Master Your Money: Essential Personal Finance Strategies for 2025

As we approach 2025, mastering your money has never been more critical in an ever-evolving financial landscape. With inflation rates fluctuating, interest rates rising, and the digital economy expanding, individuals must adopt essential personal finance strategies to secure their financial futures. Whether you're looking to build an emergency fund, invest wisely, or navigate the complexities of cryptocurrency, understanding the fundamentals of budgeting, saving, and smart investing will empower you to make informed decisions. This article explores key strategies that will help you take control of your finances and thrive in the coming year and beyond.

Introduction

As we step into 2025, the financial landscape continues to evolve rapidly, driven by technological advancements, shifting economic trends, and changing consumer behaviors. Mastering personal finance is more important than ever, as individuals seek to secure their financial futures amidst uncertainties. This article will explore essential personal finance strategies that can help you navigate the complexities of the modern financial world, empowering you to make informed decisions and achieve your financial goals.

Understanding Your Financial Situation

Before diving into specific strategies, it's crucial to have a clear understanding of your current financial situation. This involves evaluating your income, expenses, assets, and liabilities. Start by creating a comprehensive budget that outlines your monthly income and expenditures. This will allow you to identify areas where you can cut back and save. Additionally, consider using financial apps and tools that can help you track your spending and analyze your financial habits.

Building an Emergency Fund

An emergency fund is a crucial component of a solid financial strategy. It acts as a financial safety net, providing you with peace of mind in case of unexpected expenses, such as medical emergencies or job loss. Aim to save at least three to six months' worth of living expenses in a high-yield savings account. By prioritizing your emergency fund, you can avoid going into debt when unforeseen circumstances arise.

Debt Management: Tackling High-Interest Debt

Debt can be a significant barrier to financial freedom. In 2025, it’s essential to have a strategy for managing and reducing debt, particularly high-interest debt like credit card balances. Start by assessing your debt situation and prioritizing payments based on interest rates. Consider using the debt snowball or debt avalanche method to pay down your debts systematically. Additionally, explore options for consolidating loans or negotiating with creditors to lower interest rates.

