Top Tax-Efficient Investment Strategies

From utilizing tax-advantaged accounts to strategic asset allocation, understanding the nuances of capital gains and losses can significantly enhance your financial portfolio. This article explores the top tax-efficient investment strategies for 2025, empowering you to make informed decisions that not only grow your wealth but also protect it from excessive taxation. Embrace these strategies to secure a prosperous financial future.

Introduction

As we approach 2025, many investors are seeking ways to maximize their wealth while minimizing tax liabilities. Tax-efficient investing is an essential strategy that can significantly enhance your overall returns by reducing the tax burden on your investment gains. This article will explore various tax-efficient investment strategies to help you make informed decisions and optimize your financial outcomes in the coming year.

Understanding Tax Efficiency

Before diving into specific strategies, it’s important to understand what tax efficiency means in the context of investing. Tax efficiency refers to the ability of an investment to minimize taxes incurred on returns, whether through capital gains, dividends, or interest income. The goal is to retain as much of your earnings as possible after taxes. By employing tax-efficient strategies, investors can enhance their wealth accumulation over time.

Utilizing Tax-Advantaged Accounts

One of the most effective ways to maximize your wealth is by taking full advantage of tax-advantaged investment accounts. These accounts provide significant tax benefits that can enhance your overall returns.

1. Individual Retirement Accounts (IRAs)

IRAs, including Traditional IRAs and Roth IRAs, offer different tax benefits. Traditional IRAs allow you to defer taxes on your contributions and earnings until retirement, potentially lowering your taxable income during your high-earning years. Roth IRAs, on the other hand, allow for tax-free withdrawals in retirement, provided certain conditions are met. In 2025, consider maximizing your contributions to these accounts to take advantage of their tax benefits.

2. 401(k) Plans

Employer-sponsored 401(k) plans are another excellent way to invest tax-efficiently. Contributions to a traditional 401(k) are made pre-tax, reducing your taxable income for the year. Additionally, many employers offer matching contributions, which can significantly boost your retirement savings. In 2025, ensure you contribute enough to capture any employer match, as this represents free money.

3. Health Savings Accounts (HSAs)

HSAs are often overlooked as a tax-efficient investment vehicle. Contributions to an HSA are tax-deductible, and the funds grow tax-free. Withdrawals for qualified medical expenses are also tax-free. In 2025, consider using your HSA not only for immediate healthcare expenses but also as a long-term investment vehicle, as funds can be invested in various assets.

Investing in Tax-Efficient Assets

Choosing the right types of investments is crucial for achieving tax efficiency. Some assets are inherently more tax-efficient than others.

1. Index Funds and ETFs

Index funds and exchange-traded funds (ETFs) are generally more tax-efficient than actively managed mutual funds. They typically have lower turnover rates, which translates to fewer taxable capital gains distributions. In 2025, consider allocating a significant portion of your portfolio to index funds and ETFs to minimize your tax burden.

2. Tax-Managed Funds

Tax-managed funds are specifically designed to minimize taxes for investors. These funds employ strategies such as tax-loss harvesting and holding onto investments for longer periods to reduce capital gains taxes. In 2025, consider incorporating tax-managed funds into your investment strategy for additional tax efficiency.

3. Municipal Bonds

Investing in municipal bonds can provide tax-free interest income at the federal level, and often at the state level as well for residents of the issuing state. This makes them an attractive option for investors in higher tax brackets. In 2025, consider allocating a portion of your fixed-income investments to municipal bonds to enhance tax efficiency.

Capital Gains Strategies

Managing capital gains is a crucial aspect of tax-efficient investing. Here are some strategies to help you minimize capital gains taxes.

1. Long-Term Investing

Holding investments for over a year qualifies you for long-term capital gains tax rates, which are generally lower than short-term rates. In 2025, focus on a long-term investment strategy to benefit from these lower rates, allowing your investments to grow while minimizing tax liabilities.

