Top Investment Apps for Beginners in 2025: Your Guide to Smart Investing

Introduction

As we step into 2025, the world of investing continues to evolve, with technology playing a pivotal role in making investment opportunities more accessible than ever. For beginners, navigating the investment landscape can be overwhelming, but the rise of investment apps has simplified the process. These applications not only provide a user-friendly interface but also offer educational resources, diverse investment options, and tools for managing portfolios. In this guide, we'll explore the top investment apps for beginners in 2025, helping you make informed decisions and embark on your investing journey with confidence.

1. Robinhood

Robinhood remains a popular choice among beginner investors in 2025 due to its intuitive design and commission-free trading. The app allows users to trade stocks, ETFs, options, and cryptocurrencies without paying any commission fees. Its user-friendly interface is perfect for beginners who are just starting to learn about investing.

In addition to its trading features, Robinhood has expanded its offerings to include educational resources and articles that help users understand market trends, investment strategies, and financial literacy. The app also provides a feature called “Robinhood Snacks,” which delivers daily market updates in a concise and engaging format, making it easier for beginners to stay informed.

2. Acorns

Acorns is an innovative investment app that focuses on the concept of micro-investing. It allows users to invest their spare change by rounding up purchases made with linked debit or credit cards. For example, if you buy a coffee for $3.50, Acorns will round up the transaction to $4.00 and invest the $0.50 difference into a diversified portfolio.

This unique approach makes investing accessible for beginners who may feel intimidated by traditional investing methods. Acorns also offers educational content through its “Grow” feature, which provides articles and tips to help users understand investing better. Additionally, the app provides personalized investment portfolios based on users' risk tolerance and financial goals, making it an excellent choice for new investors.

3. Stash

Stash is another investment app designed for beginners, offering a unique blend of educational resources and investment opportunities. Users can start investing with as little as $5, allowing them to build a portfolio gradually. Stash focuses on fractional shares, which means users can purchase a fraction of a share in well-known companies, making it easier to diversify their investments.

One of Stash’s standout features is its emphasis on financial education. The app provides users with personalized guidance, investment recommendations, and articles that help them understand various investment concepts. Additionally, Stash offers a banking feature, allowing users to manage their spending and savings in one place while investing simultaneously.

4. Fidelity Mobile App

Fidelity has long been a trusted name in the investment world, and its mobile app continues to cater to both beginner and experienced investors. The Fidelity Mobile App offers commission-free trading for stocks, ETFs, and options, making it an attractive option for new investors looking to minimize costs.

