Top 401(k) Providers with Low Fees for 2025: Maximize Your Retirement Savings

Introduction

As we move towards 2025, the importance of maximizing retirement savings through effective planning and investment strategies cannot be overstated. A significant component of this planning involves selecting the right 401(k) provider. A well-chosen 401(k) plan can bolster your retirement savings, while minimizing fees is critical to ensuring that more of your hard-earned money is put to work for your future. In this article, we will explore some of the top 401(k) providers with low fees for 2025, helping you to navigate the options available and make informed decisions for your retirement.

The Importance of Low Fees

When it comes to retirement savings, fees can have a substantial impact over time. Even a small difference in fees can lead to thousands of dollars in lost savings by the time you retire. For instance, a 1% annual fee on a $100,000 investment can cost you over $50,000 in retirement savings over 30 years, assuming a 7% annual return. Therefore, understanding and comparing fees should be a top priority when choosing a 401(k) provider.

Criteria for Selecting Top 401(k) Providers

To identify the best 401(k) providers with low fees for 2025, we considered several factors:

- Fee Structure: Providers should offer transparent fee structures, including low administrative fees and investment expenses.

- Investment Options: A diverse range of investment options, including low-cost index funds and ETFs, is essential for effective portfolio diversification.

- Customer Service: High-quality customer service and support can make a significant difference in managing your retirement account.

- Ease of Use: A user-friendly platform for account management and investment tracking is vital for participants.

- Plan Flexibility: Flexibility in plan design, including options for automatic enrollment and matching contributions, is advantageous.

Top 401(k) Providers with Low Fees for 2025

1. Vanguard

Vanguard is renowned for its low-cost investment options, particularly its index funds. Vanguard's 401(k) plans typically feature low administrative fees and a wide selection of investment choices. Their emphasis on investor education and user-friendly platforms makes them a top choice for employers and employees alike.

2. Fidelity Investments

Fidelity is another leading provider known for its competitive pricing and robust array of investment options. Fidelity offers a range of low-cost index funds, as well as tools for retirement planning and education. Their commitment to transparency in fees and excellent customer service further solidifies their reputation as a leading 401(k) provider.

3. Charles Schwab

Charles Schwab provides a range of low-cost investment options, including no-fee index funds. Their 401(k) plans are designed to minimize costs while offering a comprehensive suite of investment tools. Schwab’s intuitive platform and dedicated customer support make it a favorable choice for those seeking to maximize their retirement savings.

4. T. Rowe Price

T. Rowe Price is known for its actively managed funds, but it also offers low-cost index funds. Their 401(k) plans come with transparent fee structures and a wide range of investment options. T. Rowe Price focuses on providing education and resources for plan participants, making it easier for them to navigate their retirement savings.

5. Betterment for Business

Betterment for Business is a digital investment platform that offers low-cost 401(k) plans with an emphasis on robo-advisory services. They provide a diversified portfolio of low-cost ETFs, making investment management straightforward and accessible. Their user-friendly interface and automated features appeal to tech-savvy individuals looking to simplify their retirement planning.

6. ADP Retirement Services

ADP is a well-known payroll service provider that also offers 401(k) solutions. Their plans are designed with low fees and provide a range of investment options. ADP’s platform is known for its reliability and integration with payroll services, making it easy for employers to manage retirement contributions.

7. Principal Financial Group

Principal Financial Group offers a range of retirement solutions, including 401(k) plans with competitive fees. They provide a broad selection of investment options and robust educational resources for participants. Principal's commitment to helping employees save effectively for retirement sets them apart in the industry.

8. Employee Fiduciary

Employee Fiduciary is a smaller, but highly regarded provider known for its low-cost 401(k) plans. They focus on offering transparent pricing and a selection of low-cost index funds. Employee Fiduciary’s personalized service and commitment to fiduciary responsibility make them a great option for small to mid-sized businesses.

9. Guideline

Guideline is a modern 401(k) provider that offers low fees and a streamlined digital experience. Their plans come with no setup or monthly fees for employers and a focus on low-cost investment options. Guideline’s automated features and user-friendly interface attract businesses looking for simplicity in retirement plan management.

10. Ubiquity Retirement + Savings

Ubiquity Retirement + Savings specializes in providing low-cost 401(k) plans for small businesses. They offer transparent pricing with no hidden fees and a variety of investment options. Ubiquity’s commitment to helping small business owners establish effective retirement plans is commendable, making them an excellent choice for startups and small companies.

How to Choose the Right Provider for Your Needs

Choosing the right 401(k) provider involves assessing your unique needs and preferences. Here are some steps to help you make an informed decision:

- Evaluate Fee Structures: Carefully review the fee schedules of potential providers. Look for providers that offer transparent pricing and avoid those with hidden fees.

- Consider Investment Options: Ensure that the provider offers a diverse range of low-cost investment options that align with your risk tolerance and investment goals.

- Assess Customer Support: Look for providers with strong customer service ratings and support resources that can assist you in managing your account effectively.

- Review Plan Flexibility: Consider the flexibility of the plan, including options for automatic contributions, employer matching, and loan provisions.

