Navigating the Road to Savings: A Comprehensive Guide to Car Insurance

Car insurance is a critical aspect of responsible vehicle ownership, offering financial protection in case of accidents, theft, or other unforeseen events. With a variety of coverage options and providers, finding the right car insurance policy can be overwhelming. In this guide, we'll start with an engaging story of how car insurance helped a driver in a tough situation, then delve into the essentials of car insurance, including the types of coverage available and tips for choosing the best policy for your needs.

A Story of Unexpected Relief

Meet Tom, a young professional who had just bought his first car. Eager to hit the road, Tom was diligent about finding the best car insurance policy to protect his new investment. After thorough research, he selected a policy that offered comprehensive coverage, including liability, collision, and comprehensive insurance.

One rainy evening, Tom was involved in a minor collision when another driver skidded on the wet road and hit his car. Fortunately, Tom’s insurance policy covered the damages to his vehicle, as well as the medical expenses for minor injuries he sustained. Without the insurance coverage, Tom would have faced substantial out-of-pocket costs and considerable stress.

The insurance company promptly handled the claim, covering the repair costs and providing a rental car while Tom’s vehicle was in the shop. Tom’s experience highlighted the peace of mind and financial protection that a good car insurance policy can offer. He was grateful for having made the right choice and relieved that he didn’t have to bear the financial burden of the accident alone.

Understanding Car Insurance

Car insurance provides coverage for various risks associated with vehicle ownership and driving. Here’s a closer look at the key aspects of car insurance and the types of coverage available:

- Types of Car Insurance Coverage:Liability Insurance: Covers damages and injuries you cause to others in an accident. This includes bodily injury liability (medical expenses for other parties) and property damage liability (repairs to other people’s property).Collision Insurance: Covers damage to your own vehicle resulting from a collision, regardless of who is at fault. This is particularly useful if you’re involved in an accident with another vehicle or an object.Comprehensive Insurance: Provides coverage for non-collision-related incidents, such as theft, vandalism, fire, natural disasters, and hitting an animal. It helps protect your vehicle from a wide range of potential risks.Personal Injury Protection (PIP): Covers medical expenses for you and your passengers in the event of an accident, regardless of who is at fault. PIP can also cover lost wages and other related costs.Uninsured/Underinsured Motorist Coverage: Protects you if you’re involved in an accident with a driver who has insufficient or no insurance coverage. This helps cover medical expenses and repair costs when the at-fault party cannot pay.

