Free Business Checking Accounts: A Smart Choice for Small Businesses

Running a business comes with many expenses, and managing your finances effectively is crucial to your success. One of the essential tools every business needs is a checking account. For small business owners, a free business checking account can be an excellent way to minimize banking costs while still having access to the necessary features to manage your business finances effectively.

What is a Free Business Checking Account?

A free business checking account is a type of business bank account that does not charge a monthly maintenance fee. These accounts typically offer basic services such as check writing, electronic transfers, and debit card access without the usual fees associated with traditional business accounts. While there may still be other fees, such as for wire transfers or overdrafts, the absence of monthly maintenance fees makes these accounts especially attractive to small business owners.

Key Features of Free Business Checking Accounts

1. No Monthly Maintenance Fees

The most obvious benefit of a free business checking account is the lack of monthly fees. Traditional business accounts can charge anywhere from $10 to $30 per month, depending on the bank and account type. By choosing a free account, you avoid these recurring fees and save money, which can be put to better use in growing your business.

2. Basic Banking Features

Free business checking accounts often come with the essential features required for day-to-day business operations:

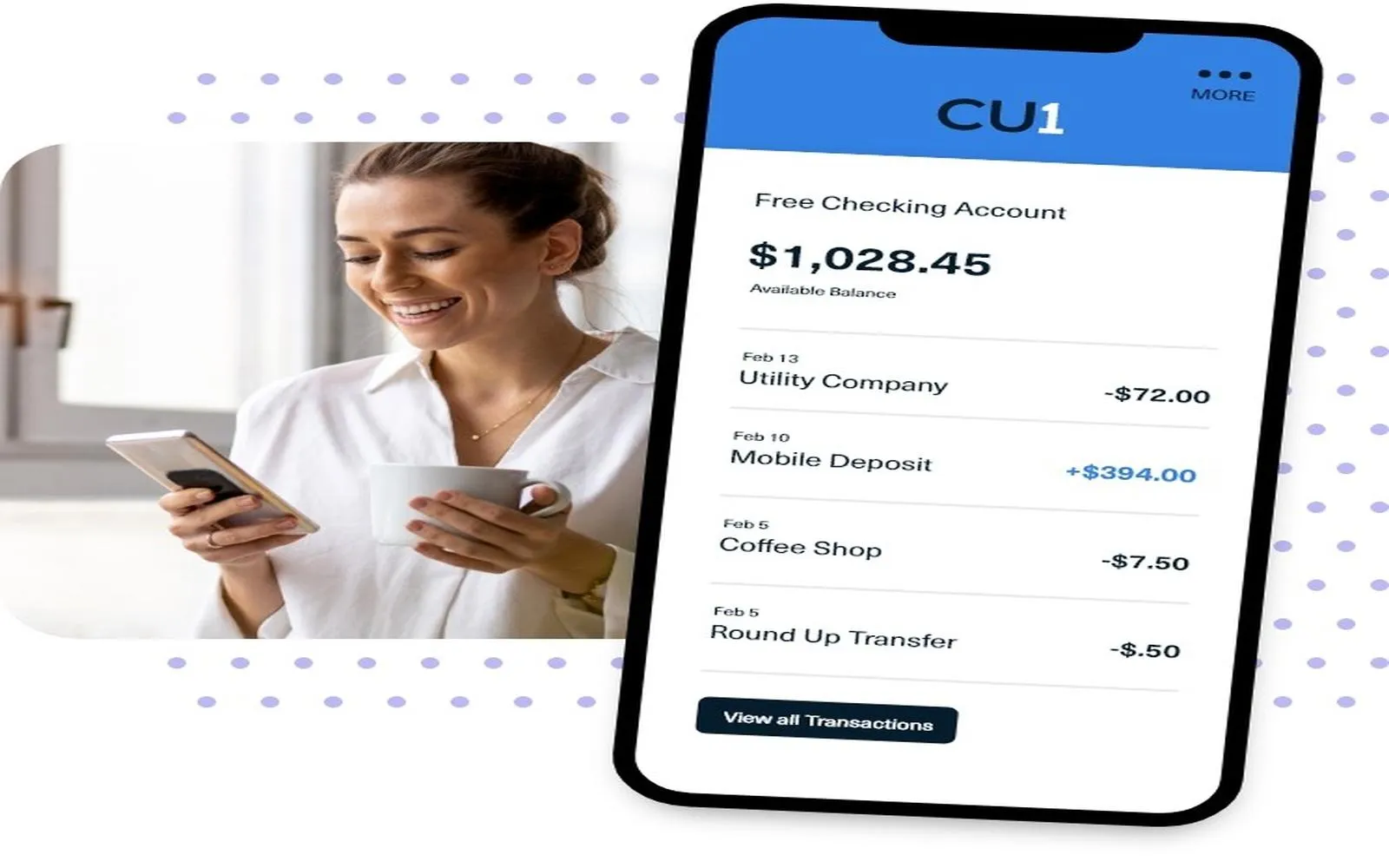

- Debit card access: Use your card for business purchases, ATM withdrawals, and payments.

- Check writing: Write checks for suppliers, employees, and other business-related expenses.

- Online and mobile banking: Access your account, view transactions, and make transfers from anywhere at any time.

- Direct deposit: Accept payments directly from clients and deposit wages to employees efficiently.

3. Free Transactions

Many free business checking accounts include a certain number of monthly transactions, such as debit card purchases, deposits, and transfers, at no charge. This allows you to manage daily business finances without incurring extra fees for every transaction.

