How to Open a Business Bank Account Online for Free in the U.S.

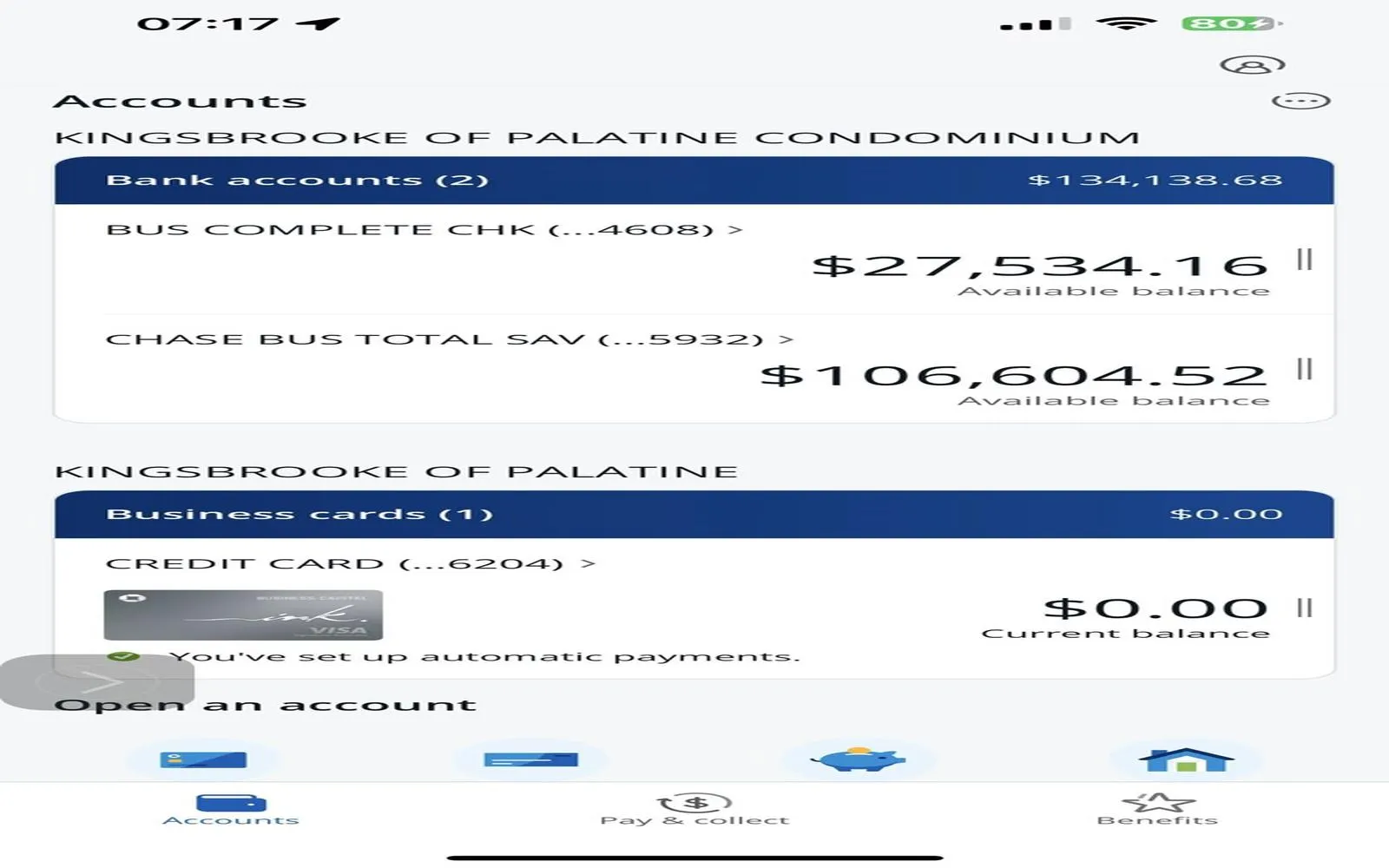

Opening a business bank account online for free is one of the first and most important steps when launching or managing a small business in the United States. It helps separate your personal and business finances, improves bookkeeping, and builds credibility with clients and vendors.

