Virtual Cards: Revolutionizing Business Payments

In today's digital world, virtual cards have become an essential tool for businesses looking to streamline payments, enhance security, and simplify financial processes. Whether for purchasing software, paying for subscriptions, or managing travel expenses, virtual cards offer a convenient and efficient solution. Here’s why virtual cards are transforming business payment systems.

What Are Virtual Cards?

A virtual card is a digital version of a physical debit or credit card. It’s issued by a bank or financial institution and can be used for online purchases or recurring payments. Unlike traditional cards, virtual cards don’t have a physical form and are typically used for specific transactions rather than general everyday spending.

Key Features of Virtual Cards:

- Instant issuance: Virtual cards are issued immediately, allowing businesses to make purchases as soon as they need them.

- Customizable limits: Businesses can set spending limits and expiration dates for each virtual card, providing greater control over expenditures.

- No physical card: There is no need for a physical card, making virtual cards ideal for online transactions and e-commerce purchases.

Benefits of Virtual Cards for Businesses

Virtual cards offer a variety of benefits that help businesses improve efficiency, security, and cost control. Here’s a closer look at the advantages:

1. Enhanced Security

- Reduced Risk of Fraud: Virtual cards are ideal for reducing the risk of credit card fraud since the card details are only valid for the specific transaction or merchant. This minimizes exposure and prevents unauthorized usage.

- Unique Card Details: Each virtual card has unique numbers, making it harder for hackers to use or replicate the card information.

2. Streamlined Expense Management

- Simplified Payment Tracking: Virtual cards allow businesses to track each transaction easily. This makes it simpler to allocate expenses, monitor cash flow, and prepare reports for accounting.

- One-Time or Recurring Payments: Virtual cards can be assigned to a specific vendor for one-time payments or used for recurring subscriptions, like software licenses or cloud services, ensuring payments are consistently met without manual intervention.

3. Improved Cash Flow Management

- Spending Controls: Businesses can set custom limits on virtual cards, preventing overspending. This allows better budget management and control over company finances.

- Easy Fund Allocation: Virtual cards make it easy for businesses to assign funds to specific departments, projects, or employees, providing clear accountability and control over business expenses.

4. Flexibility and Convenience

- Global Transactions: Virtual cards can be used for international transactions, making them ideal for businesses with global operations.

- Instant Availability: Since virtual cards are issued instantly, there’s no need to wait for a physical card to arrive, allowing businesses to make purchases immediately.

5. Cost Savings

- No Physical Card Fees: Unlike traditional credit or debit cards, there are no fees for issuing physical cards. This can help businesses save money, especially for companies with a large number of employees who need cards for business expenses.

- Reduced Processing Fees: Some virtual card providers offer lower transaction fees compared to traditional card payment systems.

How Virtual Cards Are Used in Business

Virtual cards can be used for various purposes, making them versatile tools for businesses. Here are some common ways businesses utilize virtual cards:

- Vendor Payments: Virtual cards can be used to pay suppliers, contractors, or other vendors for services and goods. By creating a unique card for each vendor, businesses can track payments and prevent fraud.

- Travel Expenses: Businesses can issue virtual cards to employees for business travel expenses, ensuring clear limits and easy expense tracking.

- Software and Subscriptions: Many businesses rely on software as a service (SaaS) platforms. Virtual cards are a great way to manage and pay for recurring software subscriptions.

- Employee Expenses: Instead of issuing physical cards to employees for office supplies or client meals, businesses can use virtual cards to set specific spending limits and ensure purchases align with company policies.

How to Get Started with Virtual Cards

Getting started with virtual cards is straightforward. Here’s how you can implement them for your business:

- Choose a Provider: Many banks and financial institutions offer virtual card services. Some popular platforms include:Revolut for BusinessAirwallexDivvyBrexPleo

- Create Cards for Specific Uses: Once you’ve set up your account, you can generate virtual cards with specific limits for each purpose (e.g., employee travel, vendor payments, or subscriptions).

- Assign to Employees or Departments: Virtual cards can be assigned to employees or departments based on their needs. You can set individual limits, expiration dates, and usage restrictions to keep spending under control.

- Track and Report Transactions: Most virtual card providers offer integration with accounting software, making it easier to track and categorize each transaction.

