Mastering Business Finance: Unlocking the Secrets to Financial Success

Mastering business finance is essential for any entrepreneur or organization aiming for long-term success. Understanding the intricacies of financial management not only helps in maintaining liquidity but also supports strategic planning and investment decisions. In this article, we will delve into key concepts and strategies that can help unlock your business's financial potential.

Understanding Financial Statements

The foundation of mastering business finance lies in understanding financial statements. Financial statements provide a snapshot of a company's financial health. The three primary financial statements are the balance sheet, income statement, and cash flow statement. Each serves a unique purpose and offers valuable insights.

The balance sheet reflects what a company owns (assets) and owes (liabilities) at a specific point in time. This statement is crucial for assessing the company's net worth and overall financial stability. The income statement, on the other hand, summarizes revenues and expenses over a particular period, revealing the company's profitability. Lastly, the cash flow statement tracks the movement of cash in and out of the business, providing insight into liquidity and operational efficiency.

Budgeting and Forecasting

Effective budgeting and forecasting are vital components of sound financial management. A budget serves as a financial roadmap, outlining expected revenues and expenses. By creating a detailed budget, businesses can allocate resources efficiently, control spending, and set realistic financial goals.

Forecasting takes budgeting a step further by predicting future financial performance based on historical data and market trends. Accurate forecasting allows businesses to anticipate challenges and seize opportunities, ensuring they remain agile in a rapidly changing economic environment. Incorporating tools such as financial modeling and scenario analysis can enhance the accuracy of your forecasts.

Cash Flow Management

Cash flow is often referred to as the lifeblood of a business. Without sufficient cash flow, even profitable companies can face financial difficulties. Managing cash flow involves monitoring incoming and outgoing cash to ensure that the business can meet its obligations and invest in growth.

Implementing effective cash flow management strategies can significantly improve financial health. This includes maintaining an adequate cash reserve, optimizing accounts receivable and payable, and regularly reviewing cash flow projections. Additionally, consider negotiating favorable payment terms with suppliers and offering discounts for early payments from customers to enhance cash flow.

