Top Trends in Bank Accounts for 2025: What You Need to Know

As we approach 2025, the banking landscape is poised for significant transformation, driven by technological advancements and evolving consumer preferences. Key trends are emerging that will redefine how individuals manage their finances, from the rise of digital-only banks to the integration of artificial intelligence in personal finance management. Enhanced security features, such as biometric authentication and blockchain technology, are becoming standard, while sustainable banking practices are gaining traction among eco-conscious consumers. This article explores the top bank account trends for 2025, providing insights into what you need to know to stay ahead in an increasingly competitive financial ecosystem.

Introduction

As we approach 2025, the banking landscape is experiencing transformative changes driven by technology, consumer behavior, and regulatory shifts. Understanding these trends will be essential for consumers and financial institutions alike. This article explores the top trends in bank accounts for 2025 and what you need to know to make informed decisions regarding your banking needs.

1. Digital-First Banking

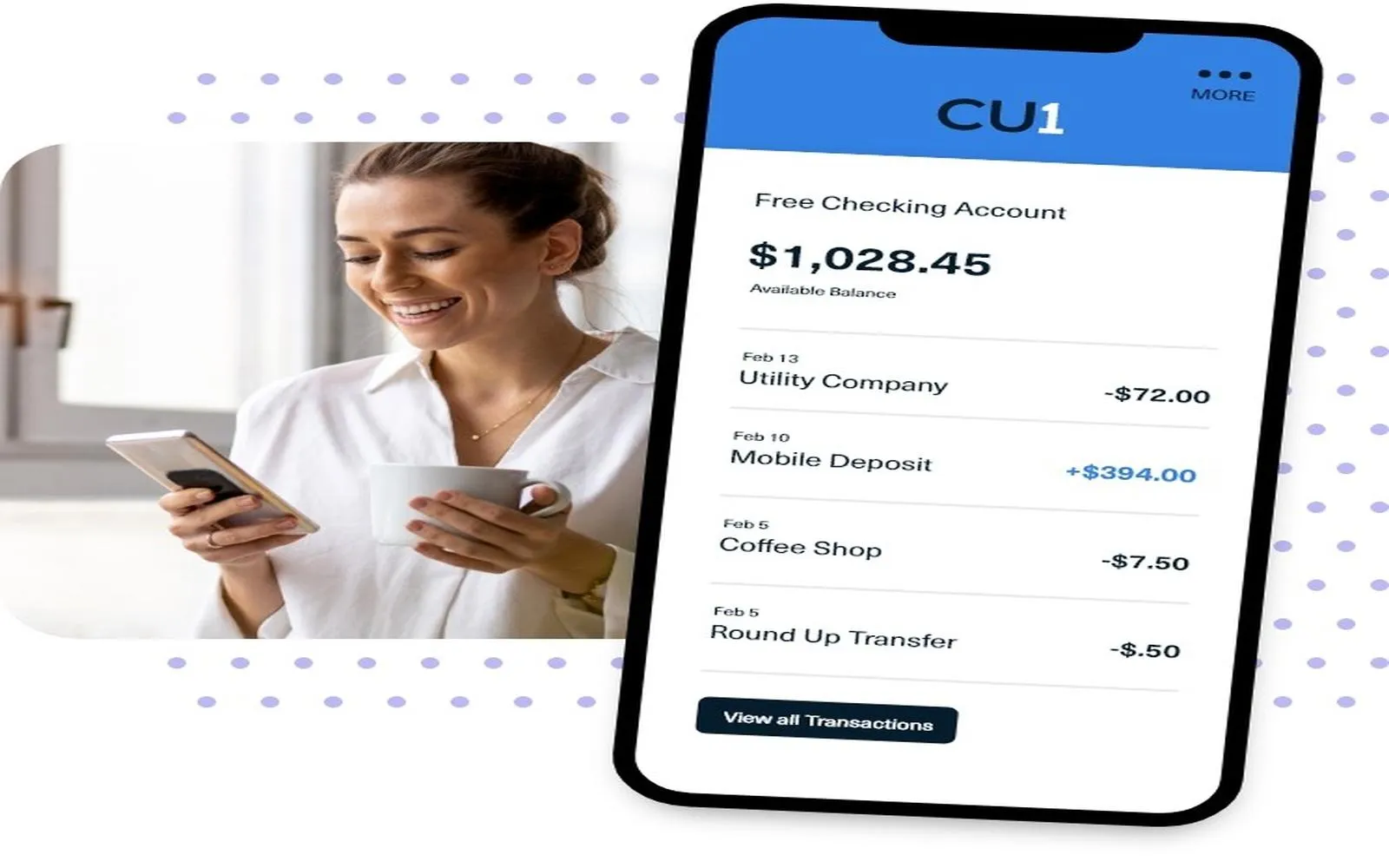

In 2025, digital banking will be the norm rather than the exception. Traditional banks are increasingly investing in their online platforms to offer seamless, user-friendly experiences. With mobile apps becoming the primary point of interaction, customers expect features such as instant account access, real-time transaction notifications, and easy fund transfers. This shift means consumers will need to be comfortable managing their finances through digital interfaces, while banks must focus on enhancing their cybersecurity measures to protect sensitive information.

2. Open Banking and APIs

Open banking, which allows third-party providers to access banking data through APIs (Application Programming Interfaces), is set to revolutionize the financial services landscape by 2025. This trend promotes competition and innovation, enabling consumers to access a wider range of financial products and services tailored to their needs. As a result, banks will need to consider partnerships with fintech companies and other financial institutions to enhance their offerings and create a more robust ecosystem for customers.

3. Personalized Banking Experiences

