Top Business Checking Accounts in 2025: Maximize Your Financial Efficiency

In 2025, business banking is evolving with options that enhance financial efficiency for entrepreneurs and small business owners. With tech advancements and customer-focused services, top business checking accounts streamline transactions, minimize fees, and integrate with accounting software. This guide explores the best accounts to help you make informed decisions that align with your goals and strategy in a competitive market.

Introduction

In the fast-paced world of business finance, choosing the right checking account can significantly impact your company's financial efficiency. As we venture into 2025, the landscape for business checking accounts is evolving rapidly, with banks and financial institutions offering innovative solutions tailored to the needs of modern businesses. This article aims to highlight the top business checking accounts of 2025 and provide insights into how they can help maximize your financial efficiency.

Understanding Business Checking Accounts

A business checking account is essential for managing a company's finances. Unlike personal checking accounts, these accounts are designed specifically for business transactions, offering features that cater to the unique cash flow needs of companies. In 2025, the significance of choosing the right account is even more pronounced as businesses face new challenges and opportunities in the digital economy.

Key Features to Consider

When selecting a business checking account, certain features can help you maximize financial efficiency. Here are some key elements to consider:

- No Monthly Fees: Many accounts now offer no monthly maintenance fees, allowing businesses to save money.

- Transaction Limits: Depending on your business model, look for accounts with high or no transaction limits to avoid excess fees.

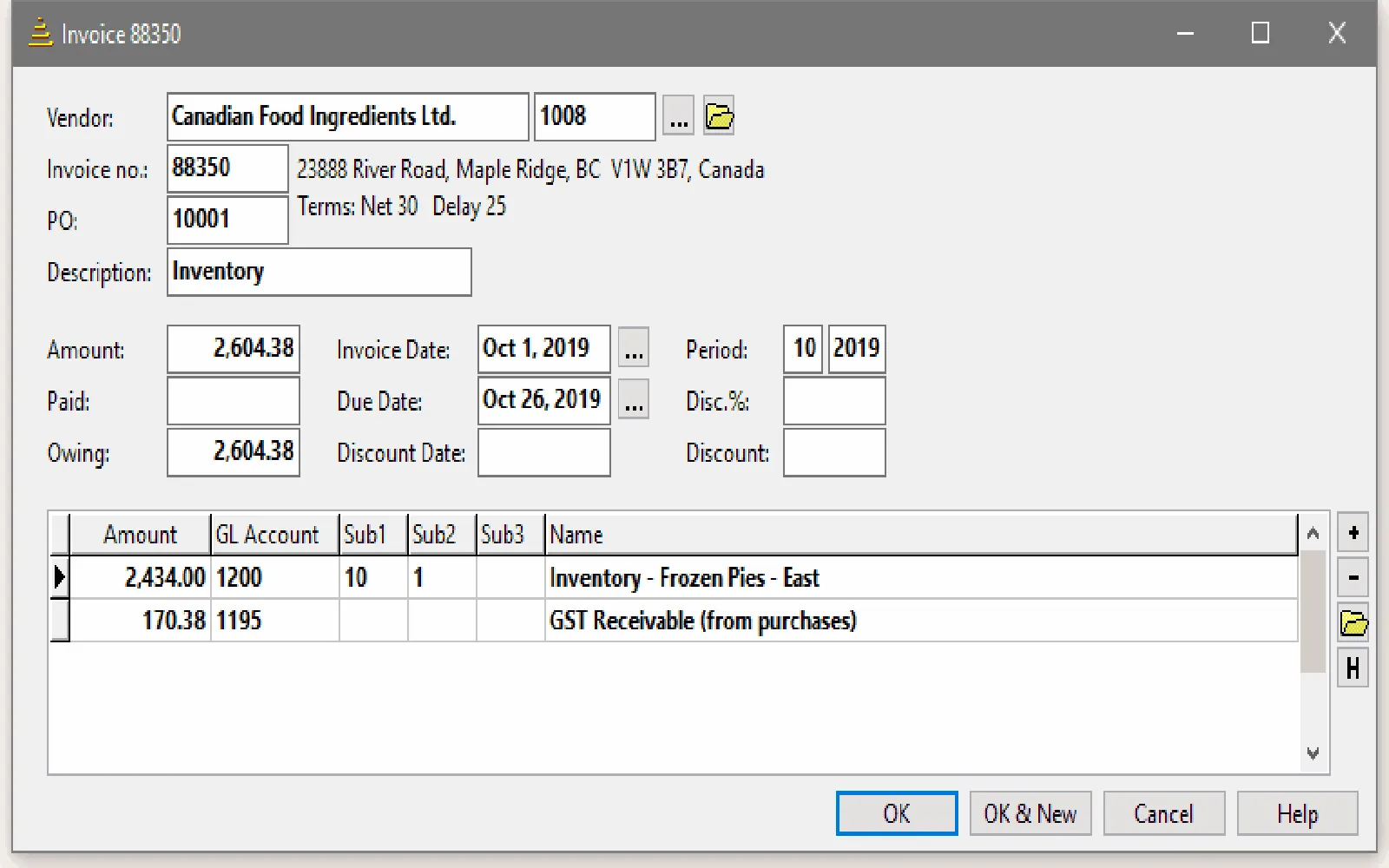

- Integration with Financial Tools: Seamless integration with accounting software can simplify bookkeeping and financial management.

