Maximize Your Wealth: The Ultimate Guide to Passive Investment Strategies for 2025

As we step into 2025, the pursuit of financial independence has never been more attainable, thanks to the rise of innovative passive investment strategies. This ultimate guide aims to empower investors of all experience levels to maximize their wealth with minimal effort. By leveraging automation, diversification, and strategic asset allocation, you can create a robust portfolio that works for you while you focus on life's other pursuits. From index funds to real estate crowdfunding, discover how these passive approaches can help you build a sustainable financial future in an ever-evolving economic landscape.

Introduction to Passive Investment Strategies

As we approach 2025, the investment landscape is evolving rapidly, influenced by technological advancements, changing regulations, and shifting economic paradigms. For both novice and seasoned investors, understanding passive investment strategies is crucial for maximizing wealth over the long term. This guide will delve into various passive investment strategies, their benefits, potential risks, and how to implement them effectively to build a robust portfolio that withstands market fluctuations.

Understanding Passive Investing

Passive investing involves a long-term investment strategy that aims to maximize returns by minimizing buying and selling activities. Unlike active investing, where managers frequently trade assets to outperform the market, passive investing relies on the market's overall growth and typically involves lower fees and expenses. This approach is grounded in the belief that markets are efficient, and consistently beating the market is challenging for most investors.

The Benefits of Passive Investment Strategies

Passive investment strategies offer several advantages that make them appealing to a broad range of investors:

- Cost-Effectiveness: Passive investments generally have lower fees compared to active management, which can significantly enhance long-term returns.

- Time Efficiency: With less frequent trading, passive investors spend less time managing their portfolios, allowing them to focus on other financial goals.

- Reduced Emotional Stress: By adopting a long-term view, investors can reduce the emotional turmoil associated with market volatility, making it easier to stick to their investment plans.

- Diversification: Many passive investment strategies, such as index funds and ETFs, provide built-in diversification, reducing the risk associated with individual stocks or sectors.

Types of Passive Investment Strategies

There are several passive investment strategies that investors can consider. Each has its distinct characteristics and suitability depending on individual financial goals.

