Unlocking Opportunities: The Top HELOC Lenders of 2025 to Fuel Your Financial Goals

In an ever-evolving financial landscape, Home Equity Lines of Credit (HELOCs) have emerged as a powerful tool for homeowners seeking to unlock the potential of their property equity. As we step into 2025, the demand for flexible financing options continues to rise, prompting lenders to enhance their offerings and streamline the borrowing process. Whether you're planning a home renovation, consolidating debt, or funding a major purchase, selecting the right HELOC lender can significantly impact your financial success. This article explores the top HELOC lenders of 2025, highlighting their unique features, competitive rates, and customer service excellence to help you make informed decisions that align with your financial goals.

The world of personal finance is constantly evolving, and as we step into 2025, many individuals are seeking innovative ways to harness their home equity to achieve their financial goals. Home Equity Lines of Credit (HELOCs) have emerged as a popular solution for homeowners looking to unlock opportunities, whether it's funding a home renovation, consolidating debt, or investing in education. In this article, we will explore the top HELOC lenders of 2025, providing insights into their offerings and how they can help you fuel your financial ambitions.

The Rise of HELOCs: A Financial Game Changer

Once considered a niche financial product, HELOCs have gained significant traction over the past few years. With rising home values, many homeowners find themselves sitting on a goldmine of equity. This newfound wealth can be leveraged through a HELOC, allowing individuals to borrow against the equity they've built in their homes. Unlike traditional loans, HELOCs offer flexibility, lower interest rates, and the ability to borrow only what you need, making them an attractive option for many.

As we delve deeper into the top HELOC lenders of 2025, we will not only evaluate their products but also share stories of individuals who have successfully used HELOCs to transform their financial landscapes.

Understanding HELOCs: A Brief Overview

Before we explore the top lenders, it's essential to understand what a HELOC is and how it works. A Home Equity Line of Credit is a revolving line of credit secured by your home. Homeowners can borrow against the equity they have built, typically up to 85% of the home's appraised value, minus any outstanding mortgage balances.

HELOCs generally come with a draw period of 5 to 10 years, during which borrowers can withdraw funds and make interest-only payments. After the draw period ends, the loan enters a repayment phase where both principal and interest must be repaid. This structure offers homeowners the flexibility to manage their cash flow effectively.

Choosing the Right Lender: Key Considerations

With numerous lenders competing for your business, selecting the right HELOC lender can feel overwhelming. Here are some key factors to consider:

- Interest Rates: Look for competitive rates that can save you money over the life of the loan.

- Fees: Be aware of any closing costs, annual fees, or penalties for early repayment.

- Flexibility: Evaluate the lender's policies on borrowing limits and repayment options.

- Customer Service: Read reviews and seek recommendations to find a lender known for excellent customer support.

Now, let's explore the top HELOC lenders of 2025, highlighting their unique offerings and how they can help you unlock your financial opportunities.

1. Bank of America: A Trusted Name with Competitive Rates

Bank of America has long been a stalwart in the financial services industry, and their HELOC products are no exception. With competitive interest rates and a robust online platform, Bank of America makes it easy for homeowners to access their equity.

Consider the story of Sarah, a single mother who wanted to renovate her aging kitchen. With the help of Bank of America's streamlined application process and favorable rates, she secured a HELOC that allowed her to transform her kitchen into a modern space without breaking the bank. The renovations not only improved her quality of life but also increased the value of her home.

2. Wells Fargo: Tailored Solutions for Every Homeowner

Wells Fargo is known for its personalized approach to banking. Their HELOC offerings include options for both fixed and adjustable rates, allowing borrowers to choose the best fit for their financial situation.

John and Lisa, a young couple looking to start a family, turned to Wells Fargo for a HELOC to fund their dream home renovation. By utilizing their home equity, they created a nursery and updated their living space, setting the stage for their growing family. Wells Fargo's attentive customer service ensured they felt supported throughout the process.

3. Citibank: Innovative Technology and Competitive Features

Citibank has embraced technology to enhance the HELOC experience for its customers. Their intuitive online platform allows borrowers to manage their accounts easily and track their spending.

