1099 Payroll Solutions: Streamlining Freelance and Contractor Payments

In today's workforce, many businesses rely on 1099 workers—freelancers, independent contractors, or consultants. Unlike traditional W-2 employees, 1099 workers are self-employed and require a different set of payroll practices. Managing 1099 payroll can be tricky, but the right solutions make it easier for businesses to stay compliant and ensure timely, accurate payments.

What Are 1099 Workers?

A 1099 worker refers to a person who is not an employee of a company but provides services for them. These workers are paid on a per-project or hourly basis and are responsible for their own taxes. Businesses must report these payments using IRS Form 1099-NEC.

Why Use 1099 Payroll Solutions?

Managing 1099 workers requires a unique approach to payroll since businesses don’t withhold taxes for independent contractors. Effective 1099 payroll solutions help businesses:

- Stay compliant with tax laws

- Simplify payment processing

- Automate reporting and filing

- Avoid penalties for incorrect 1099 filings

Key Features of 1099 Payroll Solutions

✅ Automated Tax Calculations

These solutions ensure businesses don’t accidentally withhold or miscalculate taxes. Some tools can also help contractors set aside their taxes, sending reminders for estimated payments.

✅ E-Filing of 1099 Forms

Many 1099 payroll platforms offer direct e-filing of 1099-NEC forms to the IRS, reducing the chances of mistakes and late filings.

✅ Payment Flexibility

Whether paying hourly rates or per-project amounts, payroll solutions for 1099 contractors often support multiple payment methods—direct deposit, checks, or even PayPal.

✅ Compliance with Local and Federal Laws

These tools stay updated on local and federal tax regulations, ensuring that 1099 contractors and freelancers are paid in compliance with the latest legal requirements.

✅ Contractor Self-Service Portal

Many platforms allow contractors to access their payment history, tax documents, and submit invoices, offering transparency and reducing administrative tasks for employers.

Top 1099 Payroll Solutions

| Tool | Key Features | Best For |

|---|---|---|

| Gusto | Automated 1099 filings, integrated payroll, compliance alerts | Small businesses with 1099 contractors |

| QuickBooks Payroll | 1099 tax calculations, e-filing, easy invoice management | Businesses using QuickBooks for accounting |

| Paychex | 1099 contractor management, direct deposit, payroll reports | Larger companies with mixed employee/contractor models |

| OnPay | 1099 and W-2 payroll, tax filing, simplified reporting | Growing small businesses with contractors |

| Square Payroll | Self-service for contractors, 1099-NEC filing, tax calculations | Small businesses and gig-based companies |

Benefits of Using 1099 Payroll Solutions

⏱️ Saves Time

- Automates manual tasks like invoicing, tax calculations, and 1099 form filing.

💡 Enhances Accuracy

- Reduces errors in tax calculations and form submissions, minimizing IRS penalties.

🛡️ Ensures Compliance

- Stay on top of local, state, and federal regulations, making sure all payments and paperwork are up to date.

🚀 Improves Contractor Experience

- Provide 1099 contractors with easy access to payment details and tax documents, fostering a positive working relationship.

How to Choose the Right 1099 Payroll Solution

When selecting a 1099 payroll solution for your business, consider:

- Number of contractors: Some platforms are ideal for small businesses, while others cater to larger workforces.

- Integration: Make sure the solution integrates with your accounting software.

- Features: Evaluate the level of automation, tax support, and document filing the platform offers.

- Cost: Determine the right balance of features and cost for your budget.

Final Thoughts

For businesses working with 1099 contractors, leveraging a payroll solution designed for freelance and contractor payments simplifies your accounting, tax filing, and reporting processes. By investing in a reliable platform, you ensure timely payments, tax compliance, and a smoother business operation for both you and your independent workforce.

