Convenience at Your Fingertips: The Ultimate Guide to Online Payment Systems

In today's digital age, the need for convenient and secure payment methods has never been greater. Online payment systems have revolutionized the way we make transactions, offering a wide range of options to suit different needs and preferences. From e-wallets to mobile payment apps, there are numerous platforms available that allow users to make fast and hassle-free payments from the comfort of their own homes. In this ultimate guide to online payment systems, we will explore the various options available, compare their features and benefits, and provide tips for choosing the right system for your needs. Whether you're a business owner looking for a reliable payment solution or a consumer seeking a convenient way to make purchases online, this guide has got you covered.

Convenience at Your Fingertips: The Ultimate Guide to Online Payment Systems

With the advancement of technology and the proliferation of the internet, online payment systems have become an integral part of our daily lives. Whether you're shopping online, paying bills, or transferring money to friends and family, the ability to handle transactions with just a few clicks or taps has revolutionized personal finance. This ultimate guide will explore the various online payment systems available and how they can simplify your financial transactions.

Understanding Online Payment Systems

Online payment systems, also known as electronic payment systems, allow individuals and businesses to conduct financial transactions over the internet. These systems eliminate the need for physical cash or checks and offer a secure and convenient way to transfer money. The main types of online payment systems include:

- Credit and Debit Card Processing

- Digital Wallets

- Bank Transfers

- Peer-to-Peer Payment Platforms

Credit and Debit Card Processing

Credit and debit card processing is one of the most widely used forms of online payment. When making an online purchase, you can simply enter your card details, and the transaction is processed through a secure payment gateway. Most online retailers and service providers accept major credit and debit cards, which makes it easy to make purchases without physical cash.

Digital Wallets

Digital wallets, or e-wallets, are virtual accounts that store payment information for online transactions. Popular digital wallet providers include:

- PayPal

- Apple Pay

- Google Pay

- Venmo

These platforms allow you to make payments without repeatedly entering your card details. Many digital wallets also offer features like peer-to-peer payments, bill splitting, and rewards programs.

Bank Transfers

Bank transfers, also known as electronic funds transfers (EFT), let you move money from one bank account to another. This method is often used for large transactions or recurring payments such as rent or utilities. Bank transfers can be conducted through online banking or mobile banking apps, providing a secure and straightforward payment option.

Peer-to-Peer Payment Platforms

Peer-to-peer (P2P) payment platforms, such as:

- Venmo

- Cash App

- Zelle

allow users to send and receive money directly from their bank accounts or digital wallets. These platforms are ideal for splitting bills, paying friends, or making small transactions. Their popularity stems from their ease of use and the ability to transfer money instantly.

Benefits of Using Online Payment Systems

Online payment systems offer numerous advantages:

- Convenience: Make transactions from anywhere with an internet connection, eliminating the need for cash or checks. Whether you're at home, at work, or on the go, you can quickly and securely complete payments.

- Enhanced Security: Many online payment systems use advanced security features, such as encryption and fraud detection, to protect your financial information.

- Transaction Tracking: Online platforms often provide detailed transaction histories, spending reports, and budgeting tools, helping you monitor your finances more effectively.

- Business Efficiency: For businesses, online payment systems streamline the payment process, allowing for various payment methods and automating recurring transactions. This can improve cash flow, reduce administrative costs, and enhance customer satisfaction.

Choosing the Right Online Payment System

When selecting an online payment system, consider your specific needs and preferences:

- Frequency of Use: If you frequently shop online, a digital wallet with secure payment options and rewards might be ideal.

- Business Needs: For businesses, look for a payment gateway that integrates with your e-commerce platform and offers features like advanced reporting and invoicing.

- Fees: Compare transaction fees, currency conversion fees, and any additional charges associated with each payment system to find the best value.

- Security: Choose platforms with robust security measures, including encryption, two-factor authentication, and fraud detection, to safeguard your financial information.

Conclusion

Online payment systems have transformed the way we handle financial transactions, offering convenience and security. From shopping online and paying bills to transferring money to loved ones, the range of available systems caters to diverse needs. By understanding the different types of online payment systems and their benefits, you can select the best platform for your needs and enjoy a more streamlined and secure financial experience.

