Protect Your Company with the Best Farmers Insurance Options

Protect your company with the best Farmers Insurance options tailored to meet your unique business needs. Offering comprehensive coverage plans, Farmers Insurance ensures that your assets and employees are safeguarded against unexpected risks. Discover customizable policies designed to provide peace of mind while you focus on growing your business. Choose reliability and expertise with Farmers Insurance today.

Understanding Farmers Insurance for Businesses

When it comes to securing your business, Farmers Insurance offers a variety of options tailored to meet the unique needs of different industries. Whether you run a small local shop or a larger enterprise, understanding your coverage options is essential to protecting your assets and ensuring business continuity. Farmers Insurance provides comprehensive plans that can safeguard against unforeseen events, making it a top choice for many business owners.

Key Coverage Options from Farmers Insurance

Farmers Insurance offers several key coverage options that can help protect your company:

- General Liability Insurance: This type of insurance protects against claims of bodily injury, property damage, and personal injury that may occur on your business premises or due to your products and services.

- Commercial Property Insurance: Essential for protecting your business property, this coverage can help you recover losses due to theft, fire, or natural disasters.

- Business Interruption Insurance: If your business operations are disrupted due to a covered event, this insurance can help replace lost income and cover ongoing expenses.

- Workers' Compensation Insurance: Required in most states, this coverage protects your employees in case of work-related injuries, ensuring they receive medical treatment and compensation.

