Your Ultimate Guide to Investing in Mutual Funds in 2025: Strategies for Success

Understanding Mutual Funds

Mutual funds have long been a popular investment vehicle, especially for those looking to build wealth over time without the burden of managing individual stocks. As we move into 2025, it’s vital to understand what mutual funds are and how they operate. Essentially, a mutual fund pools money from multiple investors to purchase a diversified portfolio of stocks, bonds, or other securities, managed by professional portfolio managers.

The Appeal of Mutual Funds

One of the main attractions of mutual funds is their diversification. By investing in a single fund, you can gain exposure to a wide array of assets, which can help mitigate risk. Additionally, mutual funds are typically accessible to investors with varying budgets, allowing you to start investing with relatively small amounts. Another benefit is the professional management that these funds offer, as fund managers conduct research and make decisions on behalf of the investors.

Types of Mutual Funds

Before investing in mutual funds, it’s crucial to understand the different types available. In 2025, you will find several categories:

- Equity Funds: These funds primarily invest in stocks. They can be further categorized into growth funds, value funds, and sector-specific funds.

- Debt Funds: These invest in fixed-income securities such as bonds and treasury bills. They are generally considered safer than equity funds.

- Hybrid Funds: These funds invest in a mix of equity and debt, providing a balanced approach to risk and return.