Investing for the Future

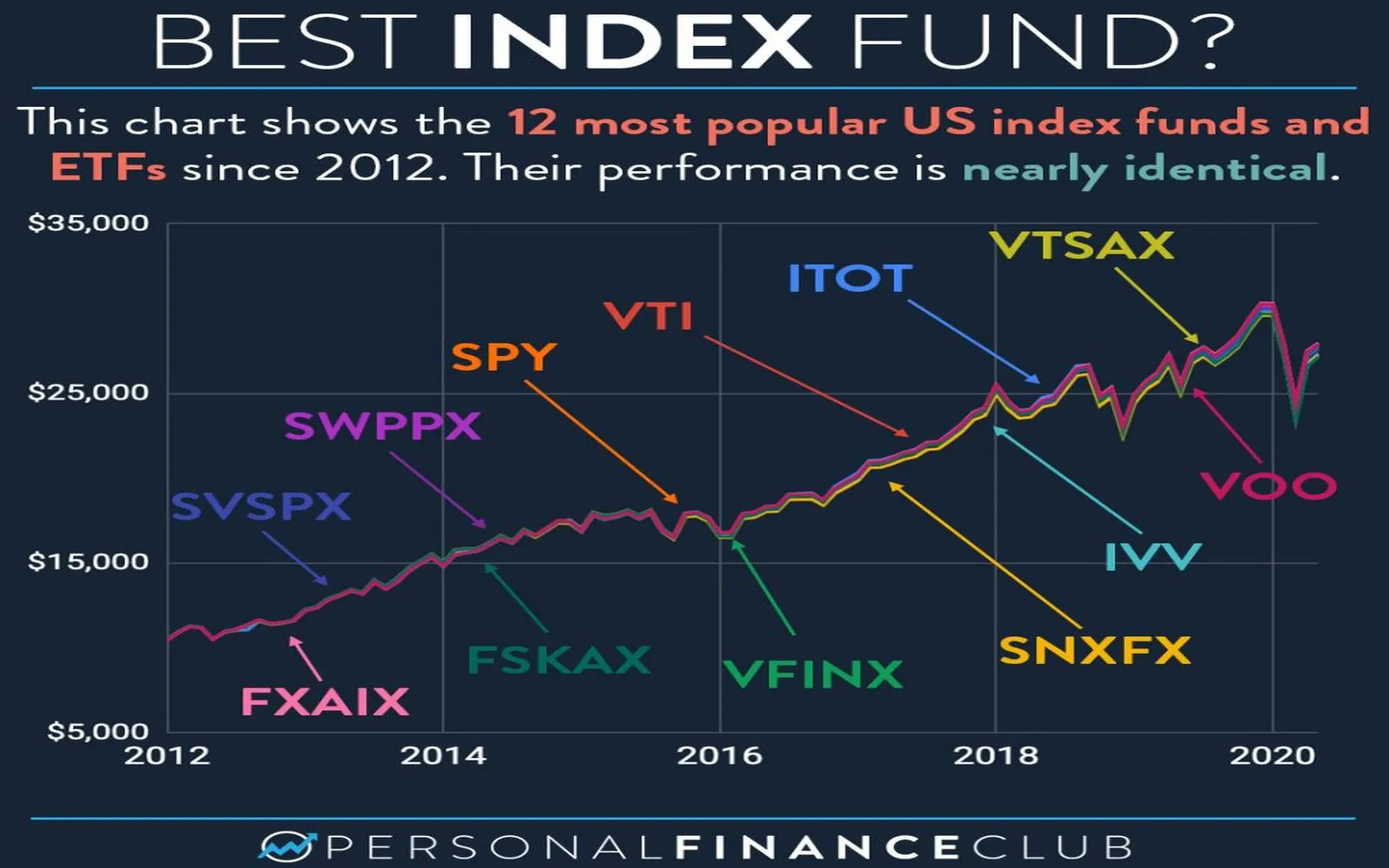

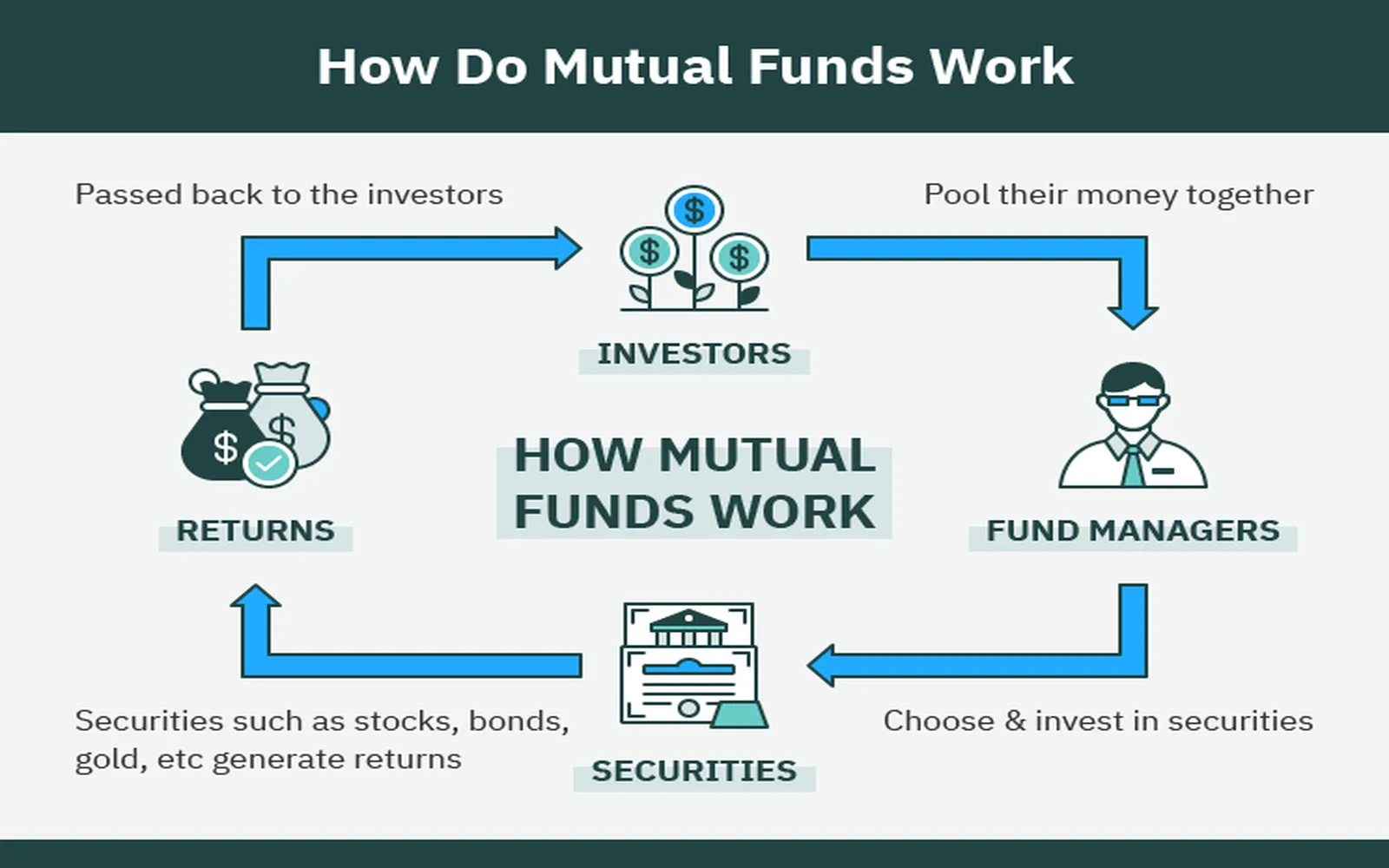

Investing is a vital component of long-term financial success. With inflation and rising living costs, it’s crucial to make your money work for you. Begin by educating yourself about various investment vehicles, such as stocks, bonds, mutual funds, and real estate. Consider setting up a diversified investment portfolio that aligns with your risk tolerance and financial goals. Furthermore, take advantage of employer-sponsored retirement accounts, like 401(k) plans, and consider contributing to individual retirement accounts (IRAs) to maximize your retirement savings.

Understanding Financial Markets

In 2025, staying informed about financial markets is more important than ever. Global events, technological advancements, and economic shifts can all impact your investments and financial decisions. Subscribe to financial news platforms, follow reputable financial analysts, and consider joining investment communities to stay updated. Understanding market trends will help you make informed decisions about when to buy, sell, or hold your investments.

Embracing Technology for Financial Management

Technology has transformed the way we manage our finances. In 2025, leveraging financial technology (fintech) can enhance your budgeting, saving, and investing processes. Numerous apps and platforms offer features such as automatic savings, investment tracking, and real-time spending alerts. Research and choose tools that suit your needs and preferences, and integrate them into your financial management routine to stay organized and informed.

Setting Financial Goals

Having clear financial goals is essential for creating a roadmap to financial success. In 2025, take the time to define both short-term and long-term goals. Short-term goals may include saving for a vacation or paying off a specific debt, while long-term goals could involve planning for retirement or buying a home. Utilize the SMART criteria—Specific, Measurable, Achievable, Relevant, and Time-bound—to outline your goals effectively. Regularly review and adjust your goals as circumstances change.

Educating Yourself on Financial Literacy

Financial literacy is a vital skill that can significantly impact your financial well-being. In 2025, prioritize educating yourself about personal finance topics, including budgeting, investing, and retirement planning. Consider enrolling in online courses, attending workshops, or reading books authored by financial experts. Increasing your financial literacy will empower you to make informed decisions and navigate complex financial situations with confidence.