Comparing Farmers Insurance Plans

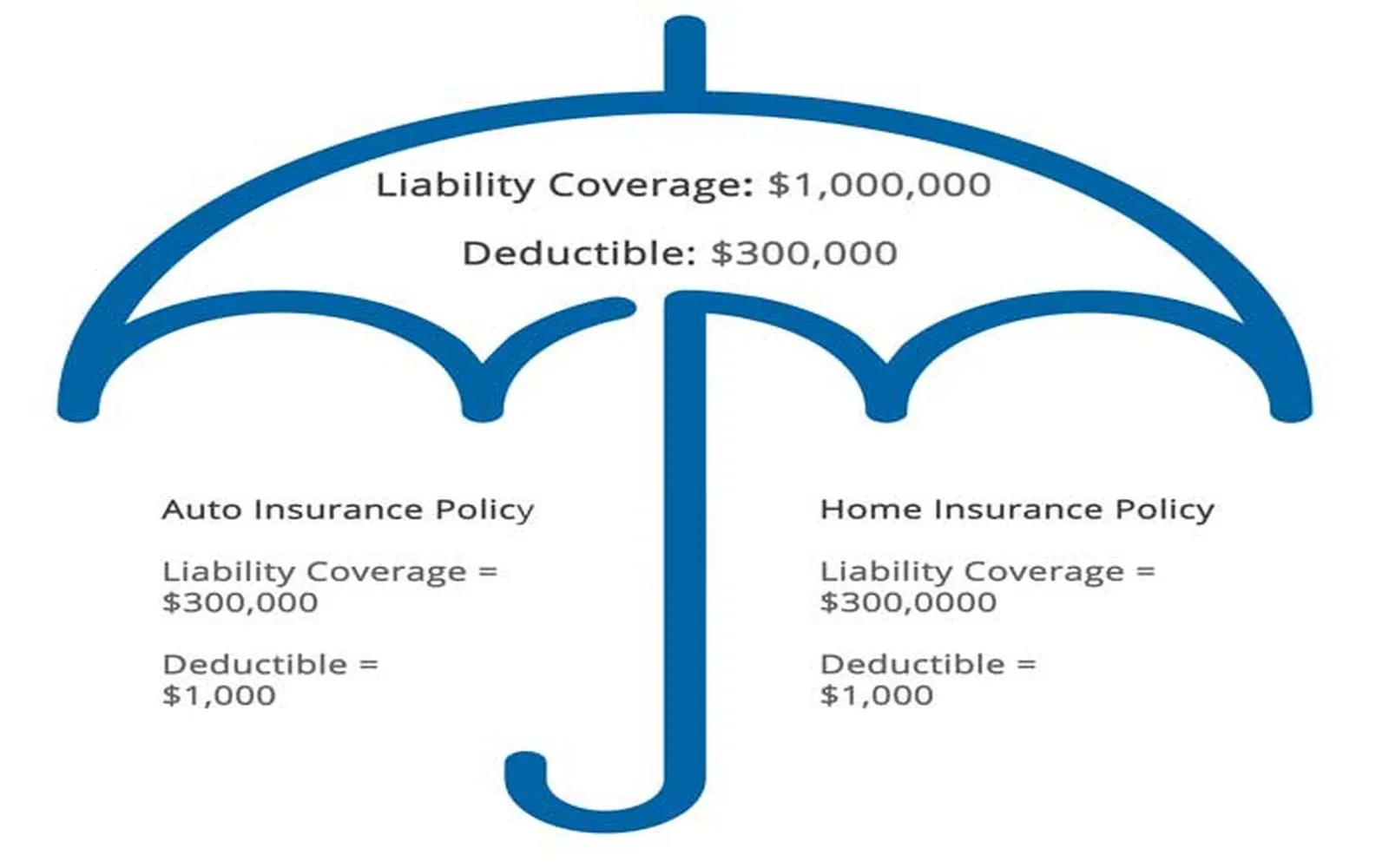

To help you understand the various plans offered by Farmers Insurance and how they stack up against competitors, we have created a comparison chart. This chart highlights the main features and benefits of some popular policies available for businesses.

| Insurance Type | Coverage Limit | Deductible | Key Benefits |

|---|---|---|---|

| General Liability | $1 Million | $500 | Protects against lawsuits, covers legal fees, and medical expenses. |

| Commercial Property | $2 Million | $1,000 | Covers repair or replacement of damaged property, including buildings and equipment. |

| Business Interruption | $500,000 | $1,000 | Reimburses lost income and ongoing expenses during shutdowns. |

| Workers' Compensation | $1 Million | N/A | Covers medical expenses and lost wages for injured employees. |

Why Choose Farmers Insurance for Your Business?

Choosing the right insurance provider is critical for your business's long-term health. Here are some reasons why Farmers Insurance stands out:

- Customizable Policies: Farmers allows you to tailor your insurance package to fit your specific business needs, ensuring you only pay for what you need.

- Strong Financial Backing: With a solid reputation and financial stability, Farmers Insurance is a trustworthy partner that can support your business in times of need.

- Dedicated Agents: Farmers agents are knowledgeable and can help you navigate through the options, ensuring you understand your coverage and make informed decisions.

Tips for Selecting the Best Farmers Insurance for Your Company

When selecting the best Farmers Insurance options for your business, consider the following tips:

- Assess Your Risks: Identify the specific risks associated with your industry and operations. This will help you determine the necessary coverage.

- Compare Quotes: Always obtain multiple quotes and compare them to find the best coverage at an affordable price.

- Read Reviews: Look for customer reviews and testimonials to gauge the experiences of other business owners with Farmers Insurance.

- Consult with an Agent: Discuss your needs and concerns with a Farmers Insurance agent who can provide expert advice tailored to your business.

Conclusion

Protecting your company with the best Farmers Insurance options is crucial in today’s unpredictable business environment. With comprehensive coverage options, strong financial backing, and customizable policies, Farmers Insurance can help safeguard your business against potential risks. By taking the time to assess your insurance needs and consult with knowledgeable agents, you can ensure that your business is well-protected, allowing you to focus on what matters most: growing your company and serving your customers.

