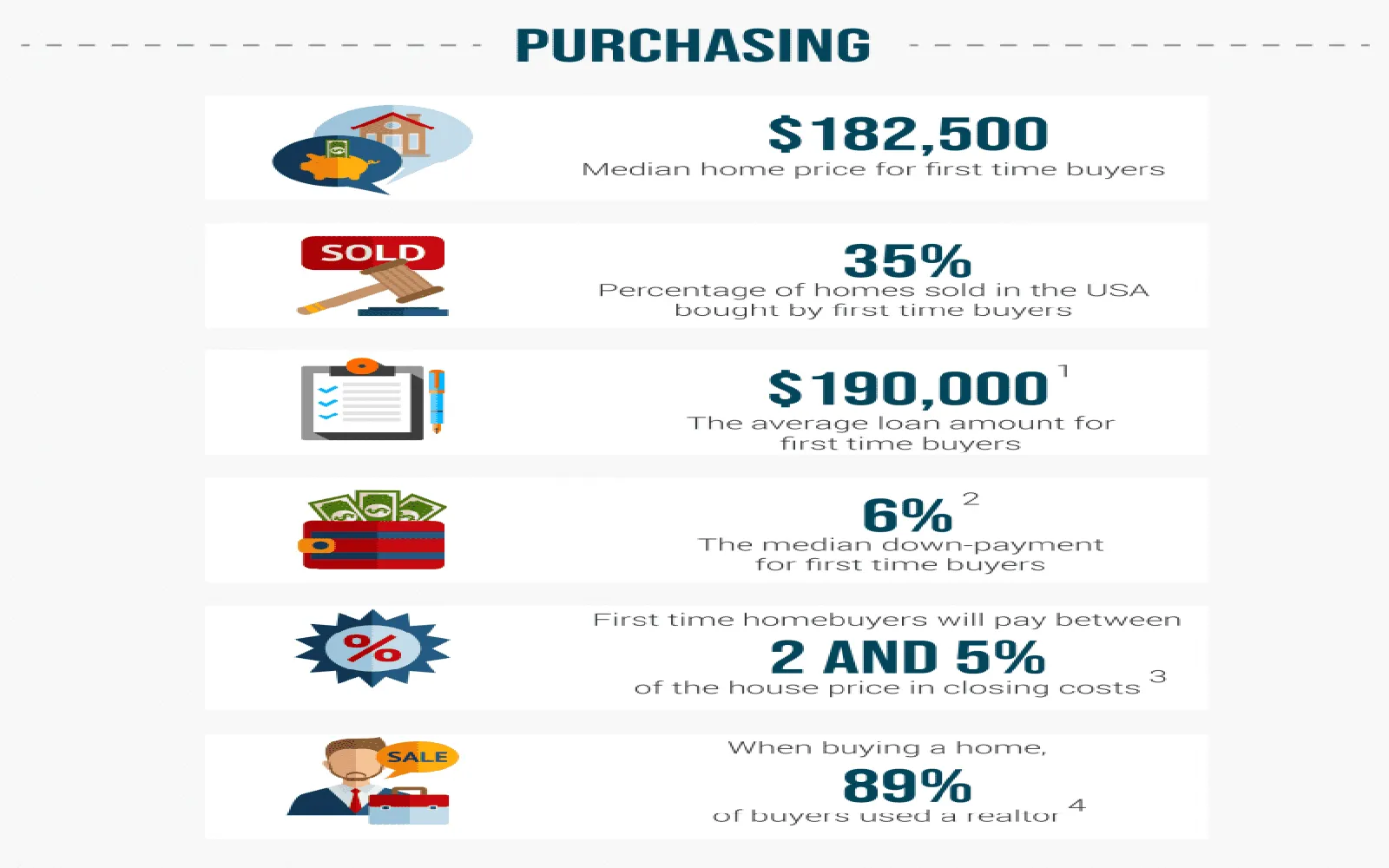

Affordable Home Insurance for First-Time Buyers in 2025: Your Complete Guide to Savings and Coverage

