Top Tax Preparation Services for Small Businesses in 2025: Maximize Your Savings and Compliance

Introduction

As we step into 2025, small businesses continue to face unique challenges, particularly in the realm of taxation. With the complexities of tax codes, deductions, and compliance regulations constantly evolving, it’s crucial for small business owners to choose the right tax preparation services that not only maximize savings but also ensure compliance with federal and state laws. This article explores the top tax preparation services available for small businesses in 2025 and how they can help you navigate the intricate landscape of taxation.

Understanding the Importance of Tax Preparation Services

Tax preparation services offer an invaluable resource for small businesses, providing expertise in navigating tax regulations, filing accurate returns, and identifying deductions that can save money. In 2025, the importance of these services cannot be overstated. With increased IRS scrutiny and changing tax laws, small businesses need to ensure they are compliant while also optimizing their tax positions.

Criteria for Choosing a Tax Preparation Service

When selecting a tax preparation service, small business owners should consider several factors:

- Experience and Specialization: Look for services that specialize in small business taxation. Experienced professionals are more likely to understand the nuances of your industry.

- Technology and Tools: In an increasingly digital world, tax preparation services that utilize advanced technology can streamline the process and improve accuracy.

- Client Reviews and Reputation: Researching client reviews and testimonials can provide insights into a service’s reliability and effectiveness.

- Personalized Service: Seek out firms that offer personalized services, as they are more likely to understand your unique business needs.

- Advisory Services: Some tax preparation services go beyond basic filing and offer strategic tax planning advice.

Top Tax Preparation Services for Small Businesses in 2025

1. H&R Block

H&R Block has long been a household name in tax preparation, and in 2025, it continues to offer comprehensive services tailored to small businesses. With a robust online platform and in-person options, H&R Block provides flexibility for business owners. Their small business tax services include entity formation, bookkeeping, and year-round tax planning. Their experienced tax professionals are adept at identifying deductions specific to your business, ensuring you maximize your savings.

2. TurboTax Business

TurboTax Business remains a popular choice for small business owners who prefer a DIY approach. In 2025, TurboTax has enhanced its user interface and guidance features, making it easier for entrepreneurs to navigate tax preparation. The software offers a step-by-step process, ensuring that users don’t miss out on credits and deductions. For small business owners who are comfortable with technology, TurboTax can be a cost-effective solution that still provides thorough support.

3. TaxAct

TaxAct has gained recognition for its affordability and user-friendly platform. In 2025, it offers tailored solutions for small businesses, including S corporations and partnerships. TaxAct’s software is designed to simplify tax preparation while maximizing deductions. Their customer support team is readily available to assist users with any questions that arise during the filing process, making it a great option for small business owners seeking an efficient service.

4. Bench

Bench is a unique hybrid service that combines bookkeeping and tax preparation. In 2025, it continues to cater to small businesses by offering a seamless integration of real-time bookkeeping with tax preparation services. Bench’s team of experts ensures that your financial records are accurate, which simplifies the tax filing process. Their proactive approach to tax planning helps small businesses stay compliant and minimize their tax liabilities.

5. TaxSlayer Pro

TaxSlayer Pro is an excellent choice for small business owners looking for a comprehensive tax solution. In 2025, this service offers a range of features, including e-filing and support for various business structures. TaxSlayer Pro’s pricing is competitive, and it provides users with the tools they need to navigate complex tax situations. With a focus on maximizing deductions, this service is ideal for small businesses aiming to optimize their tax position.

6. Jackson Hewitt

Jackson Hewitt is another well-established tax preparation service that has adapted to the needs of small businesses in 2025. Offering both in-person and online options, Jackson Hewitt provides personalized service with a focus on customer satisfaction. Their tax professionals are well-versed in small business tax laws and can help identify deductions and credits that might otherwise be overlooked. Additionally, they offer a guarantee on their services, providing peace of mind for business owners.

7. CPA Firms

For small businesses with more complex financial situations, partnering with a Certified Public Accountant (CPA) firm can be beneficial. In 2025, many CPA firms offer specialized tax preparation services for small businesses. These firms not only assist with tax filings but also provide strategic tax planning advice throughout the year. A CPA’s expertise can be invaluable for navigating intricate tax laws and optimizing your business’s tax strategy.

8. Online Tax Services

Beyond traditional providers, several online tax services have emerged as strong contenders for small business tax preparation. Services like eFile.com and FreeTaxUSA offer affordable solutions, allowing small business owners to file their taxes with ease. While these platforms may not provide the same level of personalized service as some larger firms, they can be a cost-effective option for straightforward tax situations. In 2025, these services continue to innovate, offering user-friendly interfaces and comprehensive support.

