Mastering Your Income Tax: The Ultimate Guide to Online Advice

Navigating the complex world of income tax can be a daunting task for many individuals. With constantly changing tax laws and regulations, it can be overwhelming to keep up with the latest information and ensure that you are maximizing your tax savings. Fortunately, there is a wealth of online advice and resources available to help you master your income tax. From expert blogs and forums to comprehensive tax preparation software, the internet offers a plethora of tools and guidance to assist you in understanding and managing your tax obligations. In this ultimate guide, we will explore the best online advice for mastering your income tax and provide tips for utilizing these resources to your advantage. Whether you are a tax novice or a seasoned pro, this guide will help you take control of your tax situation and make the most of your financial resources.

Understanding Your Income Tax

Income tax is a significant aspect of both personal and business finance. It is a tax levied by the government on individuals and businesses based on their income, and mastering it can greatly impact your financial health. The intricacies of tax laws and regulations can be overwhelming, but with the right guidance and resources, you can navigate your income tax obligations effectively. This article provides insights into how you can master your income tax and make informed financial decisions.

Educating Yourself on Income Tax

One of the most effective ways to manage your income tax is by educating yourself about the subject. Numerous online resources offer comprehensive guides and advice on income tax. These resources cover essential topics such as:

- Tax Deductions: Understanding what expenses you can deduct from your taxable income.

- Tax Credits: Identifying available credits that can reduce your tax liability.

- Filing Requirements: Learning about what is needed to file your taxes correctly.

- Tax Planning Strategies: Exploring ways to plan ahead to minimize your tax burden.

By taking the time to read and comprehend these resources, you can gain the knowledge needed to handle your income tax responsibilities with confidence.

Utilizing Online Tools and Calculators

Online tax tools and calculators are invaluable for managing your income tax. These tools can assist with:

- Estimating Tax Liability: Calculating how much you may owe in taxes.

- Calculating Deductions and Credits: Identifying potential deductions and credits to reduce your tax liability.

- Determining Refunds or Amounts Owed: Estimating your potential tax refund or the amount you may owe.

Additionally, many online platforms offer free tax filing services, making it easier to file your taxes accurately and on time. Leveraging these tools ensures that you make the most of your tax benefits and manage your income tax efficiently.

Seeking Professional Advice

While online resources are valuable, there are times when personalized advice from a tax professional is necessary. Certified tax experts can offer tailored guidance and address specific tax-related questions. Professional advice is particularly beneficial if you face complex tax situations or need clarity on particular tax issues. Engaging a tax professional can help you navigate the complexities of income tax and make well-informed decisions.

Staying Informed on Tax Law Changes

Tax laws and regulations are continually evolving, and staying informed about changes is crucial. Regular updates can be found through:

- Government Websites: Official sites provide updates on new tax laws and regulations.

- Tax Publications: Periodicals and guides offer detailed information on changes.

- Financial News Outlets: Media coverage on tax law changes can also be useful.

By keeping up-to-date with these changes, you can adjust your tax planning proactively and take advantage of new opportunities to reduce your tax liability.

Implementing Tax Planning Strategies

Effective tax planning is key to managing your income tax. Strategies you might consider include:

- Maximizing Deductions: Identifying all possible deductions to lower your taxable income.

- Contributing to Tax-Advantaged Accounts: Utilizing accounts such as IRAs or HSAs to benefit from tax advantages.

- Structuring Income: Planning how to receive income in a way that minimizes taxes.

Additionally, online resources provide guidance on long-term tax planning, including retirement, estate planning, and investment strategies that significantly impact your overall tax situation.

Conclusion

Mastering your income tax is an essential component of personal and business financial management. With a wealth of online resources at your disposal, you can educate yourself, use tax tools and calculators, seek professional advice, stay informed about tax law changes, and implement effective tax planning strategies. By taking advantage of these resources, you can enhance your financial well-being and manage your income tax responsibilities more effectively.

