Top Roth IRA Options for 2025: Secure Your Retirement with the Best Plans

Introduction

As we approach 2025, the importance of securing a comfortable retirement is more critical than ever. With rising living costs, healthcare expenses, and an uncertain economic future, many individuals are turning to retirement savings vehicles like Roth IRAs. A Roth IRA, or Individual Retirement Account, offers unique tax advantages, making it an attractive option for many investors. In this article, we will explore the top Roth IRA options for 2025 to help you make informed decisions for your retirement savings.

What is a Roth IRA?

A Roth IRA is a type of retirement savings account that allows individuals to save money on a tax-free basis. Contributions to a Roth IRA are made with after-tax dollars, which means you won't pay taxes on withdrawals during retirement, provided certain conditions are met. This can be particularly advantageous for those who expect to be in a higher tax bracket during retirement. Additionally, Roth IRAs have no required minimum distributions (RMDs), allowing your investments to grow tax-deferred for as long as you wish.

Benefits of a Roth IRA

There are several benefits to having a Roth IRA, making it a popular choice among retirement savers:

- Tax-Free Withdrawals: Withdrawals of both contributions and earnings are tax-free in retirement, provided the account has been open for at least five years and the account holder is at least 59½ years old.

- No Required Minimum Distributions: Unlike traditional IRAs, Roth IRAs do not require account holders to take distributions at a certain age, allowing for greater flexibility in retirement planning.

- Contribution Flexibility: Individuals can continue to contribute to a Roth IRA as long as they have earned income, making it a viable option for those who work part-time in retirement.

- Estate Planning Benefits: Roth IRAs can be passed on to heirs tax-free, providing a financial legacy without the burden of taxes.

Top Roth IRA Options for 2025

As you consider your retirement savings strategy for 2025, here are some of the top Roth IRA options to explore:

1. Vanguard Roth IRA

Vanguard is well-known for its low-cost index funds and ETFs, making it a popular choice for Roth IRA investors. With a Vanguard Roth IRA, you can choose from a wide range of investment options, including both traditional and Roth mutual funds. Vanguard's focus on low expense ratios can help maximize your long-term returns.

Vanguard also provides excellent educational resources and tools to help you understand investing and retirement planning, making it a great choice for both novice and experienced investors.

2. Fidelity Roth IRA

Fidelity is another top contender for Roth IRA options in 2025. With no account minimums and a broad selection of mutual funds, ETFs, and other investment options, Fidelity offers flexibility for investors. Additionally, Fidelity's user-friendly online platform makes it easy to manage your account and investments.

Fidelity is also known for its research and resources, providing investors with valuable insights to help guide their investment decisions.

3. Charles Schwab Roth IRA

Charles Schwab offers a comprehensive Roth IRA with no account minimums and a range of investment options, including stocks, bonds, ETFs, and mutual funds. Schwab's commission-free trading on a variety of investment products makes it an appealing choice for cost-conscious investors.

Moreover, Schwab provides robust educational tools and personalized investment advice, making it an excellent option for those who want to learn more about retirement investing.

4. TD Ameritrade Roth IRA

TD Ameritrade is well-regarded for its trading platform, making it an excellent choice for active investors looking to manage their Roth IRA. With no minimum balance requirement and access to a wide range of investment products, TD Ameritrade can cater to various investment strategies.

The platform also offers advanced trading tools, research, and educational resources, which can be beneficial for those looking to engage in self-directed investing.

5. E*TRADE Roth IRA

E*TRADE is another strong contender for Roth IRA options in 2025, known for its user-friendly platform and extensive investment offerings. With no account minimums and commission-free trades on stocks and ETFs, E*TRADE provides flexibility for investors.

The platform also offers a wealth of educational resources and investment research, helping investors make informed decisions and stay on track with their retirement goals.

6. MERRILL EDGE Roth IRA

Merrill Edge, a Bank of America company, provides a solid Roth IRA option, particularly for those who want to combine banking and investing. With no account minimums and access to a variety of investment choices, Merrill Edge is a convenient option for existing Bank of America customers.

