Streamline Your Finances: The Ultimate Guide to Accounts Payable Software

Understanding Accounts Payable Software

Accounts payable software is a digital tool that helps businesses manage their outstanding bills and payments to suppliers or vendors. By automating the accounts payable process, companies can not only save time but also reduce errors associated with manual data entry. The primary functions of accounts payable software include invoice processing, payment approvals, tracking expenses, and generating reports for better financial visibility.

Benefits of Using Accounts Payable Software

Implementing accounts payable software offers numerous advantages that can significantly streamline your financial operations. Here are some key benefits:

- Improved Efficiency: Automation helps speed up the invoice processing time, allowing businesses to pay their vendors on time and avoid late fees.

- Reduced Errors: Manual data entry can lead to mistakes that may cost your business money. Accounts payable software minimizes these risks by automating calculations and data entry.

- Better Cash Flow Management: With improved visibility into pending payments and due dates, businesses can plan their cash flow more effectively, ensuring they have the funds available when needed.

- Enhanced Compliance: Many accounts payable solutions come with built-in compliance features, helping businesses adhere to regulatory requirements and maintain accurate records.

- Cost Savings: By reducing the time and resources spent on manual processes, businesses can save significantly on operational costs.

Key Features to Look for in Accounts Payable Software

When selecting accounts payable software, it’s essential to consider the features that will best suit your business needs. Here are some critical functionalities to look out for:

- Invoice Management: The software should provide tools to automate invoice capture, approval workflows, and payment processing.