Meet Tom, an entrepreneur who needed capital to launch his small business. By leveraging a HELOC through Citibank, he accessed the funds he needed without the hassle of applying for a traditional business loan. The flexibility of a HELOC allowed him to withdraw only what he needed, ultimately leading to the success of his venture.

4. Chase: Comprehensive Banking Solutions

Chase is another heavyweight in the banking industry, offering a range of financial products, including HELOCs. Their application process is straightforward, and they provide personalized financial advice to help borrowers make informed decisions.

When Rachel and Mark wanted to consolidate their high-interest debt, they turned to Chase for a HELOC. By using their home equity, they paid off outstanding credit card balances, significantly reducing their monthly payments. With the help of Chase's financial advisors, they created a budget that allowed them to regain control of their finances.

5. Discover Home Equity Loans: A Fresh Perspective

Discover Home Equity Loans is known for its straightforward approach to lending. They offer clear terms and competitive rates, making it an attractive option for homeowners seeking a HELOC.

Emma, a retiree looking to fund her travels, found Discover's HELOC to be the perfect solution. With her home equity, she was able to take the trip of a lifetime, exploring destinations she had always dreamed of visiting. Discover's transparent process ensured that Emma felt confident in her financial decisions.

6. U.S. Bank: Flexibility and Support

U.S. Bank stands out for its commitment to customer service and flexibility. Their HELOC products come with various options, including interest-only payment plans and flexible borrowing limits.

When David needed funds for a major home repair, he turned to U.S. Bank. Their responsive customer support team guided him through the process, helping him secure a HELOC that fit his budget. David was able to address his home’s issues promptly, ensuring a safe and comfortable living environment for his family.

7. SoFi: A Modern Approach to Home Equity

SoFi is known for its innovative approach to finance, catering to a younger demographic. Their HELOC products offer competitive rates and no origination fees, appealing to first-time borrowers.

Kelly, a recent college graduate, decided to take the plunge into homeownership. With a HELOC from SoFi, she was able to finance her home renovations and create a space that reflected her unique style. SoFi's user-friendly platform made managing her loan a breeze, allowing her to focus on her career and personal life.

8. PNC Bank: Community-Centric Solutions

PNC Bank takes pride in its commitment to local communities. Their HELOC offerings are designed to meet the diverse needs of homeowners across different regions.

When Alex, a community organizer, wanted to renovate a community center, he turned to PNC Bank for a HELOC. The bank's community-focused approach resonated with Alex, and he was able to secure the funds needed to create a space for local events and gatherings. PNC Bank's support allowed Alex to make a meaningful impact in his neighborhood.

9. Flagstar Bank: Specializing in Home Equity

Flagstar Bank specializes in home equity products, making them a go-to lender for HELOCs. Their competitive rates and personalized service cater to a diverse clientele.

Maria, a small business owner, found herself in need of capital to expand her operations. With a HELOC from Flagstar Bank, she accessed the funds necessary to upgrade her equipment and hire additional staff. The bank's expertise in home equity lending provided Maria with the confidence she needed to take her business to the next level.

10. Credit Unions: Local Options for HELOCs

Don't overlook local credit unions when searching for a HELOC lender. Many credit unions offer competitive rates and personalized service, making them an excellent choice for borrowers.

James, a longtime member of his local credit union, decided to explore a HELOC for home improvements. With lower fees and a friendly lending team, he secured the funds needed to create his dream backyard. The credit union's community-oriented approach made the entire process feel like a collaboration, rather than a transaction.

Conclusion: Unlocking Your Financial Future

As we look ahead to 2025, the opportunities presented by HELOCs are more accessible than ever. By choosing the right lender, homeowners can unlock the potential of their home equity to achieve their financial goals. Whether it's renovating your home, consolidating debt, or funding education, the right HELOC can provide the financial flexibility you need.

In this ever-changing financial landscape, stories of individuals like Sarah, John, and Emma highlight the transformative power of HELOCs. By carefully considering your options and selecting a lender that aligns with your needs, you can embark on a journey toward financial empowerment. Remember, the key to success lies in understanding your options and making informed decisions that will lead to a brighter financial future.

