Top Vacation Rental Insurance Options for 2025: Protect Your Investment and Enjoy Peace of Mind

Introduction

As the vacation rental market continues to flourish, property owners are increasingly aware of the need for comprehensive insurance coverage. With the rise in demand for short-term rentals, the potential for risks associated with hosting guests has also escalated. In 2025, selecting the right vacation rental insurance is more critical than ever. This article explores the top vacation rental insurance options available, helping property owners protect their investments and enjoy peace of mind.

Understanding Vacation Rental Insurance

Vacation rental insurance is specifically designed to cater to the unique risks associated with short-term rental properties. Unlike standard homeowner's insurance, which may not cover rental activities, vacation rental insurance provides tailored coverage that includes property damage, liability, and loss of income due to unforeseen events. In 2025, the options available have evolved, offering more flexibility and comprehensive protection than ever before.

Key Coverage Options

When considering vacation rental insurance, property owners should be aware of the key coverage options available:

- Property Damage Coverage: This coverage protects against damages caused by guests, including accidental damage or vandalism. Most policies will cover repair or replacement costs up to a specified limit.

- Liability Coverage: Liability insurance is crucial for protecting property owners from lawsuits due to guest injuries or property damage. This coverage typically includes legal fees and settlements.

- Loss of Income Coverage: If a property becomes uninhabitable due to a covered event, loss of income coverage compensates property owners for lost rental income during the repair period.

- Natural Disaster Coverage: Many policies offer specific coverage for natural disasters such as floods, earthquakes, or hurricanes. This is particularly important for properties in high-risk areas.

- Theft and Vandalism Protection: Coverage against theft or vandalism can help property owners recover losses if their rental is damaged or items are stolen by guests.

Top Vacation Rental Insurance Options for 2025

With a clear understanding of the essential coverage options, let’s explore some of the top vacation rental insurance providers in 2025.

1. Proper Insurance

Proper Insurance has emerged as a leading choice for vacation rental insurance in 2025. They specialize in providing comprehensive coverage tailored to short-term rental properties. Their policies include property damage, liability, and loss of income coverage. Additionally, Proper Insurance offers a unique feature: coverage for host liability, protecting property owners against claims that arise from rental activities.

2. CBIZ Vacation Rental Insurance

CBIZ offers a robust vacation rental insurance program designed specifically for property owners. Their policies include coverage for property damage, liability, and loss of income. CBIZ is known for its exceptional customer service and claims support, ensuring that property owners have assistance when they need it most. Their customizable options allow owners to select the coverage limits that best fit their needs.

3. Allstate

Allstate is a well-known name in the insurance industry and offers vacation rental insurance as part of its comprehensive homeowner’s insurance policies. With options for added liability coverage and protection against rental-related incidents, Allstate provides peace of mind for property owners. Their established reputation and extensive network of agents make it easy for owners to obtain advice and support.

4. Slice Insurance

Slice Insurance stands out for its innovative approach to vacation rental insurance. Their on-demand coverage allows property owners to purchase insurance for specific rental periods, making it ideal for those who may not rent year-round. This flexibility is particularly appealing for seasonal property owners. Slice’s policies cover property damage, liability, and even accidental damage caused by guests.

5. Airbnb Host Protection Insurance

For those who list their properties on Airbnb, the platform offers Host Protection Insurance, which provides up to $1 million in liability coverage for hosts. While this coverage is beneficial, it’s essential for property owners to understand its limitations and consider additional coverage for property damage and loss of income. Airbnb’s insurance can serve as a supplementary option but may not be sufficient for all scenarios.

6. Assurant

Assurant is another reputable provider that offers vacation rental insurance tailored for short-term rentals. Their policies cover property damage, liability, and loss of income, along with options for additional coverage for specific risks. Assurant is known for its quick claims processing and excellent customer service, making it a popular choice among vacation rental owners.

7. State Farm

State Farm provides vacation rental insurance as part of its homeowner’s insurance offerings. This insurance can be customized to include coverage for property damage, liability, and loss of rental income. With a strong financial backing and a wide network of agents, State Farm ensures that property owners receive personalized service and support.

Factors to Consider When Choosing Insurance

When selecting vacation rental insurance, property owners should consider several factors to ensure they choose the right policy:

- Coverage Limits: Determine how much coverage you need based on the value of your property and potential liabilities. Choose a policy that offers sufficient limits to protect your investment.

- Premium Costs: Compare premiums from different providers to find a policy that fits your budget. Remember, the cheapest option may not always provide the best coverage.

- Deductibles: Review the deductible amounts associated with each policy. A lower deductible may mean higher premiums, while a higher deductible could save money but increase out-of-pocket costs in the event of a claim.

- Exclusions: Carefully read the policy exclusions to understand what is not covered. This will help you determine if you need additional coverage for specific risks.

