Navigating Health Insurance in 2025: Essential Tips for Coverage and Savings

In 2025, navigating health insurance is more critical than ever. With evolving policies, rising costs, and various plan options, understanding your choices can impact both health and finances. Stay informed about regulatory changes, explore telehealth services, and use new tools to compare plans. Whether a first-time buyer or seasoned policyholder, these tips will help you make informed decisions, improving coverage while maximizing savings.

Understanding the Health Insurance Landscape in 2025

As we move further into 2025, navigating the ever-evolving landscape of health insurance can feel overwhelming. With changes in legislation, advancements in medical technology, and shifts in consumer behavior, understanding your options is more important than ever. This article aims to provide essential tips for securing the best coverage and maximizing savings in the current health insurance environment.

Know Your Health Insurance Types

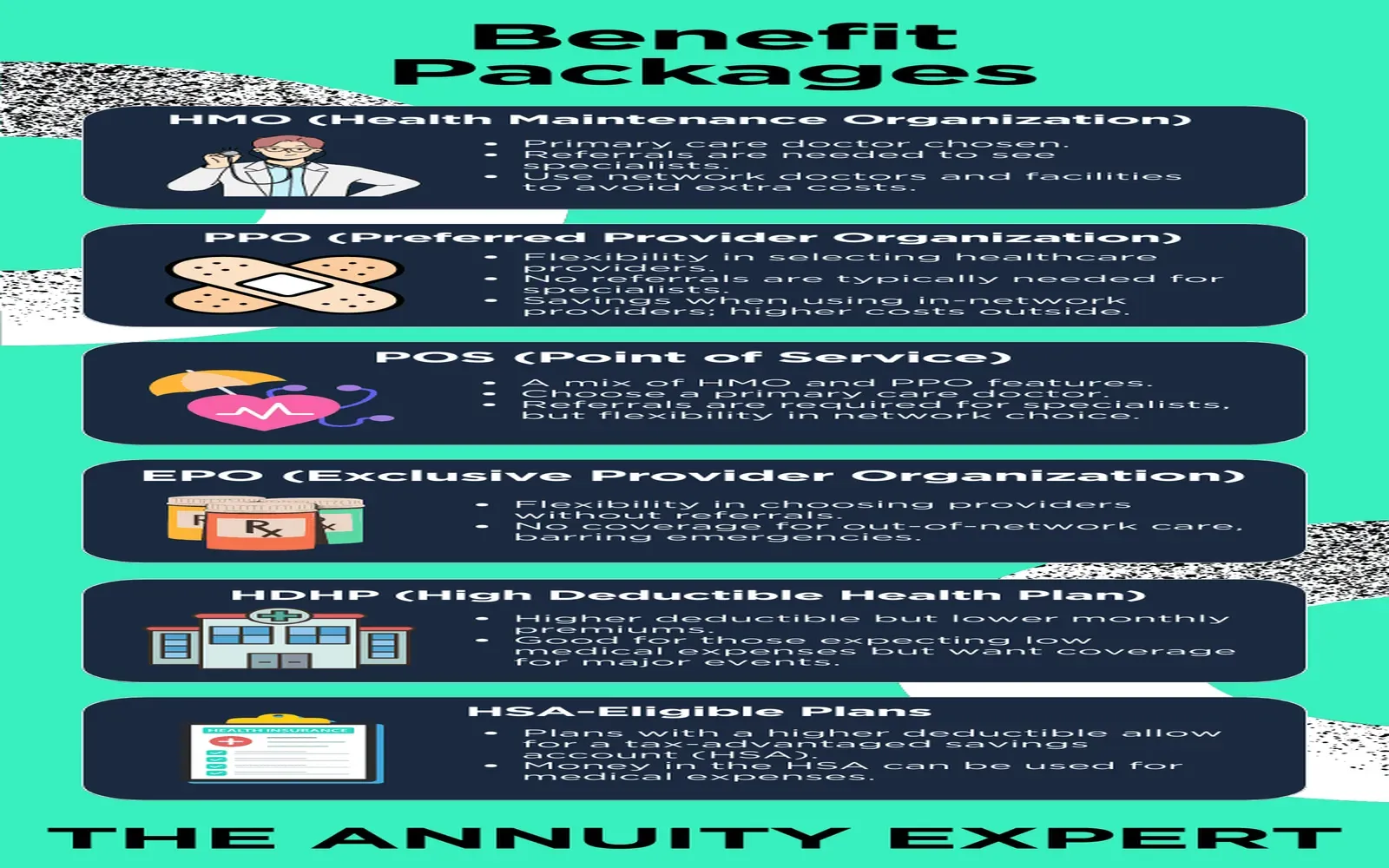

Before diving into specific tips, it's crucial to understand the various types of health insurance plans available in 2025. Here’s a brief overview:

- Health Maintenance Organization (HMO): Requires members to choose a primary care physician (PCP) and get referrals for specialist services. Generally, HMO plans have lower premiums but less flexibility in choosing providers.

- PPO (Preferred Provider Organization): Offers more flexibility when choosing healthcare providers, allowing members to see specialists without a referral. However, premiums are typically higher than HMO plans.

- EPO (Exclusive Provider Organization): Similar to PPOs but does not cover any out-of-network care except in emergencies. Lower premiums make EPO plans attractive for those comfortable with a limited provider network.

- High Deductible Health Plans (HDHP): Usually paired with Health Savings Accounts (HSAs), these plans have lower premiums but higher deductibles, making them suitable for individuals who are generally healthy and want to save on premiums.

- Medicare and Medicaid: Government programs that provide coverage for specific populations, including seniors and low-income individuals. Understanding the nuances of these programs can significantly impact your healthcare costs.

Evaluate Your Health Needs

When choosing a health insurance plan, it’s essential to assess your healthcare needs. Consider the following factors:

- Frequency of Doctor Visits: If you visit the doctor regularly for chronic conditions or preventive care, a plan with lower out-of-pocket costs may be more beneficial.