Explore

Unlocking Opportunities: Easy Business Loans for Bad Credit

Crossover SUV Fuel Efficiency: The Best Picks for 2025

A Complete Guide to Applying for Student Loans & the Best Lenders in 2025

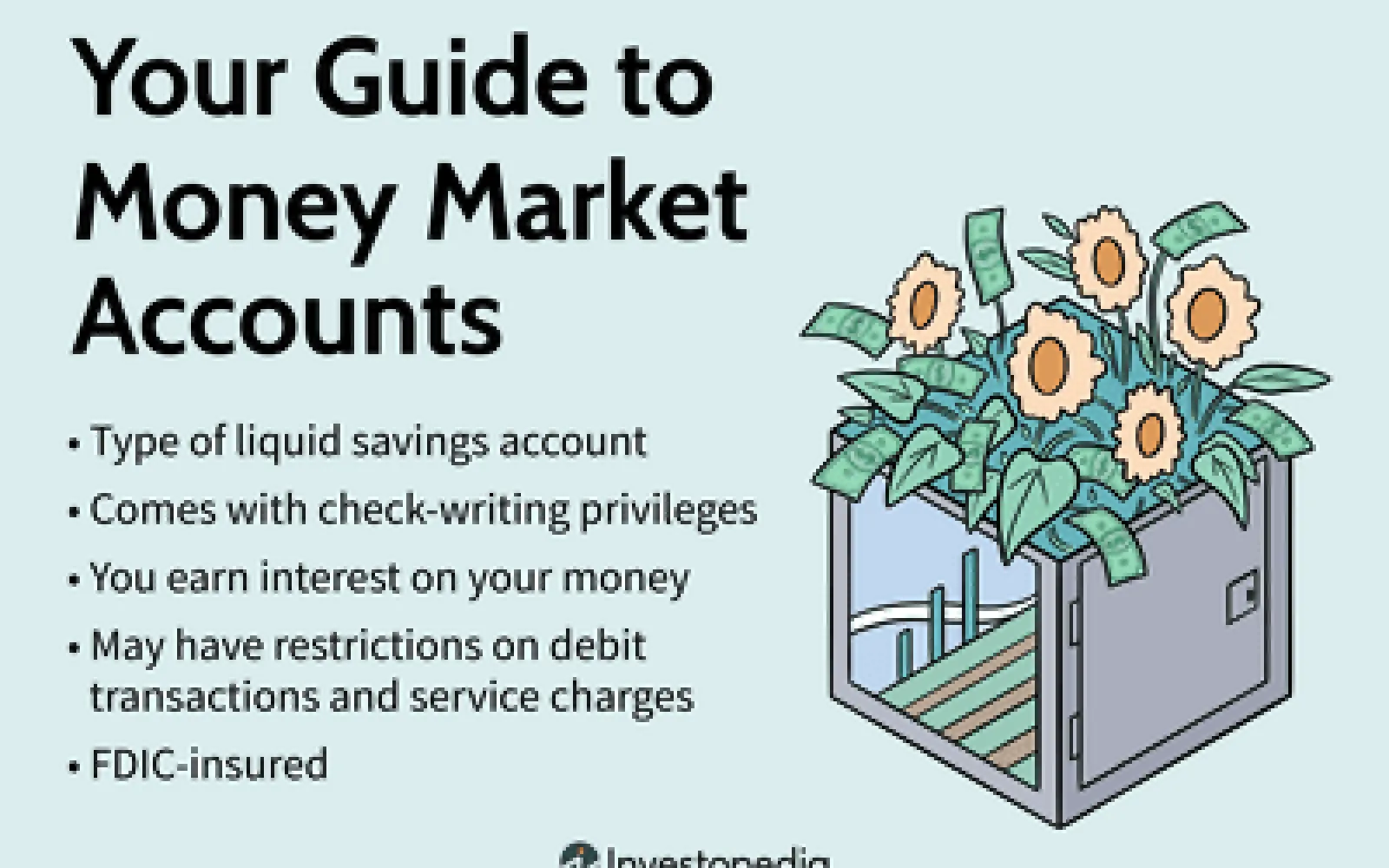

Money Market Funds: Smart Savings for Short-Term Goals

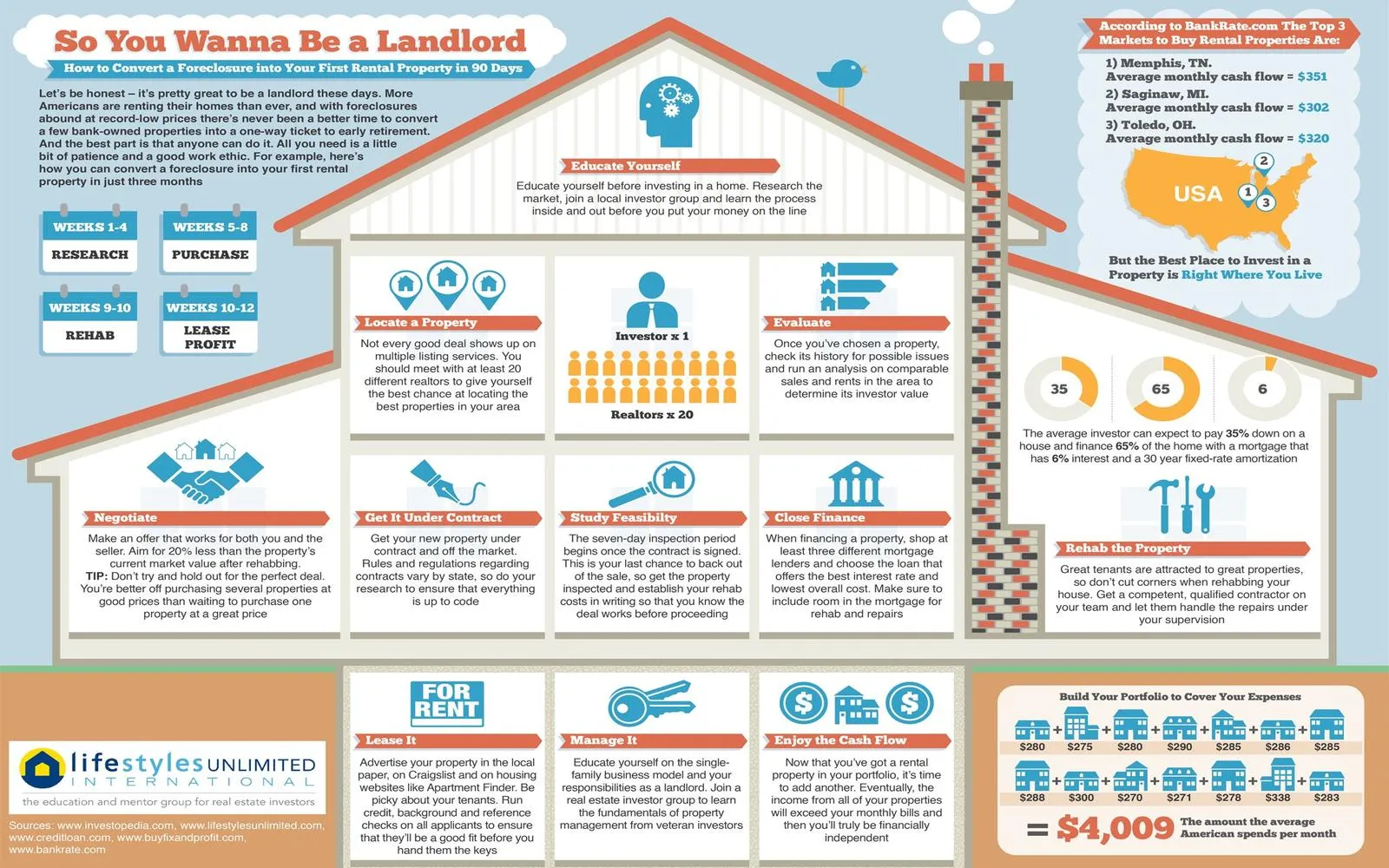

Top Real Estate Investment Opportunities in 2025: Your Guide to Profitable Ventures