Maximizing Your Savings

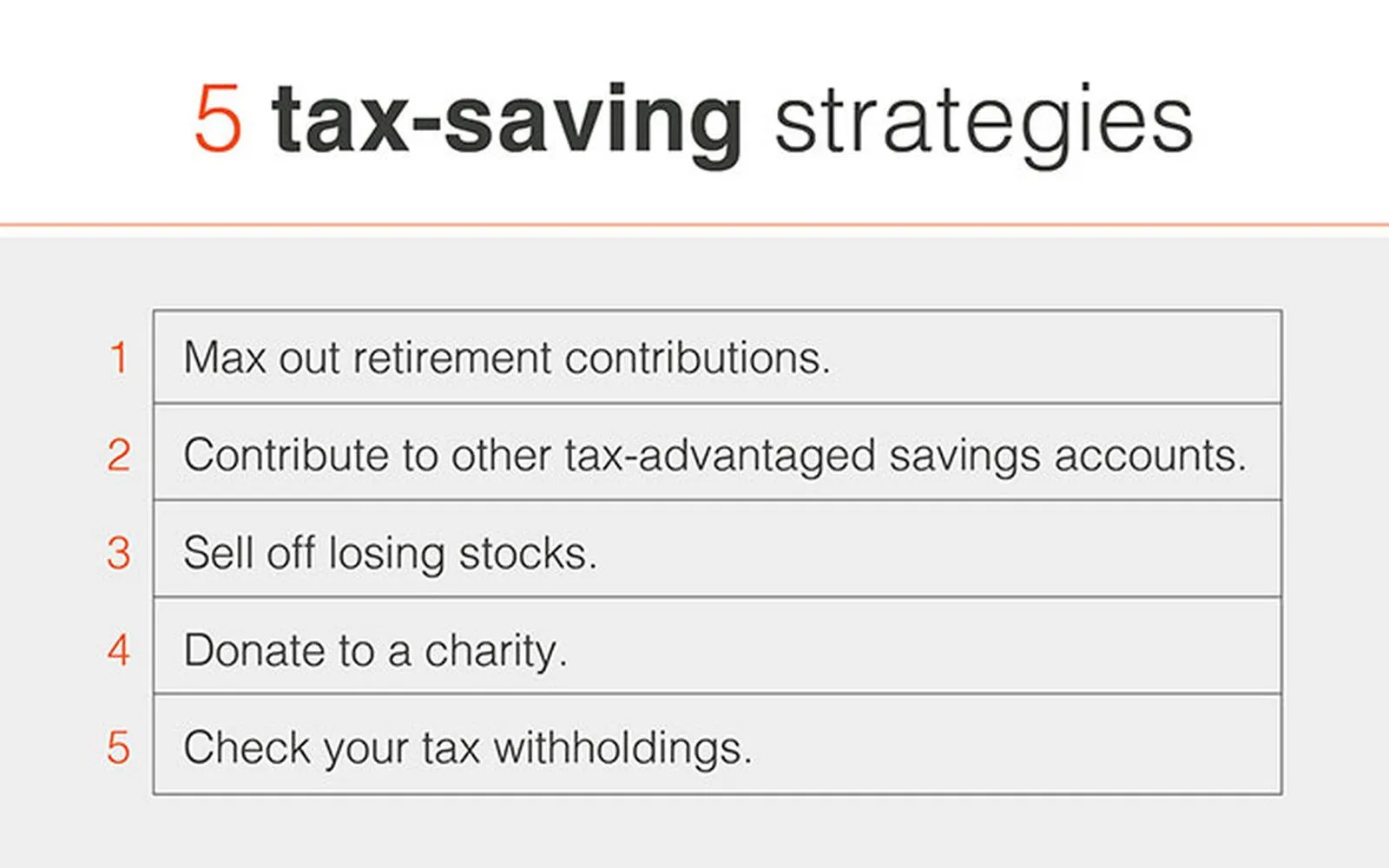

Maximizing tax savings is a priority for every small business owner. Here are some strategies that tax preparation services can help you implement:

- Identify Deductions: Many small business owners miss out on valuable deductions. Tax professionals can help identify eligible expenses, including home office deductions, equipment purchases, and business travel.

- Tax Credits: There are numerous tax credits available for small businesses, including those related to hiring, research and development, and energy efficiency. A knowledgeable tax preparer can help you take advantage of these credits.