Explore

Essential Pet Care Advice for Every Owner

Best Passive Income Ideas to Grow Your Wealth in 2025

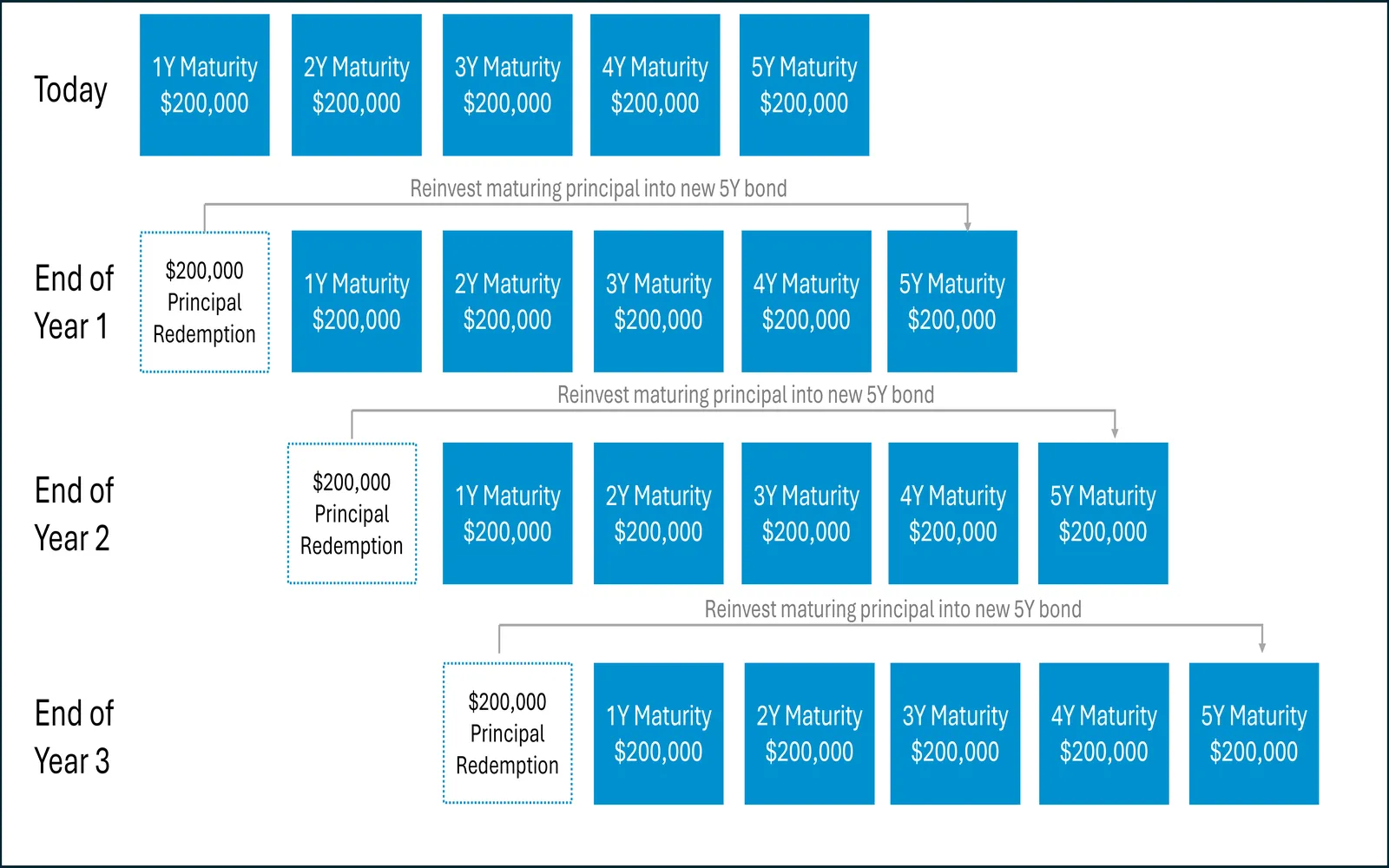

How to Use Bond Ladders for Stable Retirement Income in 2025

Mastering Evony: The Ultimate Game Guide to Conquer and Thrive

Mastering the Art of Driving: The Ultimate Guide to Manual Cars

Mastering Insurance Claims: A Comprehensive Guide to Navigating Your Coverage

Mastering Business Finance: Unlocking the Secrets to Financial Success

Tax-Efficient Investing 2025: Maximize Your Returns and Minimize Taxes