A Complete Guide to Investing in ETFs in 2025

This comprehensive guide offers essential insights into investing in ETFs in 2025. Discover the latest trends, strategies, and tips to maximize your returns while minimizing risks. Learn about different types of ETFs, their benefits, and how to build a well-diversified portfolio. Equip yourself with the knowledge needed to navigate the evolving investment landscape effectively.

Exchange-Traded Funds (ETFs) have become increasingly popular among investors due to their flexibility, lower costs, and diversification benefits. As we look ahead to 2025, understanding how to effectively invest in ETFs is crucial for both novice and seasoned investors. This comprehensive guide will walk you through the essential aspects of investing in ETFs, including how to choose the right ETFs, strategies for success, and potential risks to consider.

What are ETFs?

ETFs are investment funds that are traded on stock exchanges, much like individual stocks. They typically track a specific index, commodity, or a basket of assets, providing investors with exposure to a wide range of markets. One of the key advantages of ETFs is their ability to combine the features of mutual funds and individual stocks, offering both liquidity and diversification.

Benefits of Investing in ETFs

Investing in ETFs comes with several notable benefits:

- Diversification: ETFs can help mitigate risk by spreading investments across various assets.

- Lower Costs: Generally, ETFs have lower expense ratios compared to mutual funds, making them a cost-effective investment option.

- Tax Efficiency: ETFs are structured in a way that typically results in lower capital gains taxes.

- Liquidity: ETFs can be bought and sold throughout the trading day, providing investors with flexibility.

Choosing the Right ETFs

When selecting ETFs to invest in, consider the following factors:

- Investment Goals: Define your investment objectives, whether they are growth, income, or preservation of capital.

- Expense Ratios: Compare the costs associated with different ETFs. Lower expense ratios can lead to higher long-term returns.

