The Ultimate Guide to Pet Insurance: Coverage, Costs, and Benefits

Pets are beloved members of our families, bringing joy, companionship, and unconditional love into our lives. Just like any family member, they require care and protection, which extends to their health and well-being. Pet insurance has emerged as a valuable tool for managing the costs associated with veterinary care, offering peace of mind in the face of unexpected medical expenses. In this comprehensive guide, we’ll explore the ins and outs of pet insurance, including coverage options, costs, and the benefits it provides. We’ll also share a compelling story to illustrate how pet insurance can make a significant difference in times of need.

A Story of Unexpected Challenges

Meet the Anderson family, who had always cherished their energetic Golden Retriever, Max. Max was a bundle of joy, always ready for playtime and cuddles. When Max suddenly became ill, the Andersons were heartbroken. The veterinarian diagnosed him with a serious condition requiring extensive treatment and surgery. The costs quickly added up, and the Andersons found themselves facing a difficult decision: how to manage the financial burden while ensuring Max received the best care possible.

Fortunately, the Andersons had invested in pet insurance shortly after adopting Max. Their policy covered a significant portion of the medical expenses, including surgery, medications, and follow-up care. The financial support provided by the insurance allowed the Andersons to focus on Max’s recovery rather than worrying about the mounting bills. Max’s treatment was successful, and he returned to his playful self, thanks to the timely intervention and the support of their pet insurance policy.

Understanding Pet Insurance

Pet insurance helps pet owners manage the costs associated with veterinary care by providing financial coverage for various medical treatments and procedures. Here’s a breakdown of key aspects of pet insurance:

- Types of Coverage:Accident-Only Plans:Description: Covers costs related to injuries from accidents, such as broken bones, cuts, and bites. Does not include coverage for illnesses or routine care.Best For: Pet owners seeking basic protection for unexpected accidents without the need for illness coverage.Illness and Accident Plans:Description: Provides coverage for both accidents and illnesses, including common health issues like infections, cancer, and chronic conditions.Best For: Pet owners looking for comprehensive coverage that includes both accidents and illnesses.Comprehensive Plans:Description: Offers extensive coverage, including accidents, illnesses, hereditary conditions, and sometimes routine care like vaccinations and dental cleanings.Best For: Pet owners seeking all-inclusive coverage to address a wide range of health concerns.Wellness Plans:Description: Focuses on preventive care, including routine check-ups, vaccinations, and flea/tick prevention. Often available as an add-on to accident and illness plans.Best For: Pet owners who want to cover preventive care expenses and maintain their pet’s overall health.

- Coverage Limits:Annual Limits:Description: The maximum amount the insurance company will pay for covered expenses per policy year.Consideration: Choose a policy with limits that align with your pet’s potential medical needs.Per-Incident Limits:Description: The maximum amount the insurer will pay for a specific incident or condition.Consideration: Ensure the per-incident limit is adequate for potential high-cost treatments.Lifetime Limits:Description: The total amount the insurer will pay over the lifetime of the policy for a particular condition or treatment.Consideration: Select a policy with lifetime limits that suit your pet’s potential health needs.

- Deductibles and Reimbursement:Deductibles:Description: The amount you must pay out of pocket before the insurance coverage kicks in.Consideration: Choose a deductible amount that fits your budget and financial comfort.Reimbursement Rates:Description: The percentage of eligible expenses that the insurer will reimburse after the deductible is met.Consideration: Higher reimbursement rates can reduce your out-of-pocket expenses, but may result in higher premiums.

- Exclusions and Limitations:Pre-Existing Conditions:Description: Conditions that existed before the start of the policy are generally not covered.Consideration: Review the policy’s terms regarding pre-existing conditions and coverage limitations.Breed-Specific Conditions:Description: Some policies may exclude or have limitations on coverage for conditions common in certain breeds.Consideration: Be aware of any breed-specific exclusions and ensure the policy meets your pet’s needs.

- Choosing the Right Pet Insurance Provider:Reputation and Reviews:Description: Research the insurer’s reputation and customer reviews to assess their reliability and service quality.Consideration: Look for companies with positive feedback and a strong track record of handling claims.Financial Stability:Description: Ensure the insurer is financially stable and capable of paying out claims.Consideration: Check ratings from financial rating agencies for assurance of the company’s stability.Customer Service:Description: Evaluate the insurer’s customer service quality and responsiveness.Consideration: Choose a provider with excellent customer support and clear communication.

Top Pet Insurance Providers

Here are some of the top pet insurance companies known for their comprehensive coverage options and customer satisfaction:

- Healthy PawsOverview: Offers comprehensive coverage with no annual or lifetime limits. Known for its straightforward claims process and fast reimbursements.

- TrupanionOverview: Provides coverage for accidents and illnesses with no payout limits. Features a unique direct payment option for veterinary clinics.

- PetPlanOverview: Offers customizable plans with extensive coverage, including hereditary and congenital conditions. Known for its comprehensive policy options.