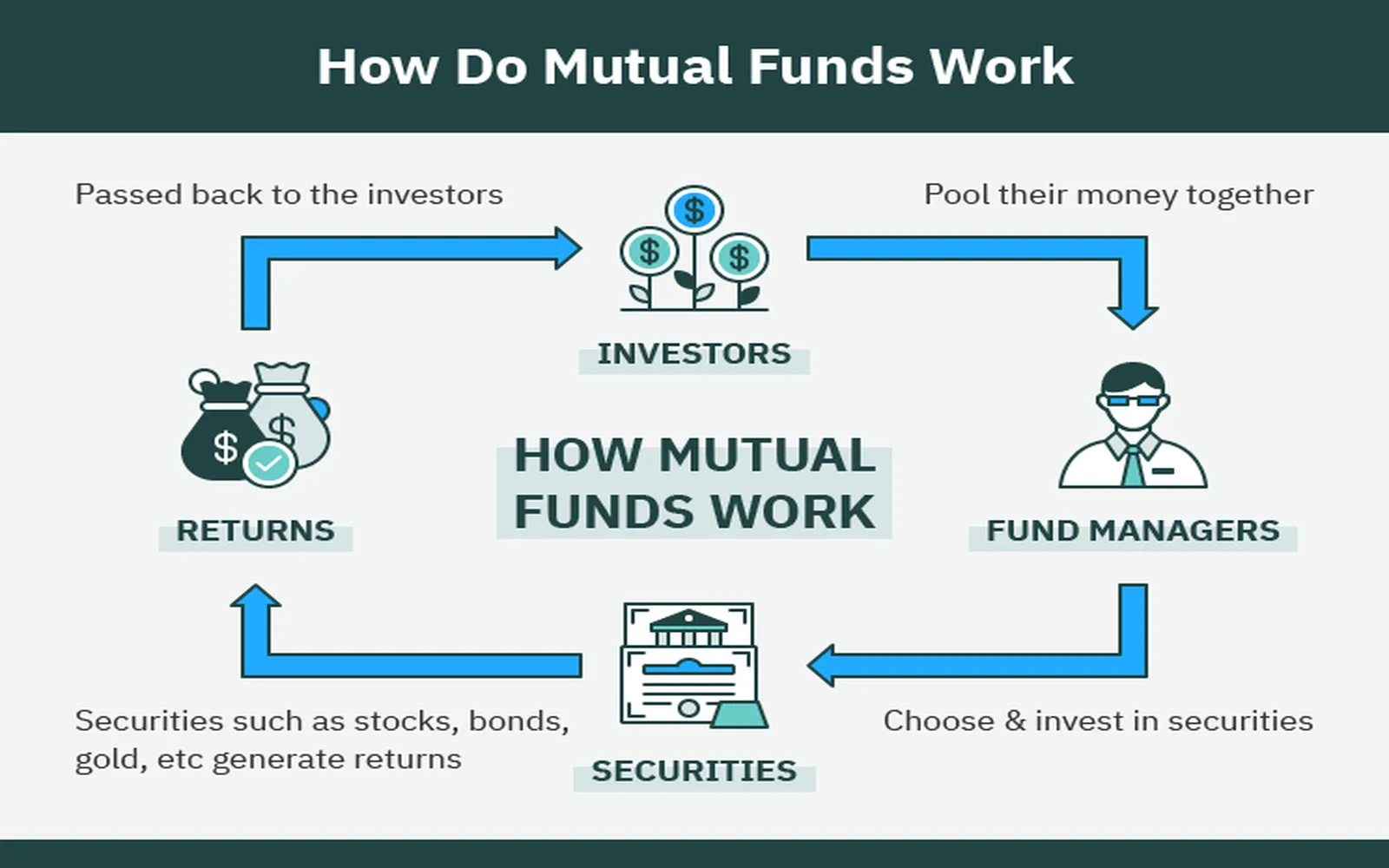

The app provides a plethora of research tools, market analysis, and educational resources to help beginners make informed decisions. Users can access real-time market data, customizable watchlists, and various investment options, including mutual funds and bonds. Fidelity’s commitment to education sets it apart, with resources that cater to different levels of investing knowledge.

5. M1 Finance

M1 Finance is a unique investment platform that combines investing with automation. It allows users to create a customized portfolio called a “pie,” which consists of different stocks and ETFs based on their preferences and risk tolerance. Beginners can choose from pre-built portfolios or create their own, making it easy to get started with investing.

One of the key features of M1 Finance is its automated rebalancing, which ensures that users’ portfolios remain aligned with their investment goals. Additionally, the app offers a no-commission trading model, allowing users to invest without worrying about fees. M1 Finance also provides educational resources and articles to help beginners enhance their investment knowledge.

6. SoFi Invest

SoFi Invest is another excellent investment app for beginners, offering a range of investment options, including stocks, ETFs, and cryptocurrencies. One of its standout features is the ability to start investing with as little as $1, making it accessible to a broad audience.

SoFi Invest also provides users with access to financial advisors, allowing beginners to receive personalized guidance and support. The app includes educational resources, articles, and webinars to help users understand various investment strategies and financial concepts. Moreover, SoFi offers additional financial services, such as loans and insurance, making it a comprehensive platform for managing finances.

7. Webull

Webull is a commission-free trading platform that has gained popularity among beginner investors. The app offers a wide range of investment options, including stocks, options, ETFs, and cryptocurrencies. Its advanced trading tools and real-time market data make it suitable for those looking to dive deeper into investing.

While Webull may have a steeper learning curve compared to some other apps, it provides a wealth of educational resources, including tutorials and market insights. The app also offers a paper trading feature, allowing beginners to practice trading without risking real money. This feature can be invaluable for those looking to build their confidence and skills before entering the market.

8. Cash App

Cash App, primarily known for its peer-to-peer payment services, has expanded its features to include investing options. Users can buy and sell stocks with no commission fees and even invest in Bitcoin. Cash App’s simplicity makes it a great choice for beginners who are already familiar with the app for their everyday transactions.

Cash App also allows users to invest in fractional shares, making it easier to diversify their portfolios with smaller amounts of money. While it may not offer as many educational resources as some other apps, its straightforward interface and ease of use make it a solid choice for beginners looking to dip their toes into investing.

9. Betterment

Betterment is a robo-advisor that simplifies the investment process for beginners by automating portfolio management. Users can set their financial goals, and Betterment will create a personalized investment portfolio that aligns with their risk tolerance and objectives. This hands-off approach is ideal for beginners who may not have the time or expertise to manage their investments actively.

Betterment offers features like automatic rebalancing and tax-loss harvesting, which can enhance overall investment performance. The app also provides educational resources and personalized advice, helping users understand their investments and make informed decisions. With low management fees and a user-friendly interface, Betterment is an excellent choice for beginners seeking a hassle-free investment experience.

10. Ally Invest

Ally Invest is part of Ally Financial, a well-known online bank. The investment app offers commission-free trading for stocks and ETFs, making it an appealing option for beginners. Ally Invest provides a range of investment options, including options trading and access to various research tools.

The app's user-friendly interface makes it easy for beginners to navigate, and it offers educational resources to help users learn about different investment strategies. Ally Invest also provides a feature called “Ally Invest Learn,” which includes articles and tutorials on various investing topics, making it easier for beginners to build their investment knowledge.