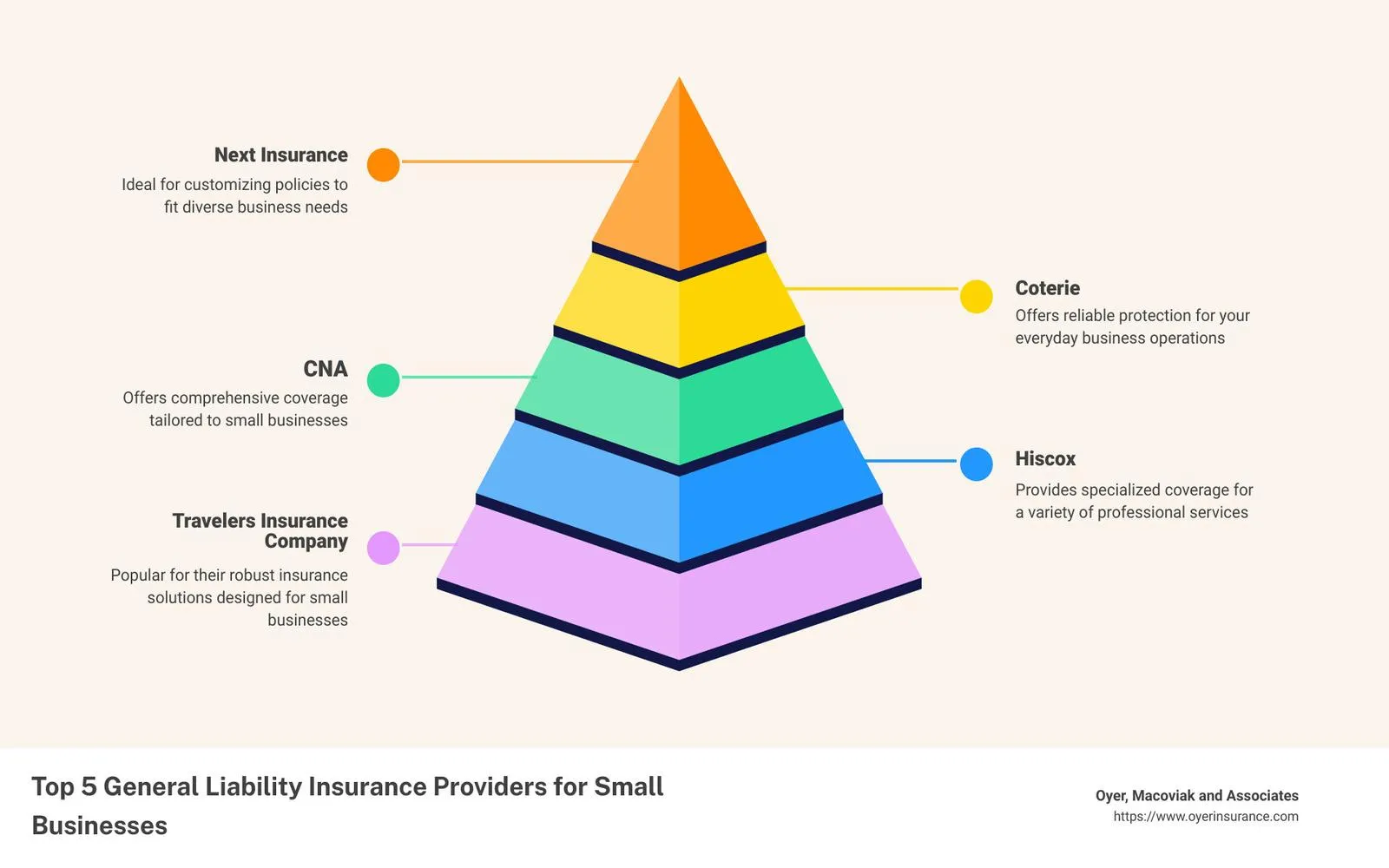

Business Liability Insurance Providers: Protecting Your Business from Risks

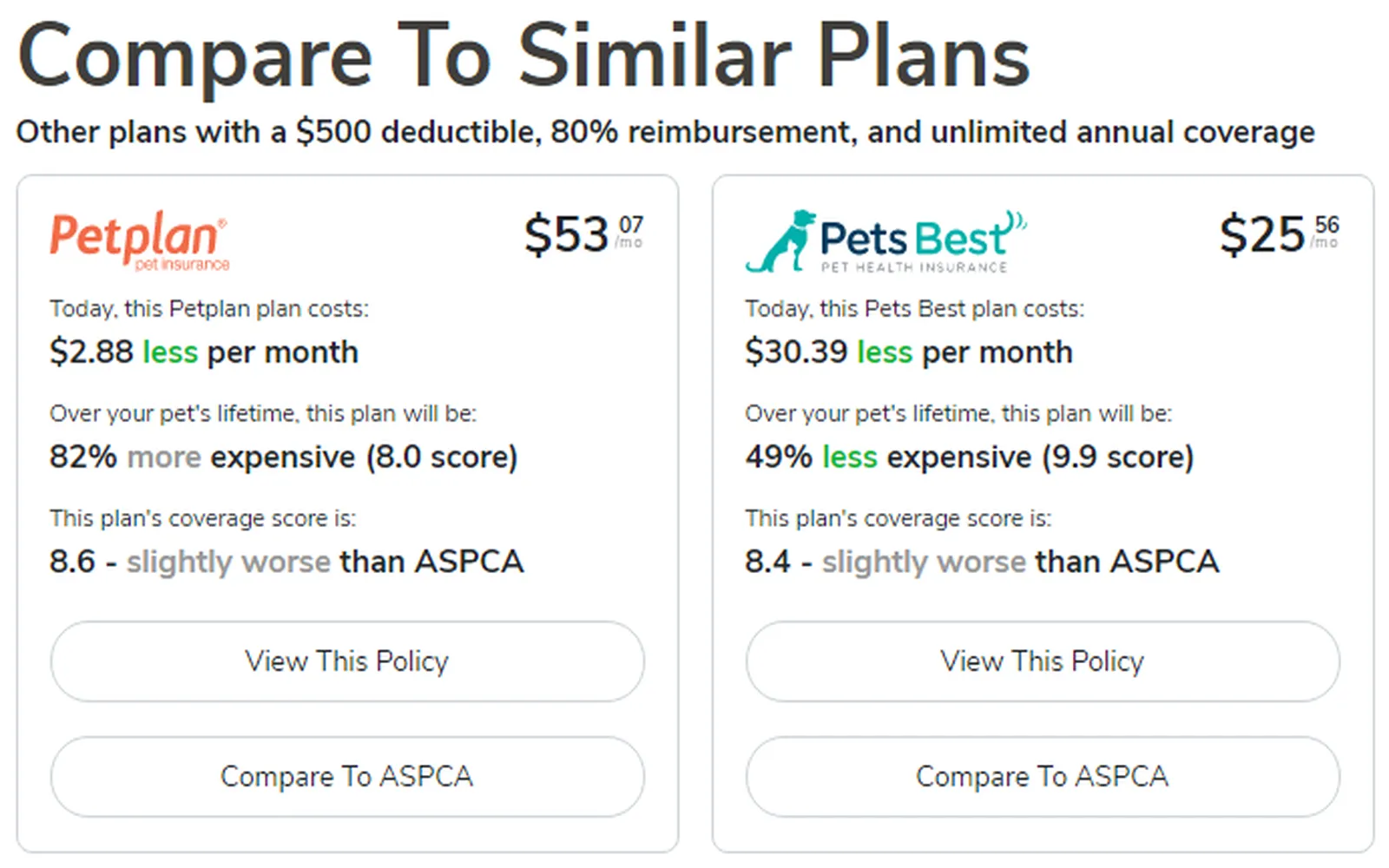