Explore

Telemedicine Services: Modern Healthcare at Your Fingertips

Home Warranty Insurance: Protecting Your Home's Systems and Appliances

The Evolution and Impact of Hotel Booking Systems on the Hospitality Industry

Mastering Your Income Tax: The Ultimate Guide to Online Advice

Maximize Your Savings in 2025: The Ultimate Guide to Amazon Credit Cards

Top Debt Consolidation Services of 2025: Your Ultimate Guide to Financial Freedom

Top 5 Cryptocurrencies to Invest in for 2025: Your Ultimate Guide to Future Success

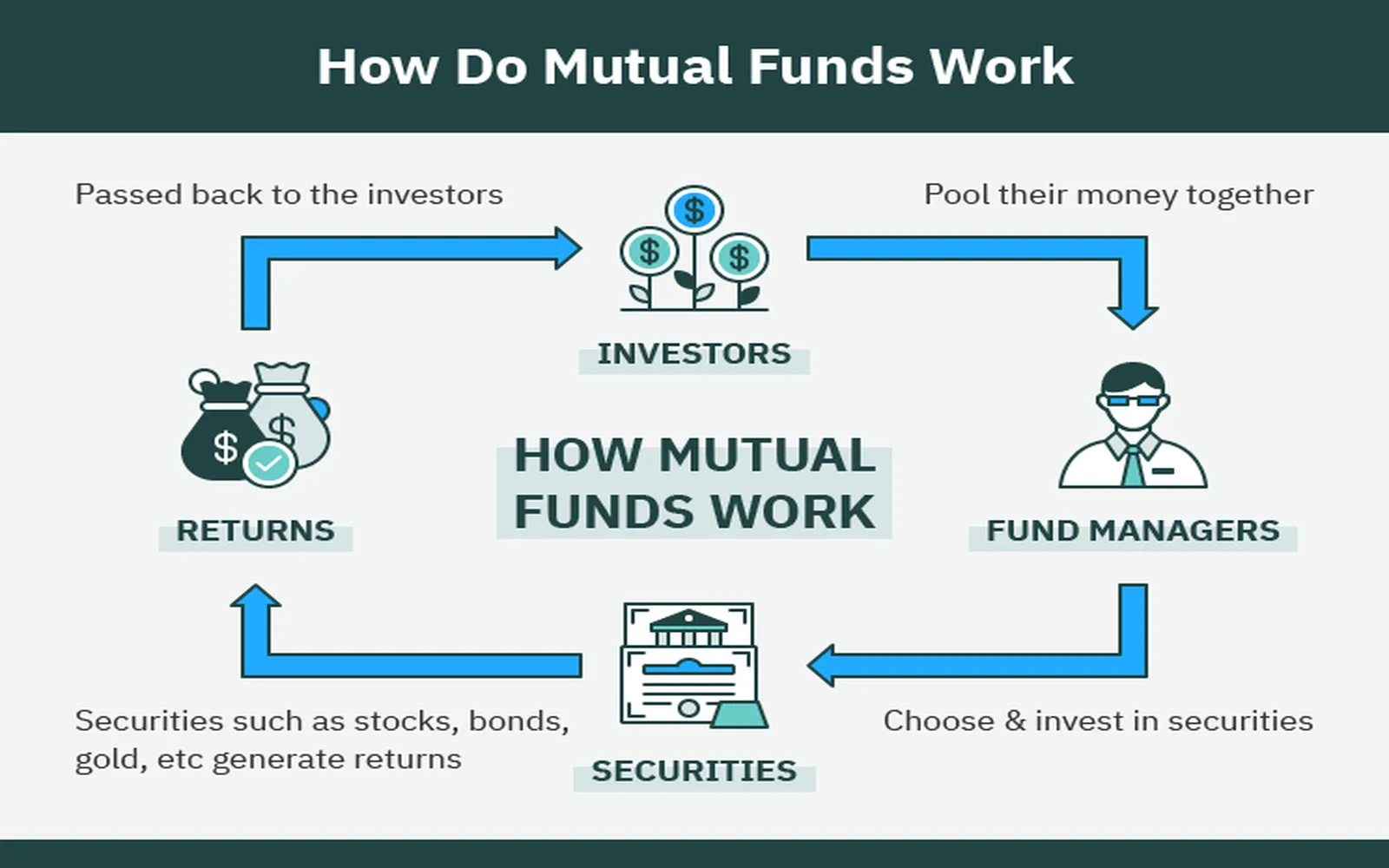

Your Ultimate Guide to Investing in Mutual Funds in 2025: Strategies for Success