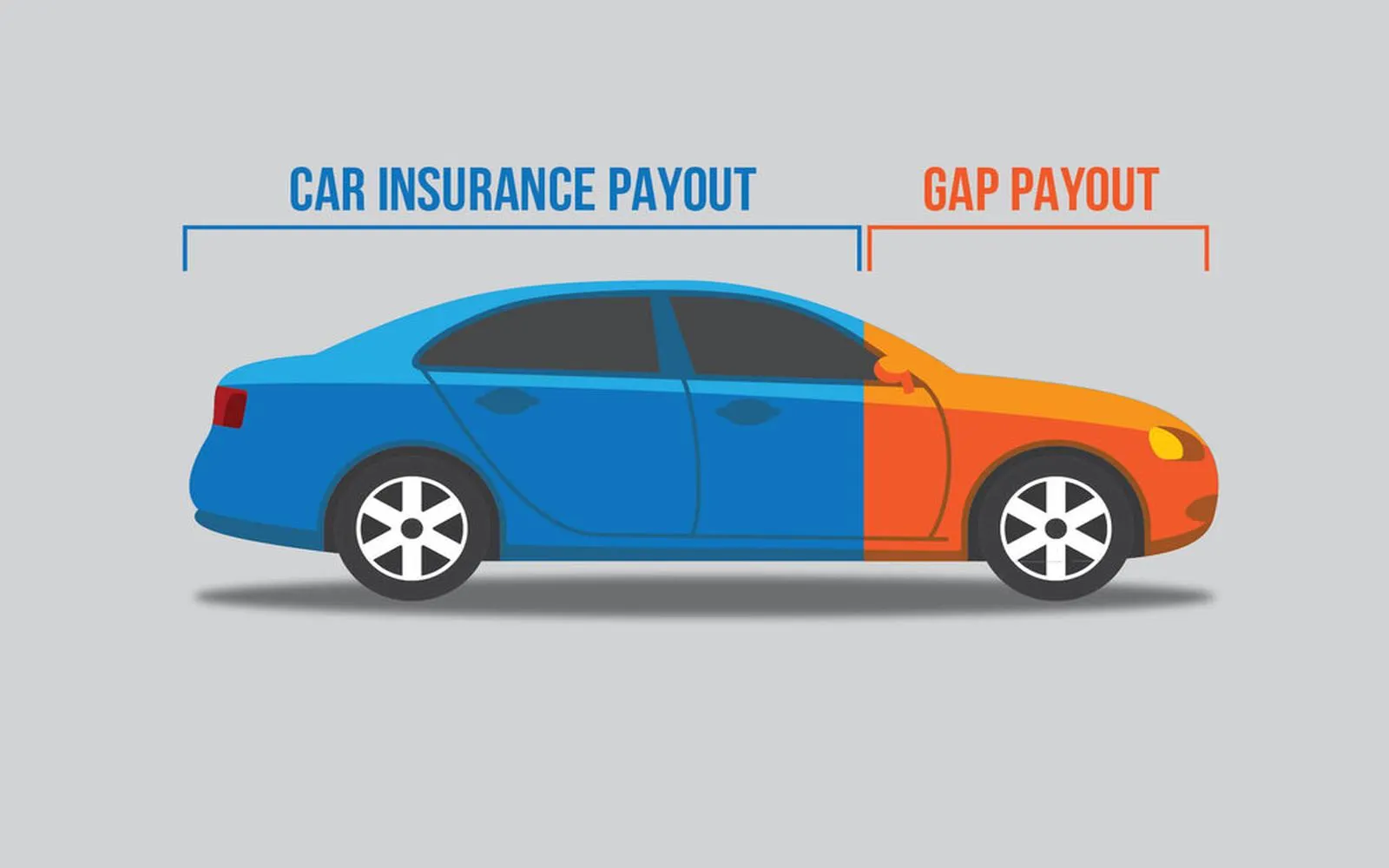

- Additional Coverage Options:Roadside Assistance: Provides services such as towing, tire changes, and fuel delivery if your car breaks down or you encounter other issues while on the road.Rental Car Coverage: Covers the cost of a rental vehicle while your car is being repaired due to a covered claim. This ensures you have transportation during the repair process.Gap Insurance: Covers the difference between the actual cash value of your vehicle and the amount you owe on your car loan or lease if your car is totaled in an accident.

Choosing the Right Car Insurance Policy

Selecting the right car insurance policy involves considering several factors to ensure you get adequate coverage at a reasonable price:

- Assess Your Coverage Needs: Evaluate the types of coverage you need based on your driving habits, the value of your vehicle, and your financial situation. Consider factors such as liability limits, deductibles, and additional coverage options.

- Compare Quotes: Obtain quotes from multiple insurance providers to compare premiums, coverage options, and discounts. Many insurance companies offer online tools or mobile apps to make it easy to get quotes and compare policies.

- Consider Deductibles: Choose a deductible amount that aligns with your budget and risk tolerance. A higher deductible generally results in a lower premium, but it means you'll pay more out-of-pocket if you file a claim.

- Check for Discounts: Look for available discounts that can lower your premium, such as safe driver discounts, multi-car discounts, bundling policies (e.g., combining car insurance with home insurance), and discounts for certain safety features or driving courses.

- Review Customer Service and Claims Process: Research the insurance company’s reputation for customer service and claims handling. Read reviews and ask for recommendations to ensure you choose a provider known for prompt and fair claims processing.

- Understand Policy Terms and Exclusions: Carefully review the policy terms, conditions, and exclusions to understand what is covered and what is not. Make sure you’re aware of any limitations or specific requirements associated with your coverage.

- Evaluate Financial Stability: Choose an insurance provider with a strong financial rating to ensure they can handle claims and provide reliable service. Check ratings from independent agencies such as A.M. Best or Moody’s.

Top Car Insurance Providers

Here are some well-regarded car insurance companies known for their comprehensive coverage options, competitive rates, and customer service:

- Geico: Offers competitive rates, a user-friendly online platform, and a variety of discounts. Known for its extensive coverage options and efficient claims process.

- State Farm: Provides a range of coverage options, personalized service, and a large network of local agents. Offers discounts for safe driving and bundling policies.

- Progressive: Known for its innovative tools, such as the Name Your Price® tool, and competitive rates. Offers customizable coverage options and discounts for multiple policies.

- Allstate: Provides a variety of coverage options, including optional add-ons, and offers discounts for safe driving and bundling. Known for its extensive network of agents.

- USAA: Offers comprehensive coverage and excellent customer service for military members and their families. Known for competitive rates and a range of discounts.

Conclusion

Car insurance is an essential investment for protecting yourself, your vehicle, and your financial well-being. By understanding the different types of coverage, evaluating your needs, and comparing options, you can find a policy that offers the right balance of protection and affordability. Like Tom’s experience, having the right car insurance can provide peace of mind and financial relief in unexpected situations. Take the time to explore your options, choose a reputable provider, and secure a policy that meets your needs. With the right car insurance in place, you can drive confidently and navigate the road ahead with greater assurance.