Top-Rated Pet Insurance in the USA: Protecting Your Furry Family Members

Truck Collision Attorney: Protecting Your Rights After an Accident

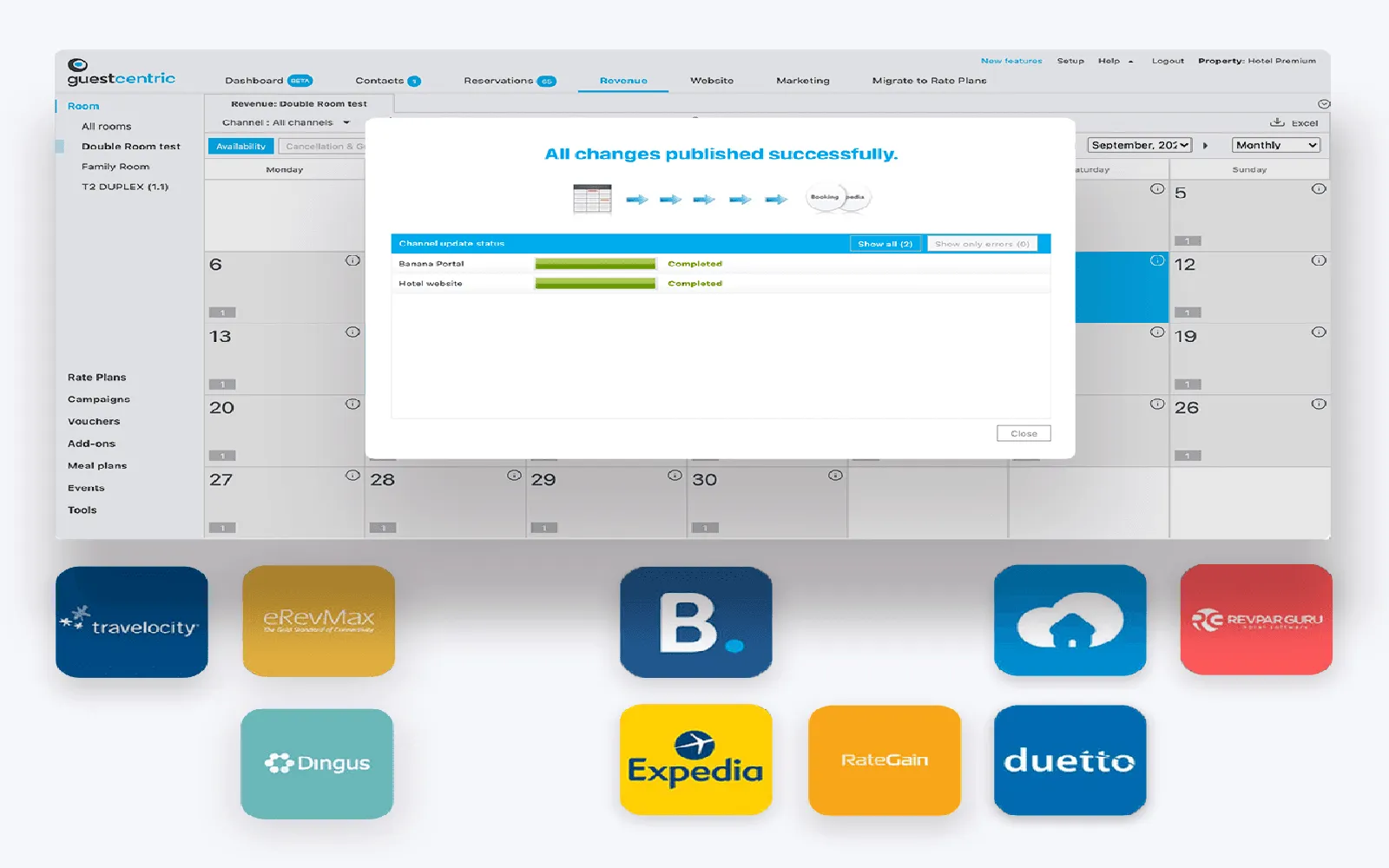

The Evolution and Impact of Hotel Booking Systems on the Hospitality Industry