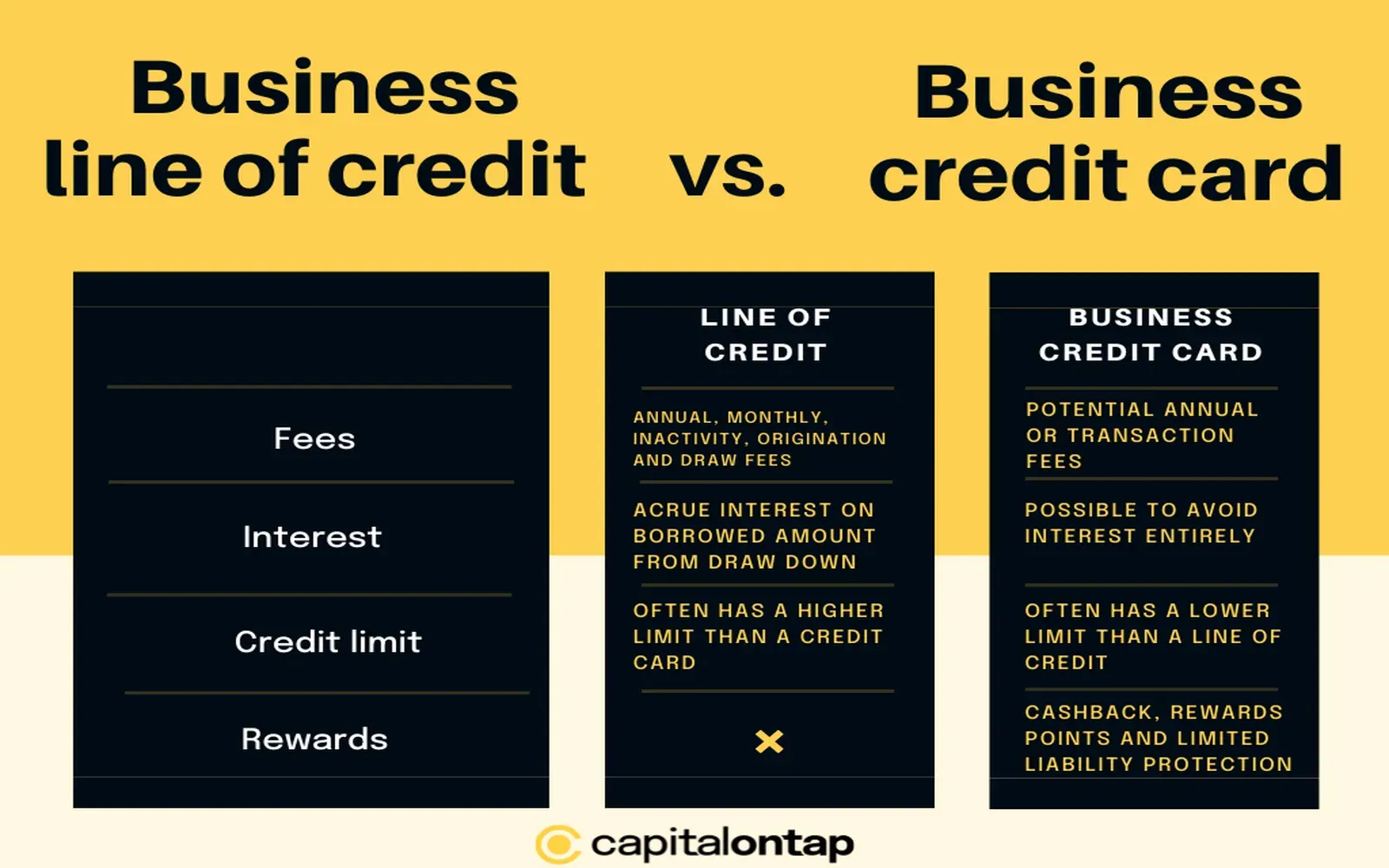

Top Business Lines of Credit for 2025: Unlocking Financial Flexibility for Your Enterprise

Top Financial Advisory Services for Businesses in 2025: Unlocking Growth and Success

Mastering Business Finance: Unlocking the Secrets to Financial Success