Tax-Efficient Investing 2025: Maximize Your Returns and Minimize Taxes

Investing wisely is not just about picking the right stocks or funds — it’s also about managing how much you pay in taxes. Tax-efficient investing 2025 strategies can help US investors keep more of their gains while legally minimizing tax liabilities. In this article, we’ll cover the key tactics, account types, and investment vehicles to optimize your portfolio for tax efficiency in 2025.

What is Tax-Efficient Investing?

Tax-efficient investing refers to the practice of structuring your portfolio and investment decisions to reduce your tax burden. This means choosing assets, accounts, and timing strategies that minimize the taxes you owe on dividends, interest, and capital gains.

Why is this important? Because taxes can significantly erode your investment returns over time. Even a small reduction in taxes can translate into thousands of extra dollars in your pocket across years.

Key Tax-Advantaged Accounts in 2025

Using the right accounts is a foundational step in tax-efficient investing. Here are the most important tax-advantaged accounts available in the US:

| Account Type | Tax Benefit | Contribution Limit 2025 (Estimated) |

|---|---|---|

| Roth IRA | Tax-free withdrawals | $6,500 |

| Traditional IRA | Tax-deductible contributions | $6,500 |

| 401(k) | Tax-deferred growth | $23,000 |

| Health Savings Account (HSA) | Triple tax advantage (contribution, growth, withdrawal) | $4,150 (individual) / $8,300 (family) |

Note: Contribution limits may be adjusted for inflation in 2025.

Top Tax-Efficient Investment Strategies

1. Hold Investments Long-Term

Long-term capital gains are taxed at a lower rate (0%, 15%, or 20% depending on income) compared to short-term gains taxed as ordinary income. Holding investments for more than one year can significantly reduce your tax bill.

2. Use Tax-Loss Harvesting

Tax-loss harvesting means selling investments at a loss to offset gains from other investments. This can help reduce your taxable income, especially in volatile markets.