- Interest Rates: Some business checking accounts offer interest on balances, providing an opportunity for money to work harder.

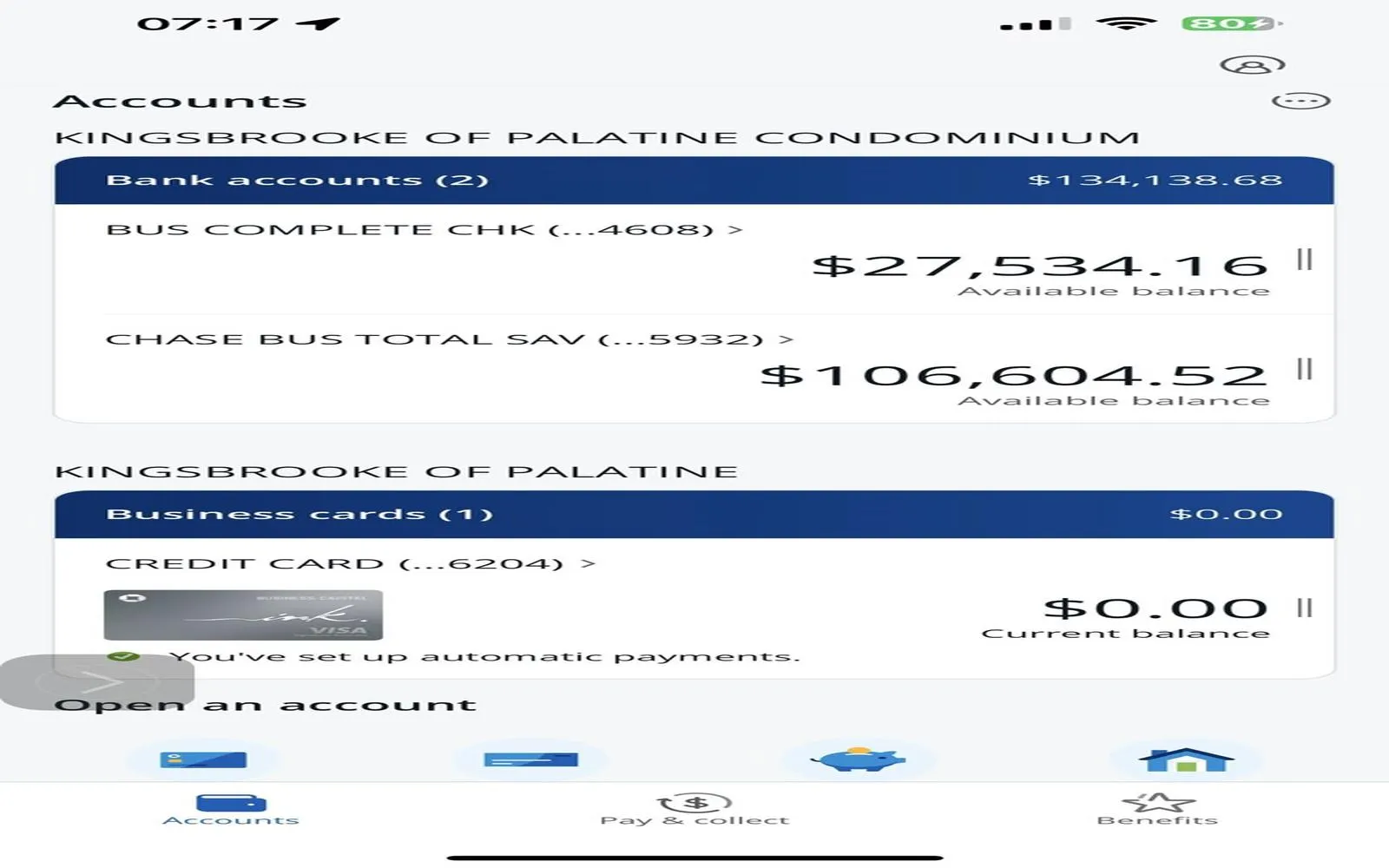

- Mobile Banking Features: In 2025, mobile banking capabilities, including remote check deposits and real-time alerts, are essential.

Top Business Checking Accounts of 2025

Here are some of the top business checking accounts in 2025, each offering unique features that cater to different business needs:

1. BlueVine Business Checking

BlueVine has emerged as a frontrunner for small businesses seeking a hassle-free banking experience. With no monthly fees and no minimum balance requirement, it allows companies to focus on growth rather than banking costs. Notably, BlueVine offers an interest rate of up to 2.0% on balances, making it an attractive option for businesses that want to earn on their cash.