Index Funds

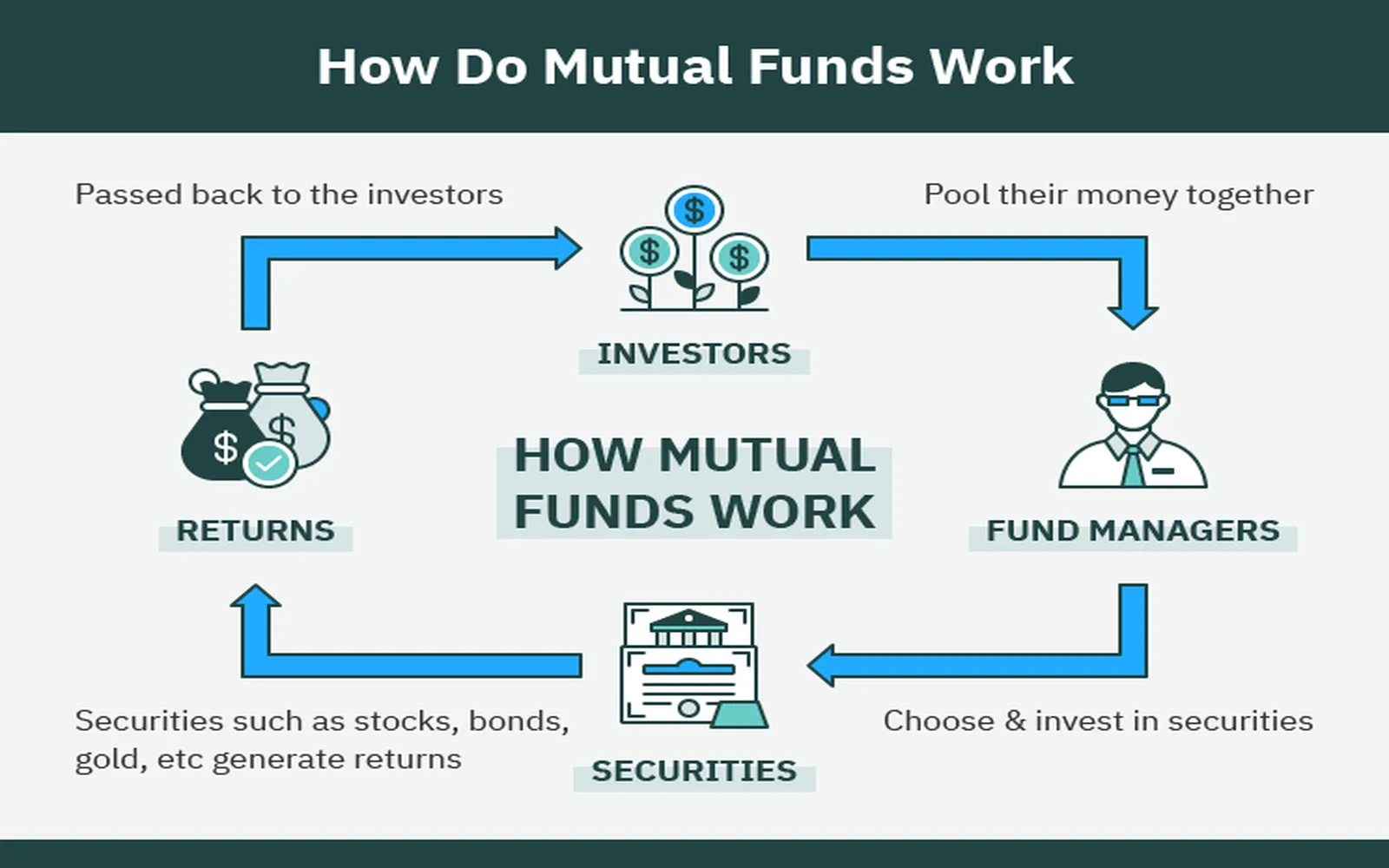

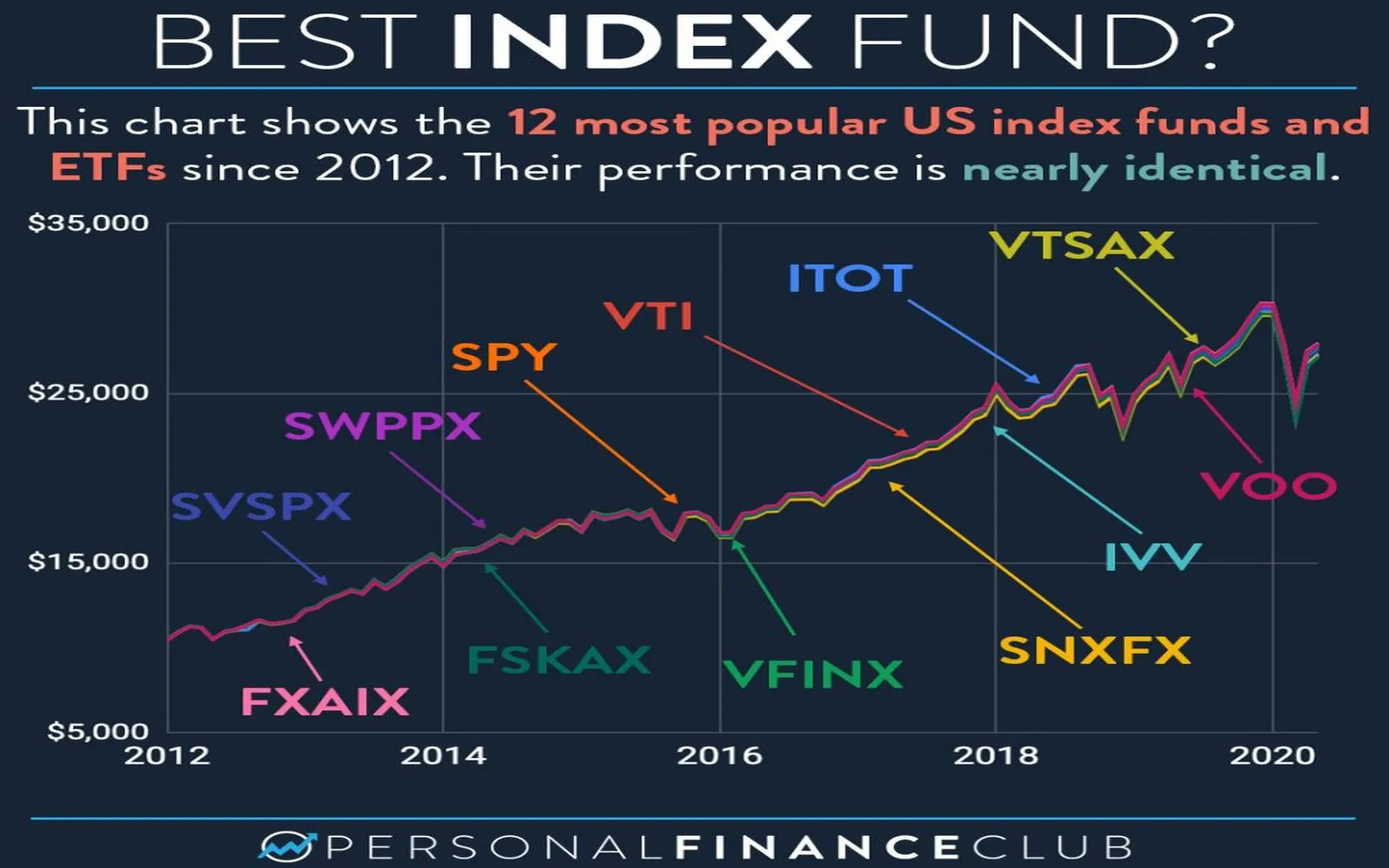

Index funds are mutual funds or exchange-traded funds (ETFs) designed to replicate the performance of a specific market index, such as the S&P 500. By investing in an index fund, investors gain exposure to a broad range of stocks, effectively diversifying their portfolios. The primary advantage of index funds is their low expense ratios and the fact that they do not require active management.

Exchange-Traded Funds (ETFs)

ETFs combine features of both mutual funds and individual stocks. They trade on exchanges like stocks but typically track an index, commodity, or a basket of assets. ETFs offer flexibility, allowing investors to buy and sell throughout the trading day. They also tend to have lower fees compared to traditional mutual funds, making them an attractive option for passive investors.

