Top-Rated Pet Insurance in the USA: Protecting Your Furry Family Members

Introduction to Pet Insurance

As pet owners, our furry companions are more than just pets; they are beloved family members. With their playful antics and unconditional love, they bring joy into our lives. However, just like any family member, pets can face unexpected health challenges that can lead to hefty veterinary bills. This reality has led many pet owners to consider pet insurance as a safety net for their furry friends. In this article, we will explore the top-rated pet insurance options available in the USA, helping you make an informed decision to protect your pets and your wallet.

The Importance of Pet Insurance

Imagine coming home to your excited puppy, only to find that he has chewed through a power cord. What follows is a frantic dash to the vet, where you learn that your pup requires emergency surgery. This scenario is a nightmare for any pet owner, but it highlights the importance of being prepared for unforeseen circumstances. Pet insurance can alleviate the financial burden of unexpected veterinary visits and treatments, allowing you to focus on what truly matters—your pet's health and happiness.

Understanding Pet Insurance Policies

Before diving into the top-rated pet insurance companies, it’s crucial to understand how pet insurance policies work. Most policies cover a variety of services, including accidents, illnesses, and preventive care. However, coverage can vary significantly between providers. Some plans offer comprehensive coverage, while others may only cover emergencies. Knowing what to look for in a policy can help you choose the right coverage for your pet’s needs.

Top-Rated Pet Insurance Companies

Now that we understand the significance of pet insurance, let’s take a closer look at some of the top-rated pet insurance companies in the USA. Each of these providers has earned a solid reputation for their coverage options, customer service, and overall reliability.

1. Healthy Paws Pet Insurance

Healthy Paws is often lauded for its comprehensive coverage and straightforward claims process. One pet owner, Sarah from California, shares her experience: “When my cat, Oliver, developed a kidney condition, I was terrified of the costs. Healthy Paws covered 90% of the treatment, which eased my worries tremendously.” The company offers unlimited annual benefits, making it a great option for those with pets that may require extensive care.

2. Embrace Pet Insurance

Embrace Pet Insurance is known for its customizable plans and wellness rewards program. Many pet owners appreciate the flexibility to tailor their coverage according to their pet’s specific needs. For example, John from New York says, “I love how I could adjust my deductible and reimbursement rate. It’s like having a plan that fits my budget perfectly.” Embrace also provides a unique wellness rewards program, which reimburses pet owners for routine veterinary care.

3. Petplan

Petplan has built a reputation for its extensive coverage, including hereditary conditions often not covered by other insurers. One satisfied customer, Lisa from Texas, recalls, “When my bulldog was diagnosed with a hip issue, I was relieved to find out Petplan covered it. It allowed us to get the best treatment without worrying about the bills.” Petplan's thorough coverage options make it a solid choice for breeds prone to specific health issues.

4. Nationwide Pet Insurance

As one of the oldest pet insurance providers, Nationwide offers a variety of plans tailored to different needs. Their comprehensive plans can cover everything from accidents to chronic conditions. Mark from Florida shares, “I’ve had Nationwide for my dog for years. They’ve always been there for us, from routine check-ups to emergency surgeries.” Their long-standing presence in the industry speaks volumes about their reliability and customer satisfaction.

5. ASPCA Pet Health Insurance

Backed by the American Society for the Prevention of Cruelty to Animals, ASPCA Pet Health Insurance is a trusted name in pet care. They offer plans that cover a wide range of services, including behavioral therapies. Emily from Oregon states, “My dog has anxiety issues, and it was a relief to know that ASPCA covered her behavioral therapy sessions.” This company not only provides excellent coverage but also supports animal welfare initiatives.

6. Figo Pet Insurance

Figo Pet Insurance stands out with its user-friendly mobile app, making it easy for pet owners to manage their policies and submit claims. Jamie from Illinois shares, “I love the Figo app! It’s so convenient to keep track of my dog’s health and submit claims quickly.” Their innovative technology and comprehensive coverage options make them a popular choice among tech-savvy pet owners.

7. Lemonade Pet Insurance

Lemonade has disrupted the pet insurance market with its unique approach to pricing and claims. Their transparent model and quick claim processing have won over many pet owners. Karen from Massachusetts states, “I never expected to get reimbursed so quickly! Lemonade’s process is so simple and efficient.” Their focus on customer experience makes them a competitive option in the industry.

Factors to Consider When Choosing Pet Insurance

With so many options available, how can you choose the right pet insurance provider for your furry friend? Here are some critical factors to consider:

1. Coverage Options

Different insurance companies offer varying levels of coverage. Ensure that the plan you choose covers both accidents and illnesses, as well as any specific needs your pet may have.

2. Deductibles and Reimbursement Rates

Understanding the deductible and reimbursement rates is crucial. Higher deductibles often mean lower monthly premiums, but you’ll need to pay more out-of-pocket when your pet requires care.

3. Waiting Periods

Many insurance plans have waiting periods for certain conditions, meaning coverage won’t kick in immediately. Be sure to read the fine print to understand when your coverage begins.