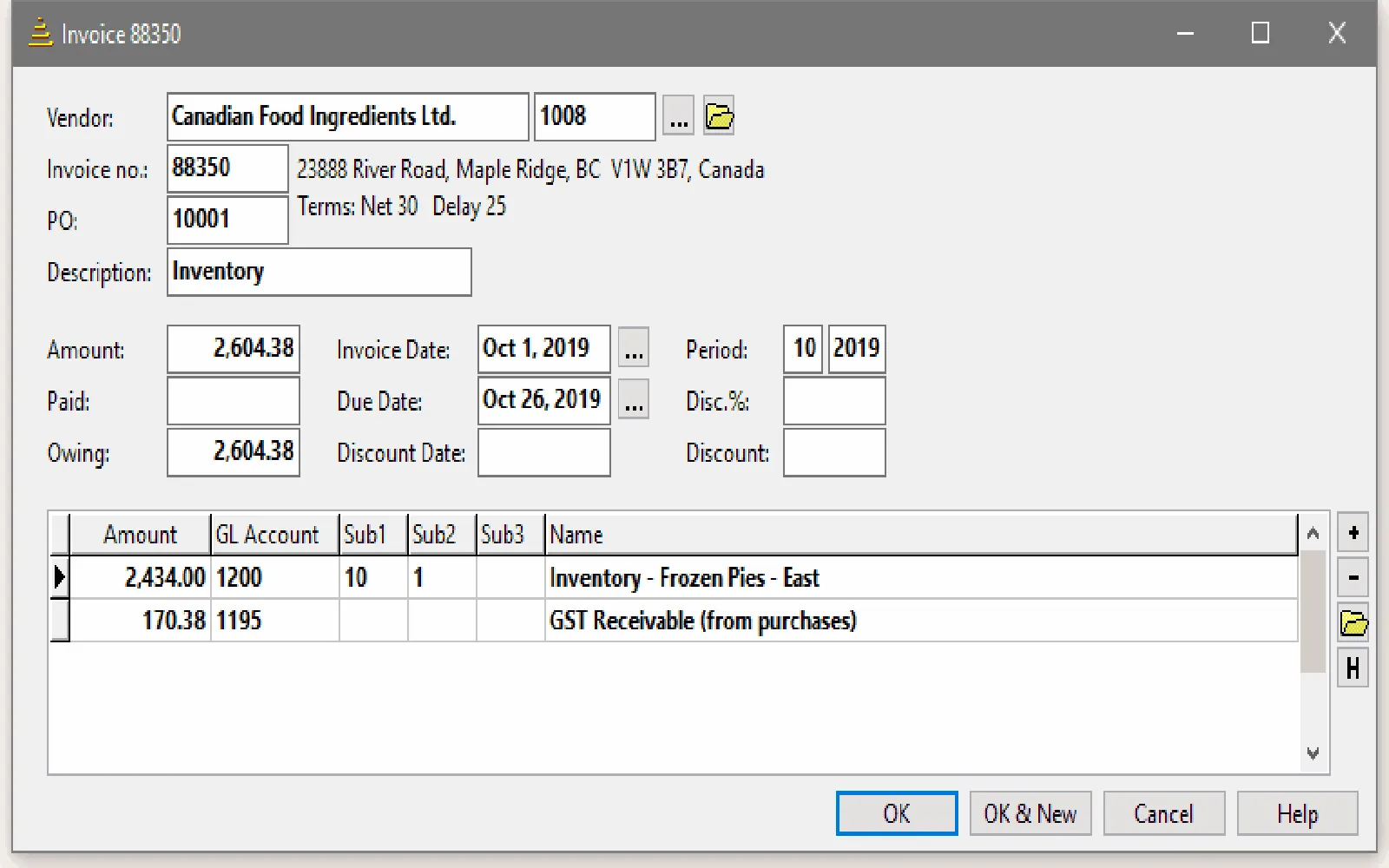

4. Banking Tools and Integrations

Some banks offer additional tools and integrations with accounting software like QuickBooks or Xero. This can save you time when tracking your business finances and making tax-related calculations.

5. Access to ATMs

While some free business checking accounts may charge fees for using out-of-network ATMs, many provide access to a large network of ATMs for free. This can help you avoid unnecessary charges when withdrawing cash for business needs.

Requirements for Opening a Free Business Checking Account

While free business checking accounts do not charge a monthly maintenance fee, they may still have certain requirements:

- Minimum deposit: Some accounts may require an initial deposit to open the account, though this is often quite low.

- Minimum balance: Certain accounts may have a minimum balance requirement to avoid fees or qualify for free services. Be sure to review the terms of the account to ensure you meet these requirements.

- Transaction limits: Some accounts may limit the number of free transactions you can make each month, with fees applied to any additional transactions.

Make sure to check these terms when selecting a free business checking account to avoid unexpected costs.

Benefits of a Free Business Checking Account

1. Cost Savings

The primary benefit is, of course, the lack of monthly fees. Small businesses, especially those just starting out, can benefit from reducing operating costs. Every dollar saved on banking fees is money you can reinvest in your business.