3. Invest in Tax-Efficient Funds

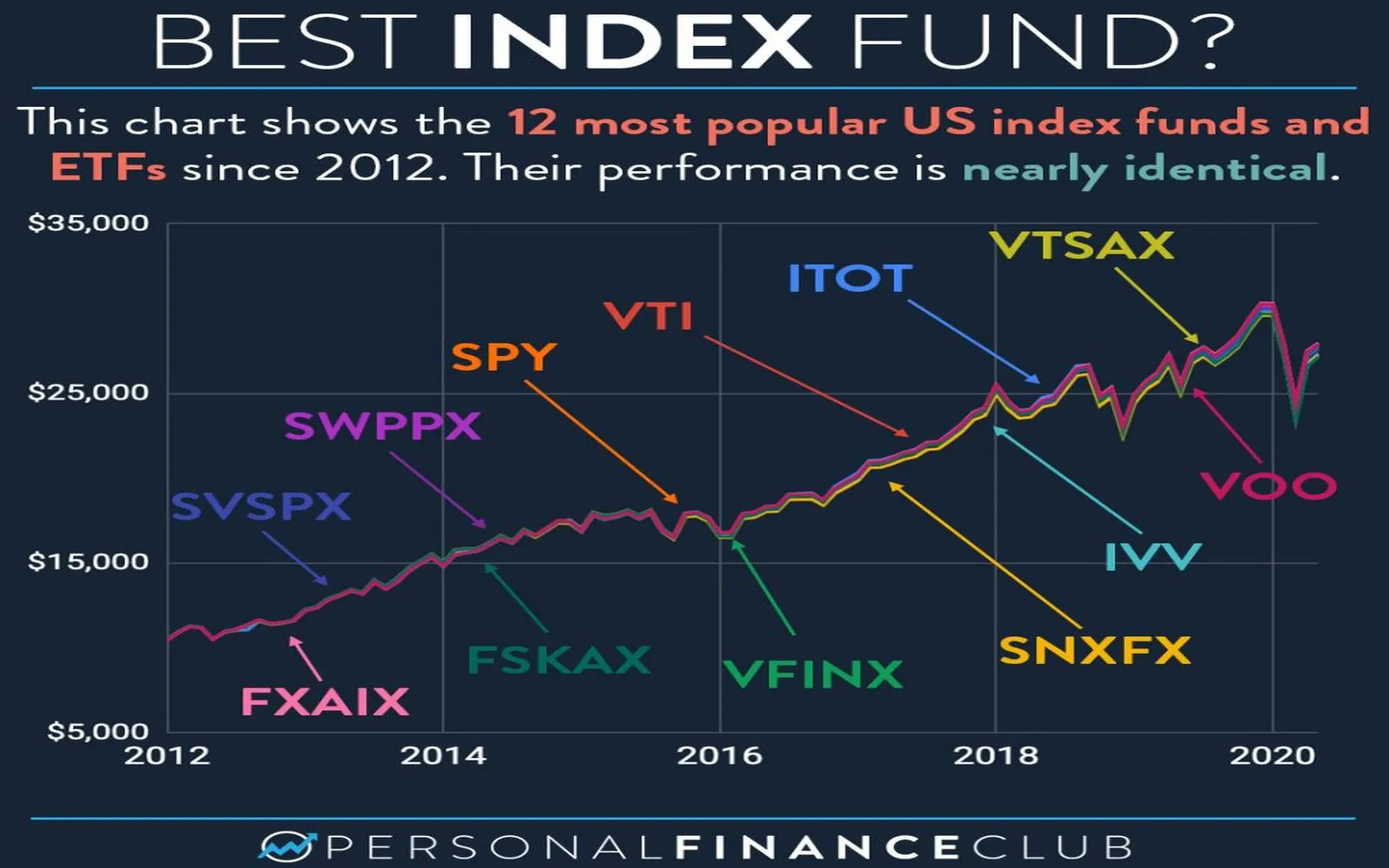

Index funds and ETFs tend to be more tax-efficient than actively managed mutual funds because they have lower turnover and generate fewer taxable events.

4. Place Tax-Inefficient Assets in Tax-Advantaged Accounts

Assets that generate a lot of taxable income, like bonds or REITs (Real Estate Investment Trusts), are better held in tax-deferred accounts such as a 401(k) or IRA.

Chart: Comparing Tax Efficiency of Different Investments

| Investment Type | Average Annual Tax Cost | Best Account Placement |

|---|---|---|

| Individual Stocks | Low | Taxable or Roth IRA |

| Index Funds/ETFs | Moderate | Taxable or Roth IRA |

| Bonds | High | 401(k) or Traditional IRA |

| REITs | High | 401(k) or Traditional IRA |

*Tax cost includes capital gains, dividends, and interest taxes.

Tax Changes to Watch in 2025

The IRS periodically updates tax brackets, contribution limits, and investment-related tax laws. Key points to watch in 2025 include:

- Potential adjustments in capital gains tax rates depending on new legislation.

- Increased contribution limits for IRAs and 401(k)s due to inflation.

- Updates to estate tax exemptions, impacting high-net-worth investors.

- Changes to Qualified Dividend Taxation impacting dividend-heavy portfolios.

Final Tips for Tax-Efficient Investing in 2025

- Diversify your account types: Use a mix of taxable, tax-deferred, and tax-free accounts.

- Review your portfolio annually: Tax rules and your personal situation change.

- Consult a tax professional: Complex portfolios benefit from personalized strategies.

- Stay informed: Keep up with IRS updates and investment industry news.

By following these tax-efficient investing 2025 strategies, you can keep more of your hard-earned money and build wealth smarter in the years ahead.

Explore

Tax-Advantaged Accounts: How They Can Boost Your Savings 2025

ESG Investing in 2025: Strategies for Sustainable Growth and Ethical Returns

Top Index Funds to Invest in for 2025: Maximize Your Returns with These Winning Strategies

Top Dividend-Paying Stocks to Invest in for 2025: Maximize Your Returns

Top Tax-Efficient Investment Strategies