Money Market Funds: Smart Savings for Short-Term Goals

Money Market Funds are an ideal choice for those looking to save for short-term goals. These funds invest in high-quality, short-term debt instruments, offering liquidity and stability. With competitive interest rates and minimal risk, they provide a smart savings alternative that helps you achieve your financial objectives while keeping your funds accessible when you need them.

When it comes to saving for short-term goals, many investors look for options that offer both safety and liquidity. One investment vehicle that has gained popularity is money market funds. These funds are designed to provide a safe place for investors to park their cash while earning a modest return. In this article, we will explore the benefits of money market funds, how they work, and why they are a smart choice for anyone looking to achieve their short-term financial goals.

What Are Money Market Funds?

Money market funds are a type of mutual fund that invests in short-term debt securities such as Treasury bills, commercial paper, and certificates of deposit. They aim to offer investors a safe and liquid investment option while providing a higher yield than traditional savings accounts. Money market funds are regulated by the Securities and Exchange Commission (SEC), which helps to ensure their stability and security.

Key Features of Money Market Funds

Several key features make money market funds an attractive option for short-term savers:

- Liquidity: Money market funds allow investors to easily access their cash. Most funds offer check-writing privileges and allow for quick withdrawals, making them ideal for emergencies or short-term expenses.

- Safety: Since these funds invest in low-risk, short-term securities, they are generally considered safe investments. While they are not insured by the FDIC, the underlying assets are often backed by the full faith and credit of the government or highly-rated corporations.

- Yield: Money market funds typically offer higher yields than traditional savings accounts. While the returns may not be as high as other investment vehicles, they are competitive enough to make them a viable option for short-term savings.

- Low Minimum Investments: Many money market funds have low minimum investment requirements, making them accessible to a wide range of investors.