With the rise of big data and artificial intelligence, personalized banking experiences will become increasingly common in 2025. Financial institutions will leverage consumer data to provide tailored recommendations, promotions, and financial advice. This can include customized savings plans, investment opportunities, and budgeting tools that align with individual customer goals. As personalization becomes a standard expectation, consumers will demand banking services that cater to their unique financial situations.

4. Sustainable Banking

As environmental concerns continue to grow, sustainable banking will gain traction in 2025. More consumers are seeking out financial institutions that prioritize sustainability and socially responsible practices. This includes banks that offer green investment options, support renewable energy projects, and have transparent policies regarding their environmental impact. Consumers will increasingly favor banks that align with their values, prompting a shift toward more sustainable banking practices across the industry.

5. Enhanced Security Features

With the rise of digital banking comes the increased risk of cyber threats. By 2025, banks will need to implement advanced security measures to protect customer data and maintain trust. Biometric authentication methods, such as fingerprint scanning and facial recognition, will become more prevalent. Additionally, banks will invest in AI-driven fraud detection systems that monitor transactions in real-time, alerting customers to any suspicious activity. As a consumer, being aware of these security features will be vital in choosing a bank that prioritizes your safety.

6. Cryptocurrency Integration

The acceptance of cryptocurrencies is expected to expand by 2025, with more banks offering services related to digital currencies. This may include the ability to hold, trade, and transact with cryptocurrencies directly within bank accounts. As governments regulate the cryptocurrency market, traditional banks will need to adapt and provide secure and compliant solutions for customers interested in digital assets. Understanding how cryptocurrency can fit into your financial portfolio will be crucial as these offerings become more mainstream.

7. Instant Payments and Real-Time Transfers

Consumers increasingly demand instant access to their funds and the ability to transfer money in real-time. By 2025, banks will focus on enhancing their payment systems to facilitate immediate transactions. This trend encompasses peer-to-peer payment platforms, instant wire transfers, and mobile payment solutions. As a customer, being aware of the speed and convenience of payment options will be essential for managing your finances effectively.