In 2025, many banks and fintech platforms make it easy to open a business checking account online without monthly fees or minimum balance requirements. Here's what you need to know.

💼 Why Your Business Needs Its Own Bank Account

No matter if you're a freelancer, LLC, or corporation, a dedicated business bank account offers key benefits:

- ✅ Separates personal and business finances

- ✅ Simplifies tax filing and accounting

- ✅ Enables direct deposit and client payments

- ✅ Improves business credibility

- ✅ Makes you eligible for business loans & credit

🏦 Top Platforms Offering Free Business Bank Accounts Online

Here are several reputable institutions where you can open a free online business checking account in the U.S.:

1. Bluevine

- Monthly Fee: $0

- Minimum Opening Deposit: $0

- Key Features: 2.0% APY on balances up to $250K, free ACH transfers, mobile app, debit card

- Best for: Small businesses that want to earn interest on deposits

2. Novo

- Monthly Fee: $0

- Opening Requirement: EIN or SSN + U.S. address

- Key Features: No hidden fees, integrations with Stripe, PayPal, QuickBooks

- Best for: Freelancers, eCommerce, and startups using online payment tools

3. Lili

- Monthly Fee: $0 (for standard account)

- Best Features: Tax tools, expense categorization, mobile-first design

- Best for: Solo entrepreneurs and freelancers

4. Mercury (for startups & tech companies)

- Monthly Fee: $0

- Key Features: FDIC-insured through partner banks, API access, virtual cards

- Best for: SaaS startups and tech-based LLCs or C-Corps

📄 What You Need to Open an Account Online

Opening a business bank account online typically takes 5–10 minutes. Here’s what you should prepare:

| Requirement | Applies to |

|---|---|

| Government ID (driver's license or passport) | All applicants |

| Social Security Number (SSN) or Employer Identification Number (EIN) | Sole props / LLCs / Corps |

| Business formation documents (e.g., Articles of Organization) | LLC, Corp |

| Business address (can be home-based) | All entities |

💡 Tip: If you're a sole proprietor, many platforms allow you to open an account with just your SSN and name registration.

🌐 How the Online Application Works

Most modern business banking providers offer a fully online application:

- Visit the provider’s website

- Click "Open Account" or "Get Started"

- Enter business name, address, and type

- Upload ID and formation documents

- Set up your login credentials

- Wait for approval (often instant or within 1–2 days)

Once approved, you can:

- Transfer funds via ACH or wire

- Receive client payments

- Order a business debit card

- Connect to accounting software

📱 Features to Look for in a Free Online Business Account

Not all “free” accounts are equal. Look for:

- No monthly maintenance fees

- No minimum balance requirements

- Free ACH and check deposits

- Mobile check deposit and app access

- Easy integrations (Stripe, QuickBooks, PayPal)

Optional but valuable features:

- Interest on balance

- Virtual debit cards

- Invoicing tools

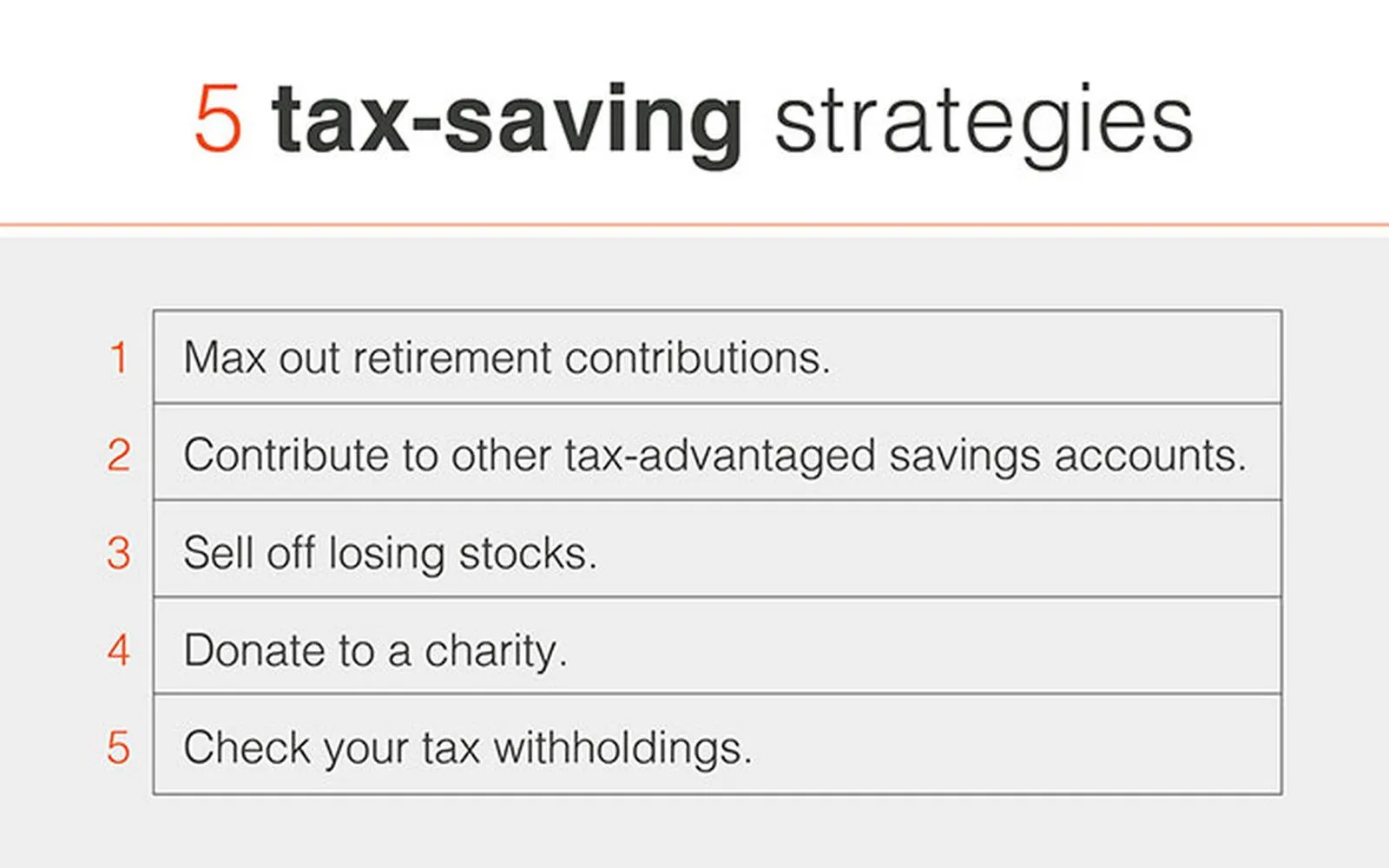

- Tax-saving features

✅ Final Thoughts

Opening a business bank account online for free is now easier and more accessible than ever. With no-fee options and fast approvals, entrepreneurs can manage finances professionally without stepping into a branch. Be sure to compare features, read the fine print, and select the account that matches your business model and growth plans.

Whether you're just starting your side hustle or scaling your LLC, the right bank account sets the foundation for sound financial management.

Explore

Free Business Checking Accounts: A Smart Choice for Small Businesses

Top Affordable Website Builder Software of 2025: Create Your Online Presence Without Breaking the Bank

Affordable Home Renovation Services in 2025: Transform Your Space Without Breaking the Bank

Affordable Appliance Repair Services in 2025: Quality Solutions Without Breaking the Bank

Affordable Home Exterior Painting Services in 2025: Transform Your Space Without Breaking the Bank

Top Trends in Bank Accounts for 2025: What You Need to Know

Top Furniture Assembly Services of 2025: Your Guide to Stress-Free Setup

10 Smart Tax-Free Savings Tips Every American Needs in 2025