The platform offers user-friendly tools and resources, including research reports and personalized investment advice, making it suitable for both beginners and experienced investors.

7. Betterment Roth IRA

For those who prefer a hands-off investment approach, Betterment offers a robo-advisor solution that can manage your Roth IRA for you. Betterment creates a personalized investment portfolio based on your risk tolerance and goals, automatically rebalancing your investments as needed.

This option is perfect for individuals who want to invest without the stress of managing their accounts actively. Betterment also provides goal-based planning tools to help you track your retirement savings progress.

8. Wealthfront Roth IRA

Similar to Betterment, Wealthfront is another robo-advisor that provides a streamlined approach to managing your Roth IRA. Wealthfront offers low fees and a variety of investment options, including automated tax-loss harvesting to enhance your returns.

With a focus on long-term growth and diversification, Wealthfront is an excellent option for those who want to invest passively while benefiting from technology-driven investment strategies.

9. Acorns Roth IRA

Acorns takes a unique approach to investing by rounding up your everyday purchases and investing the spare change into a diversified portfolio. This micro-investing platform is ideal for individuals who are just starting their investment journey or those who want to save for retirement without making large contributions upfront.

The Acorns Roth IRA allows you to automate your savings and invest for the long term. Its user-friendly app makes it easy to monitor your investments and track your progress toward your retirement goals.

10. Ally Invest Roth IRA

Ally Invest offers a competitive Roth IRA option with no account minimums and low trading fees. With a wide range of investment choices, including stocks, bonds, ETFs, and options, Ally Invest caters to various investing styles.

Ally’s user-friendly platform also provides educational resources and tools to help investors make informed decisions, making it an excellent choice for both new and experienced investors.

Choosing the Right Roth IRA for You

When selecting a Roth IRA provider, it's essential to consider several factors to ensure you choose the option that best meets your needs:

