Top Mutual Fund Trends to Watch in 2025: Maximize Your Investment Potential

As we approach 2025, the mutual fund landscape is evolving with tech advancements and changing investor preferences. ESG-focused funds are gaining traction, reflecting a shift toward responsible investing. AI and data analytics are also transforming fund management, enabling more personalized strategies. Understanding these trends is crucial for investors aiming to maximize potential and navigate the market effectively.

Introduction

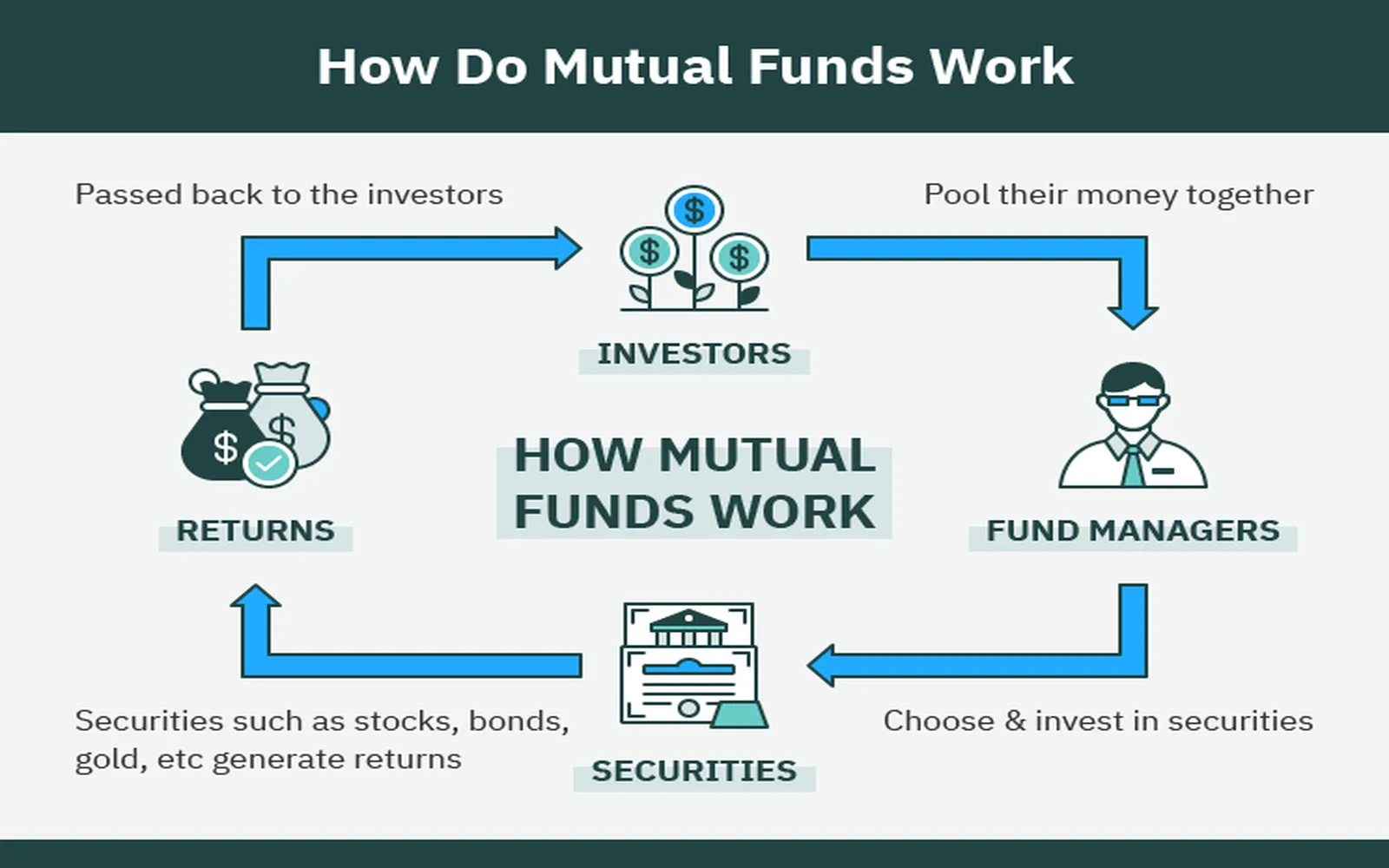

As we move into 2025, the landscape of mutual funds continues to evolve in response to changing market dynamics, investor preferences, and technological advancements. Understanding the trends that are shaping the mutual fund industry can help investors maximize their investment potential. This article explores the top mutual fund trends to watch in 2025, providing insights into how these trends can impact investment strategies and portfolio performance.

1. Rise of Sustainable Investing

One of the most significant trends in the investment world is the growing emphasis on sustainable and responsible investing. In 2025, we expect to see a continued surge in demand for mutual funds that prioritize Environmental, Social, and Governance (ESG) criteria. Investors are increasingly aware of the impact their investments can have on the world, leading to a preference for funds that align with their values.

Mutual fund companies are responding by offering a broader array of ESG-focused products. These funds not only seek competitive returns but also aim to promote positive social and environmental outcomes. As a result, investors looking to maximize their investment potential should consider integrating ESG funds into their portfolios.

2. Technological Innovations and Robo-Advisors

Technology is reshaping the way investors access mutual funds. Robo-advisors, which use algorithms to manage portfolios, are becoming increasingly popular among investors who prefer a hands-off approach. In 2025, we anticipate that the integration of artificial intelligence and machine learning will further enhance the capabilities of these platforms, allowing for more personalized investment strategies.

