Tax-Advantaged Accounts: How They Can Boost Your Savings 2025

When it comes to maximizing your savings in 2025, understanding the power of tax-advantaged accounts is essential. These accounts offer unique tax benefits that can significantly grow your wealth over time. Whether you are saving for retirement, education, or healthcare expenses, leveraging tax advantages helps you keep more of your money working for you.

What Are Tax-Advantaged Accounts?

Tax-advantaged accounts are specialized financial accounts that provide tax relief through either tax deductions, tax deferral, or tax-free growth. In the US, the most common types include:

- 401(k) Plans

- Individual Retirement Accounts (IRAs)

- Health Savings Accounts (HSAs)

- 529 College Savings Plans

These accounts incentivize saving by reducing your taxable income or by allowing your investments to grow without being taxed annually.

How Tax-Advantaged Accounts Help You Save More

By reducing the tax burden, these accounts enable you to save more money upfront or pay less tax when you withdraw funds. Here are some key benefits:

- Tax Deductions: Contributions to traditional 401(k)s and IRAs may be deductible from your taxable income, lowering your tax bill.

- Tax-Free Growth: Roth IRAs and Roth 401(k)s allow your investments to grow tax-free, and qualified withdrawals are tax-free.

- Tax-Deferred Growth: In traditional accounts, your investments grow tax-deferred, meaning you don’t pay taxes on earnings until withdrawal.

- Tax-Free Withdrawals for Qualified Expenses: HSAs and 529 plans offer tax-free withdrawals when used for qualified medical or educational expenses.

Popular Tax-Advantaged Accounts in 2025

| Account Type | Contribution Limit (2025) | Tax Benefit | Withdrawal Rules |

|---|---|---|---|

| 401(k) | $23,000 | Tax-deductible contributions or Roth (tax-free growth) | Withdrawals taxed at income rate, penalty before 59½ |

| IRA (Traditional) | $7,000 | Tax-deductible contributions | Withdrawals taxed as income, penalty before 59½ |

| Roth IRA | $7,000 | Contributions after-tax; tax-free growth & withdrawals | Withdrawals tax-free if qualified |

| Health Savings Account | $4,150 (individual) | Tax-deductible contributions & tax-free withdrawals | Must be used for qualified medical expenses |

| 529 Plan | No federal limit; varies | Tax-free growth & withdrawals for education | Withdrawals taxed if not for qualified expenses |

Why You Should Prioritize Tax-Advantaged Accounts in 2025

With rising inflation and potential tax law changes on the horizon, tax-efficient saving strategies are more important than ever. Using these accounts can:

- Increase your net returns by minimizing taxes.

- Encourage disciplined saving with annual contribution limits.

- Provide flexibility for major life events like retirement, healthcare, or education.

- Potentially reduce your taxable estate by using these accounts strategically.