Explore

Top 10 Accounting Software for Freelancers in 2025: Boost Your Business Efficiency

Top Payroll Services for Small Businesses in 2025: Streamline Your Payroll Process

Virtual Cards: Revolutionizing Business Payments

Finding the Best Home Improvement Contractor for Your Project

Revolutionize Your Business with Employee Management Software: A Complete Guide to Streamlining Operations and Improving Productivity

Client Onboarding Software: Streamlining the Client Journey

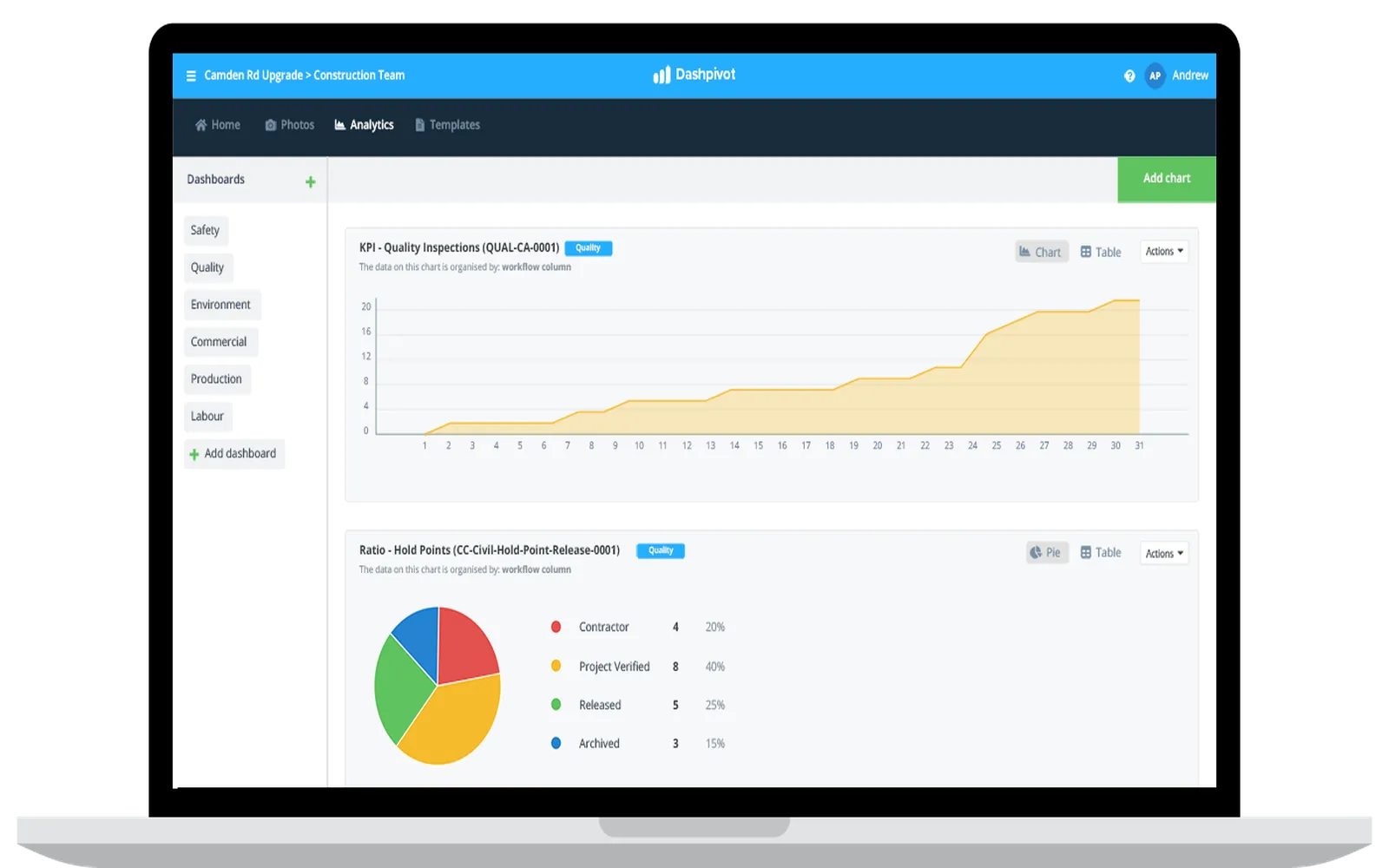

Streamlining Success: How QMS Software Empowers Small Businesses to Thrive

Cloud Management: Essential Guide to Streamlining Your Cloud Infrastructure