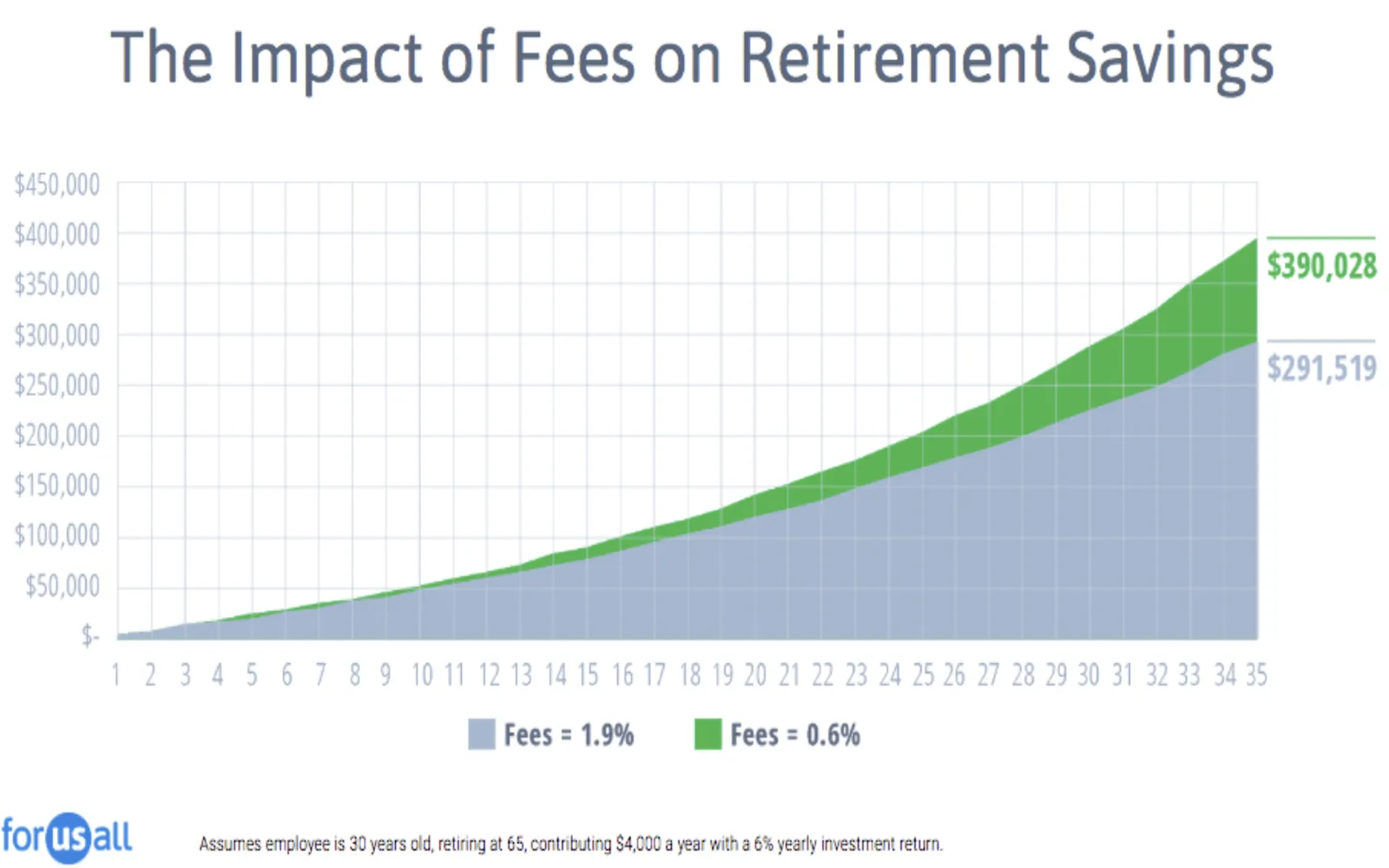

- Retirement Contributions: Contributing to retirement plans can reduce your taxable income. Tax preparation services can guide you on the best retirement options for your business.

- Entity Structure: The type of business entity you choose (LLC, S-Corp, etc.) can significantly impact your tax liability. Consulting with tax professionals can help you determine the most advantageous structure.

- Year-Round Planning: Engaging with tax professionals throughout the year rather than just during tax season can lead to better planning and savings. Regular check-ins can help you adjust your strategies as needed.

Ensuring Compliance

Compliance with tax regulations is critical for avoiding penalties and ensuring the long-term success of your small business. Here are some ways tax preparation services can help you stay compliant:

- Staying Updated on Tax Laws: Tax laws change frequently, and it can be challenging to keep up. Professional tax preparers stay informed about the latest regulations, ensuring your business remains compliant.

- Accurate Filings: Improperly filed tax returns can lead to audits and penalties. Tax preparation services ensure your returns are accurate, reducing the risk of errors.

- Record Keeping: Proper record-keeping is essential for compliance. Tax professionals can advise you on the best practices for maintaining records that will support your tax filings.

- Audit Support: In the event of an audit, having a professional tax preparer on your side can be invaluable. They can help you navigate the audit process and provide the necessary documentation.

Conclusion

In 2025, small businesses have access to a wide range of tax preparation services that can help maximize savings and ensure compliance. Whether you prefer a DIY approach with software like TurboTax or require the expertise of a CPA, it’s essential to choose a service that aligns with your business needs. By leveraging the expertise of tax professionals, small business owners can navigate the complexities of taxation, identify potential savings, and maintain compliance with ever-evolving regulations. Remember, effective tax preparation is not just about filing returns; it's about strategic planning for the future of your business.