4. Exclusions and Limitations

Each policy will have exclusions, so familiarize yourself with what is not covered. Common exclusions include pre-existing conditions, certain breed-specific conditions, and cosmetic procedures.

5. Customer Reviews

Take the time to read reviews from other pet owners. Their experiences can provide valuable insights into the company’s customer service and claims process.

Real-Life Stories of Pet Insurance Success

To further illustrate the importance of having pet insurance, let’s share a few real-life stories from pet owners who have benefited from their coverage.

The Story of Bella

When Bella, a playful Golden Retriever, suddenly stopped eating and started vomiting, her owner, Tom, rushed her to the vet. After several tests, the vet discovered that Bella had ingested a foreign object. The surgery to remove it cost over $3,000, but Tom was relieved to have pet insurance through Healthy Paws. “It was a tough time, but knowing I had insurance made the financial aspect much easier,” he says.

The Tale of Max

Max, a mischievous tabby cat, developed a severe dental infection that required surgery. His owner, Sarah, had purchased a plan from Embrace Pet Insurance, which covered the procedure. “I was surprised at how seamless the claims process was. I submitted my paperwork, and within a week, I received my reimbursement,” Sarah recalls. This experience reinforced her decision to invest in pet insurance for Max.

Conclusion

In a world where our pets are cherished members of the family, investing in pet insurance is a responsible decision that can save you from financial distress during unexpected health emergencies. With various options available, such as Healthy Paws, Embrace, Petplan, Nationwide, ASPCA, Figo, and Lemonade, you can find a policy that fits your pet’s needs and your budget.

By considering coverage options, deductibles, waiting periods, exclusions, and customer reviews, you can make an informed choice that ensures your furry family members receive the care they deserve. Remember, pet insurance is not just a financial product; it’s a commitment to your pet’s health and well-being. Protect your furry friends and enjoy peace of mind knowing that should the unexpected happen, you’re prepared.