Conclusion

As we look ahead to 2025, the investment landscape is more accessible than ever thanks to the proliferation of investment apps. For beginners, choosing the right app can make a significant difference in their investing journey. Whether you're interested in micro-investing, automated portfolio management, or hands-on trading, there’s an app that suits your needs and preferences.

It's essential for new investors to take the time to educate themselves, understand their risk tolerance, and set clear financial goals. By leveraging the features and resources offered by these top investment apps, beginners can build a solid foundation for their investment journey and work toward achieving their financial goals with confidence.

Explore

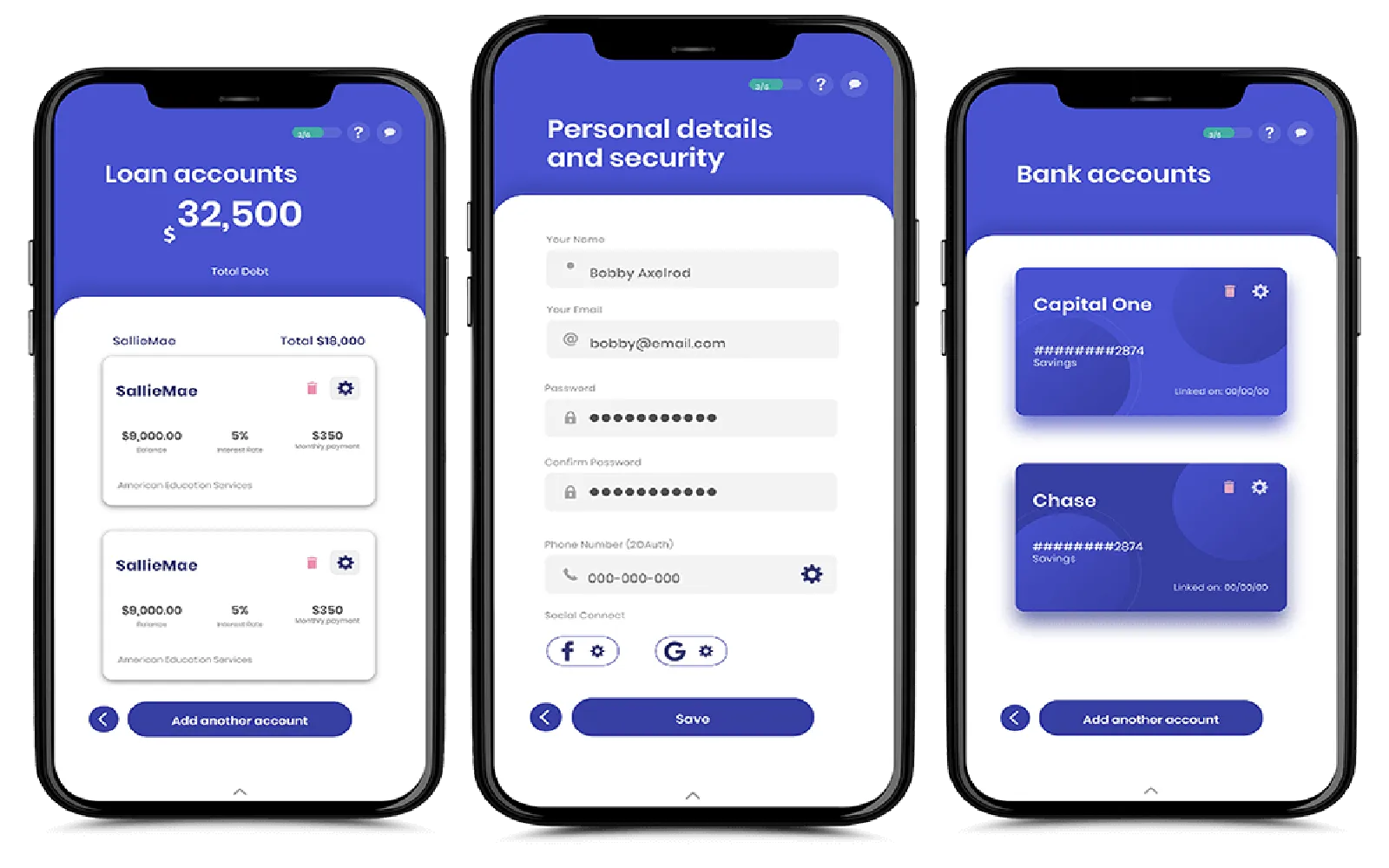

Mobile Investment Apps Changing the Game in 2025

Smart Investing in 2025: How to Start with Little Money and Grow Your Wealth

Your Ultimate Guide to Investing in Mutual Funds in 2025: Strategies for Success

A Complete Guide to Investing in ETFs in 2025

Tax-Efficient Investing 2025: Maximize Your Returns and Minimize Taxes

Top Fintech Apps of 2025: Manage Your Money Like a Pro

ESG Investing in 2025: Strategies for Sustainable Growth and Ethical Returns