Explore Business Insurance Providers of 2025: Ensure Your Company’s Future Security

Introduction

In the rapidly evolving landscape of business, safeguarding your company's assets has never been more crucial. As we enter 2025, the importance of having robust insurance coverage cannot be overstated. With emerging risks and evolving regulations, finding the right insurance provider can help ensure the future security of your business. In this article, we will explore the top business insurance providers of 2025, highlighting their offerings, strengths, and what sets them apart in a competitive market.

The Importance of Business Insurance

Business insurance serves as a protective shield against unforeseen events that can disrupt operations, lead to financial losses, or damage reputation. From natural disasters to cyber-attacks, the risks businesses face are multifaceted. Business insurance can cover a range of needs, including general liability, property insurance, professional liability, and workers' compensation. Understanding the different types of coverage available is essential for making informed decisions that align with your company’s specific needs.

1. The Hartford

The Hartford has established itself as a leading provider of business insurance solutions. Known for its comprehensive range of policies, The Hartford offers coverage tailored to small and medium-sized enterprises (SMEs). Their offerings include general liability, property insurance, and specialized policies for various industries.

One of the standout features of The Hartford is its commitment to customer service. They provide extensive resources for policyholders, including risk management tools and advice on best practices for minimizing risks. The Hartford also offers a user-friendly online platform that simplifies the process of obtaining quotes and managing policies.

2. Chubb

Chubb is recognized for its exceptional coverage options and strong financial stability, making it a top choice for businesses across various sectors. With a focus on large enterprises and specialized industries, Chubb offers tailored solutions that address unique risks.

Chubb's key strengths lie in its extensive international reach and expertise in niche markets, such as technology, healthcare, and life sciences. Their global presence allows businesses with international operations to obtain comprehensive coverage tailored to their specific needs. Additionally, Chubb has a strong claims handling process, ensuring that policyholders receive timely and fair settlements.

3. Progressive Commercial

Progressive Commercial is well-known for its flexible and affordable commercial auto insurance, making it an ideal choice for businesses that rely on vehicles for their operations. Their coverage options extend beyond just auto insurance, with offerings that include general liability, property insurance, and workers' compensation.

What sets Progressive apart is its innovative approach to underwriting and pricing. Utilizing advanced technology, they can provide personalized quotes based on individual business needs and risk profiles. Their online platform also allows for easy policy management, making it convenient for business owners to stay organized and informed.