8. Automation and AI in Banking

Automation and artificial intelligence will play a significant role in banking operations by 2025. From customer service chatbots to automated account management, AI will streamline processes and enhance customer interactions. Banks will employ these technologies to provide quicker responses to customer inquiries, optimize loan approvals, and personalize recommendations based on spending habits. Embracing these advancements will allow consumers to enjoy more efficient banking experiences.

9. Focus on Financial Wellness

In 2025, banks will increasingly prioritize financial wellness as part of their customer service offerings. This trend includes providing educational resources, budgeting tools, and financial planning services to help customers make informed decisions about their finances. Banks may partner with financial advisors or develop in-house resources to guide customers in achieving their financial goals. As a consumer, taking advantage of these resources can lead to better financial literacy and improved money management skills.

10. Shift Toward Neobanks

Neobanks, or digital-only banks, are becoming more popular as consumers seek low-cost, convenient banking solutions. By 2025, these institutions will likely continue to grow, offering features such as no-fee accounts, higher interest rates on deposits, and user-friendly interfaces. Neobanks often cater to younger consumers who prioritize technology and flexibility in their banking choices. As the market evolves, traditional banks will need to adapt to compete with these agile newcomers.

11. Subscription-Based Banking Models

Subscription-based banking models are emerging as a trend in 2025, allowing consumers to pay a monthly fee for a suite of financial services. This model can provide users with benefits such as higher interest rates, lower fees, and exclusive access to financial products. As consumers look for more value from their banking relationships, banks that offer subscription services may find a competitive edge in attracting and retaining customers.

12. Regulatory Changes and Compliance

The banking industry is subject to continuous regulatory changes, and by 2025, compliance will be more critical than ever. Financial institutions will need to adapt to new regulations concerning data privacy, anti-money laundering, and consumer protection. Staying informed about these changes will be essential for consumers to understand their rights and ensure their financial institutions comply with relevant laws.

13. Multichannel Banking Solutions

As consumers increasingly crave flexibility, multichannel banking solutions will become essential by 2025. This approach allows customers to interact with their banks through various channels, including mobile apps, websites, ATMs, and in-person branches. Ensuring a seamless experience across these channels will be vital for banks aiming to meet diverse customer preferences. Consumers should look for banks that offer consistent service and accessibility across all platforms.

14. Financial Inclusion Initiatives

Financial inclusion will be a prominent trend in 2025, with banks focusing on reaching underserved populations. This includes offering low-cost banking options, mobile banking solutions, and educational resources to help individuals who may have limited access to traditional banking services. As consumers, supporting banks that prioritize financial inclusion can contribute to broader economic growth and development in underserved communities.

15. The Rise of Robo-Advisors

Robo-advisors, automated platforms that provide investment advice based on algorithms, will become increasingly popular by 2025. These services offer low-cost investment management and financial planning solutions, making them accessible to a broader range of consumers. As more individuals seek to grow their wealth, understanding the benefits and limitations of robo-advisors will be crucial for informed investment decisions.

Conclusion

The banking landscape in 2025 will be shaped by technological advancements, changing consumer expectations, and a focus on sustainability and inclusivity. As a consumer, staying informed about these trends will empower you to make better choices regarding your banking needs. By embracing digital banking, seeking personalized experiences, and understanding the evolving regulatory environment, you can navigate the future of banking with confidence.

