Top Dividend-Paying Stocks to Invest in for 2025: Maximize Your Returns

Introduction

As we approach 2025, investors are increasingly seeking avenues to maximize returns in a turbulent economic landscape. One strategy that stands out is investing in dividend-paying stocks. These stocks not only provide a steady income stream but also tend to exhibit lower volatility compared to non-dividend-paying stocks. This article will explore the top dividend-paying stocks to consider for 2025, focusing on companies with a solid track record of dividend payments, growth potential, and overall financial health.

Understanding Dividend Stocks

Dividend stocks are shares in companies that return a portion of their earnings to shareholders in the form of dividends. These payments can be made quarterly, semi-annually, or annually. The appeal of dividend stocks lies in their ability to provide a reliable income source, especially for retirees or those looking to supplement their income. Additionally, reinvesting dividends can significantly enhance total returns over time, compounding growth and benefiting from the power of compounding.

Factors to Consider When Choosing Dividend Stocks

Before diving into specific stocks, it’s essential to understand the criteria for selecting strong dividend-paying companies. Investors should consider:

- Dividend Yield: This is the annual dividend payment divided by the stock price. A higher yield can indicate a more attractive return, but be cautious of yields that seem too good to be true.

- Dividend Growth History: Look for companies that have consistently increased their dividends over time. This indicates strong financial health and management’s commitment to returning value to shareholders.

- Payout Ratio: This ratio indicates what portion of earnings is paid out as dividends. A lower payout ratio suggests that a company has room to maintain or grow its dividend.

- Financial Health: Assess the company’s balance sheet, cash flow, and overall profitability. A company with strong fundamentals is better positioned to weather economic downturns.

- Market Position: Companies with strong market positions in their respective industries are often more resilient and capable of generating consistent profits.

Top Dividend-Paying Stocks for 2025

1. Johnson & Johnson (JNJ)

Johnson & Johnson is a diversified healthcare giant known for its consistent dividend payments. The company boasts a dividend yield of around 2.8%, and it has a long history of increasing its dividends annually for over 50 years, making it a Dividend Aristocrat. With a robust pipeline of pharmaceutical products and a stable consumer health segment, JNJ is well-positioned for continued growth.

2. Procter & Gamble (PG)

Procter & Gamble, a leader in the consumer goods sector, offers a dividend yield of approximately 2.5%. The company has a strong track record of dividend growth, having raised its dividends for over 60 consecutive years. Its diverse product portfolio, including household and personal care items, ensures steady revenue, making it a reliable investment for dividend-focused investors.

3. Coca-Cola (KO)

Coca-Cola is one of the most recognizable brands globally and pays a dividend yield of around 3.1%. The company has a history of increasing dividends for more than 50 years. As it continues to diversify its beverage offerings, including health-conscious options, Coca-Cola remains a compelling choice for investors looking for income and stability.

4. Microsoft Corporation (MSFT)

While primarily known for its technology products, Microsoft also offers an attractive dividend yield of about 0.8%. The company has consistently increased its dividend payments, signaling strong financial health and growth prospects. Microsoft’s position in cloud computing and artificial intelligence presents significant future growth opportunities, making it a solid choice for dividend investors.

5. Realty Income Corporation (O)

Realty Income is a real estate investment trust (REIT) that focuses on generating income through monthly dividends, with a yield of around 4.5%. The company invests in commercial properties with long-term leases, providing stability and consistent cash flow. Its monthly dividend payments have earned it the nickname "The Monthly Dividend Company," appealing to income-focused investors.

6. AT&T Inc. (T)

AT&T has faced challenges in recent years, but it remains a prominent dividend player with a yield exceeding 6%. The company’s restructuring efforts and focus on core telecommunications services may help stabilize its financial position. Investors should closely monitor AT&T’s ability to maintain its dividend amid evolving market conditions.

7. 3M Company (MMM)

3M is a diversified technology and manufacturing company with a dividend yield of approximately 4.3%. Known for its innovation and wide range of products, 3M has a long-standing history of increasing dividends. The company’s commitment to research and development positions it well for future growth, making it an attractive option for income-seeking investors.

8. PepsiCo, Inc. (PEP)

PepsiCo, a leader in the food and beverage industry, offers a dividend yield of around 2.8%. The company has consistently raised its dividends for over 49 years, demonstrating its commitment to returning value to shareholders. With a diverse portfolio of snacks and beverages, PepsiCo is well-positioned to navigate market fluctuations and continue generating reliable income.

9. Chevron Corporation (CVX)

Chevron is one of the largest integrated energy companies globally and offers a dividend yield of around 4.5%. The company has a history of maintaining and increasing its dividends even during periods of oil price volatility. As the energy sector evolves, Chevron’s investments in renewable energy initiatives position it for future growth, making it a compelling choice for dividend investors.

10. AbbVie Inc. (ABBV)

AbbVie is a biopharmaceutical company with a strong dividend yield of approximately 4.3%. The company’s portfolio includes blockbuster drugs, and it has a solid pipeline of potential treatments. AbbVie has consistently increased its dividends since its spin-off from Abbott Laboratories in 2013, showcasing its commitment to returning value to shareholders.

Strategies for Maximizing Returns with Dividend Stocks

Investing in dividend-paying stocks is not just about selecting the right companies; it also involves strategic planning. Here are some strategies to maximize your returns:

- Reinvest Dividends: Consider enrolling in a Dividend Reinvestment Plan (DRIP) to automatically reinvest dividends into additional shares, compounding your investment over time.