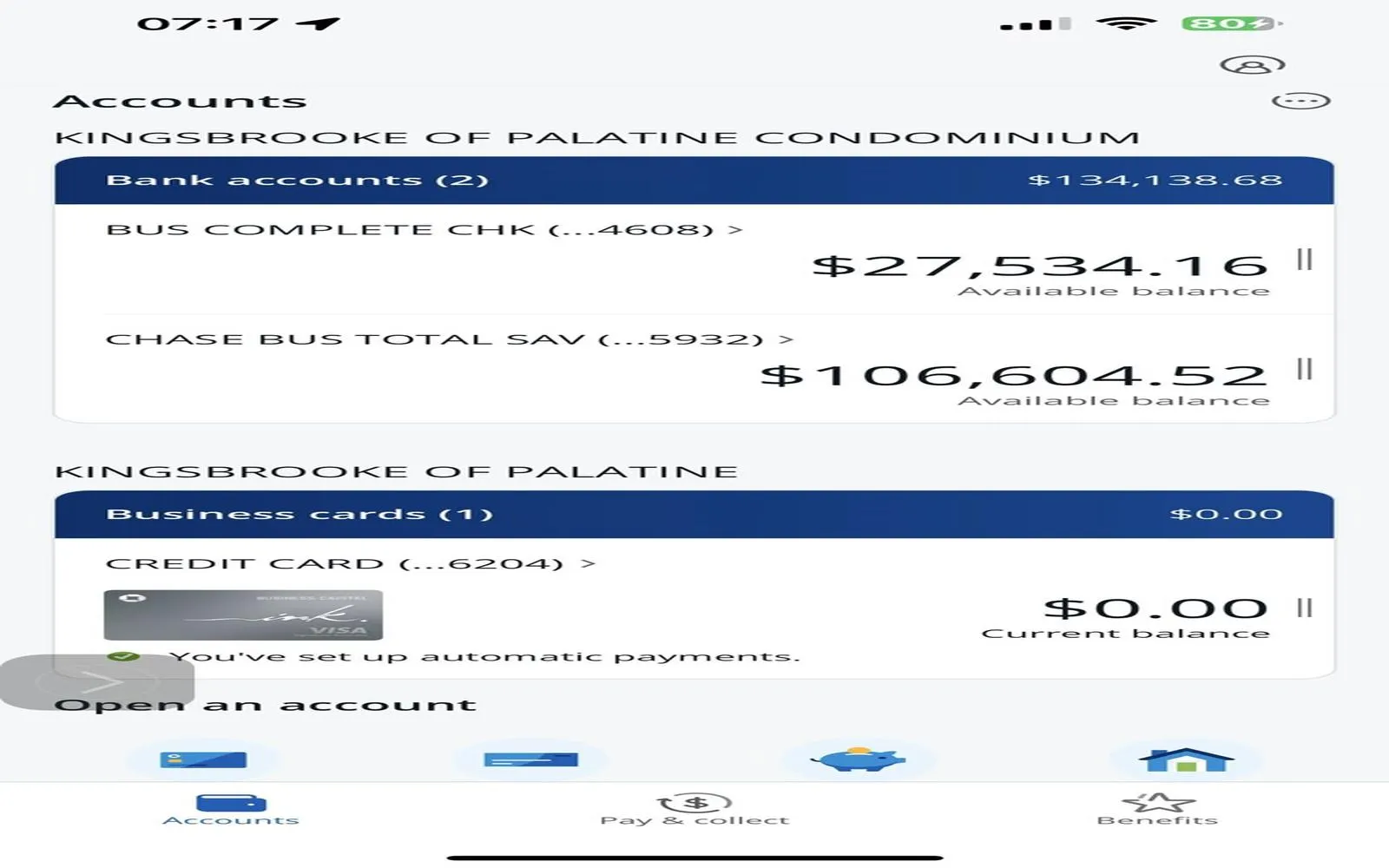

2. Improved Financial Organization

A separate business account is vital for keeping your personal and business finances distinct. This helps with accurate accounting, makes tax filing easier, and provides a clear record of your business’s financial activity.

3. Better Cash Flow Management

With free business checking accounts, you can more easily monitor and control your business’s cash flow. Having access to digital banking features allows you to keep track of incoming and outgoing transactions, helping you stay on top of your finances.

4. Access to Banking Services

Even with a free account, many banks offer access to various financial services, including loans, credit lines, and merchant services, which can be beneficial as your business grows.

Drawbacks to Consider

While free business checking accounts are an excellent choice for many small business owners, there are a few potential drawbacks to keep in mind:

- Limited features: Some free accounts may lack advanced features such as wire transfers or extensive cash deposit capabilities. If your business deals with a high volume of these transactions, you may need to upgrade to a paid account.

- Transaction limits: Free accounts may have a limited number of transactions per month. If your business has frequent deposits or purchases, you might incur fees for exceeding the limit.

How to Choose the Right Free Business Checking Account

When choosing a free business checking account, consider the following factors:

- Your business size and transaction volume: If you have a small business with minimal transaction activity, a free account is likely sufficient. However, if your business requires frequent cash deposits or wire transfers, you may need to look at accounts with more robust features.

- Additional services: Make sure the bank offers other services that may benefit your business, such as loans, credit cards, or merchant services.

- Banking tools: Check if the bank offers integrations with accounting software or other financial tools to help you manage your business finances.

Conclusion

A free business checking account can be an excellent option for small business owners who want to avoid unnecessary fees while still having access to essential banking services. It’s a straightforward way to manage your finances and keep your business running smoothly without incurring extra costs. However, it’s important to review the features and terms of each account to ensure it meets your specific needs. By selecting the right free business checking account, you can save money and focus on growing your business with confidence.

Explore

Top Business Checking Accounts in 2025: Maximize Your Financial Efficiency

10 Smart Tax-Free Savings Tips Every American Needs in 2025

How to Open a Business Bank Account Online for Free in the U.S.