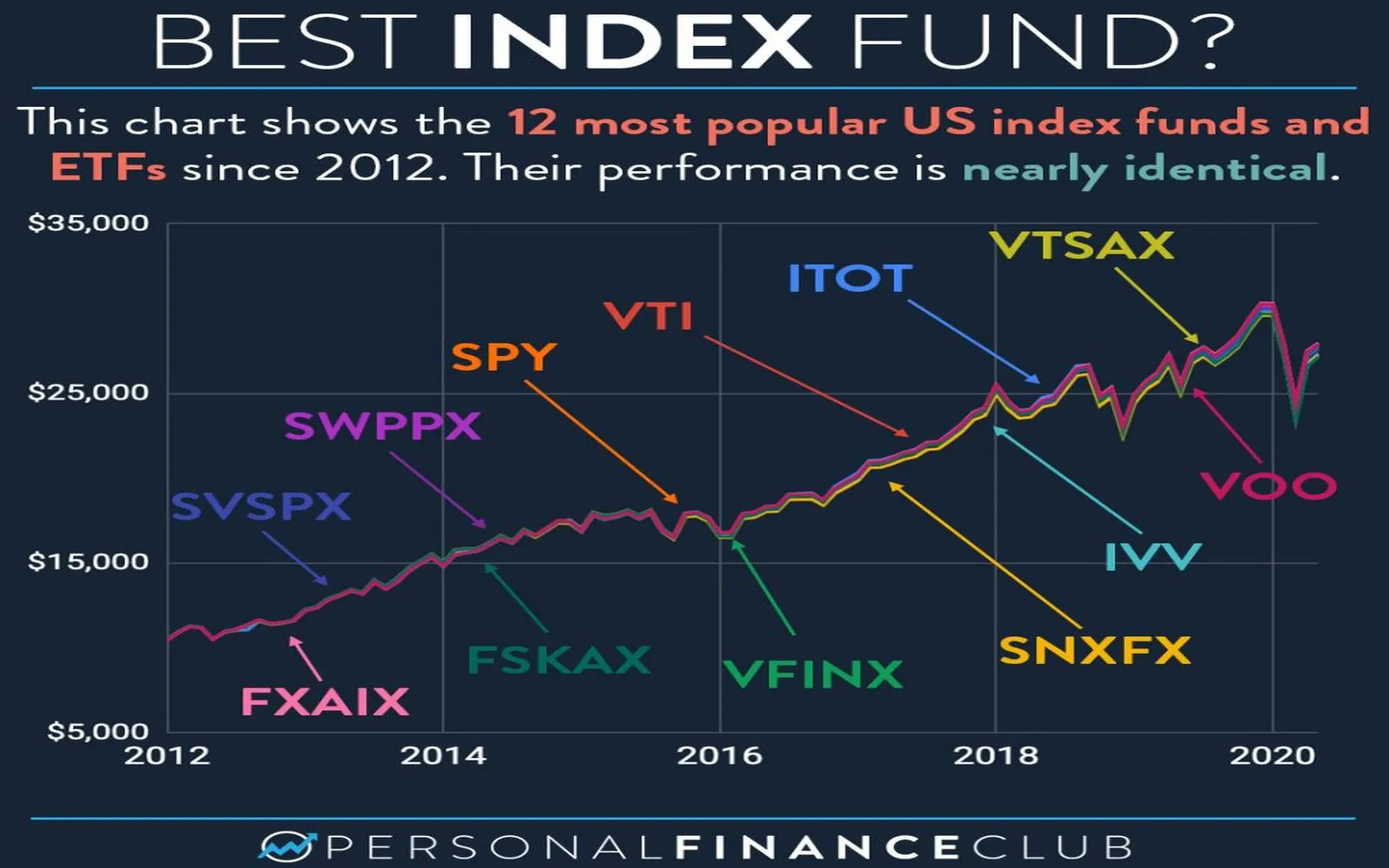

- Index Funds: These funds track a specific index like the S&P 500, providing broad market exposure with lower fees.

- Sector Funds: These focus on specific sectors of the economy such as technology, healthcare, or energy.

Evaluating Mutual Funds

When it comes to selecting the right mutual funds for your investment portfolio, there are several factors to consider:

- Performance History: Look at the fund’s historical performance, but remember that past performance is not indicative of future results.

- Expense Ratios: Lower expense ratios mean more of your money is invested. Compare the fees of different funds to find the most cost-effective options.

- Fund Manager Reputation: Research the credentials and track record of the fund managers. Their experience can play a significant role in the fund’s success.

- Investment Objectives: Ensure that the fund aligns with your personal investment goals and risk tolerance.

Setting Investment Goals

Before diving into mutual fund investments, it’s essential to define your investment goals. Are you saving for retirement, a house, or your child's education? Knowing your objectives will help you choose the right types of funds. For example, if your goal is long-term growth, you might lean towards equity funds. If you need to preserve capital for short-term goals, consider debt funds.

Creating an Investment Strategy

Once you've established your goals, the next step is to devise a comprehensive investment strategy. Here are some strategies to consider for 2025:

Dollar-Cost Averaging

This strategy involves investing a fixed amount of money at regular intervals, regardless of market conditions. It helps reduce the impact of volatility and lowers the average cost per share over time.

Asset Allocation

Determine the right mix of asset classes that align with your risk tolerance and investment horizon. A balanced portfolio may include a combination of equity, debt, and other asset types to optimize returns while managing risk.

Rebalancing Your Portfolio

Over time, the performance of different asset classes will affect your portfolio's asset allocation. Regularly rebalancing your investments ensures that you maintain your desired level of risk and can help lock in profits from well-performing assets.

Staying Informed

The investment landscape is ever-changing, and staying informed is critical to your success. In 2025, leverage technology and financial news sources to keep up with market trends, economic indicators, and fund performance. Subscribing to financial newsletters, following market analysts, and participating in investing forums can provide valuable insights.

Tax Implications of Mutual Funds

Understanding the tax implications of your mutual fund investments is crucial. In many countries, capital gains and dividends are taxed, impacting your overall returns. Stay informed about tax-efficient funds, such as those that focus on long-term investments, which may have favorable tax treatment. Additionally, consider utilizing tax-advantaged accounts, like IRAs or 401(k)s, to maximize your investments.