Conclusion

Virtual cards are quickly becoming an essential tool for businesses looking to streamline payments, enhance security, and maintain tighter control over company expenses. By offering instant issuance, customizable limits, and enhanced security, virtual cards help businesses manage transactions more efficiently while minimizing risks associated with traditional card payments. Whether for paying vendors, managing employee expenses, or handling subscriptions, virtual cards are a cost-effective, flexible solution that businesses can rely on.

Explore

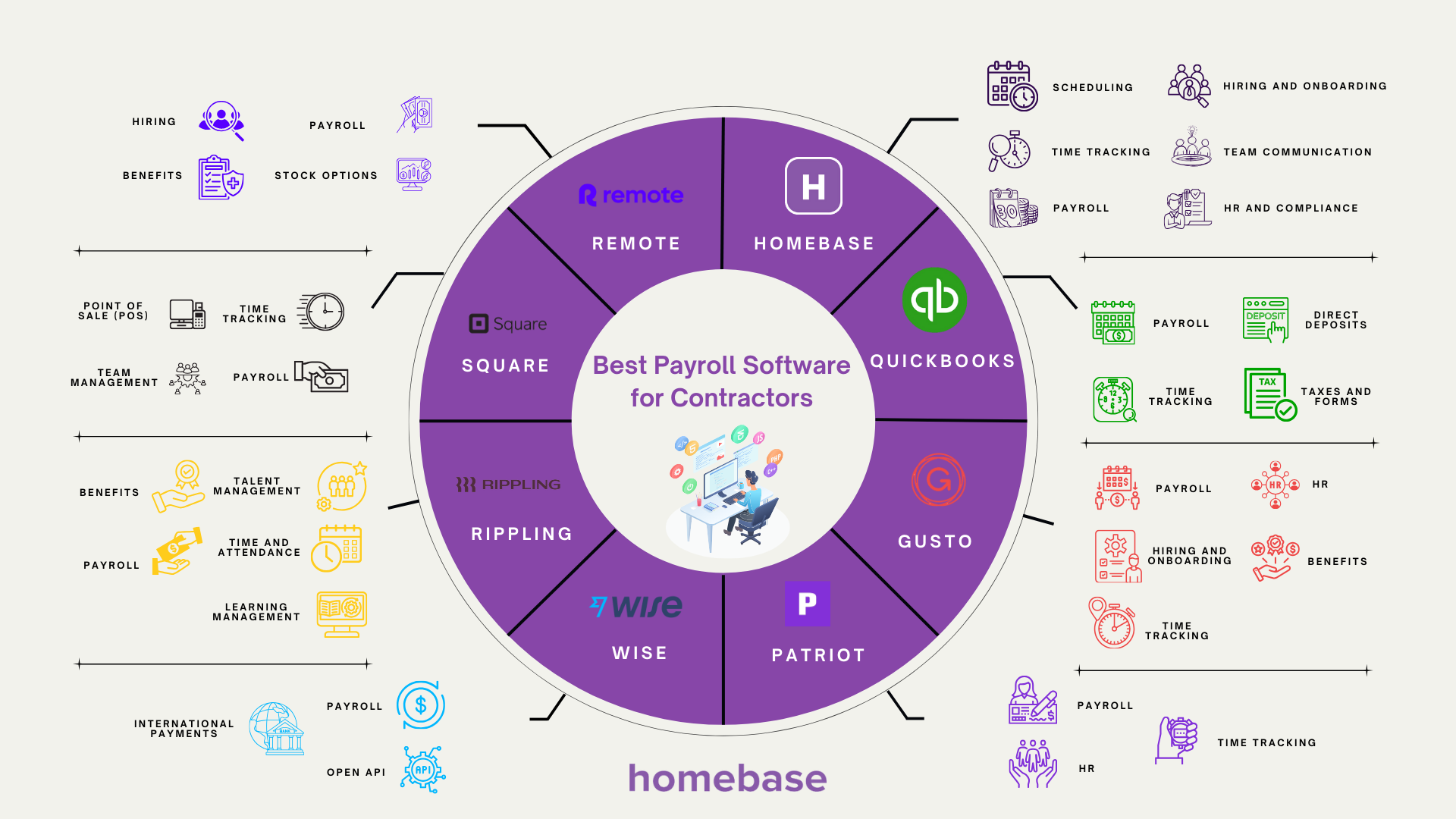

1099 Payroll Solutions: Streamlining Freelance and Contractor Payments

Top Virtual Meeting Software for Teams in 2025: Enhance Collaboration and Productivity