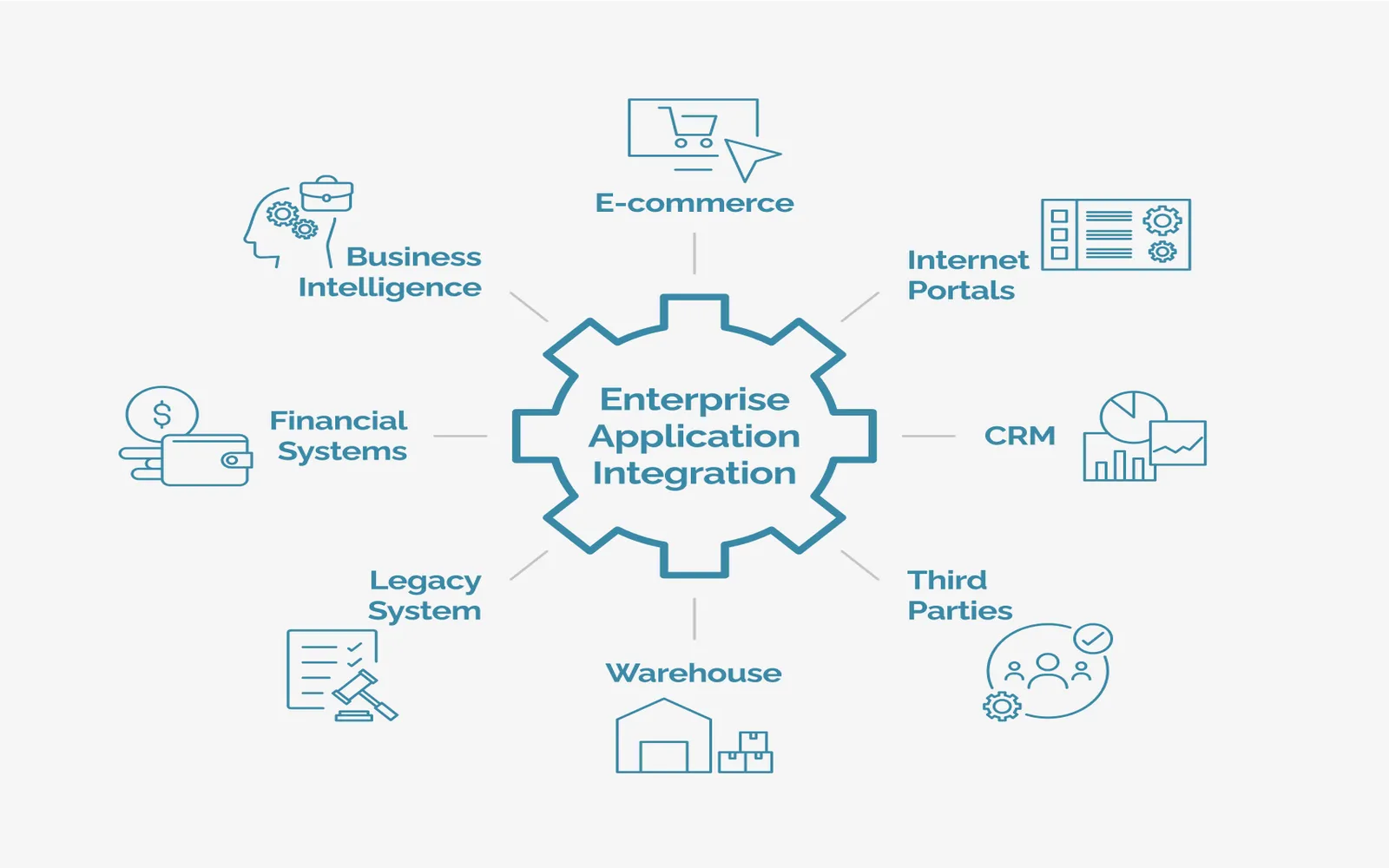

- Integration Capabilities: The accounts payable software should seamlessly integrate with your existing accounting and ERP systems to ensure a smooth flow of information.