2. Tax-Loss Harvesting

Tax-loss harvesting involves selling investments that have declined in value to offset capital gains from other investments. This strategy can help reduce your overall tax liability. In 2025, consider implementing tax-loss harvesting at year-end to maximize your tax efficiency.

3. Qualified Opportunity Zones

Investing in Qualified Opportunity Zones can offer significant tax benefits, including deferral of capital gains taxes and potential exclusion from taxes on future gains if the investment is held for a certain period. In 2025, explore opportunities in these designated areas to take advantage of the associated tax incentives.

Dividend Strategies

Dividends can be a substantial source of income for investors, but they can also lead to higher tax liabilities. Here are some strategies to manage dividends effectively.

1. Invest in Tax-Advantaged Accounts

As mentioned earlier, holding dividend-paying stocks in tax-advantaged accounts like IRAs or 401(k) plans can shield your dividend income from taxes. In 2025, prioritize placing your dividend stocks in these accounts to maximize tax efficiency.

2. Focus on Qualified Dividends

Qualified dividends are taxed at a lower rate than ordinary income. To qualify, dividends must be paid by U.S. corporations or qualified foreign corporations and held for a specific period. In 2025, consider focusing on investments that pay qualified dividends to take advantage of these lower tax rates.

3. Dividend Growth Investing

Investing in companies with a history of increasing dividend payouts can lead to long-term wealth accumulation. While dividends may be taxable, the growth of these dividends can outpace the tax burden over time. In 2025, consider a dividend growth strategy to enhance your wealth while managing tax implications.

Tax-Efficient Withdrawal Strategies

As you begin to withdraw funds from your investment accounts, it’s essential to adopt tax-efficient withdrawal strategies to minimize your tax liabilities.

1. Sequence of Withdrawals

The order in which you withdraw funds from your accounts can have significant tax implications. Generally, it’s advisable to withdraw from taxable accounts first, then tax-deferred accounts, and finally tax-free accounts like Roth IRAs. This strategy allows your tax-advantaged accounts to continue growing tax-free for as long as possible. In 2025, plan your withdrawal strategy carefully to optimize your tax situation.

2. Manage Required Minimum Distributions (RMDs)

For those aged 72 and older, Required Minimum Distributions (RMDs) must be taken from traditional IRAs and 401(k)s. Failing to take the required amount can result in steep penalties. In 2025, ensure you’re aware of RMD rules and plan for them accordingly to avoid unnecessary taxes.

Working with Tax Professionals

As tax laws and investment landscapes evolve, working with tax professionals can provide valuable insights and strategies tailored to your specific financial situation. A tax advisor or financial planner can help you navigate complex tax regulations and optimize your investment strategy for maximum tax efficiency.

Final Thoughts

Maximizing your wealth through tax-efficient investing requires careful planning and strategic decision-making. By utilizing tax-advantaged accounts, investing in tax-efficient assets, managing capital gains and dividends, and adopting effective withdrawal strategies, you can significantly enhance your overall returns and minimize your tax burden in 2025 and beyond. As always, it’s essential to stay informed about changes in tax laws and investment opportunities to ensure your strategy remains effective. By taking proactive steps and seeking professional advice, you can position yourself for financial success in the years ahead.