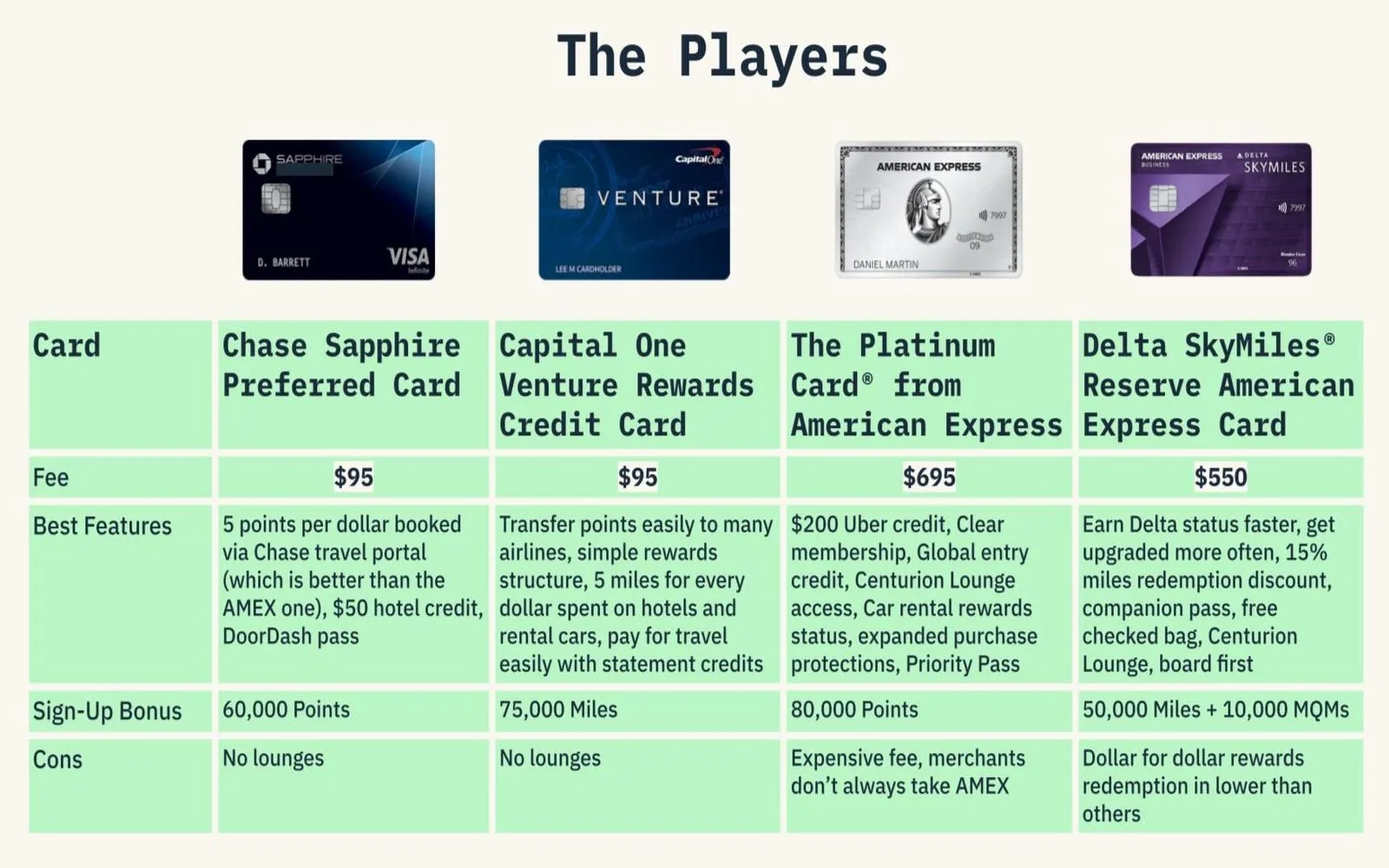

Top Small Business Credit Cards for Rewards in 2025: Maximize Your Earnings!

Maximize Your Savings in 2025: The Ultimate Guide to Amazon Credit Cards

Top 0% APR Balance Transfer Cards of 2025: Maximize Your Savings and Pay Off Debt Faster

Top Student Credit Cards for 2025: Unlock Financial Freedom and Build Credit Wisely

Top Rewards Credit Cards of 2025: Unlock Maximum Benefits and Cash Back

Top Travel Credit Cards for Rewards in 2025: Maximize Your Adventures!