A Complete Guide to Starting a Gold IRA in 2025

This complete guide provides essential steps for starting a Gold IRA in 2025. Learn about the benefits of investing in gold, how to choose a reputable custodian, and the necessary paperwork involved. With expert tips and strategies, this guide will help you navigate the gold investment landscape, ensuring a secure and prosperous future for your retirement savings.

Understanding Gold IRAs

A Gold IRA, or Individual Retirement Account, is a type of retirement account that allows you to invest in physical gold as well as other precious metals. Unlike traditional IRAs, which typically hold paper assets like stocks and bonds, a Gold IRA enables you to diversify your portfolio with tangible assets. This can be particularly appealing in times of economic uncertainty, as gold has historically maintained its value.

Why Consider a Gold IRA in 2025?

As we move into 2025, several factors make a Gold IRA an attractive option for retirement savings:

- Inflation Hedge: Gold is often viewed as a safeguard against inflation. With rising prices, many investors turn to gold to preserve their purchasing power.

- Market Volatility: Economic downturns can impact stock markets significantly. Investing in gold can provide stability.

- Diversification: A Gold IRA can help diversify your investment portfolio, reducing risk by spreading your investments across different asset classes.

Steps to Start a Gold IRA in 2025

Starting a Gold IRA involves several key steps. Here’s a comprehensive guide to help you navigate the process:

1. Research and Select a Custodian

The first step in establishing a Gold IRA is to choose a reputable custodian. A custodian is a financial institution responsible for managing the account and ensuring compliance with IRS regulations. Look for a custodian that specializes in precious metals and has a solid track record. Be sure to check their fees, customer reviews, and ratings.

2. Open Your Gold IRA Account

Once you've selected a custodian, you can proceed to open your Gold IRA account. This process usually involves filling out an application form and providing necessary documentation. The custodian will guide you through the account setup and inform you about any minimum investment requirements.

3. Fund Your Account

After your Gold IRA account is set up, you'll need to fund it. You can do this through various methods:

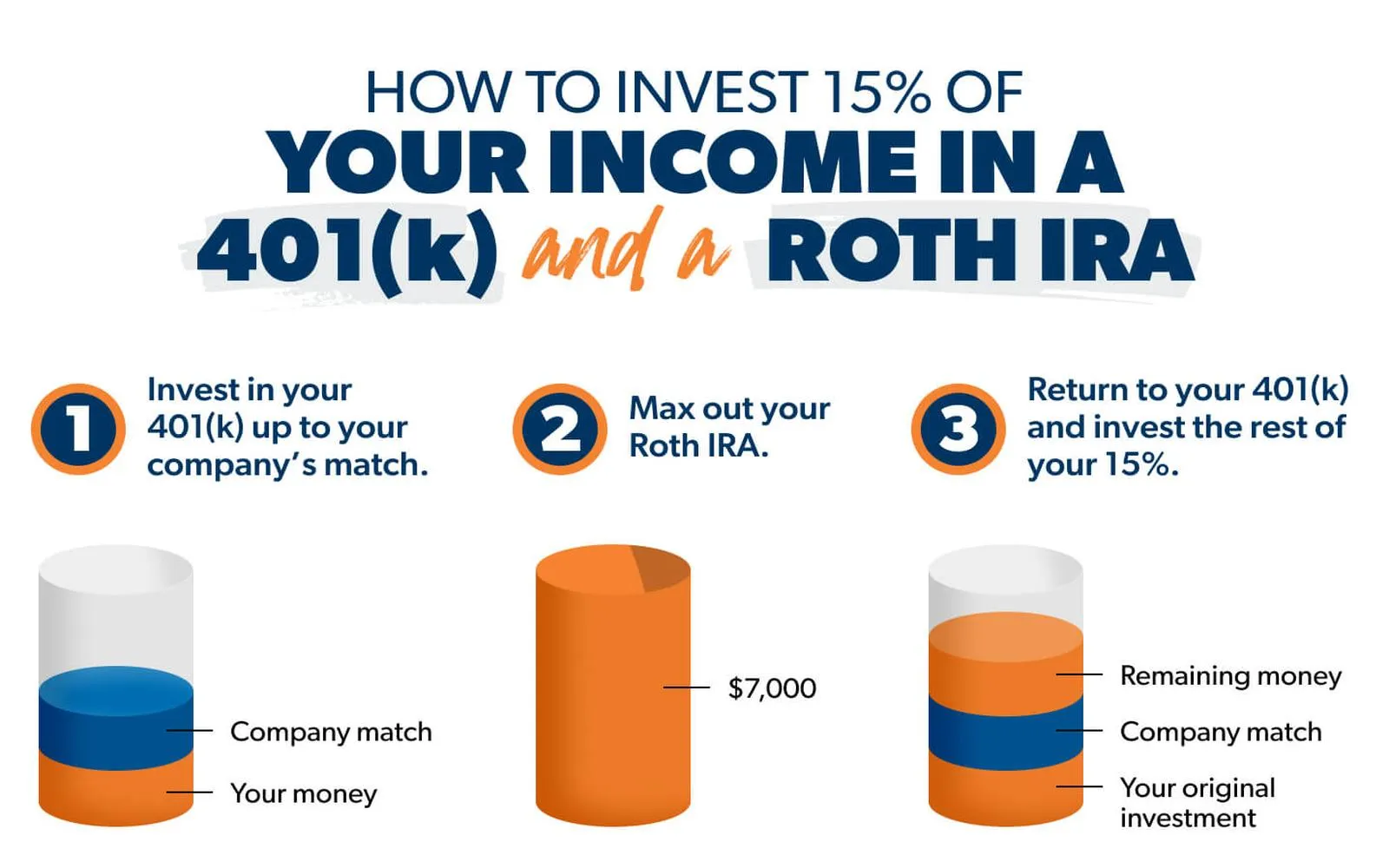

- Direct Transfer: Move funds from an existing retirement account to your new Gold IRA without incurring tax penalties.

- Rollover: If you have a 401(k) or another retirement plan, you can rollover those funds into your Gold IRA.

- Cash Contribution: You can also make a cash contribution, subject to annual contribution limits set by the IRS.

4. Choose Your Gold Investments

With your account funded, it’s time to select the gold investments you wish to include in your IRA. The IRS has specific regulations regarding the types of gold that can be held in a Gold IRA:

- Gold Coins: Only coins that meet the minimum purity standards set by the IRS are acceptable. Popular choices include the American Gold Eagle, Canadian Gold Maple Leaf, and the Australian Gold Kangaroo.

- Gold Bars: Gold bars must also meet a minimum purity of 99.5% and must be produced by an approved refiner.

Consult with your custodian to ensure you comply with all IRS regulations while selecting your investments.

5. Manage and Monitor Your Gold IRA

Once your Gold IRA is established and funded, it’s essential to monitor your investments regularly. Keep an eye on market trends and the performance of your gold assets. You may want to consult with a financial advisor to ensure your investment strategy aligns with your retirement goals.

Costs Associated with Gold IRAs

Like any investment, there are costs associated with Gold IRAs. Here’s a breakdown of common fees you may encounter:

| Type of Fee | Description |

|---|---|

| Setup Fees | Fees charged by the custodian for setting up your account. |

| Annual Maintenance Fees | Fees for maintaining your Gold IRA account each year. |

| Storage Fees | Costs for securely storing your physical gold, usually charged annually. |

| Transaction Fees | Fees incurred when purchasing or selling gold within your IRA. |

Conclusion

Starting a Gold IRA in 2025 can be a wise decision for those looking to safeguard their retirement savings against inflation and market volatility. By following the steps outlined in this guide, you can establish a Gold IRA that aligns with your financial goals. Remember to conduct thorough research, select a reputable custodian, and stay informed about the performance of your investments. With careful planning and management, a Gold IRA can be a valuable asset in your retirement portfolio.