- EmbraceOverview: Provides flexible coverage options with add-on wellness plans. Features a user-friendly app for easy claims submission and tracking.

- FigoOverview: Offers three plan options with coverage for accidents, illnesses, and optional wellness care. Known for its mobile app and 24/7 customer support.

- NationwideOverview: Provides a range of plans, including comprehensive and wellness coverage. Known for its extensive network and coverage options.

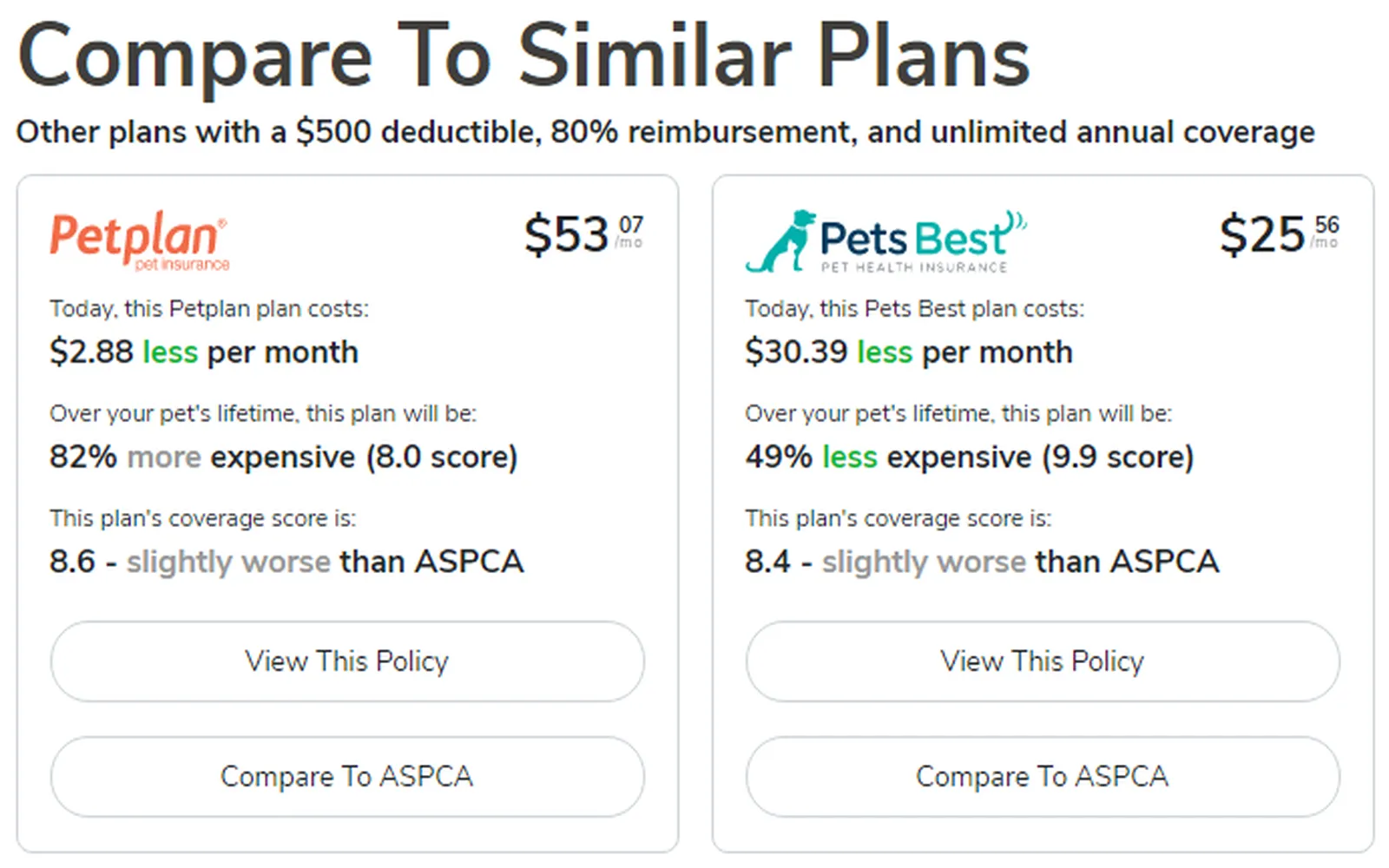

- ASPCA Pet Health InsuranceOverview: Offers coverage for accidents, illnesses, and preventive care. Known for its strong customer support and straightforward claims process.

- Bow Wow InsuranceOverview: Offers various coverage options with customizable plans and competitive rates. Known for its flexibility and customer service.

- PetFirstOverview: Provides comprehensive coverage with flexible plans and additional wellness options. Known for its quick claims processing and customer satisfaction.

- Pawlicy AdvisorOverview: An insurance comparison tool that helps pet owners find the best policy based on their needs and budget. Known for its personalized recommendations.