Robo-Advisors

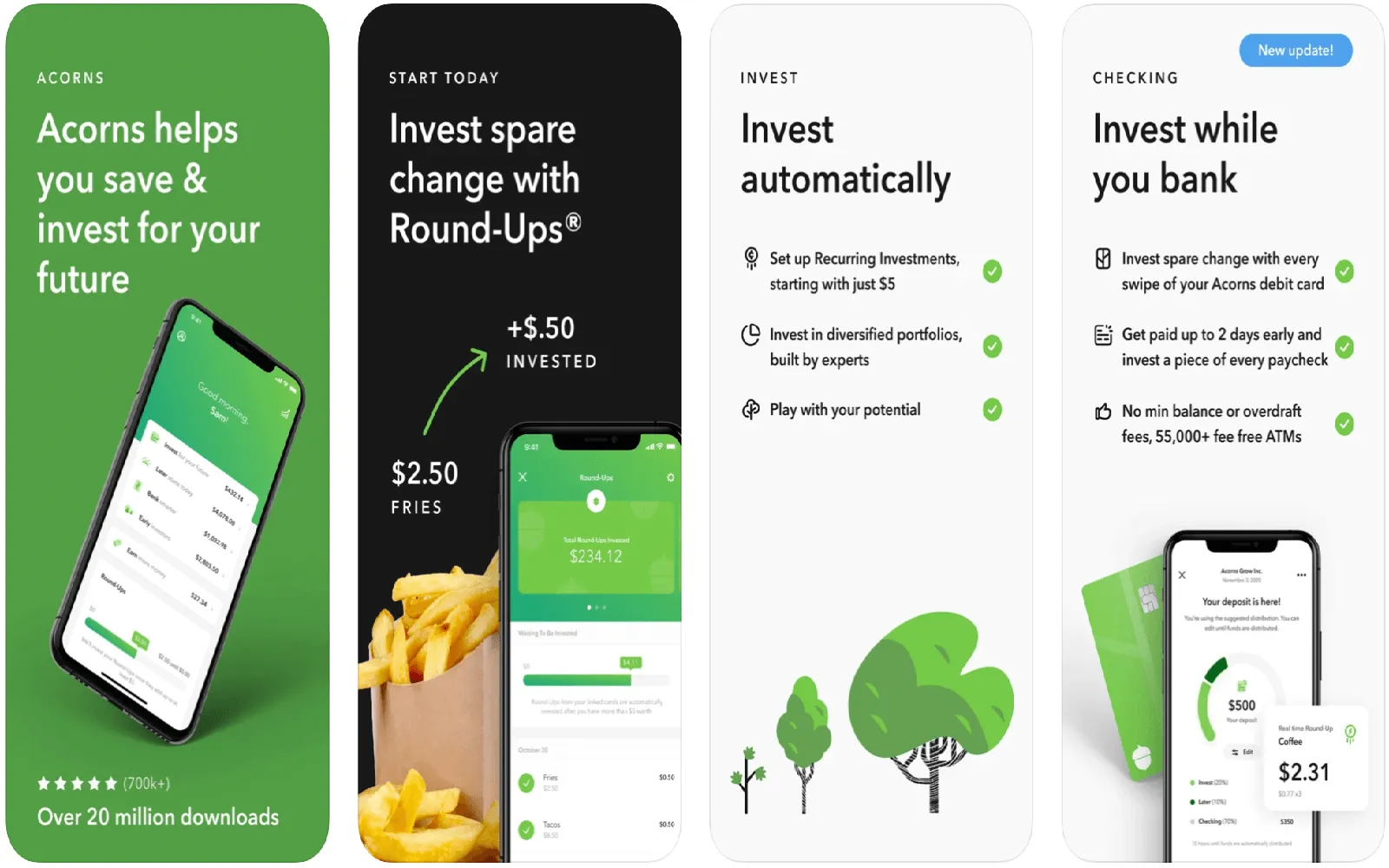

Robo-advisors are automated platforms that create and manage investment portfolios based on an investor's risk tolerance, goals, and time horizon. These platforms use algorithms to allocate assets across various investment vehicles, often utilizing low-cost ETFs and index funds. Robo-advisors provide a hands-off approach to investing, making them ideal for individuals who prefer a passive strategy without the need for extensive market knowledge.

Target-Date Funds

Target-date funds are designed for investors with a specific retirement date in mind. These funds automatically adjust their asset allocation over time, becoming more conservative as the target date approaches. For example, a target-date fund set for 2050 may start with a higher allocation to stocks and gradually shift toward bonds to minimize risk as the investor nears retirement. This makes target-date funds a suitable option for those looking for a simple, hands-off investment strategy.

Implementing Passive Investment Strategies

Now that we have explored various passive investment strategies, the next step is understanding how to implement them effectively. Follow these steps to create a passive investment portfolio that aligns with your financial goals:

1. Define Your Investment Goals

Before diving into passive investing, it’s essential to outline your financial goals. Are you saving for retirement, a child's education, or a major purchase? Understanding your objectives will help you determine the appropriate investment strategy and asset allocation.

2. Assess Your Risk Tolerance

Risk tolerance is a critical factor in determining your investment strategy. Consider how comfortable you are with market fluctuations and potential losses. Generally, younger investors with a longer time horizon can afford to take more risks, while those nearing retirement may prefer a more conservative approach.