Explore

Choosing the Right Cloud Computing Company: A Comprehensive Guide

Top Vacation Rental Insurance Options for 2025: Protect Your Investment and Enjoy Peace of Mind

Explore Business Insurance Providers of 2025: Ensure Your Company’s Future Security

Top Umbrella Insurance Policies of 2025: Protect Your Assets and Future

Top International Travel Insurance Plans for 2025: Protect Your Adventures Abroad

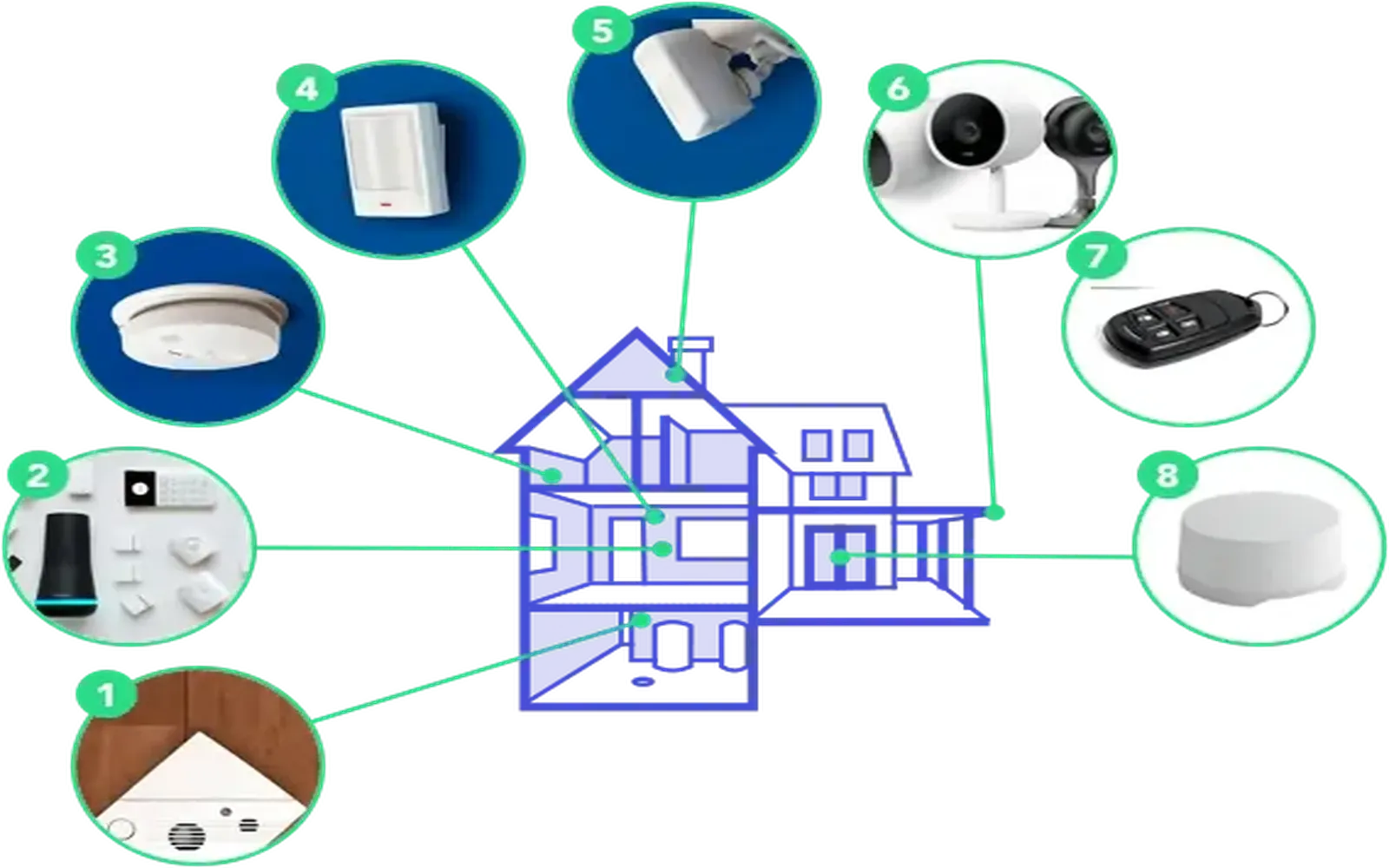

Ultimate Guide to Home Security System Installation in 2025: Protect Your Home with the Latest Technology

How to Protect Your Business Data with Advanced Security Tools

Protect Your Interests with Skilled Fraud Attorneys