Explore

LLC Formation Services: A Guide to Starting Your Business the Right Way

How to Hire a Lawyer to Sue a Hospital: A Complete Legal Guide

Revolutionize Your Business with Employee Management Software: A Complete Guide to Streamlining Operations and Improving Productivity

Top Roth IRA Options for 2025: Secure Your Retirement with the Best Plans

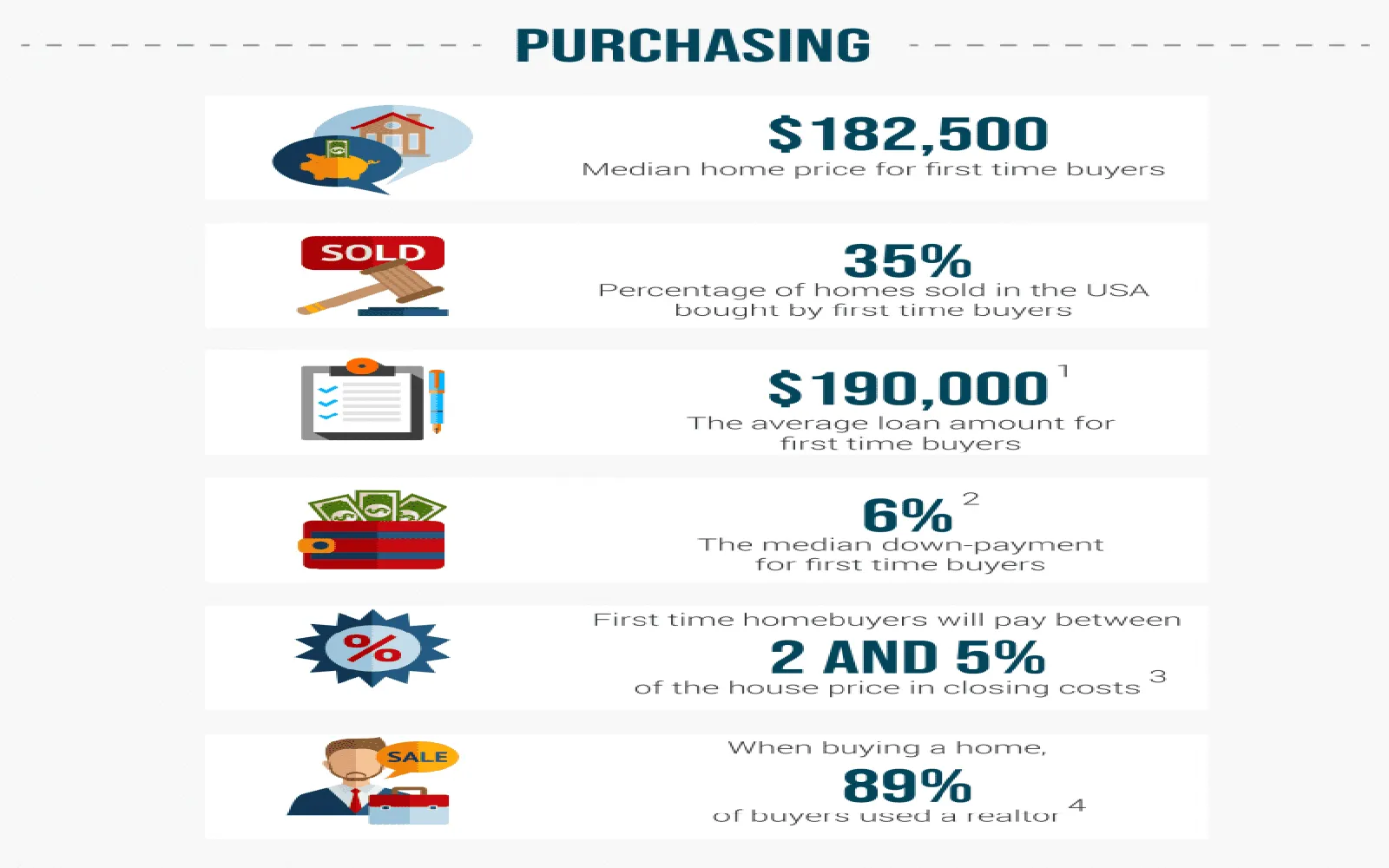

Affordable Home Insurance for First-Time Buyers in 2025: Your Complete Guide to Savings and Coverage