Explore

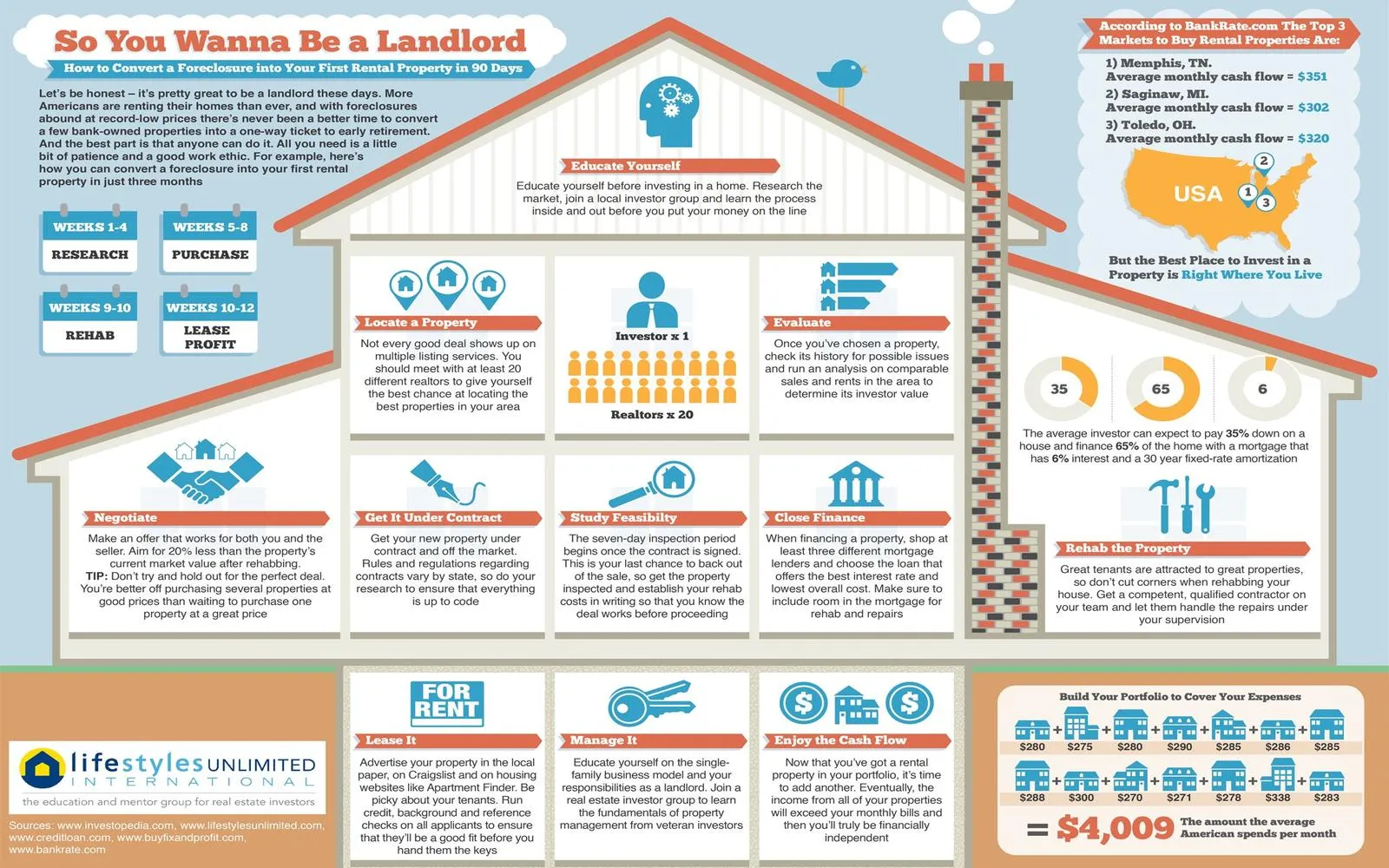

Top Real Estate Investment Opportunities in 2025: Your Guide to Profitable Ventures