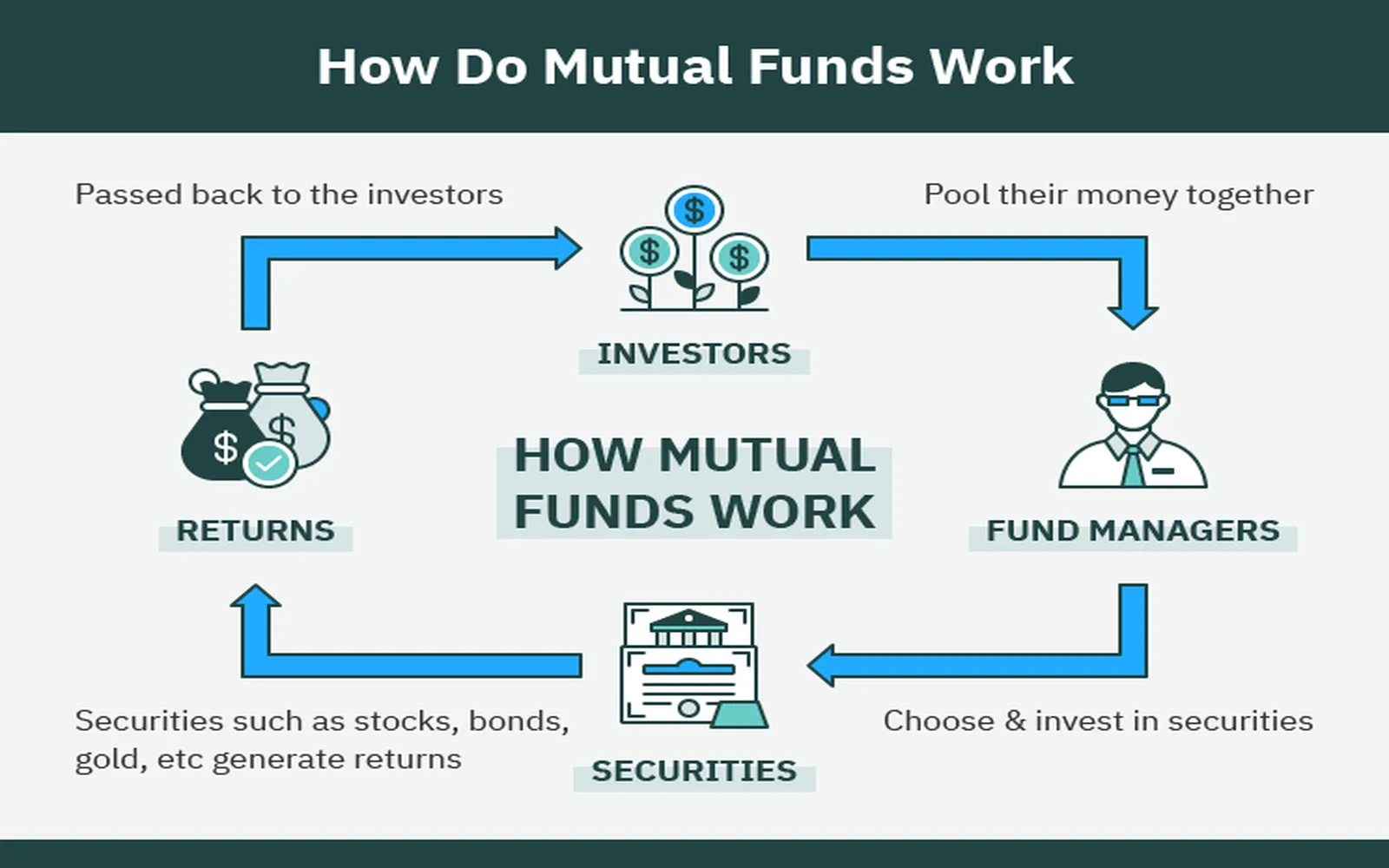

How Money Market Funds Work

Investing in a money market fund is straightforward. When you invest in a money market fund, you purchase shares in the fund, and your money is pooled with that of other investors to buy a diversified portfolio of short-term debt securities. The fund manager actively manages this portfolio to maintain liquidity and yield while minimizing risk.

One important aspect to note is that money market funds generally aim to maintain a stable net asset value (NAV) of $1 per share. This stability is achieved by keeping the underlying investments short-term and high-quality. As a result, investors can expect to get back their initial investment, plus any accrued interest, when they redeem their shares.

Comparing Money Market Funds with Other Savings Options

To better understand why money market funds are a smart choice for short-term savings, let’s compare them to other common savings options, including traditional savings accounts and certificates of deposit (CDs).

| Feature | Money Market Funds | Traditional Savings Accounts | Certificates of Deposit (CDs) |

|---|---|---|---|

| Liquidity | High | High | Low |

| Interest Rates | Moderate | Low | Higher |

| Risk | Low | Very Low | Low |

| Minimum Investment | Low | None | Moderate |

Why Choose Money Market Funds for Short-Term Goals?

Choosing a money market fund for your short-term savings has several advantages:

- Flexibility: Whether you are saving for a vacation, a down payment on a house, or an emergency fund, money market funds provide the flexibility to access your funds when needed without penalties.

- Competitive Returns: While not as high as stock market returns, the yield from money market funds can outpace traditional savings accounts, helping your savings grow more effectively.

- Diversification: Investing in a money market fund allows you to diversify your cash holdings, reducing risk compared to keeping all your savings in one type of account.

Conclusion

In summary, money market funds are an excellent option for individuals looking to save for short-term goals. With their combination of liquidity, safety, and competitive yields, these funds can help you achieve your financial objectives while keeping your money secure. As with any investment, it’s essential to do your research and consider your individual financial situation before investing in a money market fund. By making informed choices, you can set yourself on the path to achieving your short-term financial goals with confidence.