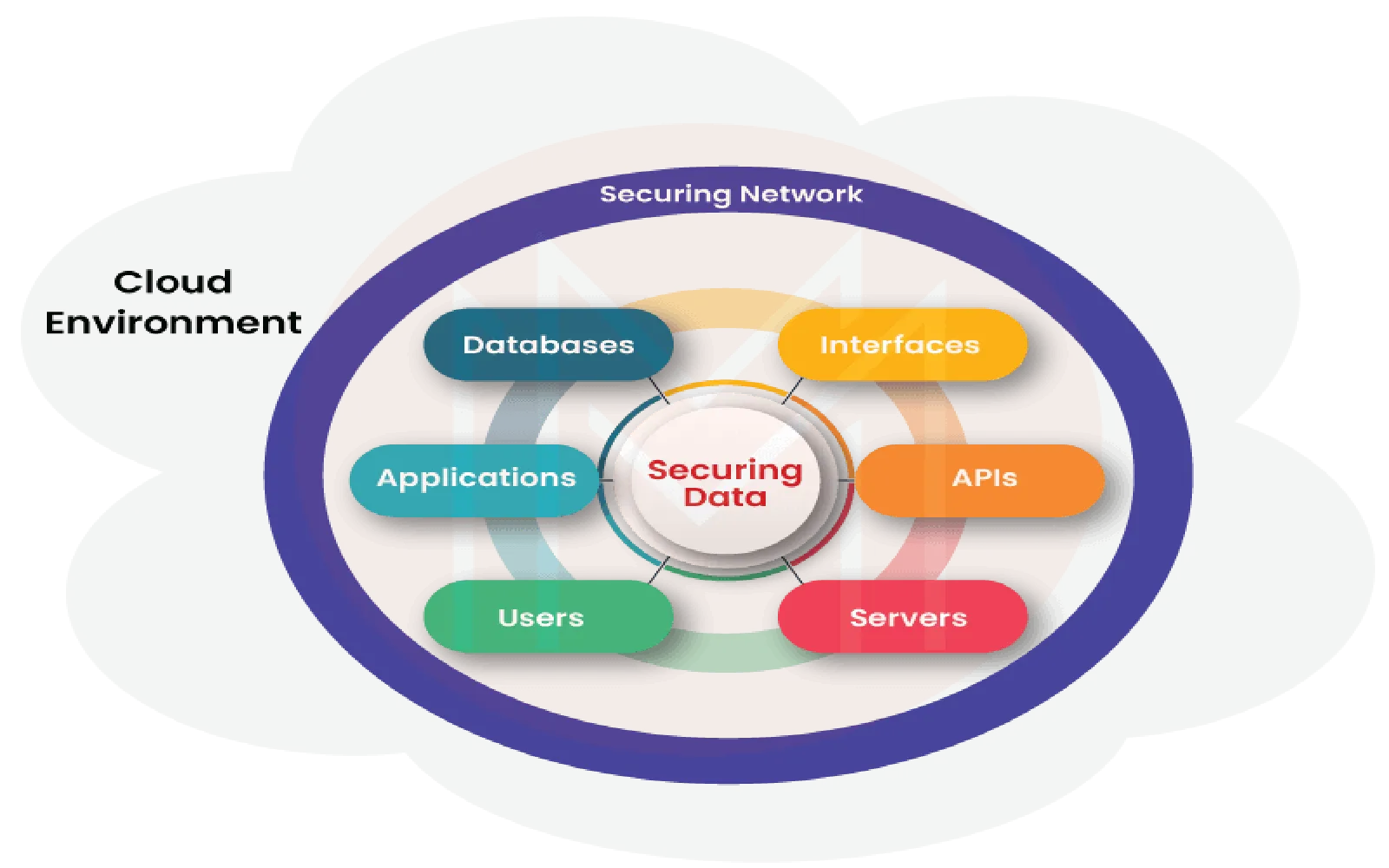

A Complete Guide to Cloud Security Architecture in 2025

A Complete Guide to Investing in ETFs in 2025

A Complete Guide to Choosing a Business Phone System in 2025