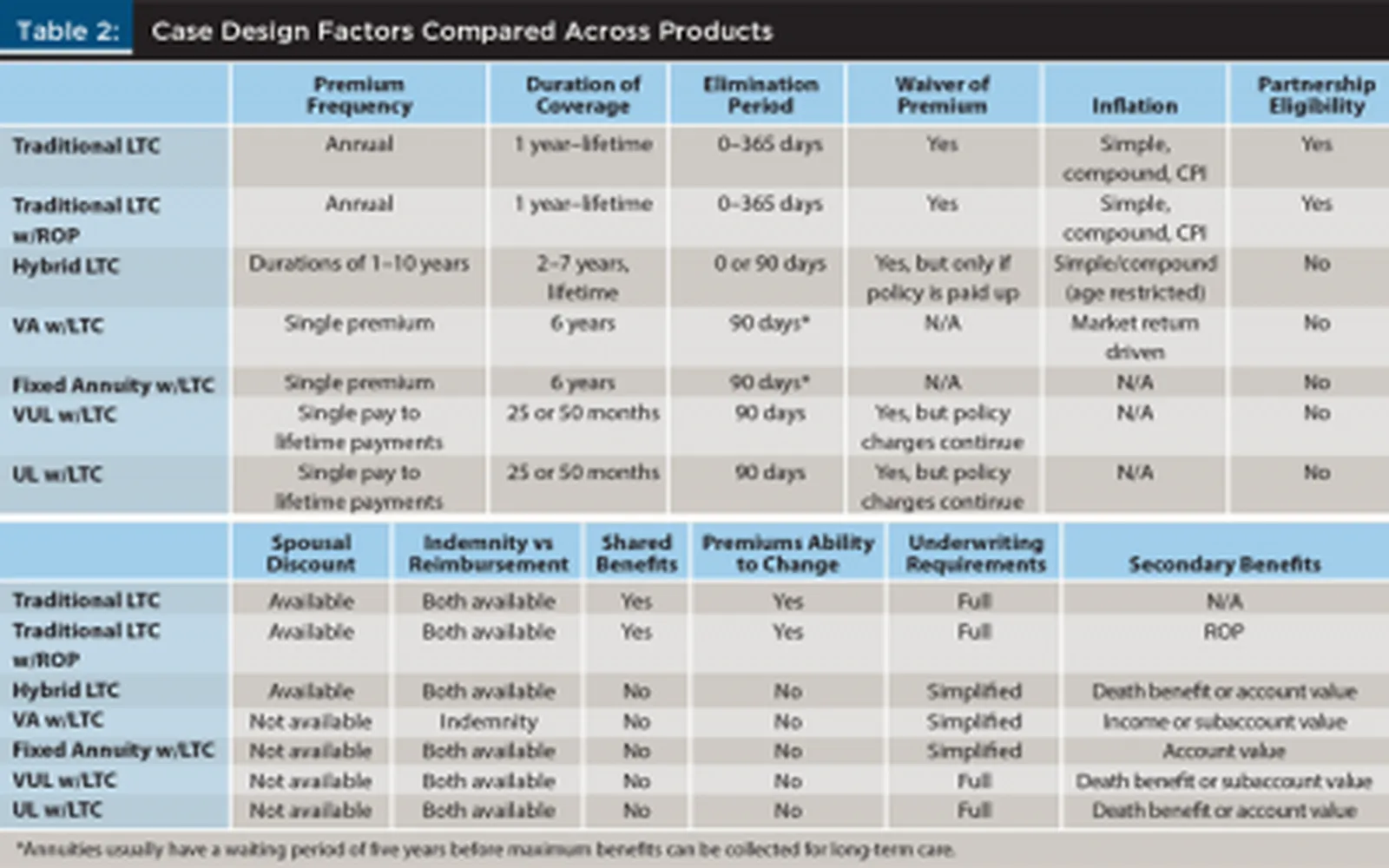

- Investment Options: Look for a provider that offers a diverse range of investment choices that align with your risk tolerance and investment strategy.