Explore

Unlocking Opportunities: The Top HELOC Lenders of 2025 to Fuel Your Financial Goals

Smart Investing in 2025: How to Start with Little Money and Grow Your Wealth

10 Smart Tax-Free Savings Tips Every American Needs in 2025

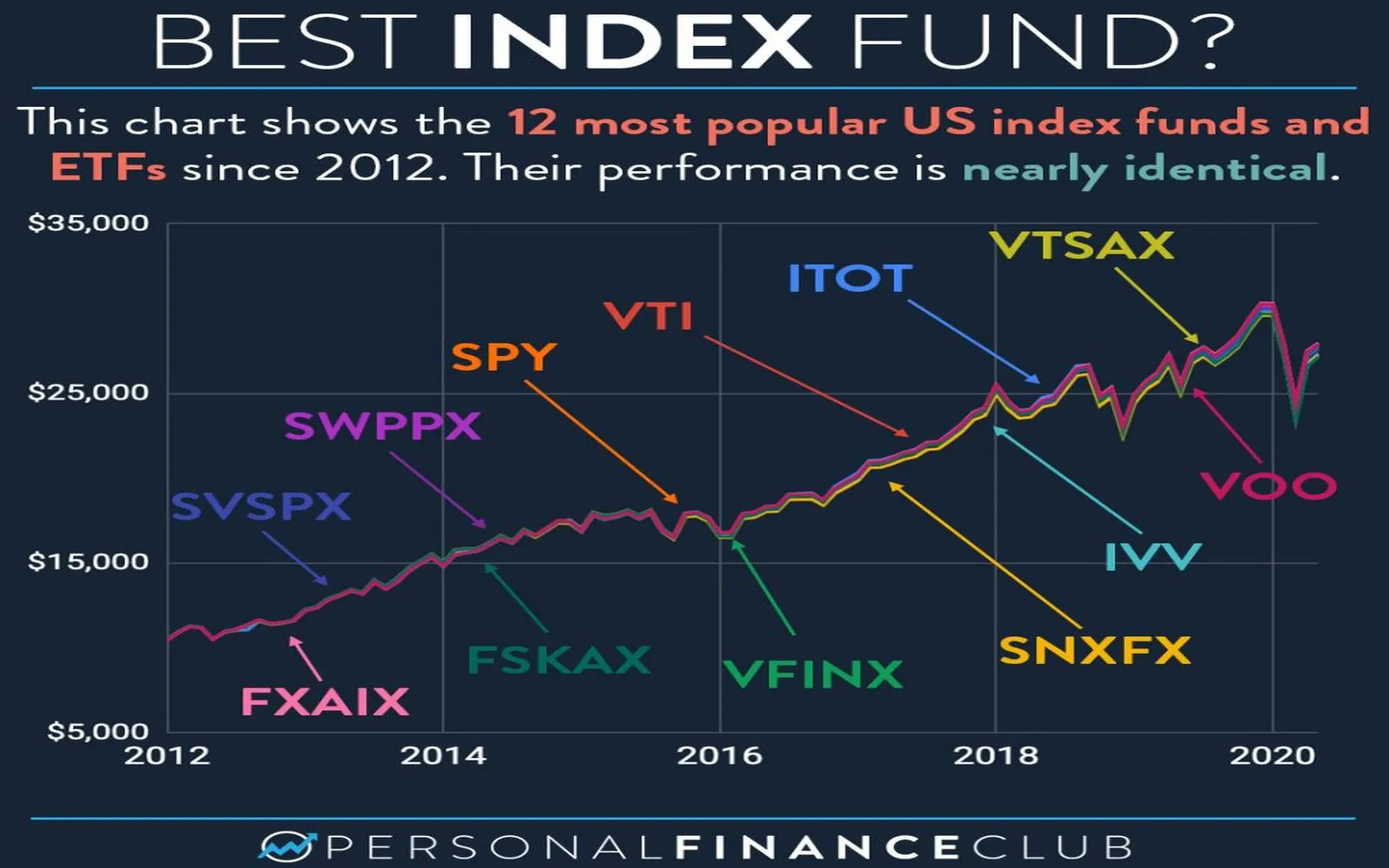

Top Index Funds to Invest in for 2025: Maximize Your Returns with These Winning Strategies

Your Ultimate Guide to Investing in Mutual Funds in 2025: Strategies for Success

Affordable Logistics and Delivery Services: Navigating 2025's Evolving Market Trends

Top SUVs in the U.S. Market for 2025: Real Options for Everyday Drivers

Decoding Economic Indicators: Your Essential Guide to Understanding Market Trends