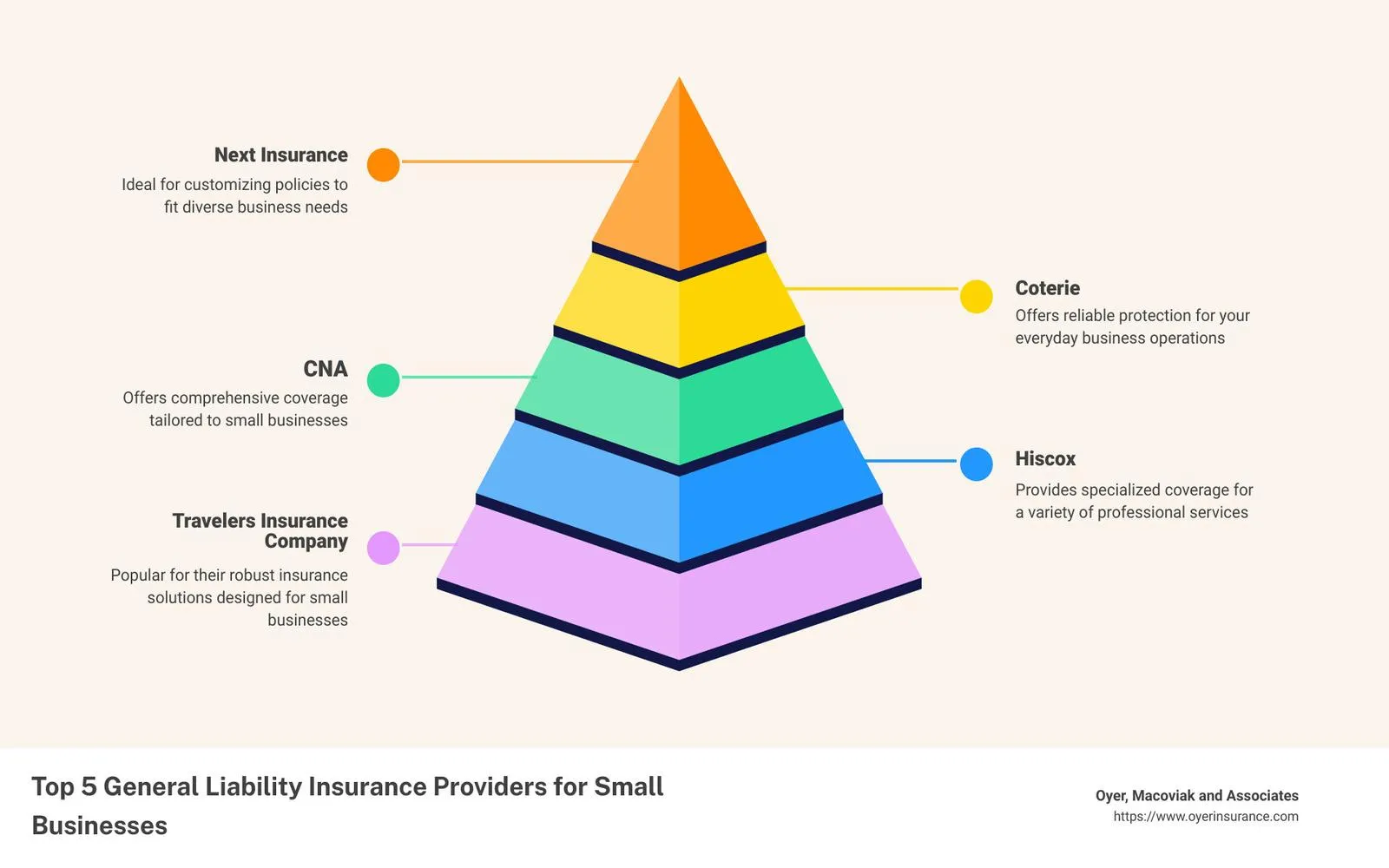

4. Hiscox

Hiscox specializes in providing insurance solutions for small businesses and professionals. Known for its tailored coverage options, Hiscox offers everything from general liability to professional indemnity insurance. They cater to a diverse range of industries, including IT, consulting, and construction.

One of the notable features of Hiscox is its commitment to supporting small business owners. Their online application process is straightforward, allowing businesses to obtain quotes quickly. Hiscox also offers risk management resources, helping policyholders to better understand their coverage and mitigate potential risks.

5. Nationwide

Nationwide is a well-established insurance provider that offers a comprehensive suite of business insurance products. Their range includes general liability, property insurance, and specialized coverage for various industries. Nationwide is particularly attractive to medium to large businesses due to its customizable policies and extensive network of agents.

One of the key advantages of choosing Nationwide is its financial stability and reputation for excellent customer service. They offer a range of risk management tools and resources to help businesses identify and mitigate risks. Additionally, Nationwide’s online platform provides easy access to policy management and claims tracking.

6. CNA

CNA is recognized for its strong focus on commercial insurance, offering a wide array of products designed for businesses of all sizes. Their coverage options include general liability, property, and specialty insurance tailored to specific industries such as construction, healthcare, and technology.

CNA is known for its expertise in underwriting and risk management, providing businesses with valuable insights to help them navigate potential challenges. Their claims support is another strong point, with dedicated professionals available to assist policyholders throughout the claims process.

7. Travelers

Travelers is one of the largest providers of business insurance in the United States, offering a broad spectrum of coverage options. Their products include general liability, property insurance, and specialized solutions for various sectors, including manufacturing and retail.

Travelers stands out for its commitment to innovation, utilizing technology to enhance the customer experience. Their risk management services are comprehensive, helping businesses assess and minimize risks effectively. Additionally, Travelers has a robust claims process, ensuring policyholders receive timely assistance when needed.

8. Zurich

Zurich is a global insurance provider with a strong focus on commercial insurance. They offer a range of products designed for businesses of all sizes, including general liability, property, and specialty insurance. Zurich is particularly well-regarded for its expertise in managing international risks, making it a top choice for companies with global operations.

One of Zurich’s strengths is its commitment to sustainability and corporate responsibility. They offer insurance solutions that support businesses in their sustainability efforts, including coverage for renewable energy projects. Their risk management resources also help businesses navigate complex regulatory environments and emerging risks.

9. AIG

AIG (American International Group) is another leading provider of business insurance, offering a comprehensive range of products tailored to various industries. Their offerings include general liability, property insurance, and specialty coverages such as cyber liability and directors and officers insurance.

AIG is recognized for its global reach and expertise in managing complex risks. They provide valuable resources and insights to help businesses identify and mitigate potential challenges. AIG’s claims handling process is also highly regarded, ensuring policyholders receive prompt and fair settlements.

10. Liberty Mutual

Liberty Mutual is a well-known name in the insurance industry, providing a wide array of business insurance products. Their offerings include general liability, property insurance, and workers' compensation, making them a one-stop-shop for many businesses.

Liberty Mutual stands out for its commitment to customer service and risk management. They offer various resources to help businesses assess their risks and implement effective safety measures. Additionally, Liberty Mutual's online platform provides easy access to policy management and claims tracking, enhancing the overall customer experience.