- Expected Medical Procedures: If you anticipate needing surgeries or specialized treatments, research which plans offer the best coverage for those services.

- Prescription Medications: Review your current medications and check which plans provide the best coverage for them, as costs can vary significantly.

- Family Health History: Consider any genetic predispositions that may require additional care in the future.

Compare Plans Effectively

With numerous options available, comparing health insurance plans can be daunting. Here are some tips to make the process easier:

- Use Online Comparison Tools: Websites like HealthCare.gov or private insurance marketplaces can help you compare plans side-by-side based on coverage, premiums, and out-of-pocket costs.

- Read Reviews and Ratings: Look for customer reviews and ratings of insurance providers to gauge their reliability and customer service quality.

- Consult with a Broker: Insurance brokers can provide personalized guidance and help you navigate complex plan details.

Understand the Costs Involved

Understanding the financial aspects of health insurance is vital for making informed decisions. Here are the key components to consider:

- Premiums: The monthly fee you pay for your health insurance coverage. Look for plans with premiums that fit your budget.

- Deductibles: The amount you must pay out-of-pocket before your insurance kicks in. Higher deductibles often mean lower premiums but can lead to significant costs if you require medical care.

- Co-payments and Co-insurance: Co-payments are fixed amounts you pay for specific services, while co-insurance is a percentage of the costs you share with your insurer. Understand these costs to anticipate your total healthcare expenses.

- Out-of-Pocket Maximum: The cap on how much you will pay for covered services in a plan year. Once you reach this limit, your insurer covers 100% of your healthcare costs.

Maximize Preventive Care Benefits

Many health insurance plans in 2025 emphasize preventive care as a cost-saving measure. Take advantage of these benefits:

- Annual Check-ups: Most plans cover routine check-ups and screenings at no cost to you, so schedule these appointments regularly to catch potential health issues early.

- Vaccinations: Stay up-to-date with vaccinations, which are often covered fully by health plans. This can help prevent costly illnesses in the long run.

- Wellness Programs: Many insurers offer wellness programs that provide incentives for healthy behaviors, such as gym memberships or discounts on fitness classes.