Tax-Advantaged Accounts: How They Can Boost Your Savings 2025

Top Trends in Bank Accounts for 2025: What You Need to Know

Streamline Your Finances: The Ultimate Guide to Accounts Payable Software

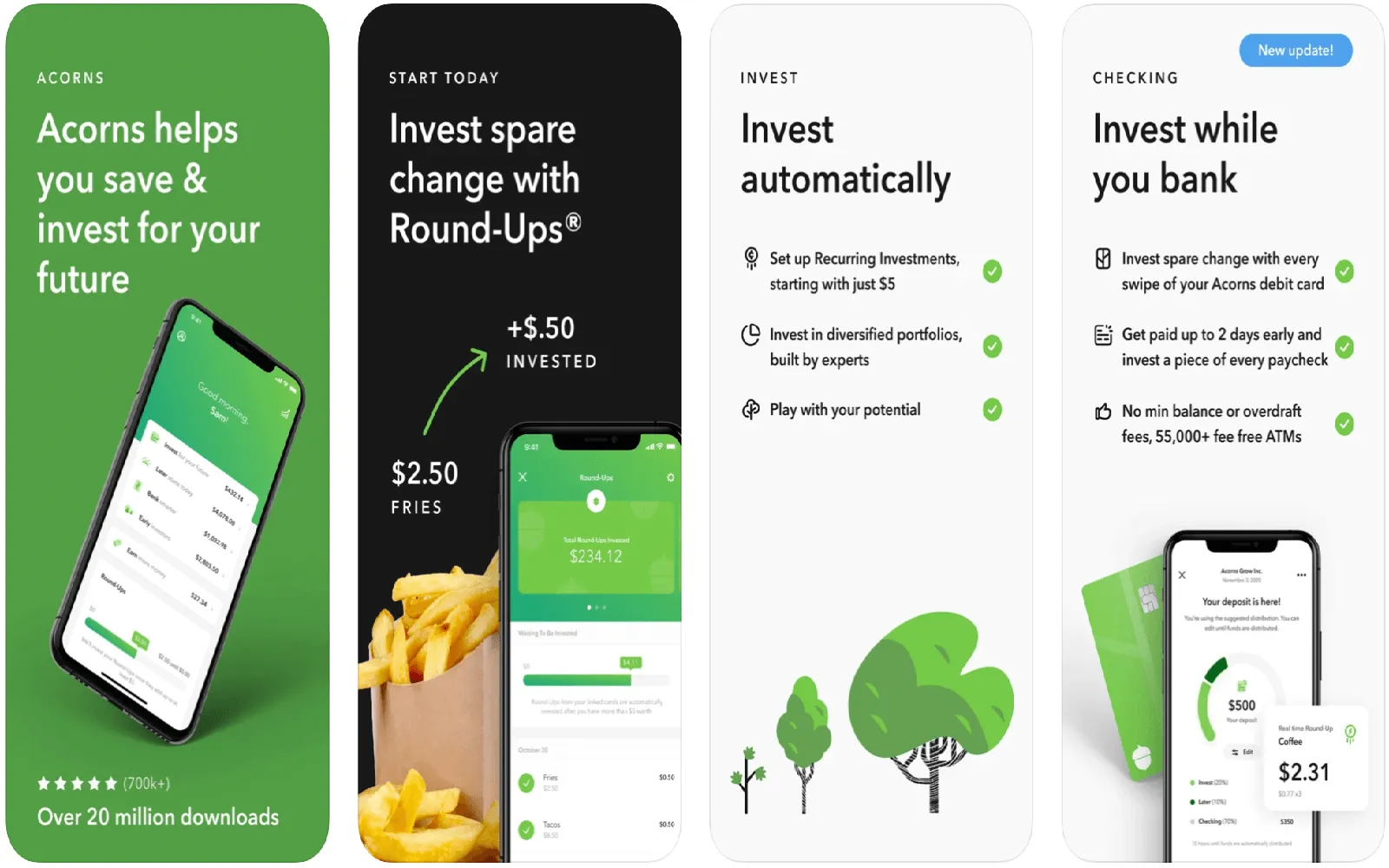

Top Investment Apps for Beginners in 2025: Your Guide to Smart Investing

Smart Investing in 2025: How to Start with Little Money and Grow Your Wealth