Choosing the Right Provider

With so many options available, choosing the right business insurance provider can be a daunting task. Here are some key factors to consider when evaluating potential providers:

- Coverage Options: Ensure the provider offers policies that align with your specific business needs.

- Financial Stability: Research the financial ratings of the provider to ensure they can meet their obligations.

- Customer Service: Consider the provider’s reputation for customer support, especially during the claims process.

- Risk Management Resources: Look for providers that offer additional resources to help you manage and mitigate risks.

- Ease of Use: Consider the user-friendliness of their online platforms for managing policies and claims.

Conclusion

As we move further into 2025, the importance of securing a solid insurance foundation for your business cannot be overstated. The top business insurance providers highlighted in this article offer a range of products and services designed to meet the diverse needs of businesses in today’s complex environment. By carefully evaluating your options and choosing a provider that aligns with your company's needs, you can ensure your business is well-protected against the uncertainties of the future.

Investing in the right business insurance not only secures your assets but also provides peace of mind, allowing you to focus on what matters most—growing your business and achieving your goals.

Explore

Top Business Insurance Providers of 2025: Secure Your Future with the Best Coverage Options

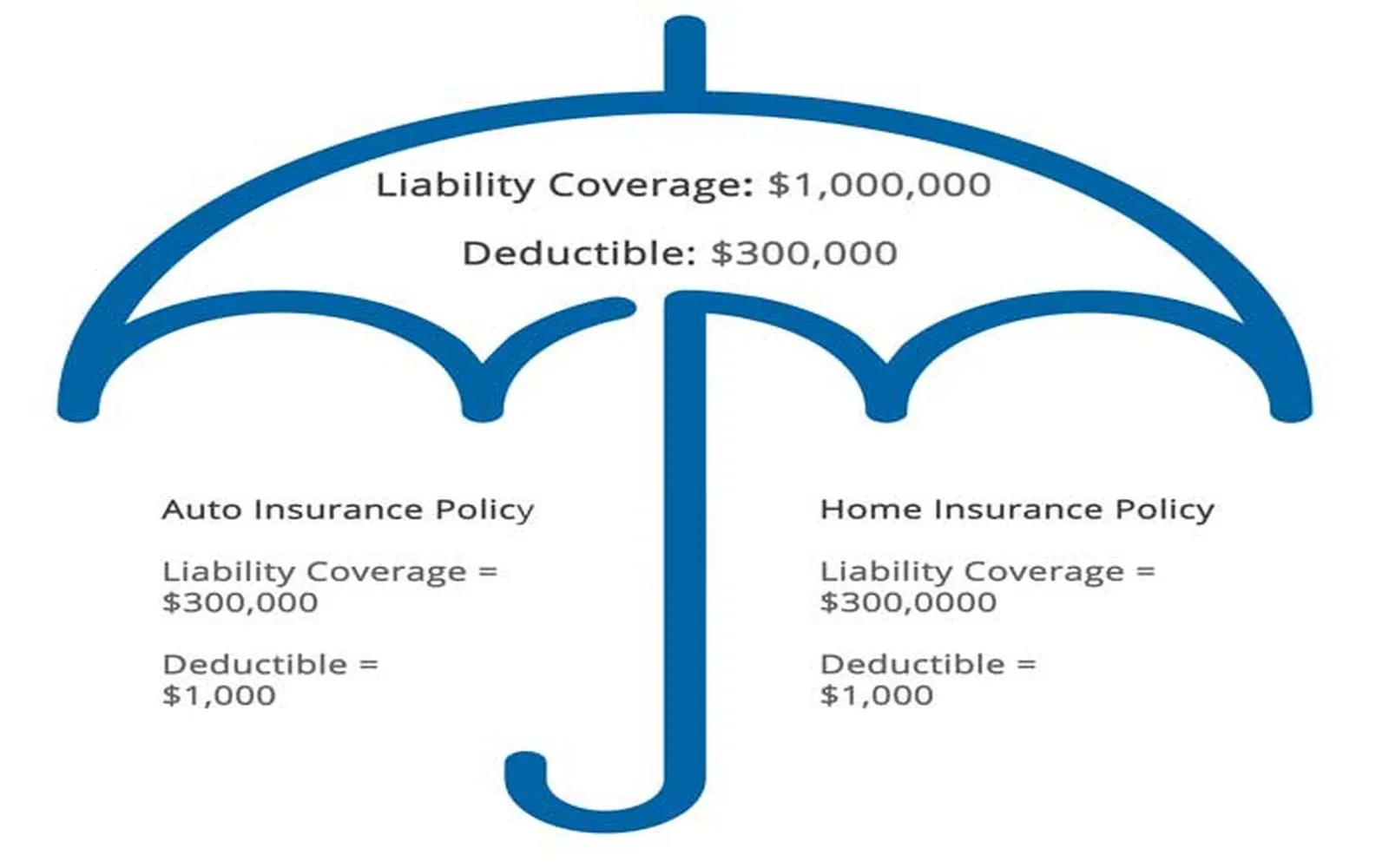

Top Umbrella Insurance Policies of 2025: Protect Your Assets and Future

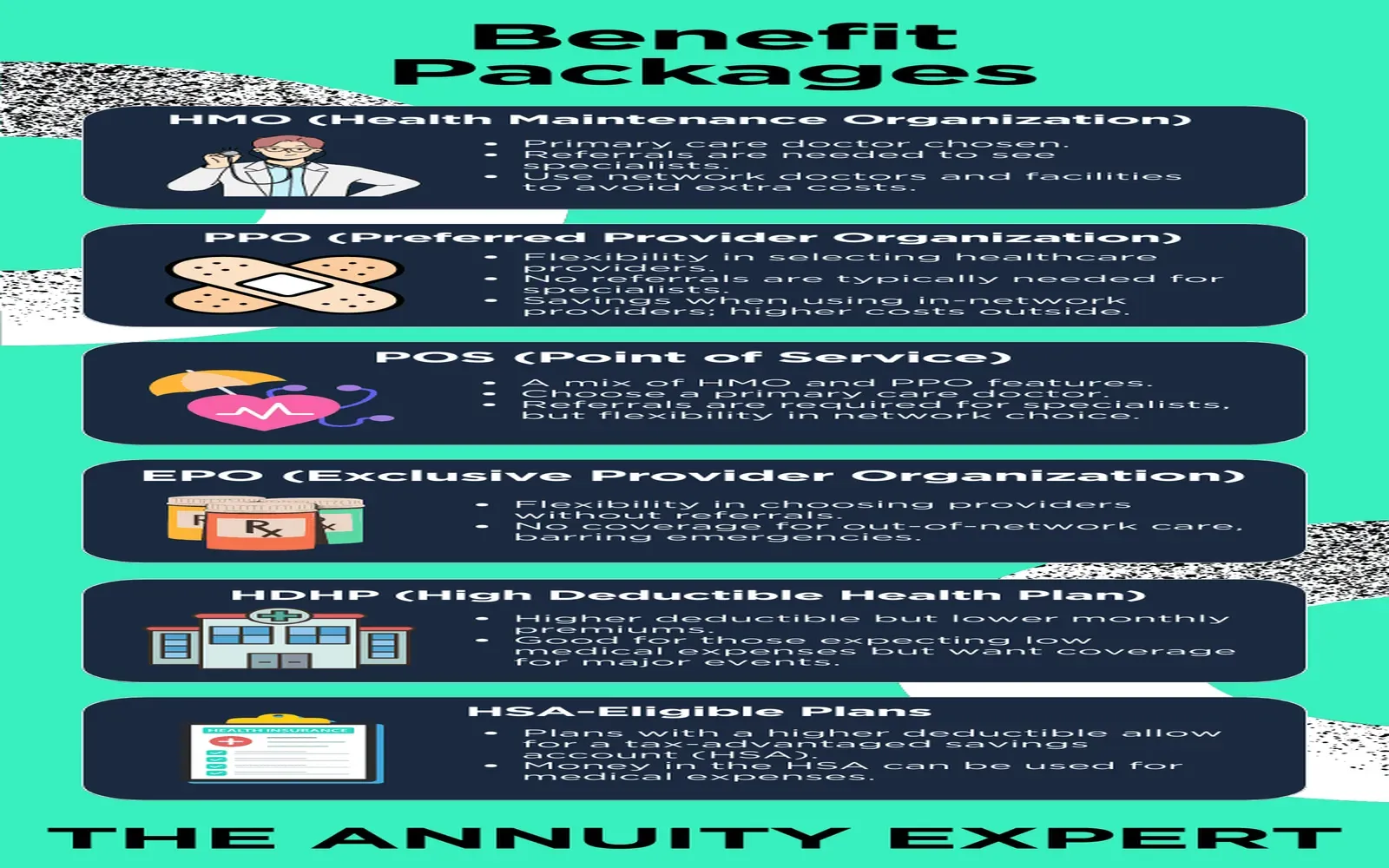

Secure Your Small Business's Future with Comprehensive Health Insurance Coverage

Liability Insurance: Protection for Individuals and Businesses

Shielding Success: Unlocking the Power of Professional Indemnity Insurance

Affordable Business Health Insurance Plans for 2025: Save Money While Protecting Your Team

A Comprehensive Guide to Commercial Property Insurance

Business Liability Insurance Providers: Protecting Your Business from Risks