Top Payroll Services for Small Businesses in 2025: Streamline Your Payroll Process

Introduction

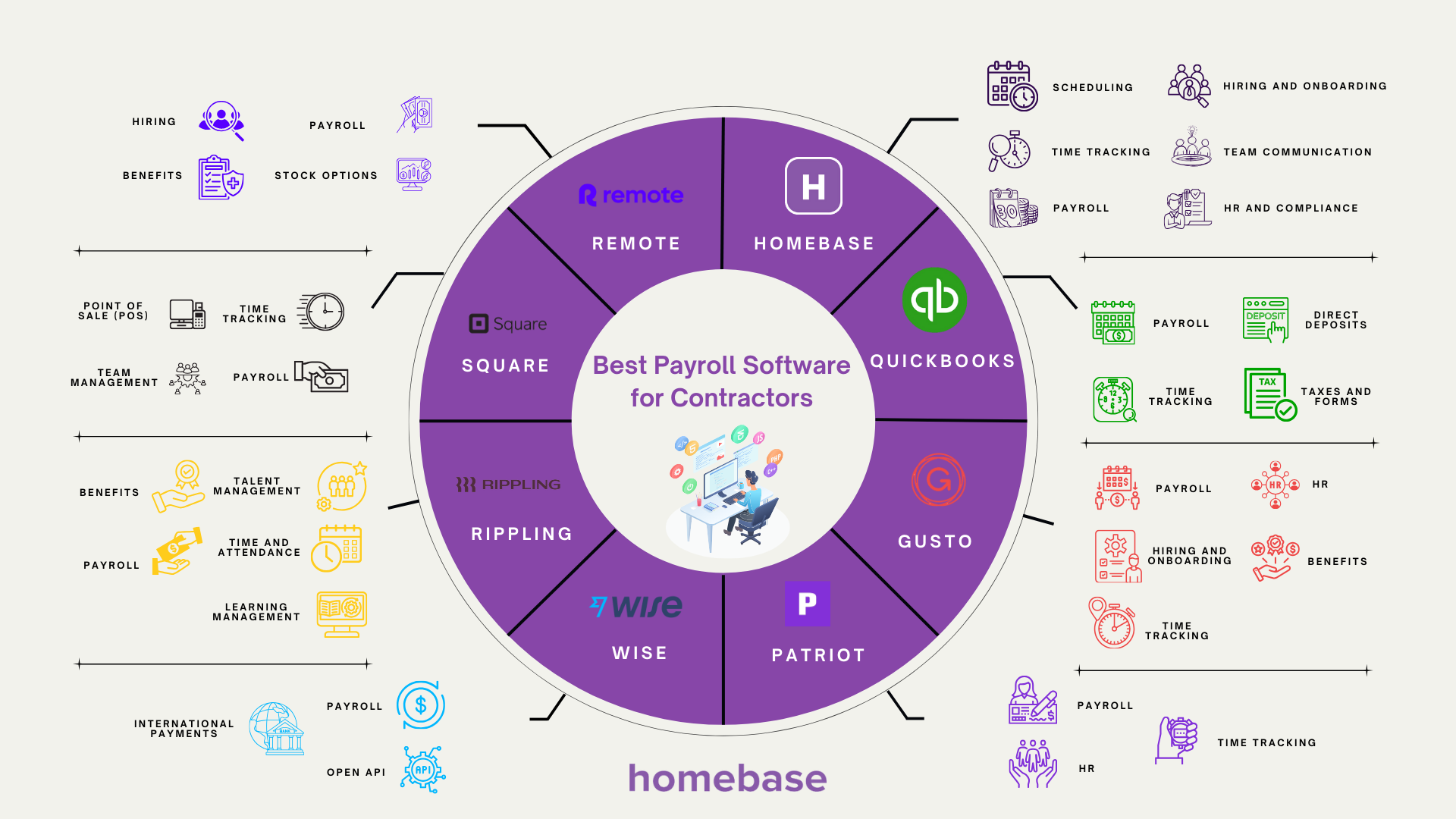

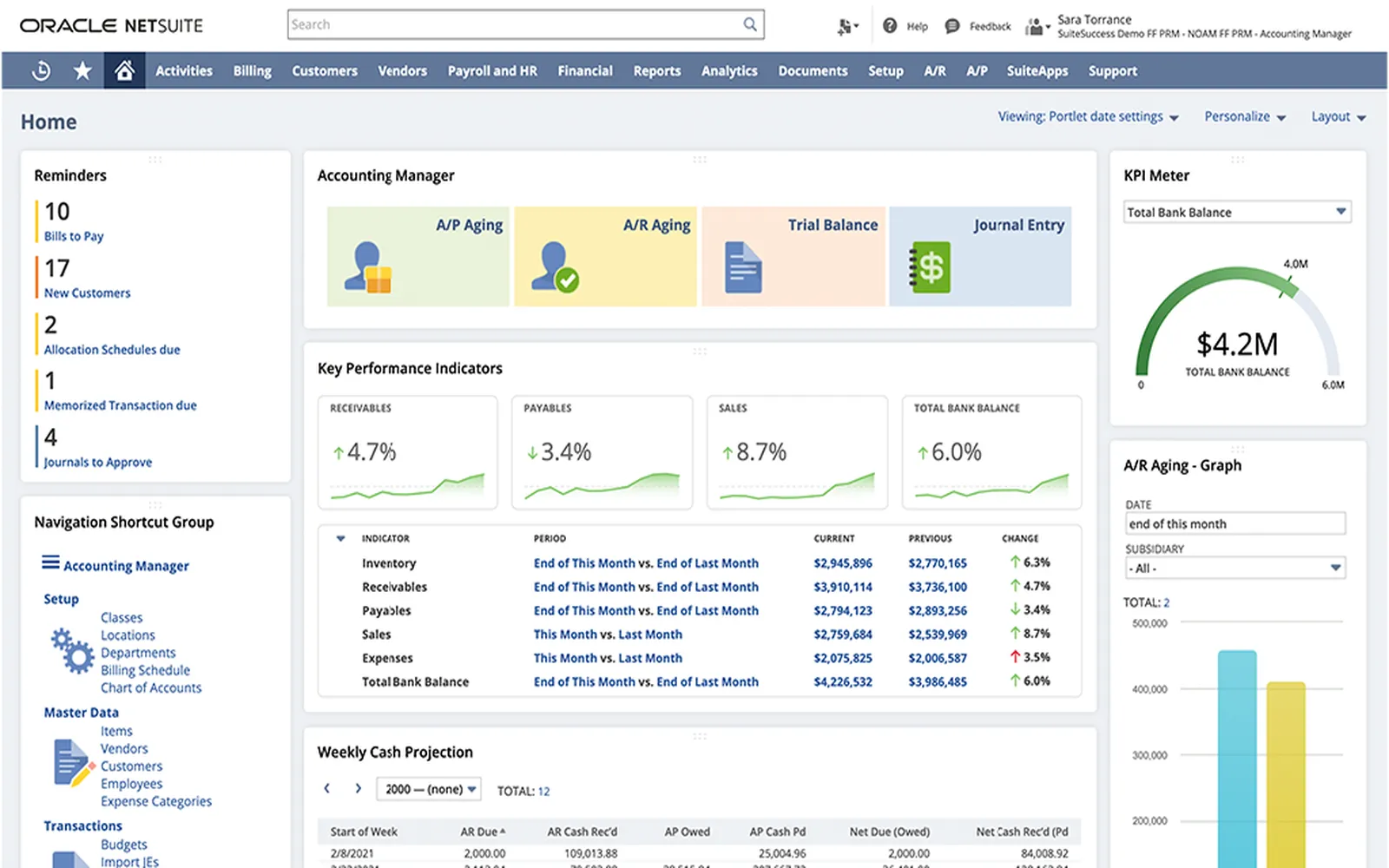

As small businesses navigate the complexities of managing their workforce, efficient payroll processing becomes crucial for success. With the rise of technology and shifting labor market dynamics, finding the right payroll service can significantly streamline operations, reduce errors, and ensure compliance with regulatory requirements. In 2025, small business owners have access to a variety of payroll services tailored to meet their specific needs. This article explores the top payroll services for small businesses in 2025, highlighting their features, benefits, and how they can help streamline your payroll process.

1. Gusto

Gusto remains a favorite among small businesses for its user-friendly interface and robust features. Designed specifically for small to medium-sized enterprises, Gusto offers an all-in-one platform that includes payroll processing, benefits management, and compliance assistance. In 2025, Gusto has enhanced its features to include automated tax calculations and filings, making it easier for business owners to stay compliant with federal and state regulations. Additionally, Gusto's mobile app allows employees to access pay stubs, manage benefits, and request time off, enhancing employee satisfaction and engagement.

