Top Long-Term Care Insurance Options for 2025: Secure Your Future Today

Understanding Long-Term Care Insurance

Long-term care insurance (LTCI) is designed to cover services that assist individuals with chronic illnesses, disabilities, or other conditions that require long-term assistance. As life expectancy increases, the necessity of planning for potential long-term care needs becomes more pressing. This insurance helps mitigate the financial burden of extended medical care, whether in a nursing home, assisted living facility, or through in-home care.

The Importance of Long-Term Care Insurance

With healthcare costs rising and many individuals lacking sufficient savings to cover potential long-term care needs, LTCI becomes an essential component of financial planning. According to a report from the U.S. Department of Health and Human Services, about 70% of people over age 65 will require some form of long-term care during their lifetimes. The average annual cost of such care can run into tens of thousands of dollars, making it crucial to have a sound insurance plan in place.

Factors to Consider When Choosing LTC Insurance

When evaluating long-term care insurance options, several key factors should be taken into account:

- Coverage Options: Different policies offer varying levels of coverage, including in-home care, assisted living, and nursing home care. Determine what type of care you may need in the future.

- Benefit Amount: Assess how much daily or monthly benefit will be provided and whether it will be sufficient to cover potential care costs.

- Elimination Period: This is the waiting period before benefits kick in. Policies with longer elimination periods typically have lower premiums.

- Inflation Protection: Consider policies that offer inflation protection to keep pace with rising care costs over time.

- Premiums: Evaluate the affordability and stability of premium costs over time, as well as the insurer's financial strength.

Top Long-Term Care Insurance Options for 2025

As we head into 2025, a variety of long-term care insurance options are available, catering to diverse needs and preferences. Here are some of the top options to consider:

1. Traditional Long-Term Care Insurance

This is the most common type of long-term care insurance. Traditional policies provide benefits for a set period, typically ranging from 2 to 6 years, and can cover various care settings. When purchasing traditional LTCI, it’s crucial to consider the elimination period, benefit amounts, and whether the policy offers inflation protection. Some leading providers include:

- Genworth Financial: Known for its comprehensive policies and strong customer service.

- Mutual of Omaha: Offers flexible options and competitive premiums.

- Northwestern Mutual: Provides a variety of customizable plans with robust inflation protection.

2. Hybrid Long-Term Care Insurance

Hybrid policies combine long-term care benefits with life insurance or an annuity. This means that if you never need long-term care, your beneficiaries will receive a death benefit or a cash value. Hybrid policies are gaining popularity due to their flexibility and the peace of mind they provide. Some notable hybrid options include:

- Nationwide CareMatters: Offers both long-term care coverage and a death benefit, with options for premium payment structures.

- Lincoln Financial Group: Provides a flexible hybrid policy with options for increasing benefits over time.

- OneAmerica: Known for its Asset-Based Long-Term Care Insurance, which integrates LTC benefits with life insurance.

3. Short-Term Care Insurance

Short-term care insurance is designed to cover temporary care needs, typically for up to one year. This option can be ideal for those who anticipate short-term rehabilitation or recovery periods following surgery or illness. Although it won’t cover long-term care needs, it can serve as a stopgap solution. Some providers include:

- Mutual of Omaha: Offers a variety of short-term care plans that are easy to understand and enroll in.

- Transamerica: Provides customizable short-term care options with straightforward benefits.

4. State Partnership Programs

State partnership programs aim to encourage individuals to purchase long-term care insurance while providing them with asset protection. These programs allow policyholders to protect a certain amount of their assets if they utilize their insurance benefits. This can be particularly advantageous for those worried about Medicaid spend-down requirements. Many states have partnerships with specific insurers, so researching local options is essential.

5. Medicare and Medicaid

While not traditional long-term care insurance, understanding how Medicare and Medicaid fit into the long-term care landscape is crucial. Medicare offers limited coverage for skilled nursing care, primarily focused on recovery after hospitalization. Medicaid, on the other hand, provides more extensive coverage for low-income individuals but has strict eligibility criteria and often requires the spend-down of assets. Considering these programs in conjunction with long-term care insurance can help create a comprehensive care strategy.

Evaluating Insurance Providers

When selecting a long-term care insurance provider, it’s essential to evaluate their financial strength and customer service reputation. Tools like A.M. Best ratings and the Better Business Bureau can provide insights into an insurer’s reliability. Additionally, reading customer reviews and seeking recommendations from financial advisors can help you make a more informed choice.

Cost of Long-Term Care Insurance in 2025

The cost of long-term care insurance varies significantly based on factors such as age, health status, and the type of policy chosen. On average, annual premiums for a 55-year-old can range from $2,000 to $4,000, depending on the coverage. It’s advisable to purchase insurance earlier in life to secure lower premiums and ensure eligibility, as costs increase with age and health declines.

Tax Implications of Long-Term Care Insurance

Long-term care insurance premiums may qualify for tax deductions, which can significantly impact overall costs. The IRS allows taxpayers to deduct qualified long-term care insurance premiums as medical expenses, subject to certain limits based on age. Additionally, some states offer tax incentives for purchasing LTCI. Consulting a tax professional can help you navigate these potential benefits.

Tips for Buying Long-Term Care Insurance

When considering long-term care insurance, keep these tips in mind:

- Assess Your Needs: Identify your potential long-term care needs based on family health history and personal preferences.