Explore

2025 Guide: How to File Taxes for Your Small Business - Tips and Essential Steps

Tax-Efficient Investing 2025: Maximize Your Returns and Minimize Taxes

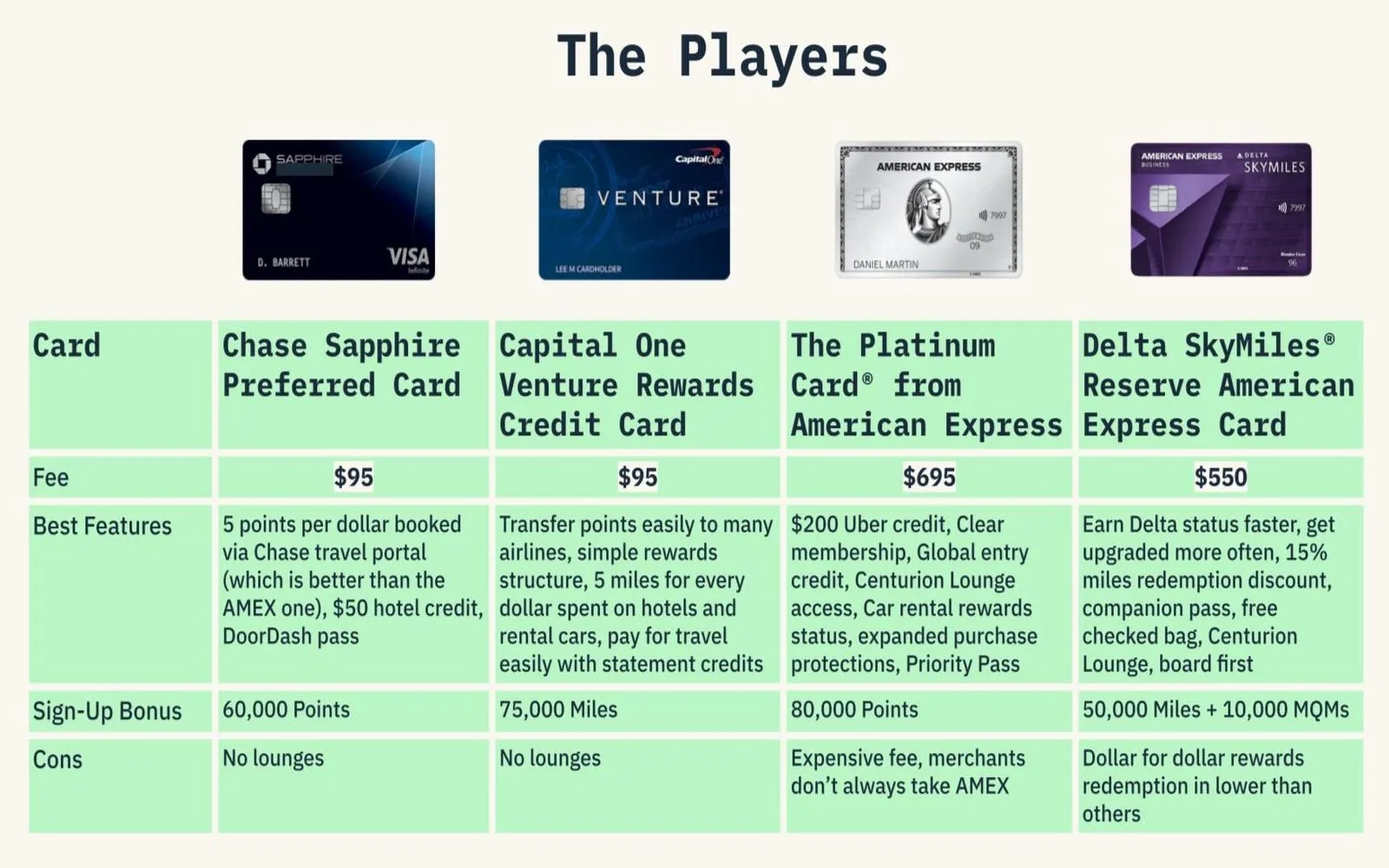

Top 0% APR Balance Transfer Cards of 2025: Maximize Your Savings and Pay Off Debt Faster

Maximize Your Savings in 2025: The Ultimate Guide to Amazon Credit Cards

Top 401(k) Providers with Low Fees for 2025: Maximize Your Retirement Savings

Maximize Your Savings: How to Use Credit Card Points for Affordable Flights in 2025

Tax-Advantaged Accounts: How They Can Boost Your Savings 2025

10 Smart Tax-Free Savings Tips Every American Needs in 2025