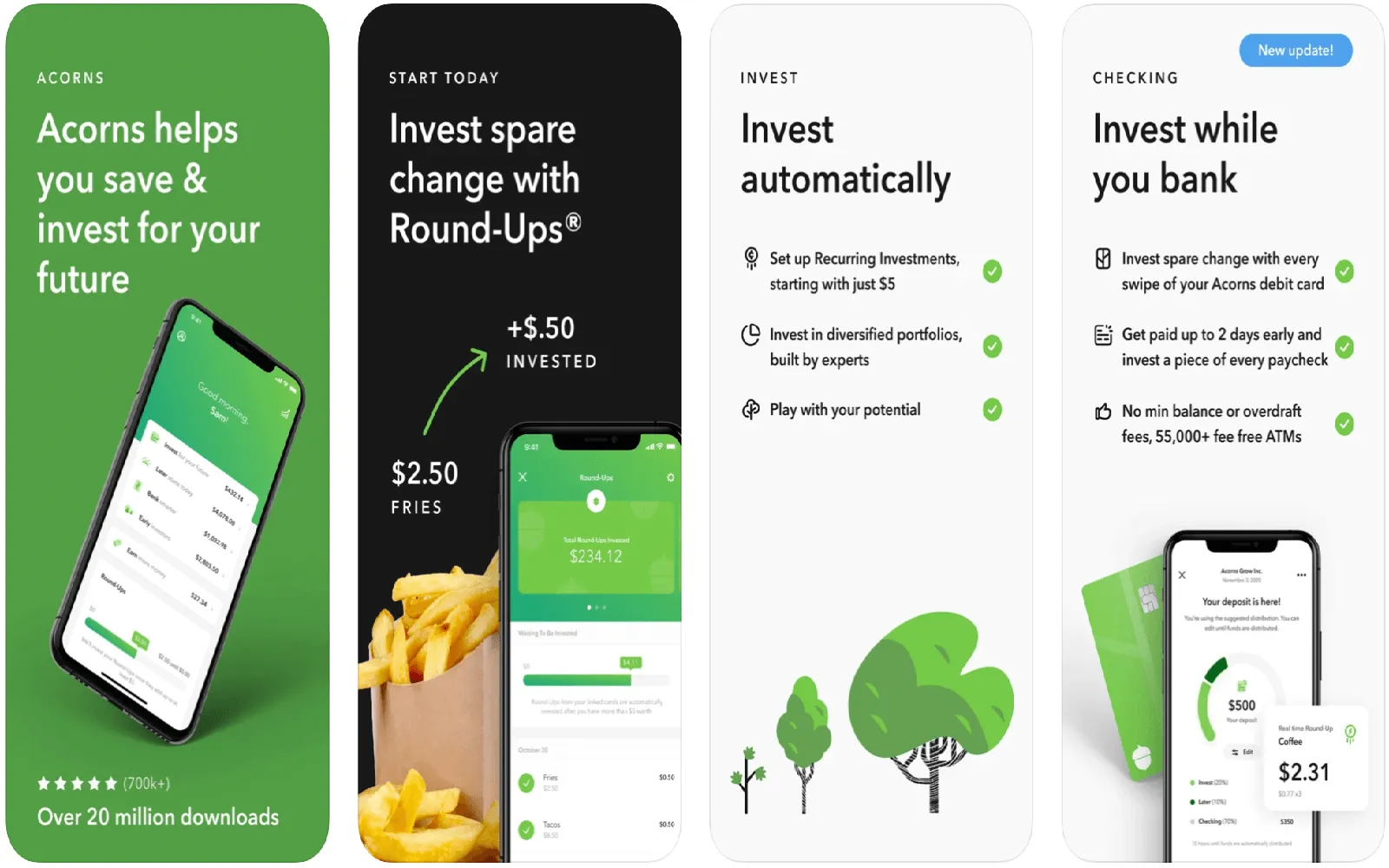

Utilizing Technology for Investing

The rise of technology has transformed the way we invest. In 2025, numerous online platforms and apps provide easy access to mutual fund investments. These tools often come with features such as automated investing, portfolio tracking, and educational resources. Explore these platforms to streamline your investment process and enhance your decision-making.

Choosing the Right Mutual Fund Platform

When selecting a platform for investing in mutual funds, consider the following:

- Fees: Look for platforms with low or no transaction fees to maximize your returns.

- Fund Selection: Ensure the platform offers a wide range of mutual funds to suit your investment strategy.

- User Experience: A user-friendly interface makes it easier to manage your portfolio and access resources.

Understanding Risks

All investments carry risk, and mutual funds are no exception. Understanding the various risks associated with mutual funds can help you make informed decisions:

- Market Risk: The value of your investments can fluctuate due to changes in market conditions.

- Interest Rate Risk: Changes in interest rates can negatively impact the performance of bond funds.

- Credit Risk: This risk pertains to bond funds, where the issuer may default on payments.

Knowing When to Exit

Knowing when to sell your mutual fund investments is just as important as knowing when to buy. Factors that may indicate it’s time to exit include:

- Poor Performance: If a fund consistently underperforms relative to its benchmark or peers, it may be time to consider a different investment.

- Changes in Investment Goals: If your personal financial goals change, reassess your portfolio to ensure alignment.

- High Fees: If a fund’s expense ratio becomes unmanageable relative to its performance, it may be worth looking for alternatives.

Building a Long-Term Investment Mindset

Investing in mutual funds should be viewed as a long-term strategy. It’s easy to get caught up in daily market fluctuations, but maintaining a long-term perspective can help you stay focused on your goals. Patience is key in allowing your investments to grow and compound over time. Avoid knee-jerk reactions to market volatility and stick to your investment plan.

Conclusion

Investing in mutual funds in 2025 can be a rewarding endeavor if approached with the right strategies and mindset. By understanding the fundamentals, evaluating various funds, and implementing a disciplined investment strategy, you can navigate the complexities of mutual fund investing successfully. Remember to stay informed, be mindful of tax implications, and build a diversified portfolio that aligns with your financial goals. With patience and persistence, you can achieve your investment objectives and build a secure financial future.