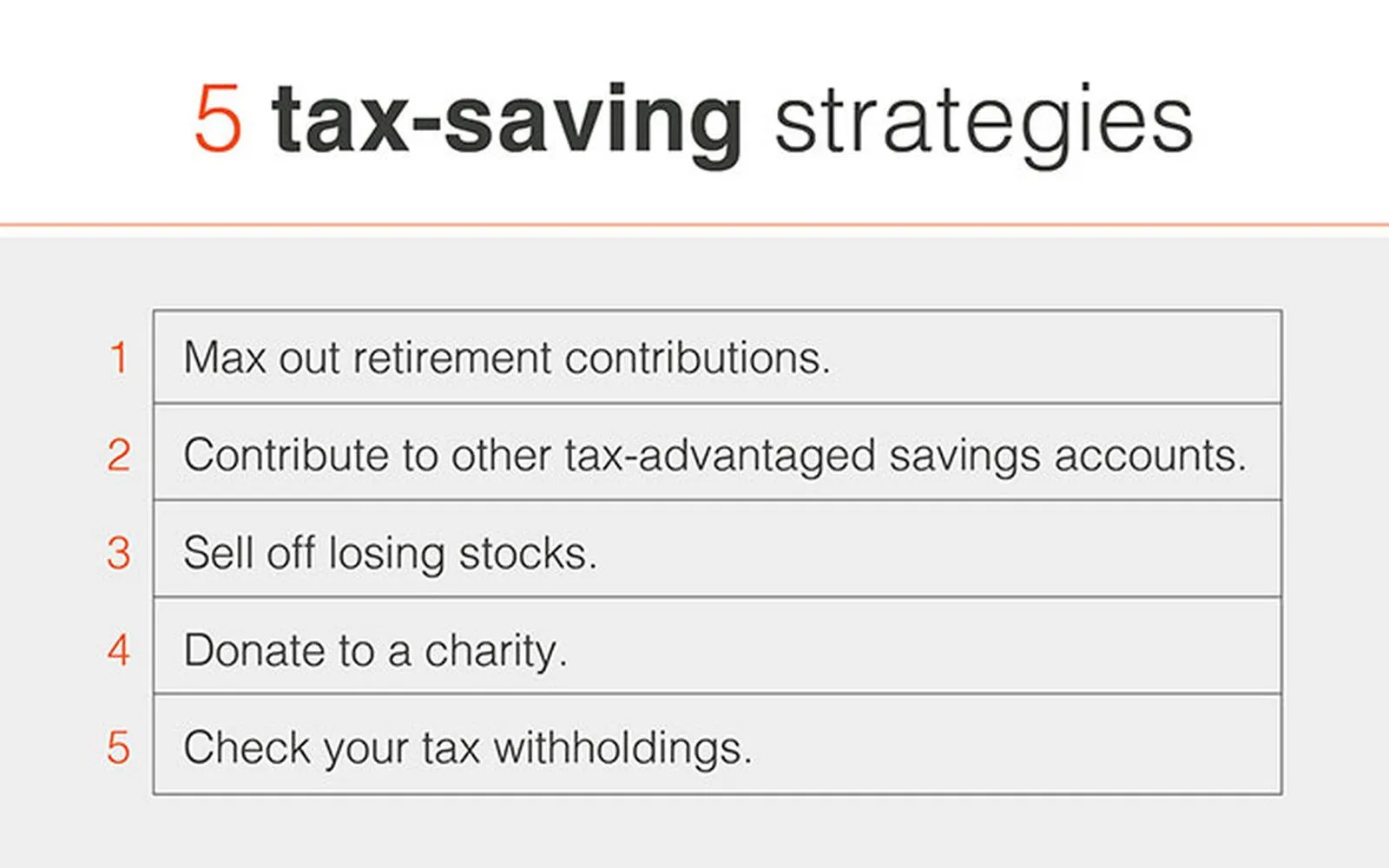

Tips to Maximize Your Savings with Tax-Advantaged Accounts

- Contribute Early and Often: Start saving early to benefit from compounding growth and tax advantages.

- Use Employer Matches: If your employer offers a 401(k) match, contribute enough to get the full match—it’s free money!

- Diversify Account Types: Combine traditional and Roth accounts to optimize tax outcomes both now and in retirement.

- Plan Withdrawals Strategically: Understand the tax implications of withdrawals to minimize penalties and taxes.

- Review Contribution Limits Annually: Stay informed about annual limits which typically increase with inflation.

Conclusion

Tax-advantaged accounts are powerful tools that can boost your savings in 2025 by reducing your tax burden and allowing your investments to grow more efficiently. Whether you’re preparing for retirement, healthcare costs, or your children’s education, using these accounts wisely is key to building long-term financial security.

Start today, optimize your contributions, and watch your savings grow smarter—not just bigger.