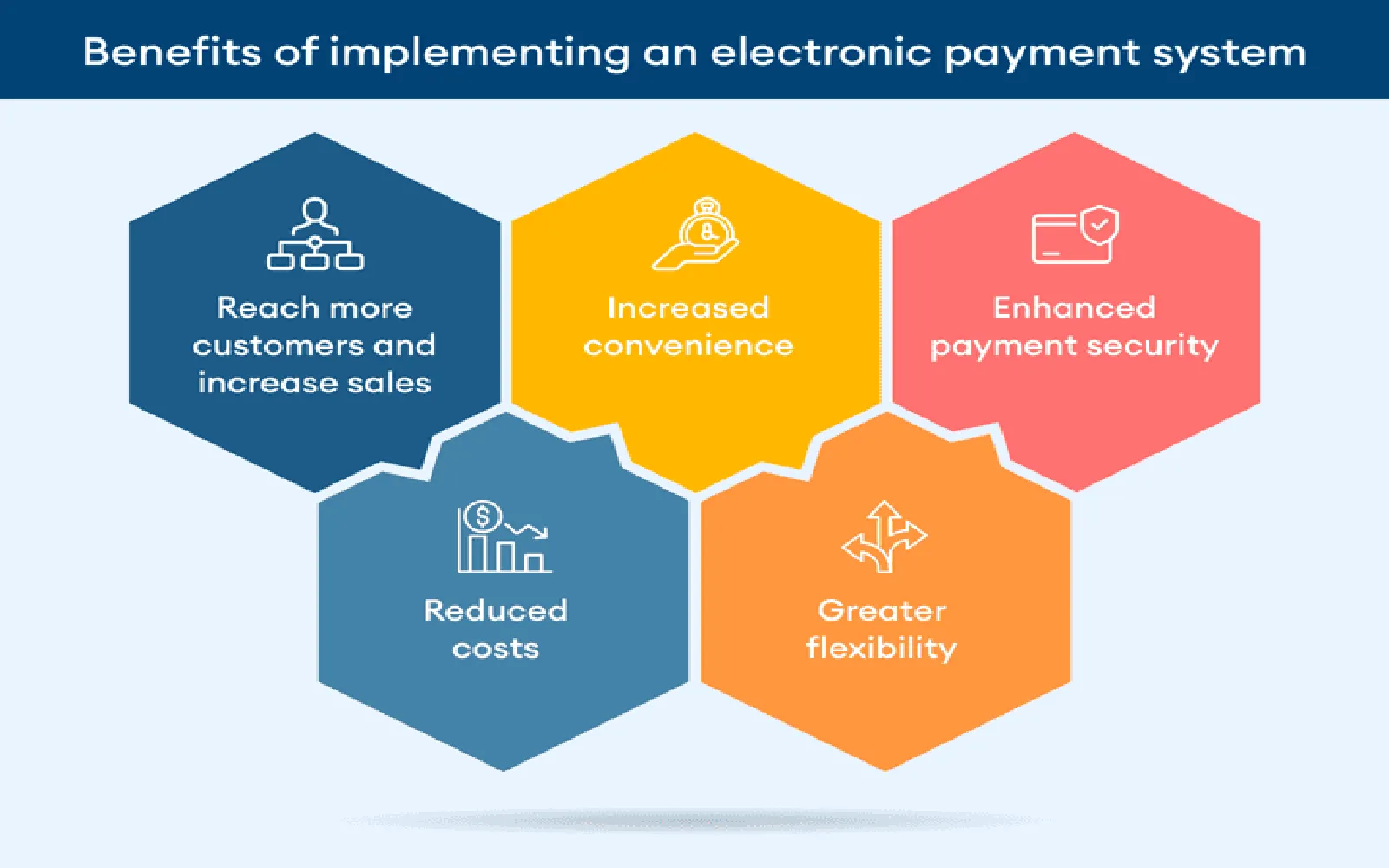

Convenience at Your Fingertips: The Ultimate Guide to Online Payment Systems

Top Home Warranty Companies in the US Compared: 2025 Guide