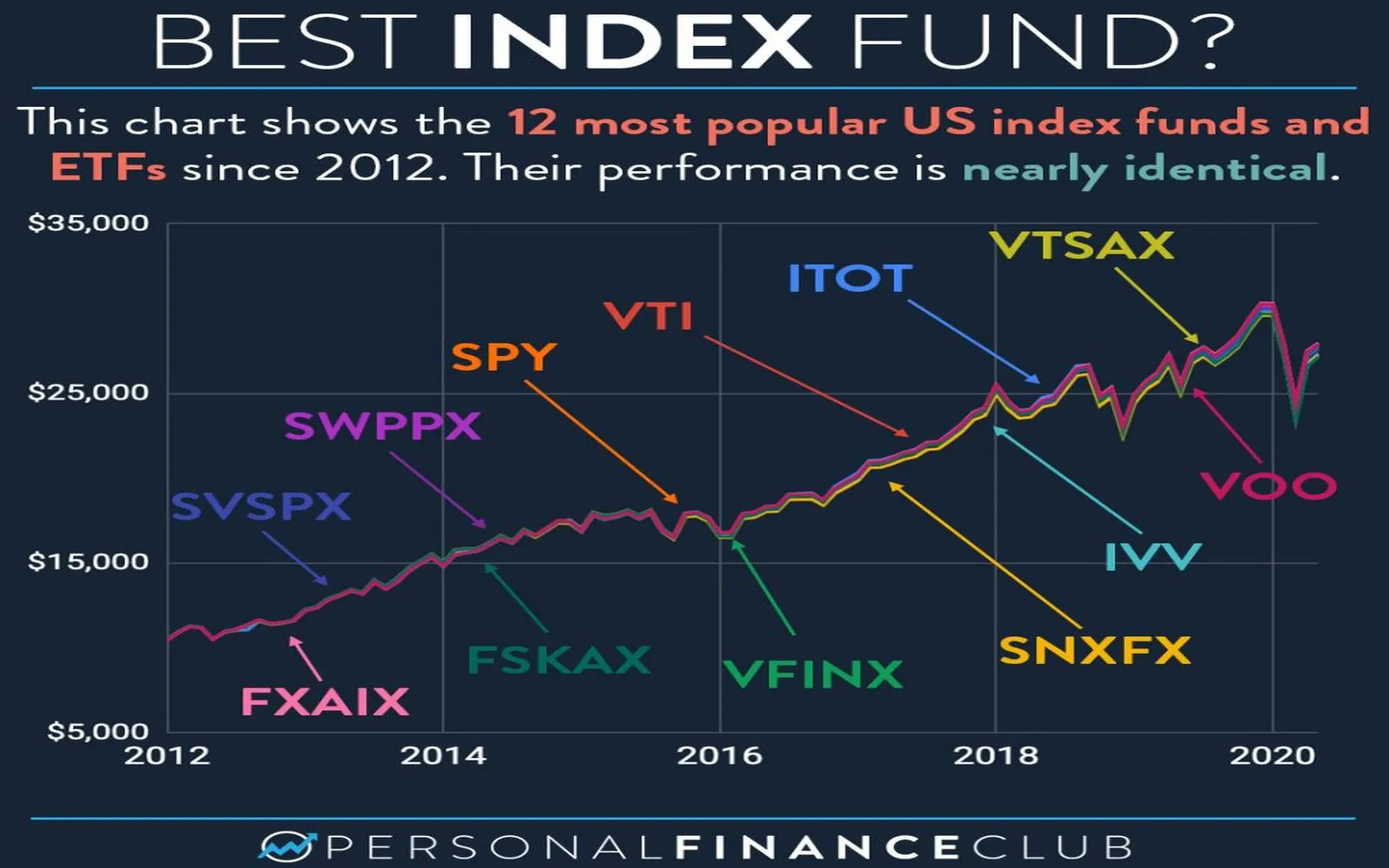

- Performance History: While past performance is not indicative of future results, it can provide insights into how the ETF has reacted to market conditions.

- Liquidity and Volume: Check the average trading volume of the ETF to ensure you can easily buy and sell shares.

- Underlying Assets: Understand what assets the ETF holds and how they align with your investment strategy.

Investment Strategies for ETFs

There are several strategies you can employ when investing in ETFs:

- Buy and Hold: This long-term strategy involves purchasing ETFs and holding them through market fluctuations, allowing you to benefit from compounding returns.

- Dollar-Cost Averaging: By investing a fixed amount regularly, you can reduce the impact of market volatility on your investment.

- Sector Rotation: This strategy focuses on investing in ETFs that track specific sectors of the economy that are expected to outperform.

- Rebalancing: Regularly review and adjust your ETF holdings to maintain your desired asset allocation.

Risks to Consider

While ETFs offer numerous advantages, they are not without risks:

- Market Risk: Like all investments, ETFs are subject to market fluctuations, which can lead to losses.

- Tracking Error: This refers to the difference between the ETF's performance and that of its benchmark index. A significant tracking error can impact your returns.

- Liquidity Risk: Although many ETFs are liquid, some may have lower trading volumes, which can lead to difficulties in buying or selling.

- Management Fees: While generally lower than mutual funds, management fees can still eat into your returns over time.

Preparing for the Future: ETF Trends in 2025

As we approach 2025, several trends are expected to shape the ETF landscape:

- Thematic ETFs: These funds focus on specific trends such as technology, healthcare innovation, or ESG (Environmental, Social, and Governance) criteria, catering to socially conscious investors.

- Active ETFs: More actively managed ETFs are expected to enter the market, providing investors with the potential for enhanced returns.

- Robo-Advisors: The rise of robo-advisors will further simplify ETF investing for beginners, automating portfolio management based on individual risk tolerance and goals.

Conclusion

Investing in ETFs can be a rewarding strategy for building wealth over time. By understanding the benefits, choosing the right ETFs, employing effective strategies, and being aware of potential risks, you can make informed decisions that align with your financial goals. As you prepare for 2025, staying informed about emerging trends will further enhance your investment journey.

ETF Investment Chart

The following chart illustrates the performance of various ETFs over the past five years:

| ETF Name | 1-Year Return | 3-Year Return | 5-Year Return |

|---|---|---|---|

| SPDR S&P 500 ETF (SPY) | 25% | 70% | 100% |

| Invesco QQQ (QQQ) | 30% | 80% | 120% |

| Vanguard Total Stock Market ETF (VTI) | 22% | 65% | 95% |

By leveraging this information and continuously educating yourself about the ETF market, you can position yourself for success in your investment endeavors.