- Shop Around: Compare quotes and policies from multiple insurers to find the best coverage for your needs.

- Understand the Fine Print: Read policy details carefully to grasp limitations, exclusions, and the claims process.

- Consult a Professional: A financial advisor specializing in long-term care can provide tailored guidance and recommendations.

Conclusion: Secure Your Future Today

Investing in long-term care insurance is a proactive step towards securing your financial future and ensuring access to necessary services as you age. With various options available in 2025, it’s vital to assess your needs, explore different policies, and select a provider you can trust. By doing so, you can rest assured that you have taken the necessary steps to protect yourself and your loved ones from the financial strain of long-term care expenses.

Explore

Top Life Insurance Options for Seniors in 2025: Secure Your Future Today

Affordable Health Insurance for Families in 2025: Your Guide to Cost-Effective Coverage Options

Unlocking Sound Savings: A Comprehensive Guide to Hearing Insurance for Seniors

Secure Your Small Business's Future with Comprehensive Health Insurance Coverage

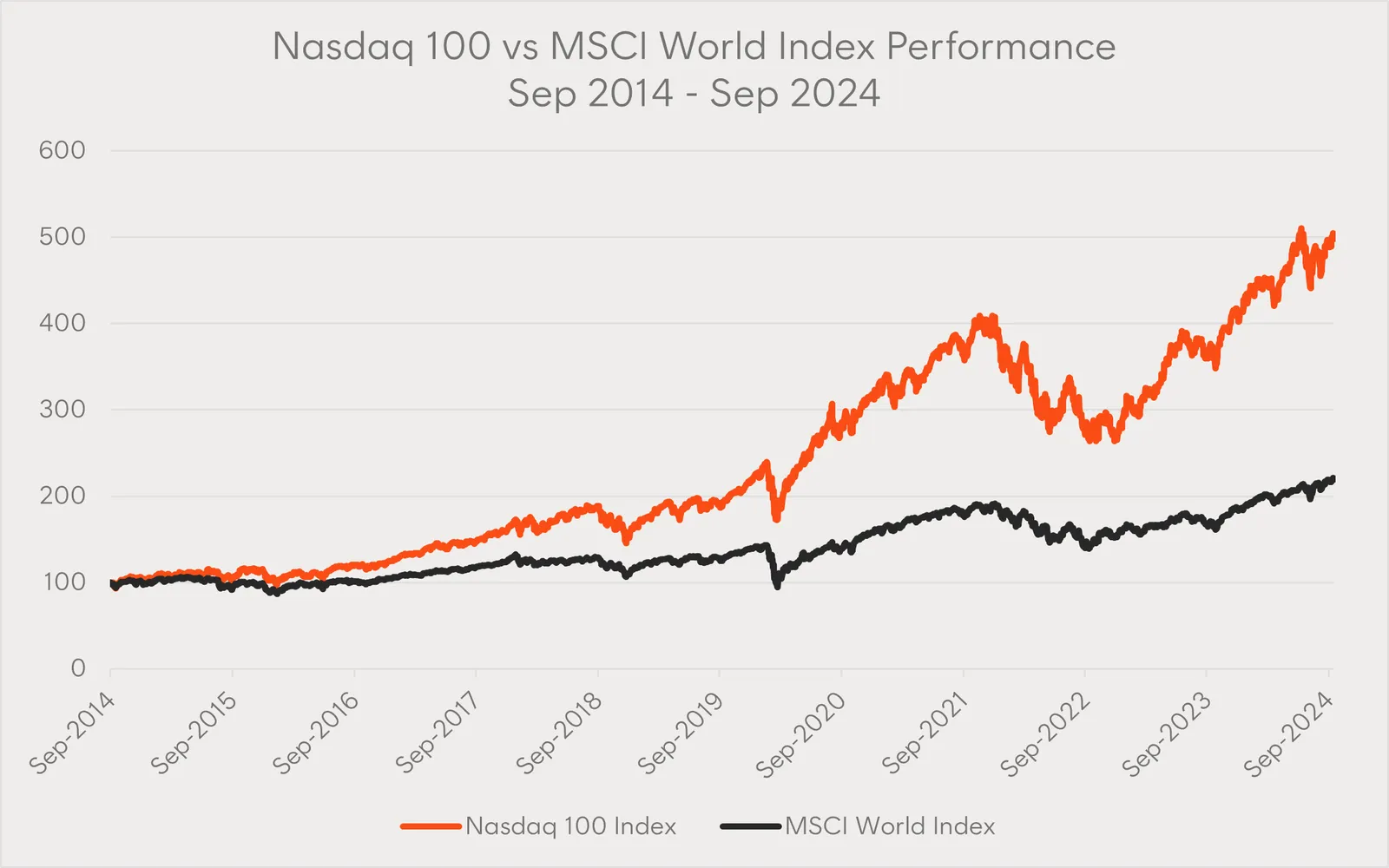

Investing in Nasdaq 100 ETFs for Long-Term Success

Top Business Insurance Providers of 2025: Secure Your Future with the Best Coverage Options

Teledentistry in 2025: Revolutionizing Oral Care for a Healthier Future

Empowering Health: The Future of Medical Support and Care