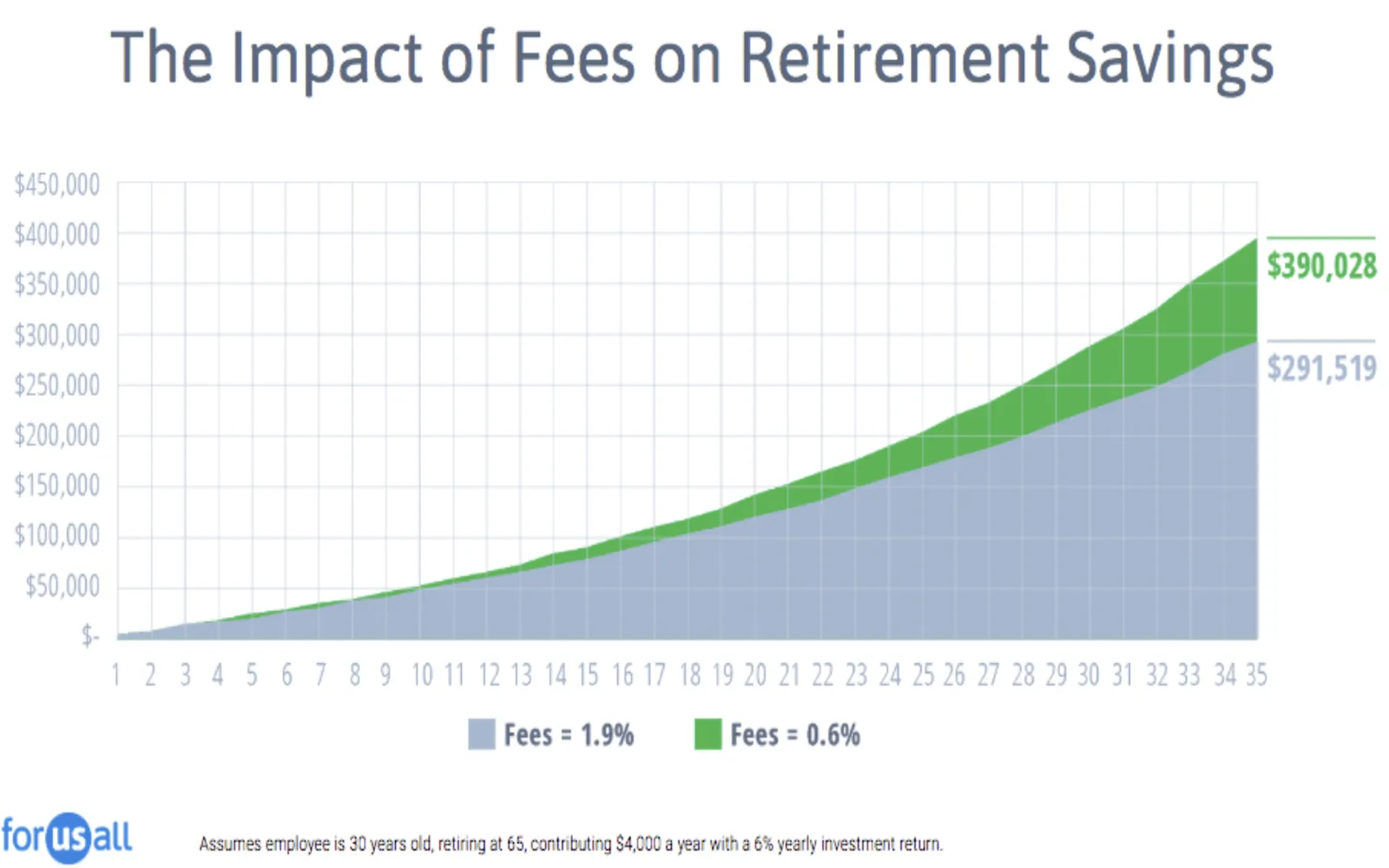

- Fees and Expenses: Compare account fees, trading commissions, and expense ratios to find a provider with low-cost investment options.

- User Experience: Choose a platform that provides a user-friendly interface, easy account management, and helpful educational resources.

- Customer Service: Good customer support can be invaluable, especially when you have questions about your account or investment strategy.

- Account Minimums: Some providers may require a minimum deposit to open a Roth IRA, so consider your current financial situation when making your choice.

Maximizing Your Roth IRA Contributions

In 2025, the contribution limits for Roth IRAs remain a crucial aspect of retirement planning. For individuals under 50, the contribution limit is $6,500, while those aged 50 and older can contribute up to $7,500, thanks to the catch-up contribution provision. It's essential to maximize your contributions each year to take full advantage of the tax-free growth potential of a Roth IRA.

Additionally, be aware of income limits that could affect your eligibility to contribute directly to a Roth IRA. In 2025, individuals with modified adjusted gross income (MAGI) over $140,000 and married couples filing jointly with a MAGI over $208,000 may need to explore backdoor Roth IRA options if they wish to contribute.

Conclusion

As you plan for your retirement journey, choosing the right Roth IRA provider is crucial for maximizing your savings and achieving your financial goals. With various options available in 2025, including traditional brokerage firms and modern robo-advisors, it's essential to evaluate your individual needs and preferences.

By carefully considering factors such as investment options, fees, and account management features, you can select a Roth IRA that aligns with your retirement vision. Start planning today to secure your financial future and enjoy the peace of mind that comes with a well-funded retirement.