Utilize Health Savings Accounts (HSAs)

Health Savings Accounts (HSAs) are a great way to save money on healthcare expenses, especially if you have a High Deductible Health Plan (HDHP). Here’s how to maximize your HSA:

- Contribute Early: Maximize your contributions as early in the year as possible to take advantage of tax-free growth.

- Invest Wisely: If your HSA allows, consider investing a portion of your savings for long-term growth. This can help you build a larger nest egg for future healthcare expenses.

- Keep Receipts: Save receipts for qualified medical expenses, as you can withdraw funds from your HSA tax-free later, even if it’s years down the line.

Stay Informed About Legislative Changes

The health insurance landscape is influenced by legislation at both state and federal levels. Stay informed about any changes that may affect your coverage:

- Proposed Bills: Monitor proposed legislation that could impact health insurance regulations, premiums, and coverage options.

- State-Specific Regulations: Each state may have unique laws that affect health insurance, so familiarize yourself with your state’s regulations.

- Open Enrollment Periods: Be aware of when open enrollment periods occur, as this is the time to make changes to your health insurance plan.

Consider Telehealth Options

Telehealth services have surged in popularity, especially since the COVID-19 pandemic. In 2025, many health plans continue to offer telehealth as a cost-effective alternative to in-person visits:

- Convenience: Telehealth allows you to consult with healthcare providers from the comfort of your home, saving time and travel costs.

- Lower Costs: Many insurers offer lower co-pays for telehealth visits compared to in-person appointments, making it a cost-effective option.

- Access to Specialists: Telehealth expands your access to specialists who may not be locally available, ensuring you receive the best care possible.

Network Restrictions and Out-of-Network Costs

Understanding your insurance provider's network is crucial for managing costs:

- In-Network vs. Out-of-Network: In-network providers have negotiated rates with your insurance, typically resulting in lower out-of-pocket costs. Be cautious with out-of-network providers, as they may lead to significantly higher expenses.

- Emergency Situations: In emergencies, you may not have control over which provider you see. Familiarize yourself with your plan’s rules regarding out-of-network emergency care.

Seek Financial Assistance if Needed

If you’re struggling to afford health insurance, various programs can help:

- Subsidies: Depending on your income, you may qualify for subsidies that lower your premiums through the Health Insurance Marketplace.

- Medicaid Expansion: In states that have expanded Medicaid, low-income individuals may qualify for state-sponsored health coverage.

- Charitable Organizations: Some nonprofits and community organizations provide assistance with medical costs, so don’t hesitate to seek help if you need it.

Review Your Plan Annually

Health insurance needs may change from year to year, making it essential to review your coverage annually:

- Reassess Your Needs: Life changes, such as a new job, marriage, or the birth of a child, can affect your healthcare needs. Re-evaluating your plan ensures it aligns with your current situation.

- Plan Performance: Review your plan's performance, including how well it covered your medical expenses and whether you had any issues with providers or claims.

Conclusion: Empower Yourself in 2025

As we navigate the complexities of health insurance in 2025, empowering yourself with knowledge and resources is crucial for making informed decisions. By understanding the types of plans, evaluating your health needs, comparing options effectively, and leveraging available benefits, you can secure comprehensive coverage while maximizing savings. Remember, health insurance is not just a financial decision; it’s an investment in your health and well-being. Stay informed, be proactive, and take charge of your healthcare journey.

Explore

Dental Insurance That Covers Implants: Your Guide to Coverage Options

Unlocking Sound Savings: A Comprehensive Guide to Hearing Insurance for Seniors

Affordable Health Insurance for Families in 2025: Your Guide to Cost-Effective Coverage Options

Affordable Business Health Insurance Plans for 2025: Save Money While Protecting Your Team

Top Life Insurance Options for Seniors in 2025: Secure Your Future Today

Top Long-Term Care Insurance Options for 2025: Secure Your Future Today

Navigating the Road to Savings: A Comprehensive Guide to Car Insurance

Secure Your Small Business's Future with Comprehensive Health Insurance Coverage