Explore

The Ultimate Guide to Pet Insurance: Coverage, Costs, and Benefits

Home Warranty Insurance: Protecting Your Home's Systems and Appliances

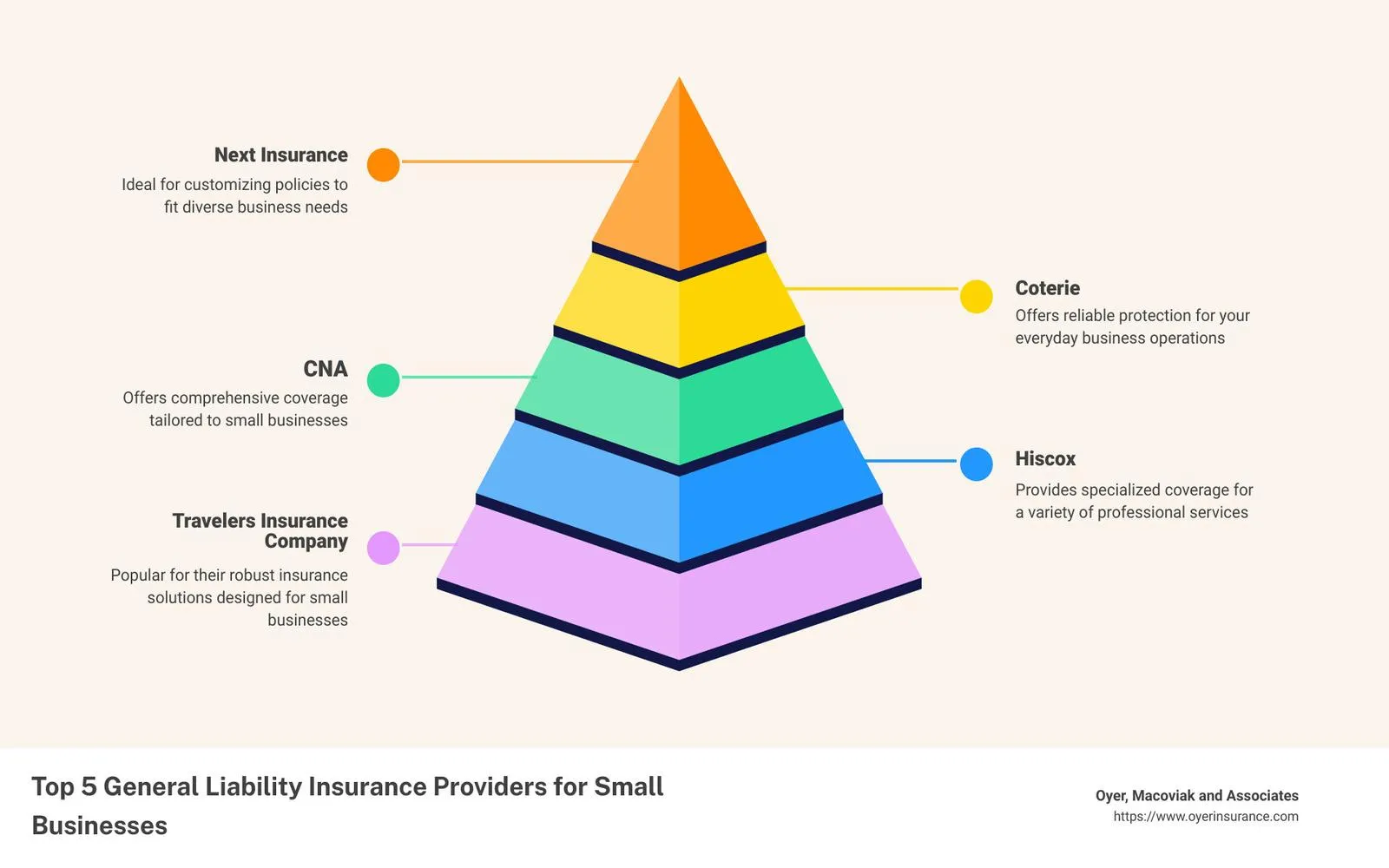

Business Liability Insurance Providers: Protecting Your Business from Risks

Truck Collision Attorney: Protecting Your Rights After an Accident

Donating in the USA: Where and How to Give

Top 2025: Cheapest Pet Insurance Providers for Affordable Coverage

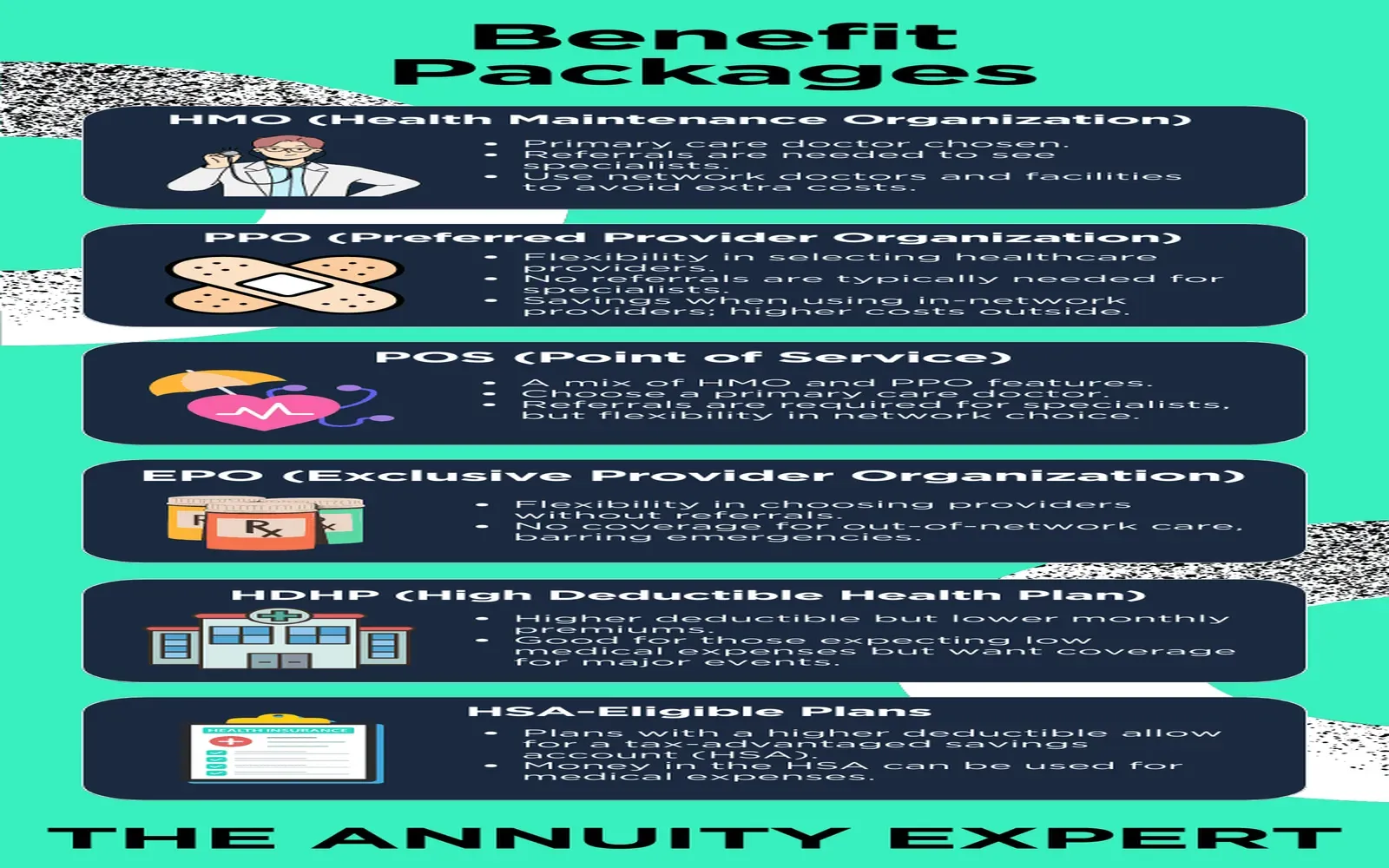

Affordable Business Health Insurance Plans for 2025: Save Money While Protecting Your Team

Top Life Insurance Options for Seniors in 2025: Secure Your Future Today