- Customer Reviews: Research customer reviews and testimonials to gauge the insurer’s reputation. Look for feedback regarding claims processing, customer service, and overall satisfaction.

How to File a Claim

Filing a claim can be a daunting process, but knowing the steps can simplify it:

- Document the Incident: Take photos and gather relevant documentation regarding the damage or incident. This evidence will support your claim.

- Contact Your Insurer: Notify your insurance provider as soon as possible. Most companies have specific timelines for reporting claims.

- Submit a Claim Form: Fill out the necessary claim forms provided by your insurer. Be thorough and accurate in your descriptions.

- Follow Up: Keep in touch with your insurer to check on the status of your claim. Be prepared to provide additional information if requested.

Conclusion

As we move through 2025, vacation rental insurance remains a crucial aspect of property management for owners in the short-term rental market. By understanding the available coverage options and selecting the right policy, property owners can protect their investments and provide a safe environment for their guests. Whether opting for specialized providers like Proper Insurance and Slice Insurance or established names like Allstate and State Farm, the key is to ensure comprehensive coverage tailored to individual needs. With the right insurance in place, property owners can enjoy peace of mind, knowing they are protected against the unforeseen challenges of the vacation rental industry.

Explore

Top Renters Insurance of 2025: Comprehensive Coverage Options You Need

Affordable Travel Insurance Options for 2025: Your Guide to Budget-Friendly Protection

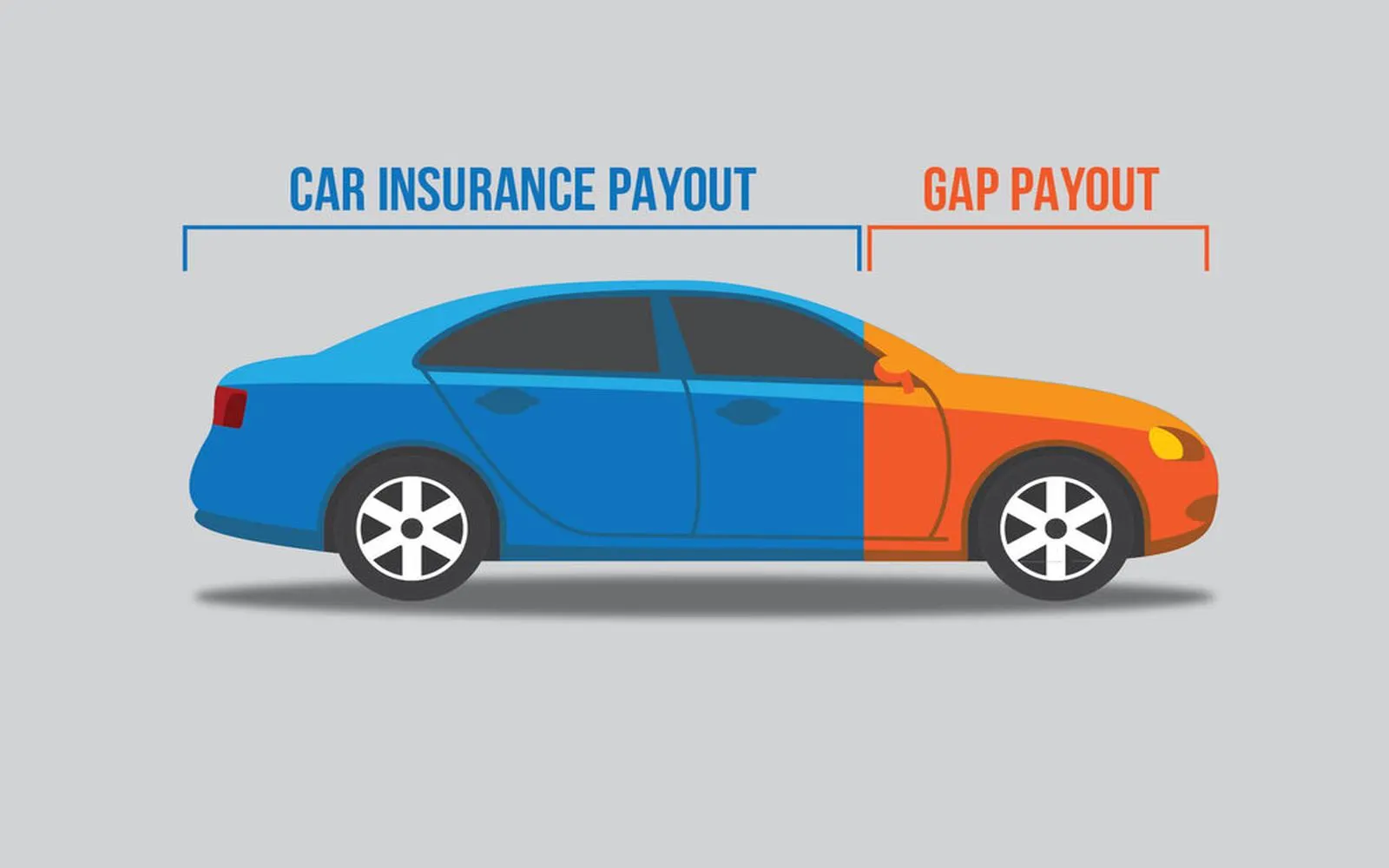

Unlocking Peace of Mind: The Essential Guide to Gap Insurance

Navigating Legal Waters: How Settlement Agreement Attorneys Can Secure Your Peace of Mind