Explore

Top Mutual Fund Trends to Watch in 2025: Maximize Your Investment Potential

Top Index Funds to Invest in for 2025: Maximize Your Returns with These Winning Strategies

ESG Investing in 2025: Strategies for Sustainable Growth and Ethical Returns

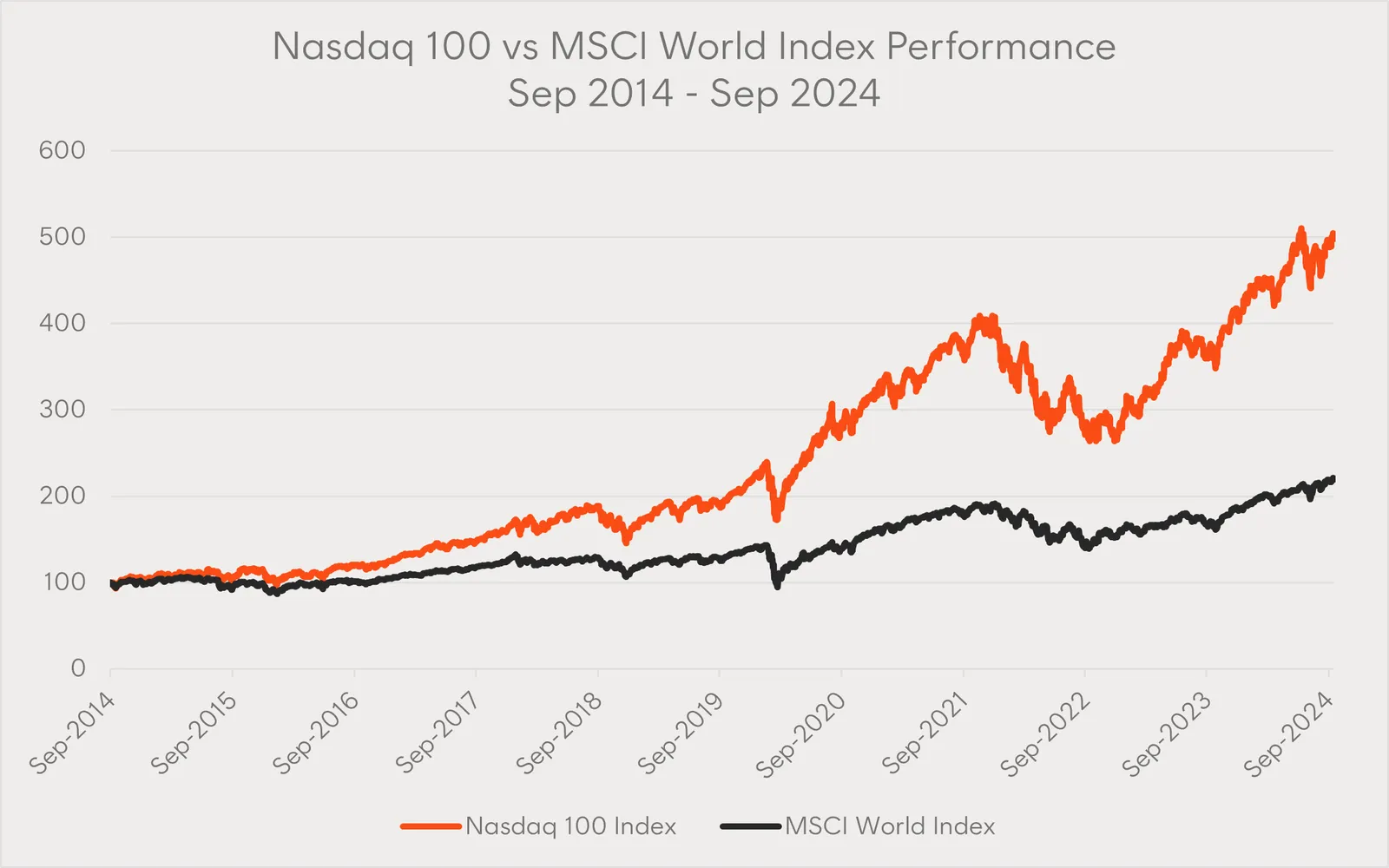

Investing in Nasdaq 100 ETFs for Long-Term Success

Top Investment Apps for Beginners in 2025: Your Guide to Smart Investing

A Complete Guide to Investing in ETFs in 2025

Money Market Funds: Smart Savings for Short-Term Goals