- Read Reviews and Testimonials: Check online reviews and seek testimonials from other users to gauge the experiences of participants with the provider.

Conclusion

As we approach 2025, selecting a 401(k) provider with low fees is crucial to maximizing your retirement savings. By considering providers like Vanguard, Fidelity, Charles Schwab, and others, you can ensure that you are making a wise investment in your future. Remember to thoroughly evaluate each provider based on fees, investment options, customer service, and plan flexibility. Taking the time to choose the right 401(k) provider will help you build a robust retirement savings strategy, ensuring that you are well-prepared for your financial future.

Explore

Maximize Your Savings in 2025: The Ultimate Guide to Amazon Credit Cards

Top 0% APR Balance Transfer Cards of 2025: Maximize Your Savings and Pay Off Debt Faster

Maximize Your Savings: How to Use Credit Card Points for Affordable Flights in 2025

Top Tax Preparation Services for Small Businesses in 2025: Maximize Your Savings and Compliance

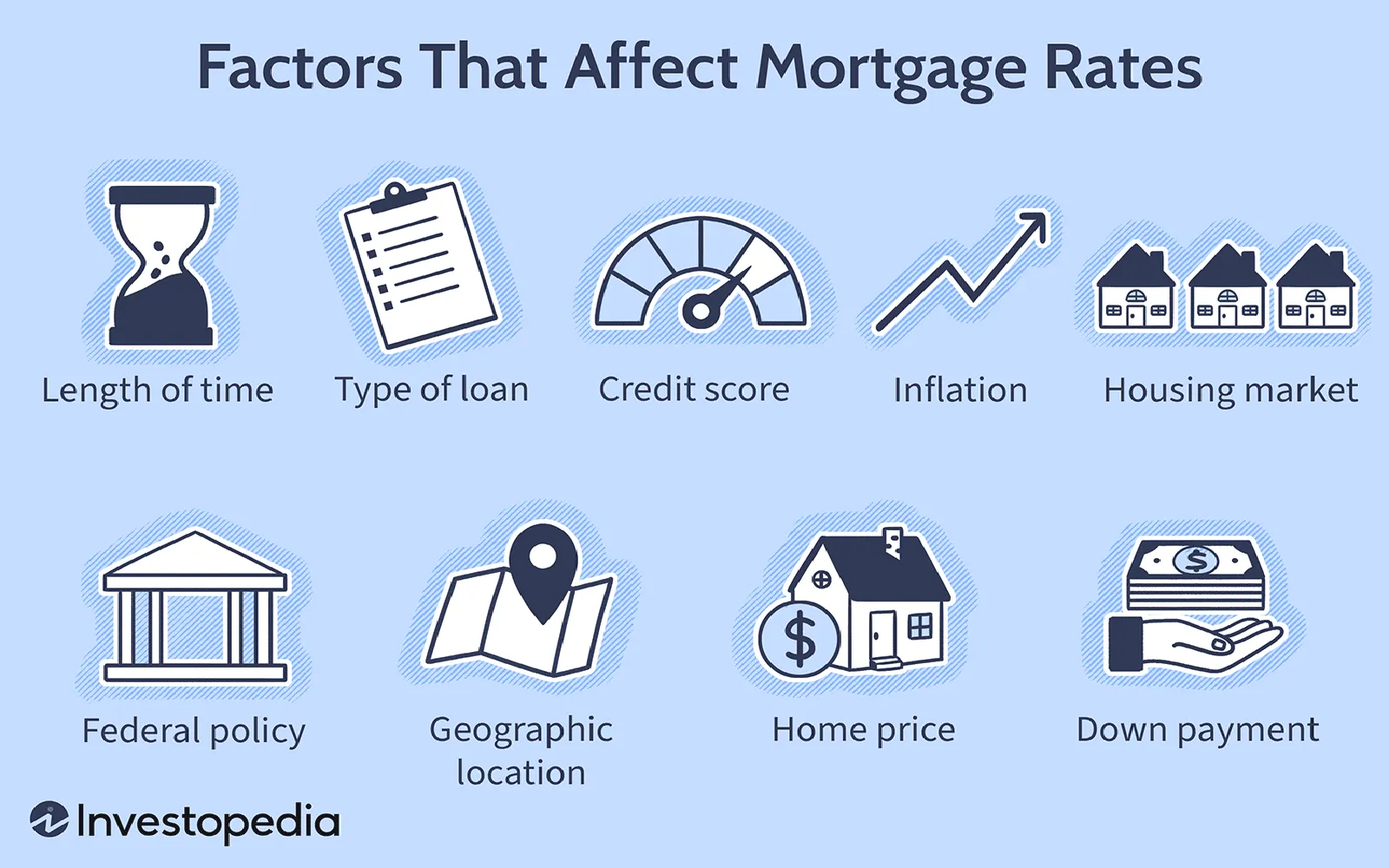

Unlocking Low-Interest Mortgages in 2025: Essential Tips for Homebuyers

Safest Investments for 2025: 10 Low-Risk Picks

8 Free & Low-Cost QR Code Tools for Packaging