3. Choose the Right Investment Vehicles

Based on your investment goals and risk tolerance, select the appropriate passive investment vehicles. You may choose a mix of index funds, ETFs, robo-advisors, and target-date funds to achieve diversification while keeping costs low.

4. Build a Diversified Portfolio

Diversification is key to minimizing risk in your investment portfolio. Aim to allocate your investments across various asset classes, including stocks, bonds, and real estate. A well-diversified portfolio can help cushion against market volatility and improve long-term returns.

5. Monitor and Rebalance Your Portfolio

While passive investing requires less frequent trading, it’s still essential to monitor your portfolio periodically. As markets fluctuate, your asset allocation may drift from its original target. Rebalancing involves adjusting your investments back to your desired allocation to maintain your risk profile.

Potential Risks of Passive Investing

While passive investment strategies offer many benefits, they are not without risks. It’s important to be aware of the potential downsides:

- Market Risk: Passive investments are subject to market fluctuations. During market downturns, even diversified portfolios can experience significant losses.

- Limited Flexibility: Passive strategies do not allow for active management during market volatility, which may result in missed opportunities or greater losses.

- Tracking Error: There may be discrepancies between the performance of an index fund or ETF and the index it tracks, known as tracking error. This can occur due to fees, expenses, and the fund's structure.

The Role of Technology in Passive Investing

Technology has revolutionized the way investors approach passive investing. The proliferation of online trading platforms, robo-advisors, and investment apps has made it easier than ever for individuals to invest in passive strategies. Here are some ways technology is shaping the future of passive investing:

1. Accessibility

Investment platforms and robo-advisors have democratized access to investment opportunities. Investors can now start with minimal capital and benefit from diversified portfolios that were once only available to high-net-worth individuals.

2. Automation

Robo-advisors automate the investment process, from asset allocation to rebalancing. This automation not only saves time but also reduces the potential for human error in investment decisions.

3. Data-Driven Insights

Advanced analytics and machine learning are helping investors make more informed decisions. Investment platforms now provide real-time data, performance tracking, and personalized recommendations, enabling investors to optimize their strategies.

Maximizing Wealth Through Tax-Efficient Investing

Passive investment strategies can also be enhanced through tax-efficient investing. Understanding the tax implications of your investment choices can significantly impact your overall returns. Here are some tips for maximizing wealth through tax-efficient investing:

1. Utilize Tax-Advantaged Accounts

Investing in tax-advantaged accounts, such as IRAs and 401(k)s, allows your investments to grow tax-deferred or tax-free. This can lead to substantial savings over time, especially for long-term investors.

2. Consider Tax-Loss Harvesting

Tax-loss harvesting involves selling investments that have lost value to offset taxable gains. This strategy can help reduce your overall tax liability and improve your after-tax returns.

3. Be Mindful of Capital Gains

Passive investing typically results in fewer taxable events than active trading, but it’s still essential to be mindful of capital gains. Holding investments for over a year can lead to lower long-term capital gains tax rates, enhancing your overall returns.

Conclusion: The Future of Passive Investing

As we move toward 2025, passive investment strategies will continue to gain traction among investors seeking to maximize their wealth. With their low costs, simplicity, and potential for long-term growth, passive strategies are well-suited for a wide range of financial goals. By understanding the various types of passive investments, implementing effective strategies, and leveraging technology, investors can build resilient portfolios that stand the test of time. Embrace the power of passive investing and take control of your financial future today.