Protect Your Company with the Best Farmers Insurance Options

2025 Car Rental Trends: Your Ultimate Guide to Affordable and Convenient Vehicle Rentals

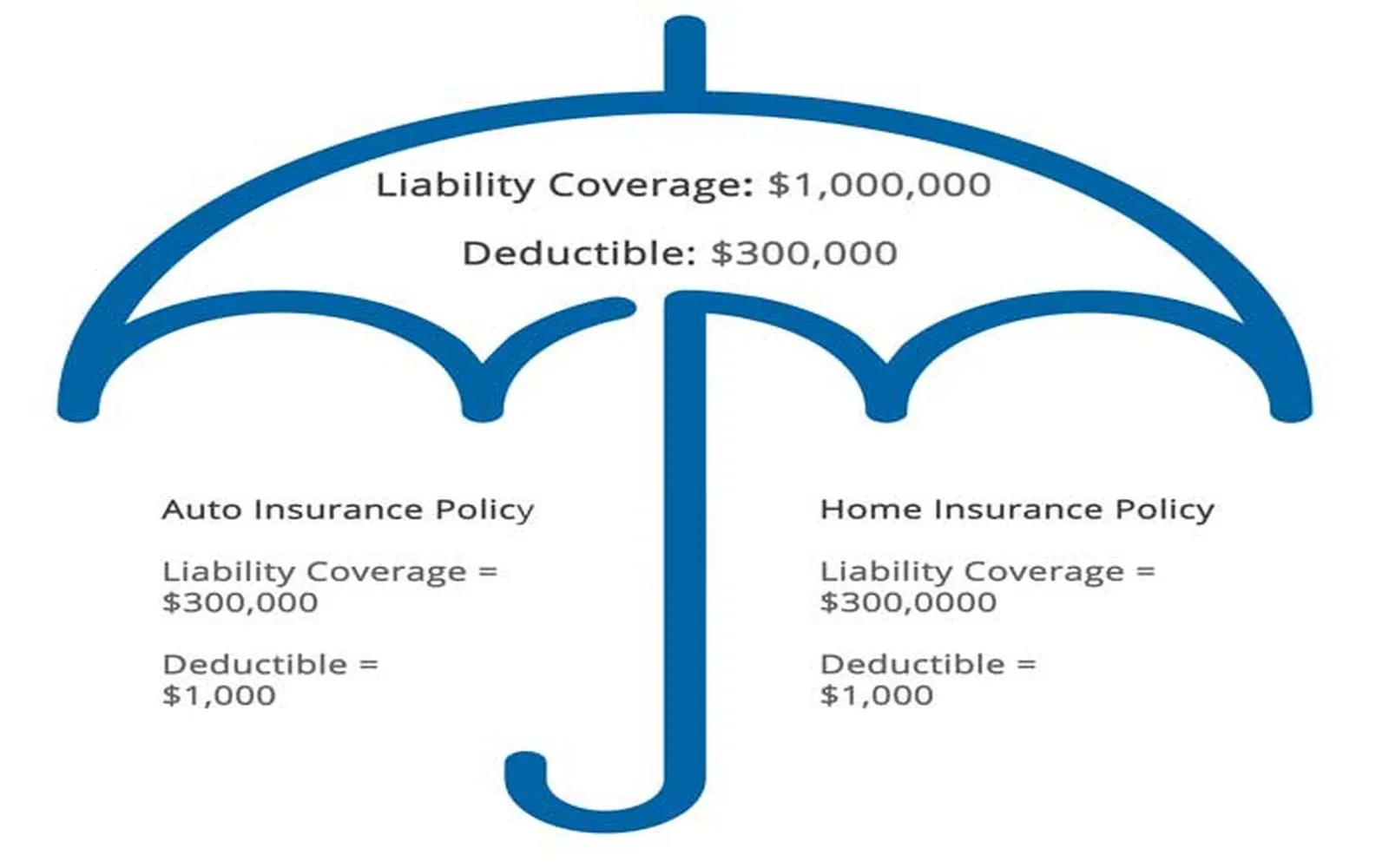

Top Umbrella Insurance Policies of 2025: Protect Your Assets and Future

Top International Travel Insurance Plans for 2025: Protect Your Adventures Abroad