Explore

Tax-Efficient Investing 2025: Maximize Your Returns and Minimize Taxes

Free Business Checking Accounts: A Smart Choice for Small Businesses

Top Tax Preparation Services for Small Businesses in 2025: Maximize Your Savings and Compliance

10 Smart Tax-Free Savings Tips Every American Needs in 2025

Top Business Checking Accounts in 2025: Maximize Your Financial Efficiency

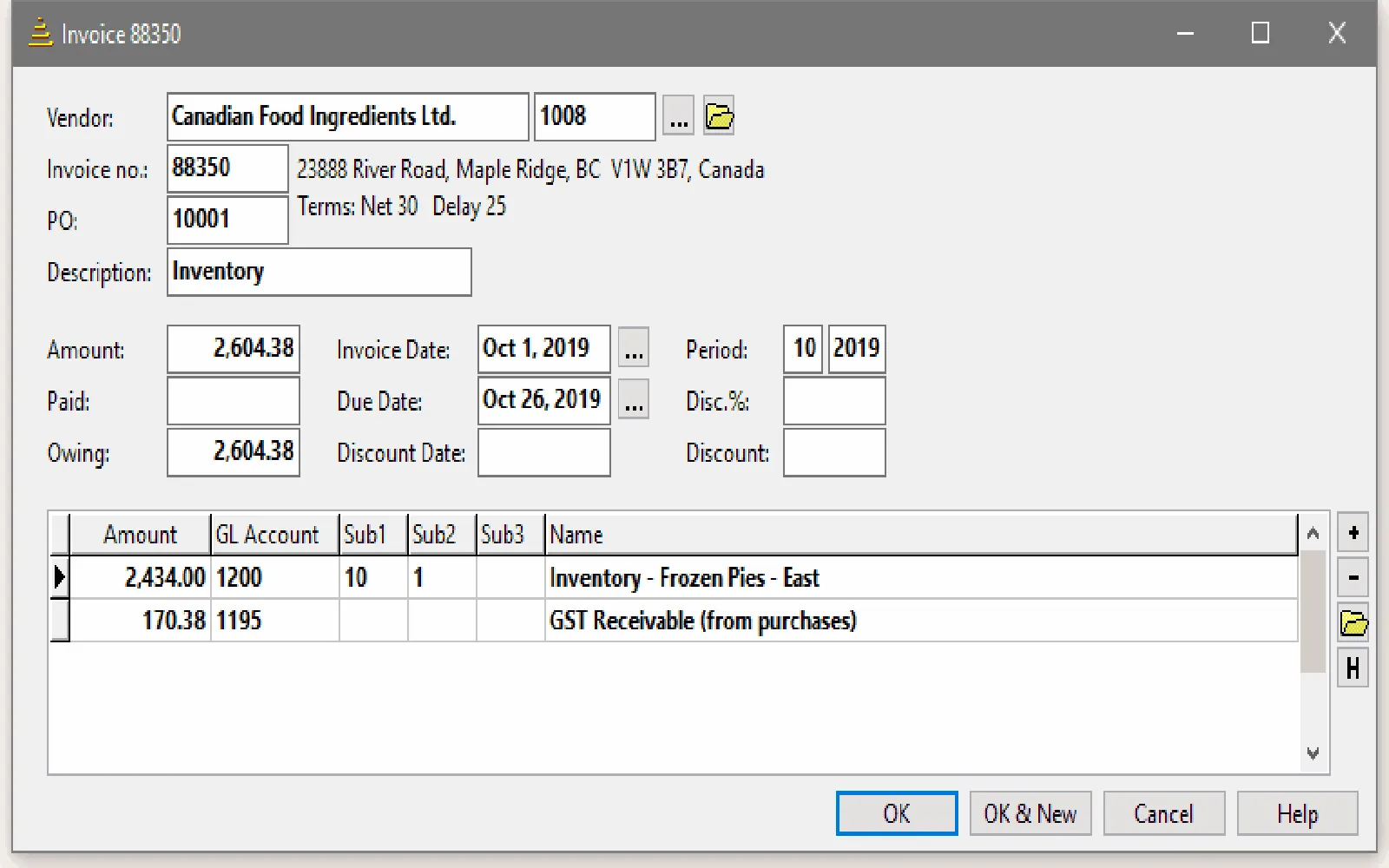

Streamline Your Finances: The Ultimate Guide to Accounts Payable Software

Top Trends in Bank Accounts for 2025: What You Need to Know

Top 10 Credit Score Improvement Tips for 2025: Boost Your Financial Health Today!