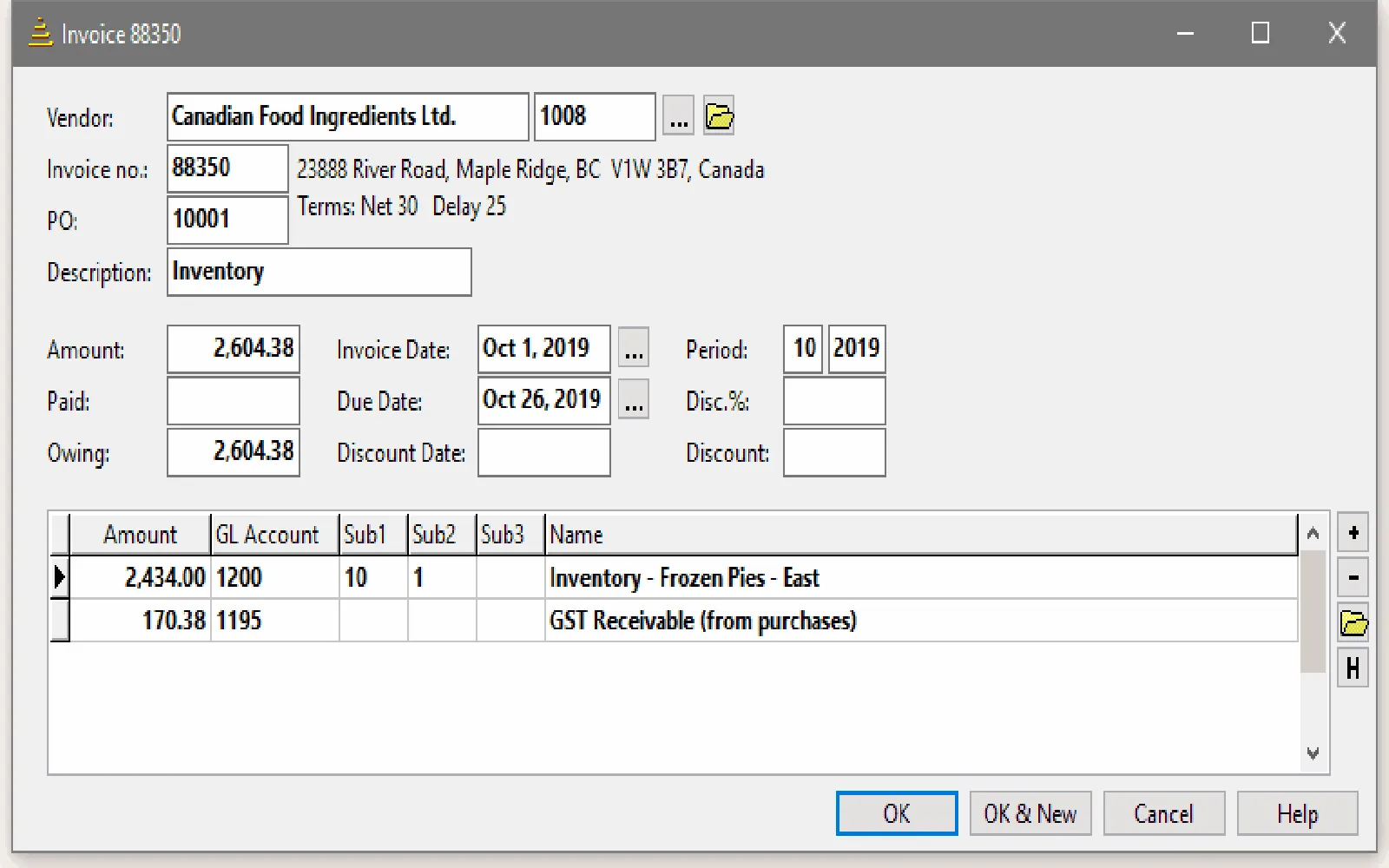

2. QuickBooks Payroll

QuickBooks Payroll continues to be a leading choice for small businesses, especially those already using QuickBooks for accounting. In 2025, the integration between QuickBooks Payroll and QuickBooks accounting software has become even more seamless, allowing for automatic syncing of payroll data with financial records. QuickBooks Payroll offers features such as direct deposit, tax calculations, and the ability to manage employee benefits. With its tiered pricing plans, businesses can choose a package that fits their budget and needs, making it an ideal solution for small businesses.

3. Paychex

Paychex is known for its comprehensive payroll services and exceptional customer support. In 2025, Paychex has expanded its offerings to include advanced HR tools, such as employee self-service portals and performance management systems. This makes it easier for small businesses to manage not only payroll but also other HR functions from one platform. Paychex's payroll solutions are particularly beneficial for businesses that need to handle complex payroll requirements, such as multiple pay rates or varying employee classifications. Their robust compliance features help protect small businesses from potential legal issues related to payroll.

4. ADP RUN

ADP has been a trusted name in payroll for decades, and its RUN platform is tailored for small businesses. In 2025, ADP RUN offers a range of features that include payroll processing, tax filing, and employee benefits management. One standout feature is the ability to customize payroll reports, giving business owners valuable insights into labor costs and employee performance. Moreover, ADP RUN has a dedicated support team available to assist users with any payroll-related queries, making it a reliable choice for small businesses seeking a comprehensive payroll solution.