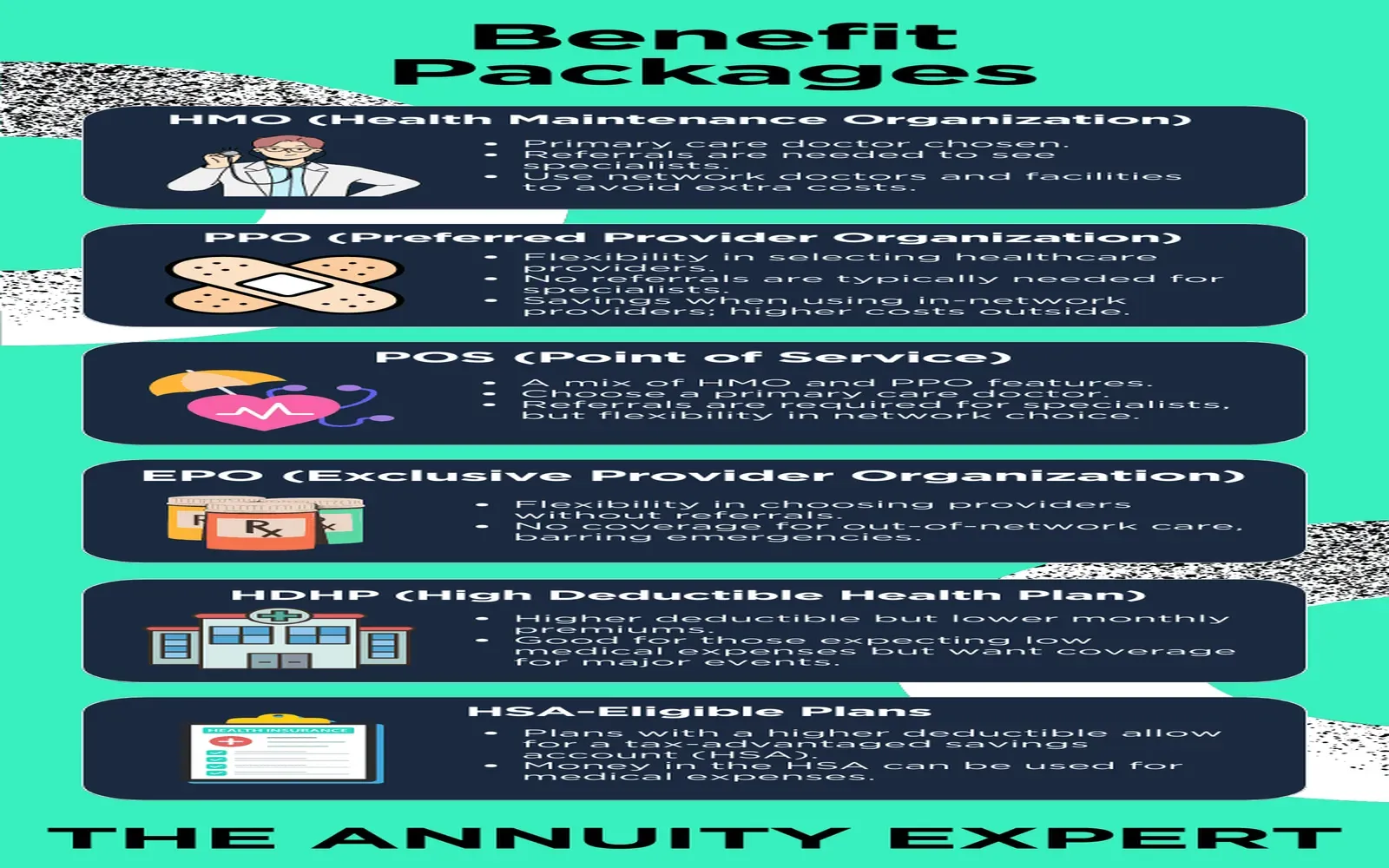

Affordable Business Health Insurance Plans for 2025: Save Money While Protecting Your Team