- Diversification: While focusing on dividend stocks, ensure your portfolio is diversified across sectors to mitigate risks associated with economic downturns.

- Monitor Performance: Regularly review your portfolio and the financial health of the companies in which you invest. Stay informed about market trends and changes in management strategies.

- Tax Considerations: Be aware of the tax implications of dividend income. Qualified dividends may be taxed at a lower rate than ordinary income, which can impact your overall returns.

Conclusion

As we enter 2025, dividend-paying stocks remain a vital component of a well-rounded investment strategy. The companies highlighted in this article represent reliable options for income-seeking investors, boasting strong financial health and a commitment to returning value to shareholders. By carefully selecting dividend stocks and employing effective investment strategies, you can maximize your returns and build long-term wealth. Always conduct thorough research and consider your financial goals and risk tolerance before making investment decisions.

Explore

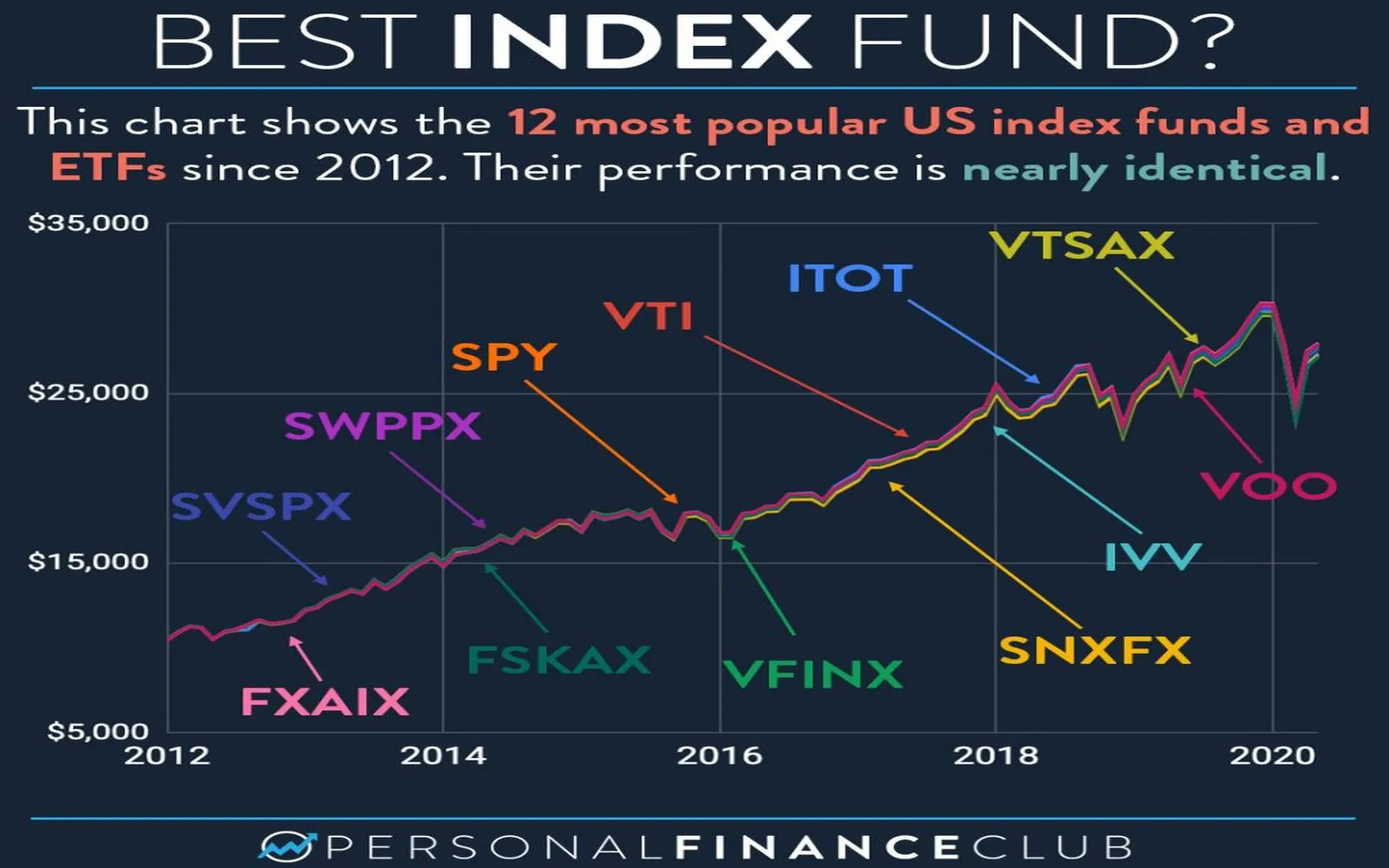

Top Index Funds to Invest in for 2025: Maximize Your Returns with These Winning Strategies

Tax-Efficient Investing 2025: Maximize Your Returns and Minimize Taxes

How to Get High-Paying Remote VA Jobs in 2025

Tech Stocks to Watch in 2025 for Big Growth

Top 5 Cryptocurrencies to Invest in for 2025: Your Ultimate Guide to Future Success

ESG Investing in 2025: Strategies for Sustainable Growth and Ethical Returns

Top Business Checking Accounts in 2025: Maximize Your Financial Efficiency