Explore

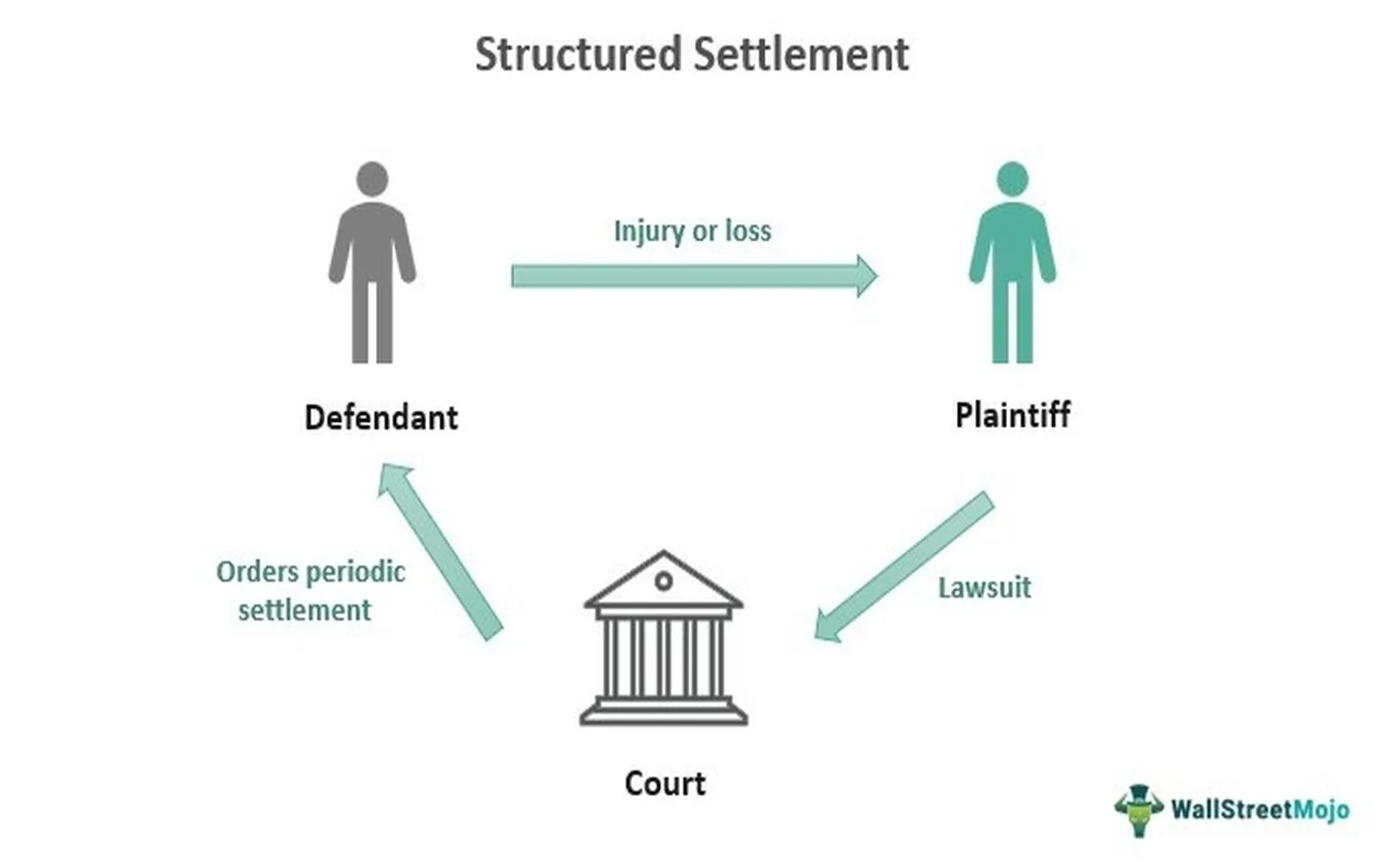

Selling a Structured Settlement Annuity: What You Need to Know

Exploring an Online Business Analytics Degree: What You Need to Know

2025 Trends in Drainage Systems Every Homeowner Should Know

Affordable Home Renovation Services in 2025: Transform Your Space Without Breaking the Bank

Affordable Appliance Repair Services in 2025: Quality Solutions Without Breaking the Bank

Affordable Home Exterior Painting Services in 2025: Transform Your Space Without Breaking the Bank

Top Affordable Website Builder Software of 2025: Create Your Online Presence Without Breaking the Bank

How to Open a Business Bank Account Online for Free in the U.S.