Conclusion

Pet insurance is an essential tool for managing the costs of veterinary care and ensuring that your furry friend receives the best possible treatment. By understanding the different types of coverage, evaluating costs and benefits, and selecting a reputable provider, you can make informed decisions that align with your pet’s needs and your financial situation. The story of the Anderson family and their Golden Retriever Max illustrates how pet insurance can provide critical support during unexpected health challenges. With the right policy in place, you can focus on providing the best care for your beloved pet while enjoying peace of mind knowing that you’re prepared for any eventuality.

Explore

Top 2025: Cheapest Pet Insurance Providers for Affordable Coverage

Top-Rated Pet Insurance in the USA: Protecting Your Furry Family Members

Dental Insurance That Covers Implants: Your Guide to Coverage Options

Trends in Pet Care: Affordable Pet Sitting Options in 2025

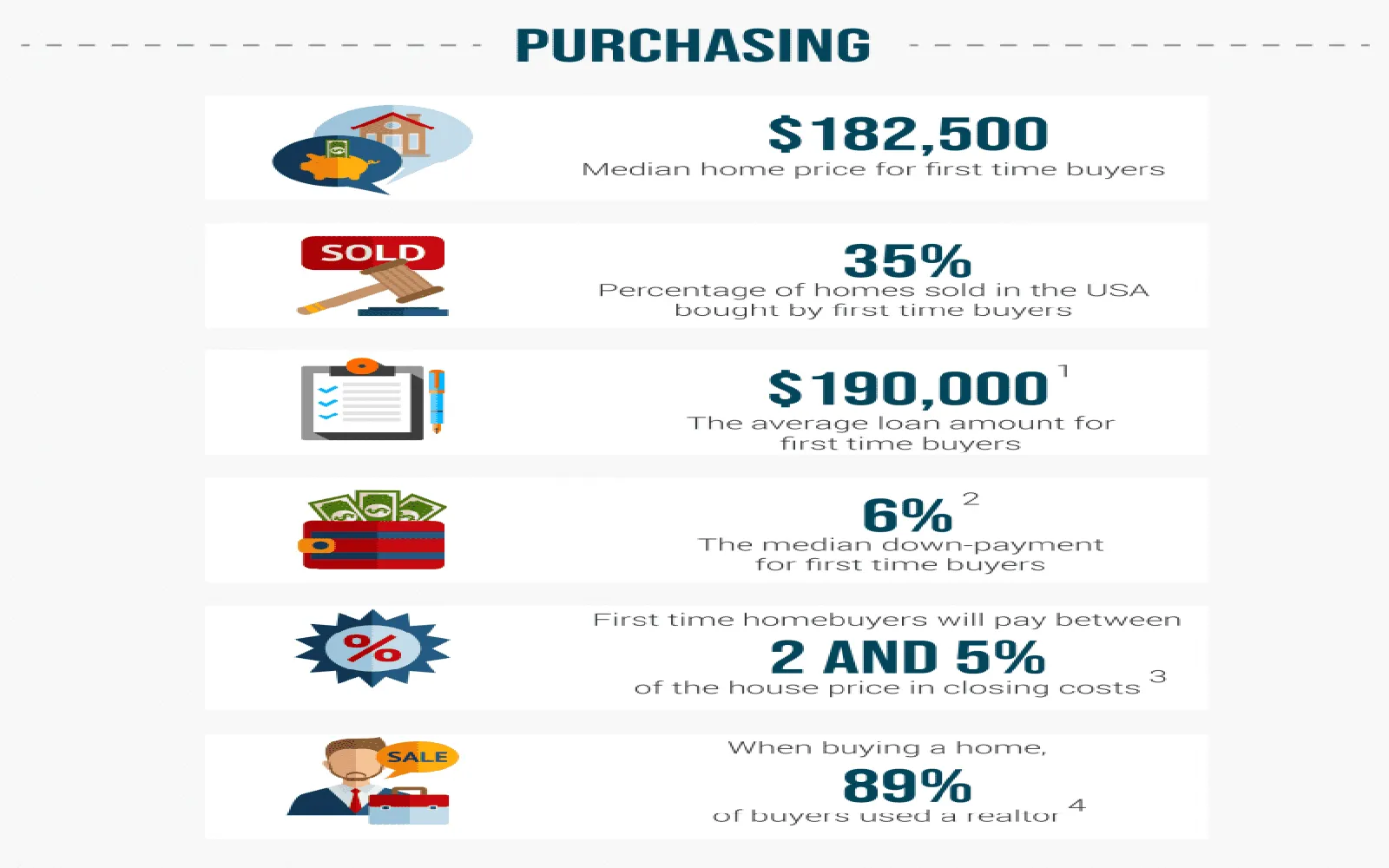

Affordable Home Insurance for First-Time Buyers in 2025: Your Complete Guide to Savings and Coverage

Affordable Health Insurance for Families in 2025: Your Guide to Cost-Effective Coverage Options

Mastering Insurance Claims: A Comprehensive Guide to Navigating Your Coverage

Navigating Health Insurance in 2025: Essential Tips for Coverage and Savings