2. Novo Business Checking

For entrepreneurs and freelancers, Novo provides an intuitive mobile banking experience. With no monthly fees and unlimited transactions, it’s perfect for businesses that require flexibility. Novo integrates seamlessly with various financial tools, including accounting and invoicing software, which enhances productivity.

3. Chase Business Complete Banking

Chase remains a trusted name in business banking. The Business Complete Banking account comes with a host of features, including access to thousands of ATMs and branches nationwide. With a monthly fee that can be waived by meeting specific criteria, it’s a solid choice for businesses looking for a comprehensive banking solution.

4. Wells Fargo Business Choice Checking

Wells Fargo offers the Business Choice Checking account, which is tailored for small to medium-sized enterprises. This account features a tiered interest rate structure, allowing businesses to earn more as their balance grows. It also offers extensive banking services, including merchant services and business credit cards, making it a one-stop shop for financial needs.

5. Axos Bank Business Checking

Axos Bank is known for its online-only banking services. The Business Checking account offers unlimited transactions with no monthly fees. Its online platform is robust, providing excellent tools for managing cash flow and making deposits. Additionally, Axos Bank offers a competitive interest rate on balances, making it a smart choice for tech-savvy businesses.

6. TIAA Bank Business Checking

TIAA Bank's Business Checking account features a strong interest rate on balances, making it suitable for businesses that want to earn while they bank. With no monthly fees and no transaction limits, it caters to businesses of all sizes. The bank's commitment to customer service and innovative tools for managing finances puts it on the list of top accounts for 2025.

7. Capital One Spark Business Checking

The Capital One Spark Business Checking account is perfect for businesses that frequently make cash deposits. With no monthly fees and unlimited transactions, it provides flexibility that many companies need. Capital One also offers a rewards program that can benefit businesses looking to maximize their expenses.

8. U.S. Bank Silver Business Checking

U.S. Bank offers the Silver Business Checking account, which is ideal for small businesses just starting. It has a low monthly fee, which can be waived, and allows for a limited number of transactions each month. The account is well-integrated with U.S. Bank’s suite of business services, making it a convenient option for new entrepreneurs.

The Role of Technology in Business Banking

As we move further into 2025, technology continues to reshape the banking landscape. Many of the accounts listed above leverage technology to enhance user experience and streamline financial management. Features such as mobile check deposit, budgeting tools, and real-time transaction alerts are now standard, enabling businesses to operate more efficiently.

Maximizing Financial Efficiency

To truly maximize your financial efficiency with a business checking account, consider the following strategies:

- Regularly Monitor Your Account: Keep an eye on your transactions and balances to ensure you are not incurring unnecessary fees.

- Utilize Online Tools: Take advantage of online banking tools offered by your institution for budgeting, invoicing, and expense tracking.

- Consider a High-Interest Account: If your business maintains a significant balance, opt for an account that offers interest to make your money work for you.

- Stay Informed on New Features: Financial institutions frequently update their offerings. Staying informed can help you capitalize on new tools and features that can benefit your business.

Conclusion

Choosing the right business checking account in 2025 is crucial for maximizing your financial efficiency. With a range of options available, it’s important to evaluate your specific business needs and select an account that offers the best features for you. From no monthly fees to high-interest rates, the right account can not only save you money but also enhance your overall financial management. As the business banking landscape continues to evolve, staying informed will empower you to make the best financial decisions for your business.

Future Considerations

As we continue to navigate the complexities of business finance in the coming years, it's essential to keep an eye on emerging trends and innovations in the banking sector. The rise of fintech, changes in regulations, and evolving customer expectations will all shape the future of business checking accounts. By staying proactive and adaptable, businesses can ensure they are well-positioned to leverage the best financial tools available.

Final Thoughts

In conclusion, selecting the right business checking account in 2025 is more than just a financial decision; it's a strategic move that can propel your business forward. Evaluate your priorities, explore the various options available, and make an informed choice that aligns with your business goals. With the right account in hand, you can enhance your financial efficiency and focus on what truly matters—growing your business.

Explore

Free Business Checking Accounts: A Smart Choice for Small Businesses

Top Cloud Storage Solutions for Businesses in 2025: Maximize Efficiency and Security

Top Small Business Credit Cards for Rewards in 2025: Maximize Your Earnings!

Tax-Advantaged Accounts: How They Can Boost Your Savings 2025

Streamline Your Finances: The Ultimate Guide to Accounts Payable Software

Top Trends in Bank Accounts for 2025: What You Need to Know

Tax-Efficient Investing 2025: Maximize Your Returns and Minimize Taxes

Maximize Your Savings in 2025: The Ultimate Guide to Amazon Credit Cards