Explore

ESG Investing in 2025: Strategies for Sustainable Growth and Ethical Returns

Maximize Your Wealth: The Ultimate Guide to Passive Investment Strategies for 2025

Tax-Efficient Investing 2025: Maximize Your Returns and Minimize Taxes

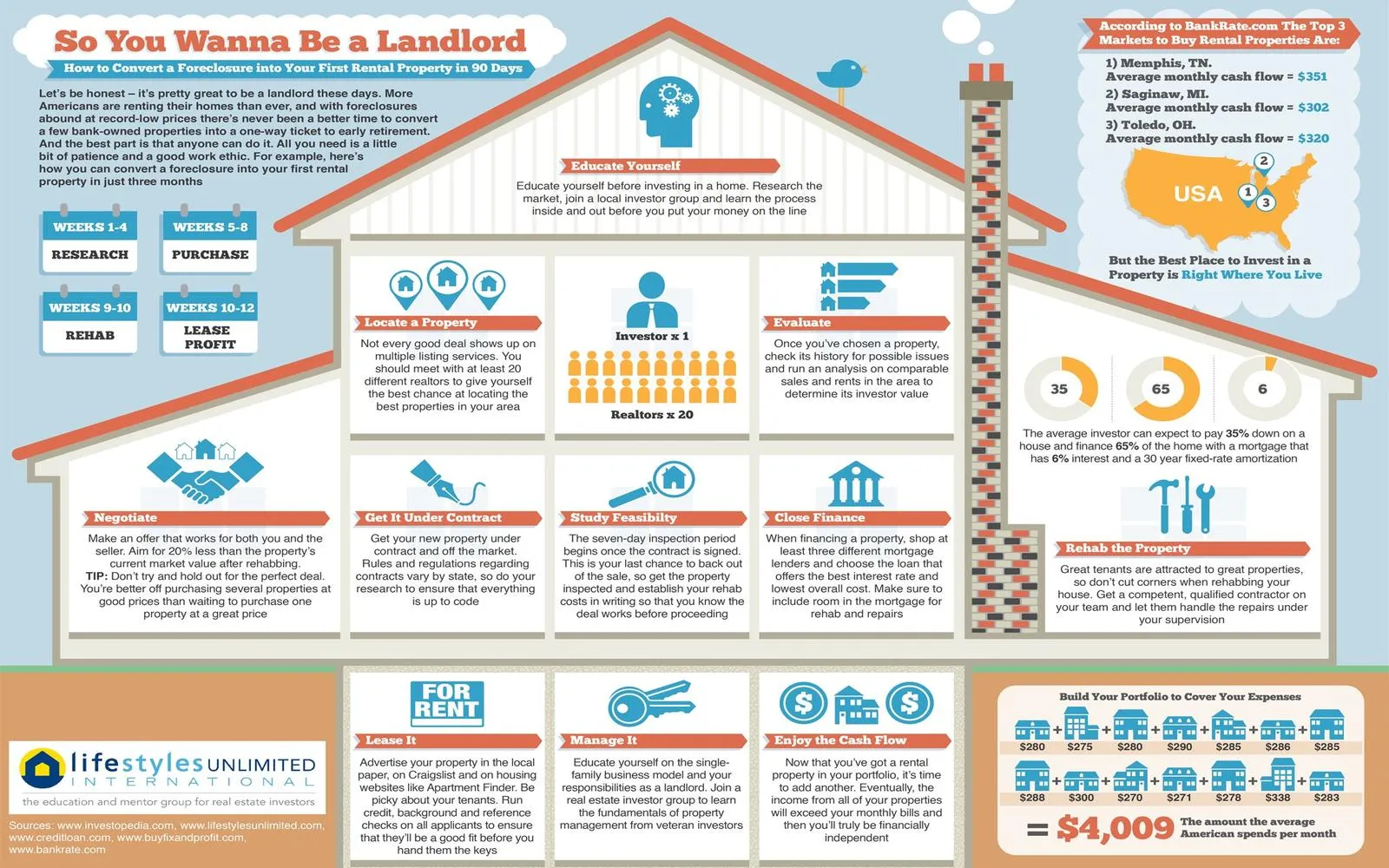

Top Real Estate Investment Opportunities in 2025: Your Guide to Profitable Ventures

Top Index Funds to Invest in for 2025: Maximize Your Returns with These Winning Strategies

Top 5 Cryptocurrencies to Invest in for 2025: Your Ultimate Guide to Future Success

Top Mutual Fund Trends to Watch in 2025: Maximize Your Investment Potential

Smart Investing in 2025: How to Start with Little Money and Grow Your Wealth