Explore

Obtaining Insurance Quotes Without Car Information: A Comprehensive Guide

Top Car Insurance Options for New Drivers in 2025: Affordable Coverage & Essential Tips

Unlocking Peace of Mind: The Essential Guide to Gap Insurance

Top Car Insurance Providers with the Best Quotes in 2025

Navigating Health Insurance in 2025: Essential Tips for Coverage and Savings

Unlocking Sound Savings: A Comprehensive Guide to Hearing Insurance for Seniors

Mastering Insurance Claims: A Comprehensive Guide to Navigating Your Coverage

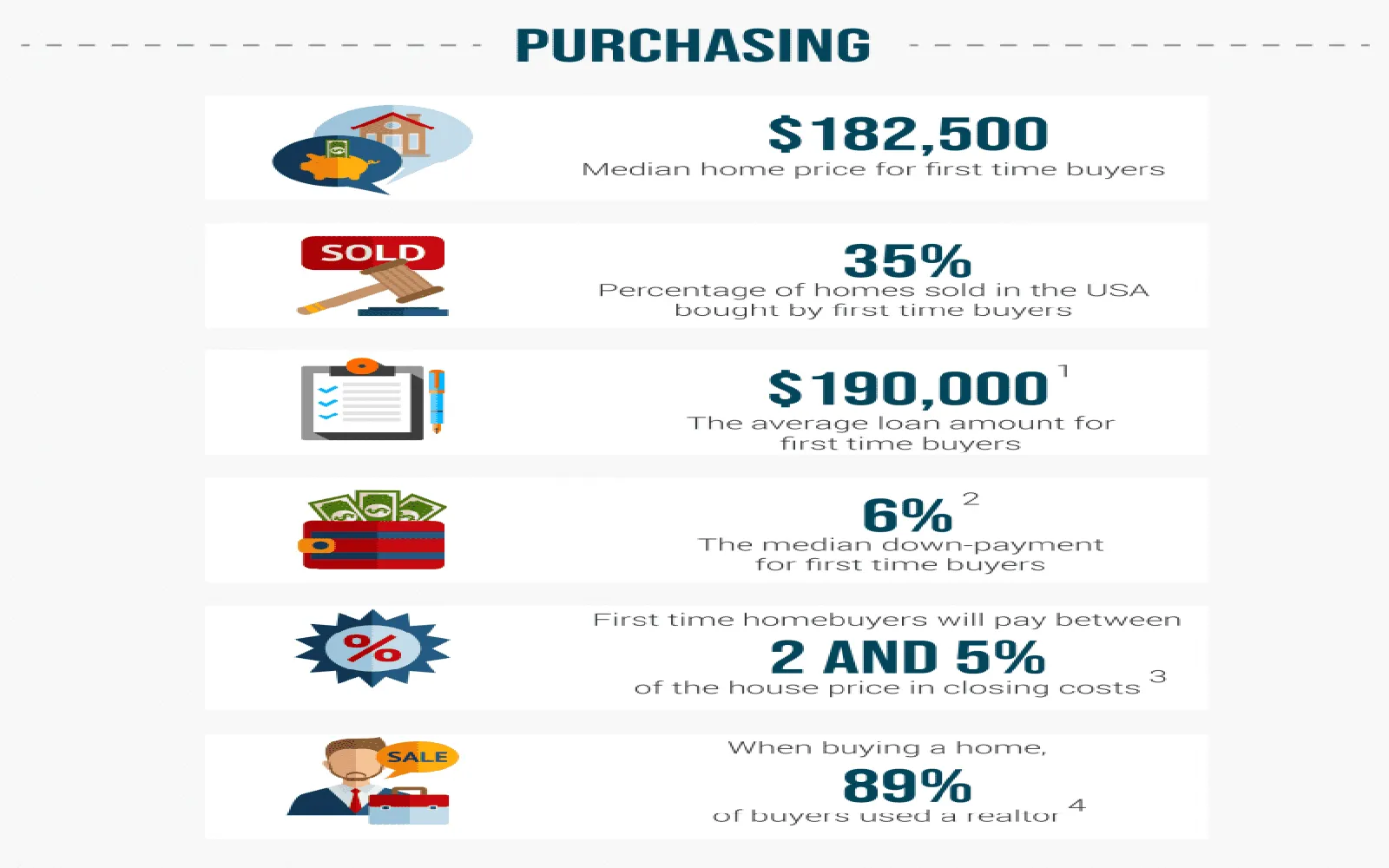

Affordable Home Insurance for First-Time Buyers in 2025: Your Complete Guide to Savings and Coverage