Top Dividend-Paying Stocks to Invest in for 2025: Maximize Your Returns

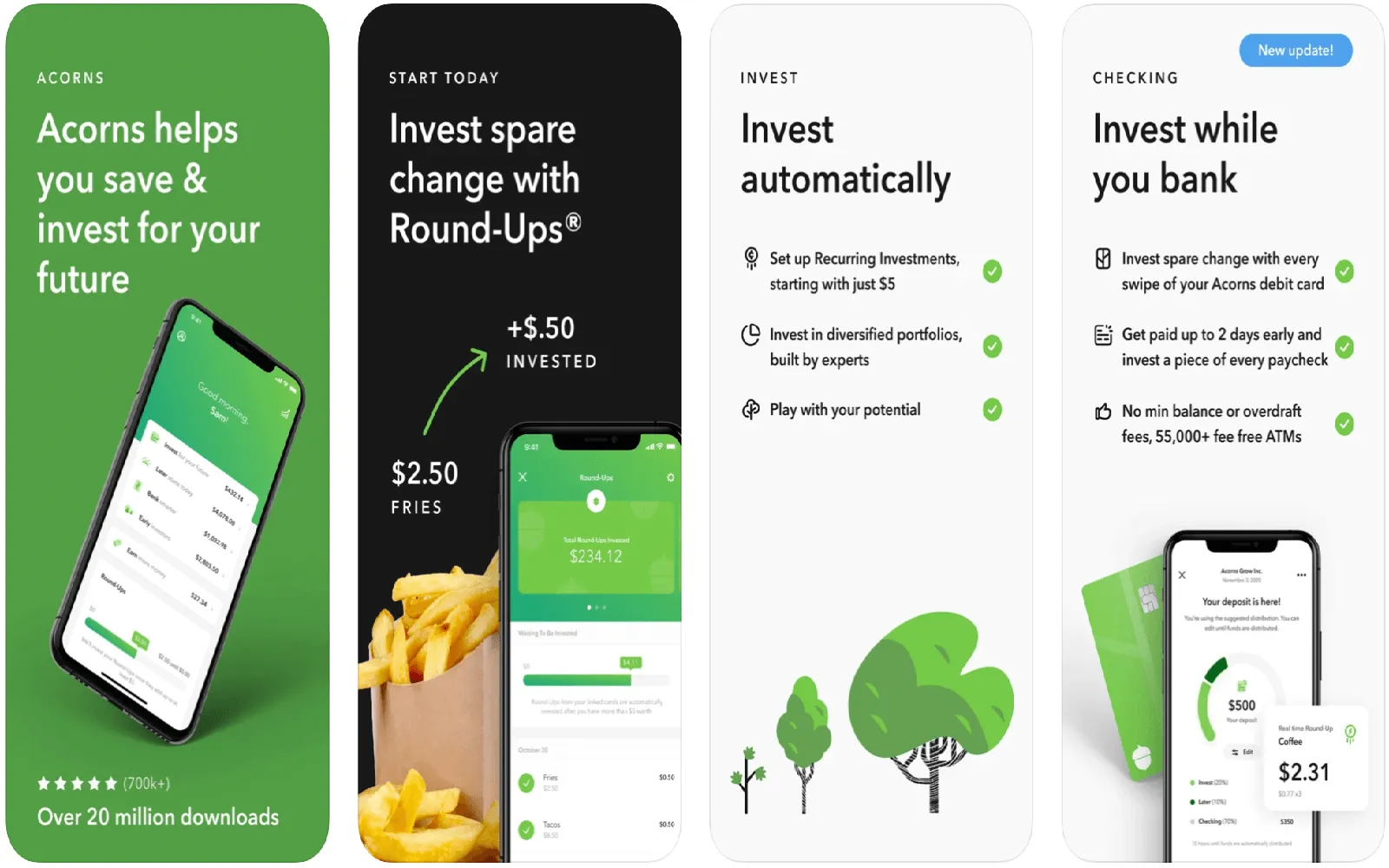

Top Investment Apps for Beginners in 2025: Your Guide to Smart Investing

Smart Investing in 2025: How to Start with Little Money and Grow Your Wealth

Tax-Efficient Investing 2025: Maximize Your Returns and Minimize Taxes

ESG Investing in 2025: Strategies for Sustainable Growth and Ethical Returns

Maximize Your Wealth: The Ultimate Guide to Passive Investment Strategies for 2025

Top Mutual Fund Trends to Watch in 2025: Maximize Your Investment Potential