Tax Planning Strategies

Tax planning is an often-overlooked aspect of personal finance. In 2025, staying informed about tax laws and regulations can help you minimize your tax liability and maximize your savings. Consider consulting with a tax professional to identify tax-saving opportunities, such as deductions and credits that apply to your situation. Additionally, explore tax-efficient investment strategies, such as investing in tax-advantaged accounts, to enhance your overall financial strategy.

Insurance: Protecting Your Assets

Insurance plays a critical role in protecting your financial well-being. In 2025, review your insurance policies to ensure you have adequate coverage for your needs. This includes health insurance, auto insurance, home insurance, and life insurance. Assess whether you need additional coverage, such as disability or long-term care insurance, based on your personal circumstances. By having the right insurance in place, you can safeguard your assets and mitigate financial risks.

Retirement Planning: The Importance of Starting Early

Retirement planning is essential for ensuring financial security in your later years. In 2025, it’s crucial to start planning for retirement as early as possible. This includes contributing to retirement accounts, such as 401(k)s and IRAs, and taking advantage of employer matching contributions. Consider your desired retirement lifestyle and calculate how much you will need to save to achieve it. The earlier you start saving and investing for retirement, the more you will benefit from compound interest over time.

Mindful Spending: Cultivating a Healthy Relationship with Money

In today's consumer-driven society, it’s easy to develop unhealthy spending habits. In 2025, focus on cultivating a mindful approach to spending. This involves being intentional about your purchases and distinguishing between needs and wants. Implement strategies such as the 24-hour rule—waiting a day before making non-essential purchases—to reduce impulse buying. Additionally, consider adopting minimalism as a lifestyle choice, which can help you prioritize experiences over material possessions.

Giving Back: Incorporating Philanthropy into Your Financial Plan

Incorporating philanthropy into your financial plan can enhance your sense of purpose and fulfillment. In 2025, consider allocating a portion of your budget to charitable donations or community initiatives. This can take various forms, including monetary donations, volunteering your time, or supporting local businesses. Giving back not only benefits others but can also provide tax deductions and improve your overall financial mindset.

Regularly Reviewing Your Financial Plan

Your financial situation is not static; it evolves over time due to changes in income, expenses, and personal circumstances. In 2025, make it a habit to review your financial plan regularly, at least annually. Assess your progress toward your financial goals, adjust your budget as necessary, and revisit your investment strategy. This proactive approach will help you stay on track and adapt to any changes in your financial landscape.

Seeking Professional Financial Advice

While self-education is essential, there may be times when you require professional guidance. In 2025, consider seeking the help of a certified financial planner or advisor to navigate complex financial decisions. A professional can provide personalized advice tailored to your unique situation, helping you create a comprehensive financial plan and optimize your investment strategy. Be sure to choose a reputable advisor with a fiduciary duty to act in your best interest.

Conclusion

Mastering personal finance in 2025 requires a proactive and informed approach. By understanding your financial situation, building an emergency fund, managing debt, investing wisely, and continuously educating yourself about personal finance, you can take control of your financial future. Embrace technology, set clear goals, and prioritize financial literacy to make informed decisions that align with your values and aspirations. Remember that financial success is a journey, and with dedication and discipline, you can achieve your financial goals and secure a prosperous future.

Explore

Maximize Your Wealth: The Ultimate Guide to Passive Investment Strategies for 2025

A Complete Guide to Investing in ETFs in 2025

Top Tax-Efficient Investment Strategies

Tax-Efficient Investing 2025: Maximize Your Returns and Minimize Taxes

Top Index Funds to Invest in for 2025: Maximize Your Returns with These Winning Strategies

Top Mutual Fund Trends to Watch in 2025: Maximize Your Investment Potential

Top Dividend-Paying Stocks to Invest in for 2025: Maximize Your Returns

Your Ultimate Guide to Investing in Mutual Funds in 2025: Strategies for Success