5. Zenefits

Zenefits is an innovative payroll service that integrates HR and benefits management into one platform. In 2025, Zenefits has introduced AI-driven tools that help businesses optimize their payroll processes and manage employee benefits more effectively. The platform's user-friendly interface allows employees to easily access their payroll information and benefits, which can enhance employee retention. Zenefits also offers compliance assistance and resources, helping small businesses navigate the often-complicated landscape of employment laws and regulations.

6. Square Payroll

Square Payroll is an excellent option for small businesses that already use Square for payment processing. In 2025, Square Payroll has improved its integration capabilities, allowing businesses to easily sync sales data with payroll. This feature is particularly beneficial for businesses in retail and hospitality, where hours worked can fluctuate significantly. Square Payroll offers straightforward pricing with no hidden fees, making it easy for small business owners to understand their payroll costs. Additionally, Square Payroll provides features such as direct deposit, tax filings, and employee benefits management.

7. OnPay

OnPay is a payroll service that caters specifically to small businesses, offering a straightforward pricing model and easy-to-use platform. In 2025, OnPay has expanded its features to include multi-state payroll capabilities, making it ideal for businesses with employees in different states. OnPay provides unlimited payroll runs, tax filings, and employee self-service options, allowing employees to access their payroll information anytime. Its customer support is highly rated, providing small businesses with the assistance they need to manage their payroll effectively.

8. Payroll4Free

For small businesses on a tight budget, Payroll4Free offers a unique solution. In 2025, this free payroll service allows users to handle payroll for up to 25 employees without any cost. While it may not have all the bells and whistles of paid services, Payroll4Free provides essential features such as direct deposit, tax calculations, and basic reporting. This makes it an attractive option for startups and small businesses looking to save on payroll costs while still managing their payroll effectively.

9. Rippling

Rippling is an emerging player in the payroll service arena, known for its innovative approach to HR and payroll management. In 2025, Rippling offers a unique feature that allows businesses to manage all their employee data, including payroll, benefits, and devices, from a single platform. This integration simplifies the process for small businesses, reducing the time spent on administrative tasks. Rippling also provides automated compliance updates, ensuring that businesses remain compliant with ever-changing labor laws and regulations.

10. Paycor

Paycor is a payroll and HR software solution designed to help small businesses manage their workforce efficiently. In 2025, Paycor has enhanced its analytics capabilities, providing business owners with valuable insights into labor costs and employee performance. The platform offers features such as payroll processing, tax compliance, time tracking, and employee onboarding. Paycor's mobile app allows employees to access their payroll information and request time off, making it a convenient choice for small businesses seeking to improve employee engagement.

Conclusion

In 2025, small businesses have access to a diverse range of payroll services that can streamline their payroll processes and help them focus on growth. Whether you prefer an all-in-one solution like Gusto or QuickBooks Payroll, or a more specialized service like Zenefits or Rippling, there are options available to meet your specific needs. By investing in a reliable payroll service, small business owners can save time, reduce errors, and ensure compliance, allowing them to concentrate on what truly matters: growing their business and supporting their employees.

Choosing the Right Payroll Service

When selecting a payroll service, small business owners should consider several factors, such as cost, features, ease of use, and customer support. It's important to assess your business's unique needs and choose a service that aligns with your operational requirements. Additionally, many payroll services offer free trials or demos, allowing you to explore their features and functionalities before making a commitment.

The Future of Payroll Services

As technology continues to evolve, payroll services will likely incorporate more advanced features, such as artificial intelligence and machine learning, to further streamline processes and improve accuracy. In the coming years, we can expect to see more automation in payroll processing, allowing small businesses to reduce manual tasks and focus on strategic initiatives. Furthermore, the integration of payroll services with other business software will become more common, creating a more cohesive experience for business owners and employees alike.

Final Thoughts

In an ever-changing business landscape, small businesses must adapt to new tools and technologies to remain competitive. Payroll services have become an essential component of this transformation, offering solutions that simplify payroll management and enhance overall efficiency. By choosing the right payroll service in 2025, small business owners can streamline their payroll processes, mitigate risks, and ultimately position their businesses for long-term success.

Explore

1099 Payroll Solutions: Streamlining Freelance and Contractor Payments

Top Accounting Software for Startups in 2025: Boost Your Business Efficiency

HR Compliance Tools for Modern Workplaces

Top HR Services for Small Businesses in 2025: Boost Your Workforce Efficiency and Growth

College Admission Services: Help with the College Application Process

Top Fund Management Software and Tools to Streamline Your Investment Strategy in 2025

Streamline Your Finances: The Ultimate Guide to Accounts Payable Software

Top 8 Tools to Streamline Your Ecommerce Operations