Investors can benefit from lower fees and increased accessibility to diversified portfolios through robo-advisors. As these platforms continue to evolve, they will play a crucial role in democratizing investment opportunities, making it easier for individuals to invest in mutual funds that align with their financial goals.

3. Increased Focus on Active Management

While passive investing has dominated the mutual fund landscape for several years, there is a renewed interest in active management strategies. In 2025, we expect to see a shift as investors seek to capitalize on market inefficiencies and take advantage of changing economic conditions. Active management allows fund managers to make real-time decisions based on market trends, economic indicators, and company performance, potentially leading to better returns.

Investors who are willing to pay slightly higher fees for active management may find opportunities for enhanced performance, particularly in volatile markets. As a result, a balanced approach that includes both passive and actively managed funds could be an effective strategy for maximizing investment potential.

4. Emphasis on Diversification

In an increasingly complex and interconnected global economy, diversification remains a critical strategy for mitigating risk. In 2025, mutual funds that offer diversified exposure across various asset classes, sectors, and geographies will be increasingly sought after. Investors are recognizing the importance of not putting all their eggs in one basket, especially in a climate characterized by geopolitical uncertainties and economic fluctuations.

Funds that provide access to international markets, alternative investments, and sector-specific opportunities may gain popularity. By diversifying their portfolios through mutual funds, investors can potentially enhance returns while reducing volatility, maximizing their overall investment potential.

5. Growth of Thematic Investing

Thematic investing is gaining traction as investors seek to capitalize on specific trends or themes, such as technology innovation, healthcare advancements, or renewable energy. In 2025, mutual funds that focus on these themes are expected to attract significant interest. Thematic funds allow investors to align their portfolios with their interests and beliefs while targeting sectors poised for growth.

However, investors should approach thematic investing with caution, as it can carry higher risks due to concentrated exposure. A well-researched approach that considers the long-term viability of the chosen theme can help investors maximize their investment potential while navigating the associated risks.

6. Fee Compression and Transparency

As competition in the mutual fund industry intensifies, fee compression is expected to continue in 2025. Investors are increasingly scrutinizing fees and seeking cost-effective investment options. This trend is leading to greater transparency regarding fee structures, allowing investors to make more informed decisions about where to allocate their capital.

Mutual fund companies that prioritize transparency and offer lower fees will likely gain a competitive advantage. Investors should carefully evaluate the total cost of ownership for mutual funds, including expense ratios and any additional fees, to ensure they are maximizing their investment potential.

7. Integration of Alternative Investments

Alternative investments, such as real estate, commodities, and private equity, are becoming more accessible through mutual funds. In 2025, we expect to see an increase in mutual funds that incorporate alternative assets into their portfolios, providing investors with diversification and potential inflation hedges.

Investors who are interested in exploring alternative investments should consider mutual funds that provide exposure to these assets. By integrating alternatives into their portfolios, investors can enhance their overall risk-return profile and potentially maximize their investment potential.

8. Regulatory Changes and Compliance

The mutual fund industry is subject to evolving regulations, and staying informed about compliance requirements is essential for investors. In 2025, we anticipate regulatory changes that may impact fund structures, disclosure requirements, and investor protections. Mutual fund companies will need to adapt to these changes to remain competitive and compliant.

Investors should pay attention to how regulatory shifts may affect their mutual fund investments. By staying informed, investors can make strategic decisions that align with their financial goals and risk tolerance, ultimately maximizing their investment potential.

9. Focus on Retirement Solutions

As demographic trends shift and more individuals approach retirement, there is a growing emphasis on mutual funds designed specifically for retirement savings. In 2025, we expect to see a proliferation of target-date funds and other retirement-focused mutual funds that cater to the unique needs of retirees.

These funds typically adjust their asset allocation over time, becoming more conservative as the target date approaches. Investors looking to maximize their retirement savings should consider incorporating these specialized mutual funds into their portfolios, ensuring they have a strategic approach to long-term wealth accumulation.

10. Enhanced Investor Education and Resources

In an era of information overload, investor education remains a crucial aspect of successful investing. In 2025, mutual fund companies will likely enhance their educational resources to help investors make informed decisions. This includes webinars, articles, and interactive tools that demystify complex investment concepts.

Investors who take advantage of these educational resources can better understand the mutual fund landscape and make more informed choices. By becoming more knowledgeable about mutual funds, investors can maximize their investment potential and align their portfolios with their financial objectives.

Conclusion

As we look ahead to 2025, the mutual fund landscape is poised for transformation driven by emerging trends in sustainable investing, technology, active management, diversification, and more. By staying informed about these trends and adapting their investment strategies accordingly, investors can maximize their investment potential and navigate the complexities of the financial markets effectively.

Whether it's incorporating ESG-focused funds, exploring alternative investments, or leveraging technology through robo-advisors, the opportunities for growth and success in mutual fund investing are abundant. By remaining proactive and informed, investors can position themselves for a prosperous financial future in 2025 and beyond.

Explore

Top Index Funds to Invest in for 2025: Maximize Your Returns with These Winning Strategies

Maximize Your Wealth: The Ultimate Guide to Passive Investment Strategies for 2025

Tax-Efficient Investing 2025: Maximize Your Returns and Minimize Taxes

Top Investment Apps for Beginners in 2025: Your Guide to Smart Investing

A Complete Guide to Investing in ETFs in 2025

Top 5 Cryptocurrencies to Invest in for 2025: Your Ultimate Guide to Future Success

Smart Investing in 2025: How to Start with Little Money and Grow Your Wealth

Your Ultimate Guide to Investing in Mutual Funds in 2025: Strategies for Success