Explore

A Complete Guide to Investing in ETFs in 2025

Top Fund Management Software and Tools to Streamline Your Investment Strategy in 2025

Your Ultimate Guide to Investing in Mutual Funds in 2025: Strategies for Success

Top Investment Apps for Beginners in 2025: Your Guide to Smart Investing

Smart Investing in 2025: How to Start with Little Money and Grow Your Wealth

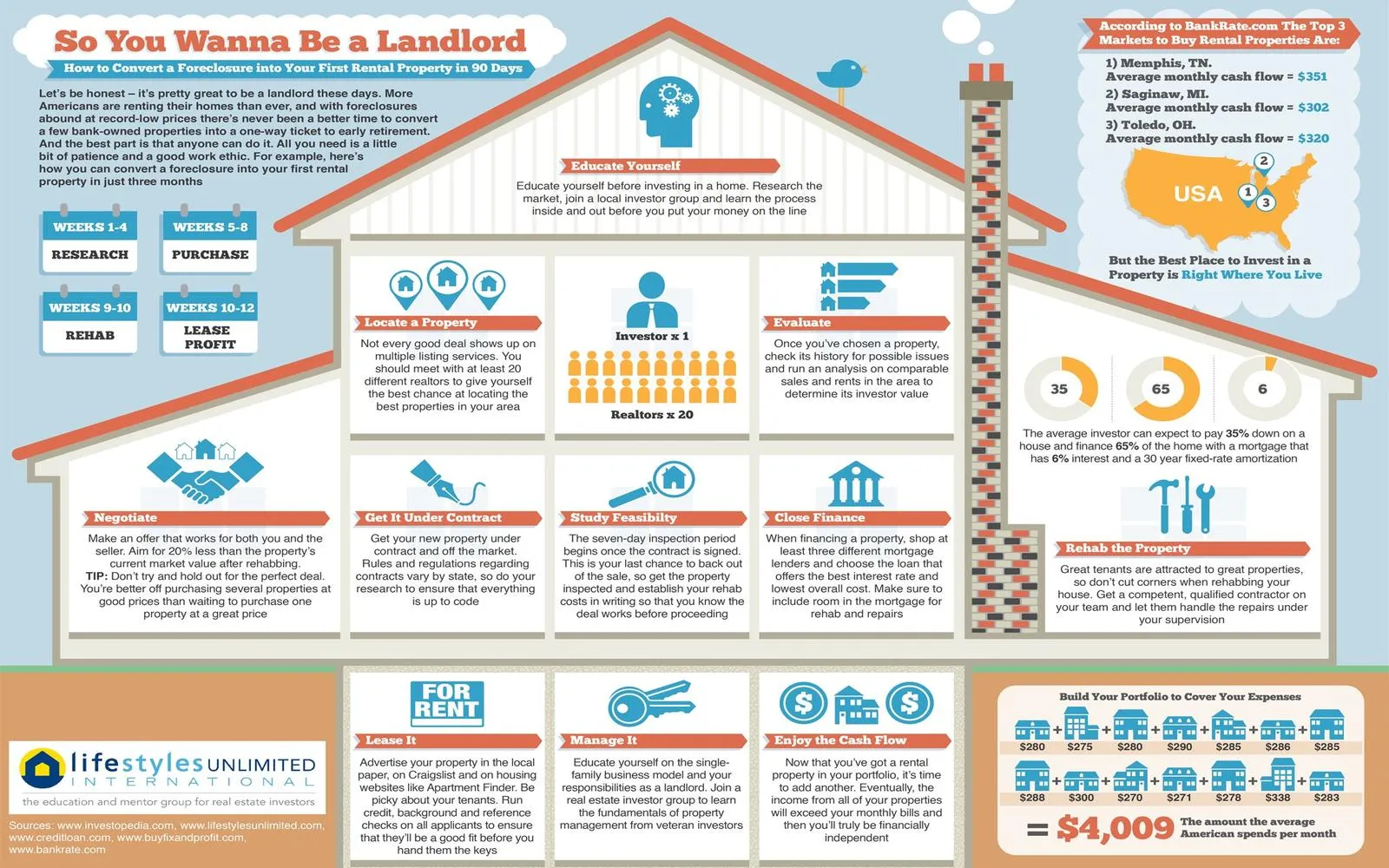

Top Real Estate Investment Opportunities in 2025: Your Guide to Profitable Ventures

Top Index Funds to Invest in for 2025: Maximize Your Returns with These Winning Strategies

Top 5 Cryptocurrencies to Invest in for 2025: Your Ultimate Guide to Future Success