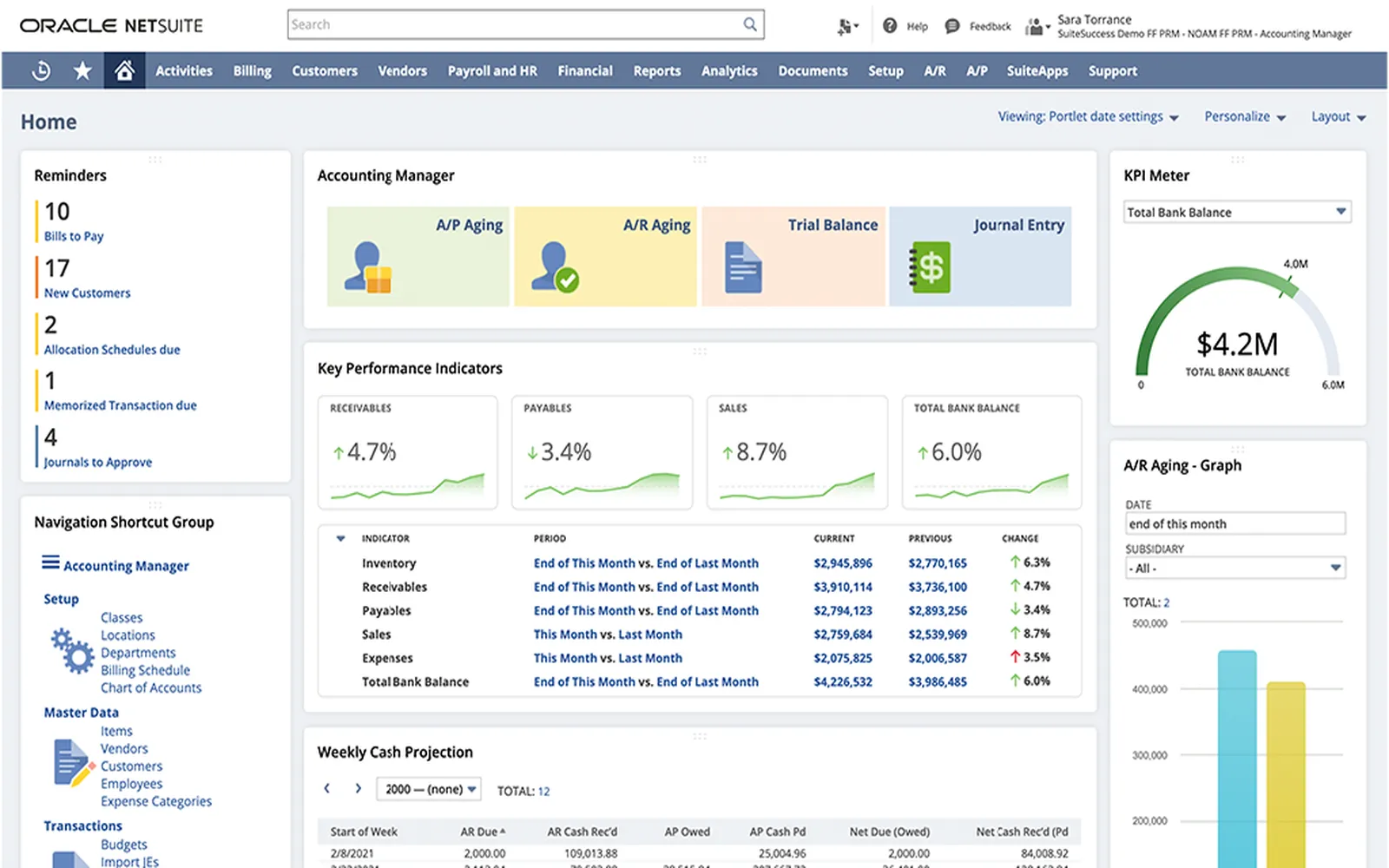

- Reporting and Analytics: Look for software that offers robust reporting features, enabling you to analyze spending patterns and vendor performance.

- Mobile Access: Many businesses benefit from mobile capabilities that allow users to manage invoices and approvals on the go.

- Security Features: Strong security protocols are vital to protect sensitive financial information and prevent unauthorized access.

Implementing Accounts Payable Software: A Step-by-Step Guide

Implementing accounts payable software can be a significant undertaking, but with a structured approach, it can be done effectively. Here’s a step-by-step guide to help you through the process:

1. Assess Your Needs

Start by evaluating your current accounts payable processes and identifying pain points. Determine what features are most important for your business and set clear objectives for what you hope to achieve with the new software.

2. Research Software Options

Look for accounts payable software solutions that meet your criteria. Read reviews, seek recommendations, and compare pricing structures. Consider both cloud-based and on-premises options based on your business requirements.

3. Request Demos

Once you’ve narrowed down your options, request demos from vendors. This will give you a hands-on look at how the software works and whether it aligns with your needs.

4. Involve Stakeholders

Involve key stakeholders from your finance team and other departments that will be affected by the new system. Their input will help ensure the software meets the needs of all users.

5. Plan for Implementation

Develop a comprehensive implementation plan that includes timelines, training sessions, and data migration strategies. Ensure that everyone involved understands their roles during the transition.

6. Train Your Team

Provide thorough training for your finance team and any other employees who will use the software. This will help ease the transition and encourage adoption.

7. Monitor and Optimize

After the software is implemented, regularly monitor its performance and gather feedback from users. Continually optimize processes to maximize the benefits of the software.

Choosing the Right Accounts Payable Software for Your Business

Choosing the right accounts payable software is crucial for streamlining your finances. Consider factors such as your business size, industry, budget, and specific needs. Some popular accounts payable software options include:

- Bill.com: Known for its user-friendly interface and robust features, Bill.com is suitable for small to medium-sized businesses.

- Tipalti: This is ideal for companies with complex payment processes and multiple currencies.

- QuickBooks: A popular choice for small businesses, QuickBooks offers integrated accounts payable features within its accounting software.

- Xero: Xero provides an intuitive interface and is perfect for small businesses looking for an affordable solution.

Conclusion

In today’s fast-paced business environment, having an efficient accounts payable process is vital for maintaining healthy cash flow and ensuring timely payments. By adopting accounts payable software, you can streamline your financial operations, reduce errors, and gain better control over your expenses. With the right software in place, your business will not only save time and money but also position itself for sustainable growth.

Explore

Free Business Checking Accounts: A Smart Choice for Small Businesses

Top Fund Management Software and Tools to Streamline Your Investment Strategy in 2025

Top Payroll Services for Small Businesses in 2025: Streamline Your Payroll Process

Top 8 Tools to Streamline Your Ecommerce Operations

Tax-Advantaged Accounts: How They Can Boost Your Savings 2025

Top Business Checking Accounts in 2025: Maximize Your Financial Efficiency

Top Enterprise Applications to Streamline Business in 2025

Streamline Shipping with the Best Freight Forwarding Companies 2025