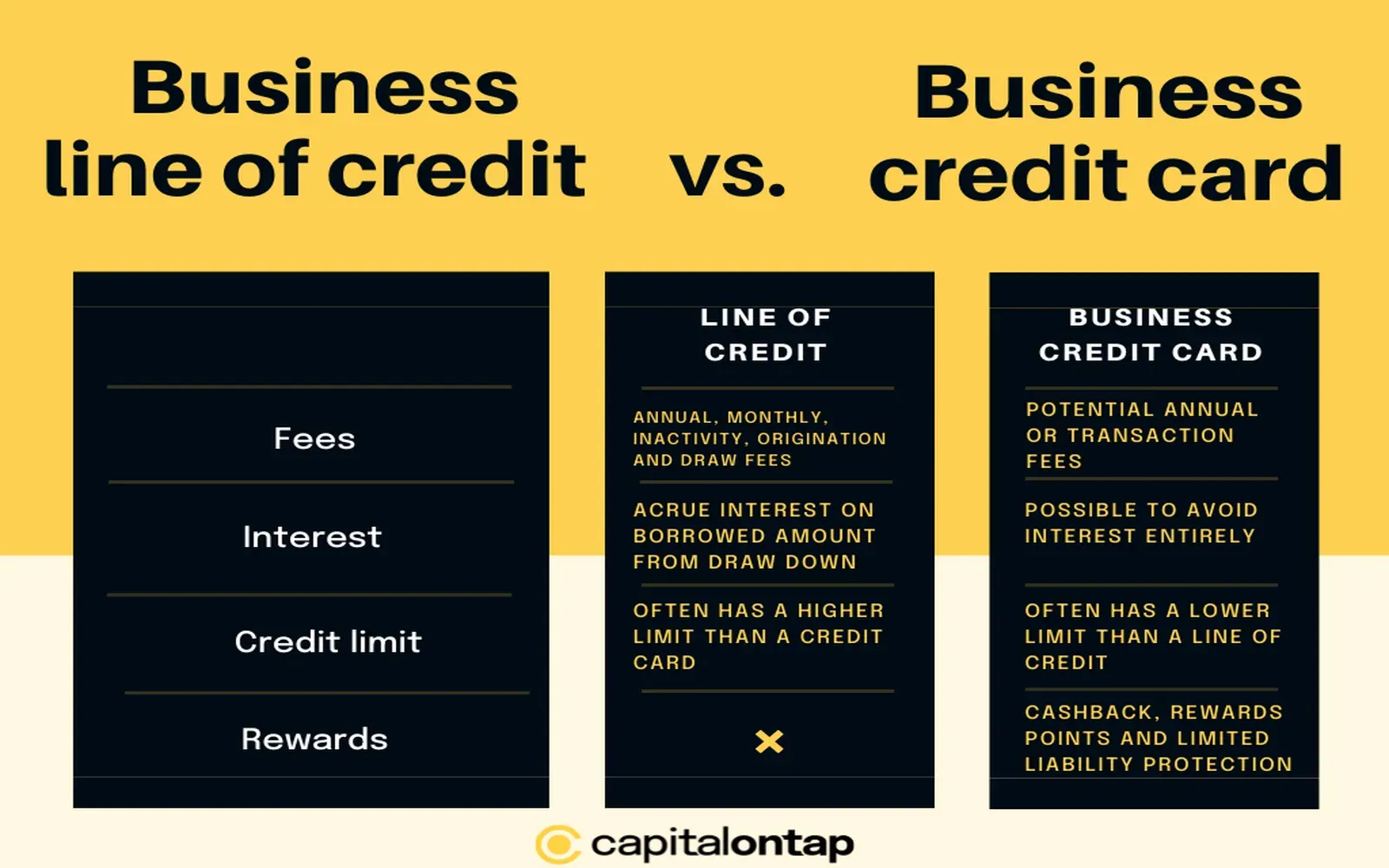

Debt Management

While debt can be a valuable tool for financing growth, poor debt management can lead to financial distress. It is crucial to understand the different types of debt and their implications for your business. Short-term debt may provide quick access to funds but often comes with higher interest rates, while long-term debt can offer lower rates and more manageable repayment terms.

To master debt management, regularly assess your debt levels and repayment capabilities. Consider the debt-to-equity ratio as a measure of financial leverage, and ensure that your business can comfortably service its debt obligations. Developing a repayment strategy can help reduce financial risk and improve creditworthiness over time.

Investment Strategies

Investing wisely is another critical aspect of mastering business finance. Whether it’s reinvesting profits into the business, exploring new markets, or investing in stocks and bonds, strategic investments can fuel growth and enhance profitability.

Before making investment decisions, conduct thorough research and analysis. Evaluate potential returns against risks, and consider factors such as market conditions, competition, and the overall economic landscape. Diversifying your investment portfolio can also mitigate risks and increase the chances of achieving financial goals.

Understanding Financial Ratios

Financial ratios are powerful tools for assessing a company's performance and financial health. By analyzing ratios such as the current ratio, quick ratio, return on equity, and profit margin, businesses can gain insights into their operational efficiency and profitability.

For instance, the current ratio measures a company's ability to cover short-term liabilities with its short-term assets, while the profit margin indicates how much profit a company makes for every dollar of revenue. Regularly monitoring these ratios can help identify trends and areas for improvement, enabling businesses to make informed financial decisions.

Leveraging Technology for Financial Management

In today's digital age, leveraging technology can streamline financial management processes and enhance accuracy. Various accounting software options are available, enabling businesses to automate bookkeeping, invoicing, and reporting tasks. This not only saves time but also reduces the risk of human error.

Moreover, financial management tools can provide real-time insights into cash flow, expenses, and profitability. By adopting cloud-based solutions, businesses can access financial data from anywhere, facilitating better decision-making and collaboration among team members.

Continuous Learning and Adaptation

Mastering business finance is not a one-time effort; it requires continuous learning and adaptation. The financial landscape is constantly evolving due to technological advancements, regulatory changes, and economic shifts. Staying informed about these changes and seeking opportunities for professional development is crucial.

Consider engaging in workshops, webinars, or financial courses to enhance your knowledge and skills. Networking with other professionals in the field can also provide valuable insights and strategies for overcoming financial challenges.

Conclusion

Mastering business finance is a multifaceted endeavor that encompasses understanding financial statements, budgeting, cash flow management, debt management, investment strategies, financial ratios, and technology integration. By honing these skills and continuously adapting to change, you can unlock the secrets to financial success and drive your business toward a prosperous future.

Explore

Unlocking Success: The Power of SMS Marketing Services for Your Business

Unlocking Business Success: The Essential Role of Registered Agent Services

Mastering Your Income Tax: The Ultimate Guide to Online Advice

Top Financial Advisory Services for Businesses in 2025: Unlocking Growth and Success

Master Your Money: Essential Personal Finance Strategies for 2025

Top Business Lines of Credit for 2025: Unlocking Financial Flexibility for Your Enterprise

Mastering Evony: The Ultimate Game Guide to Conquer and Thrive

Mastering Insurance Claims: A Comprehensive Guide to Navigating Your Coverage