Explore

A Complete Guide to Starting a Gold IRA in 2025

Top Life Insurance Options for Seniors in 2025: Secure Your Future Today

Top Long-Term Care Insurance Options for 2025: Secure Your Future Today

Top Business Insurance Providers of 2025: Secure Your Future with the Best Coverage Options

10 Best Crypto Wallets in the US: Secure Options Compared

Top 401(k) Providers with Low Fees for 2025: Maximize Your Retirement Savings

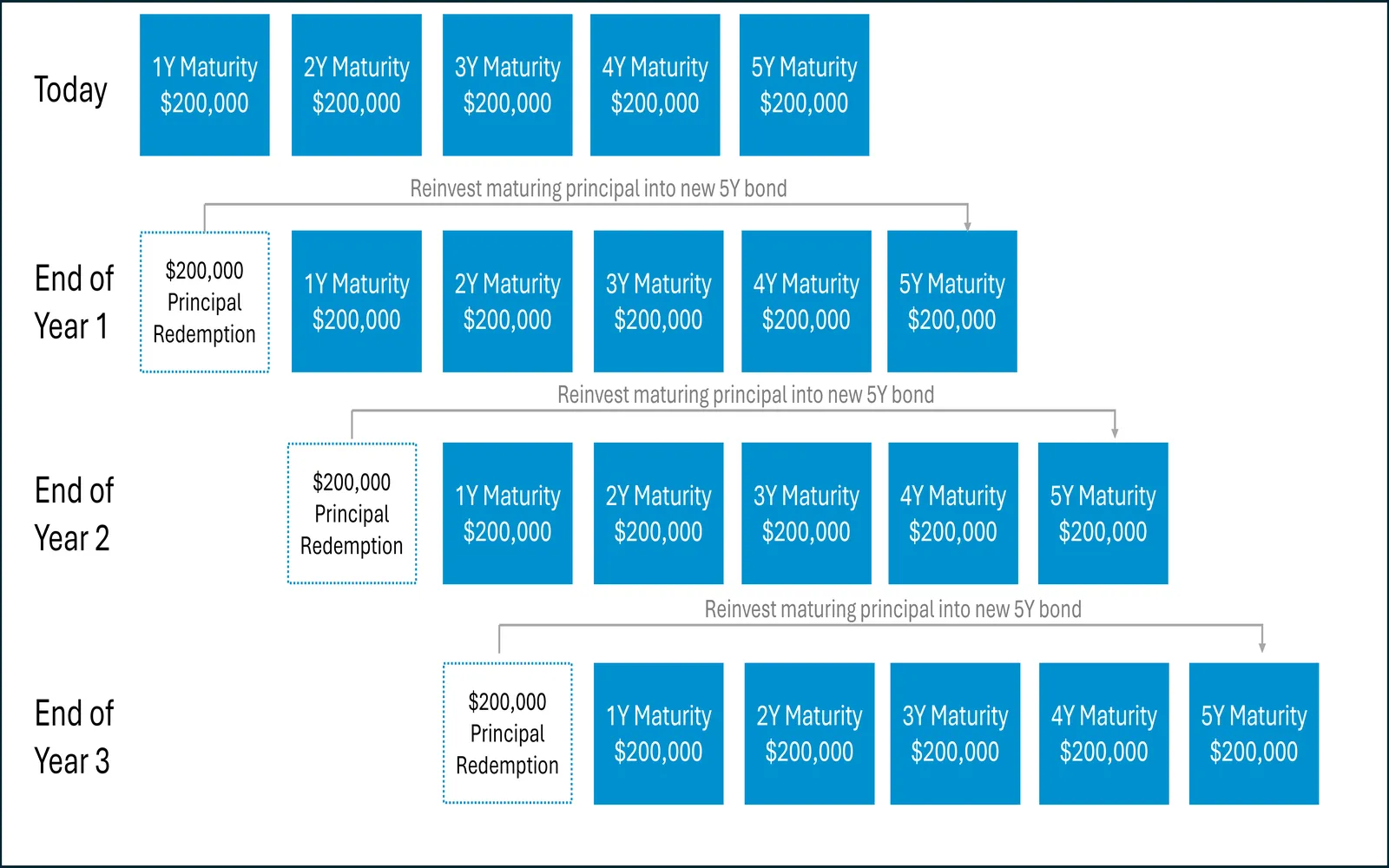

How to Use Bond Ladders for Stable Retirement Income in 2025