Unlocking Opportunities: Easy Business Loans for Bad Credit

Are you a business owner with bad credit who is struggling to secure a loan? Don't worry, because there are still options available to you. Many financial institutions and online lenders offer easy business loans for bad credit, providing an opportunity for you to access the funding you need to grow your business. These loans are designed to help businesses that may have been turned away by traditional lenders due to their credit history. By unlocking these opportunities, you can take advantage of the capital you need to invest in new equipment, expand your operations, or cover unexpected expenses. With the right loan, you can overcome the challenges of bad credit and take your business to the next level.

Understanding Bad Credit Business Loans

For many entrepreneurs, having a bad credit score can feel like a roadblock to accessing the necessary funds to start or grow their business. However, there are options available for those with less-than-perfect credit. Bad credit business loans are specifically designed to help business owners with poor credit access the capital they need to succeed.

Types of Bad Credit Business Loans

There are several types of business loans available for individuals with bad credit. One common option is a secured business loan, which requires the borrower to put up collateral, such as real estate or equipment, to secure the loan. This reduces the risk for the lender and makes it easier for those with bad credit to qualify.

Another option is an unsecured business loan, which does not require any collateral but may come with higher interest rates and stricter repayment terms. Additionally, there are alternative lenders who specialize in providing business loans to individuals with bad credit. These lenders often have more flexible eligibility requirements and faster approval processes than traditional banks.

Qualifying for a Bad Credit Business Loan

While having bad credit may make it more challenging to qualify for a business loan, it is still possible with the right approach. When applying for a bad credit business loan, lenders will typically consider factors such as the business's cash flow, revenue, and overall financial health. It's important for business owners to have a clear understanding of their financial situation and be prepared to provide documentation to support their loan application.

Additionally, having a solid business plan and demonstrating the potential for future growth can help strengthen a loan application. Lenders want to see that the business has a solid strategy for success and a clear plan for how the loan funds will be used to achieve growth and profitability.

The Benefits of Bad Credit Business Loans

One of the key benefits of bad credit business loans is the opportunity for business owners to access the capital they need to invest in their company's growth. Whether it's purchasing equipment, hiring additional staff, or expanding operations, a business loan can provide the financial resources necessary to take the business to the next level.

Additionally, successfully repaying a bad credit business loan can help improve the borrower's credit score over time. By making on-time payments and demonstrating responsible financial management, business owners can work towards building a stronger credit profile and potentially qualify for better loan terms in the future.

Challenges of Bad Credit Business Loans

While bad credit business loans can provide much-needed capital for business owners with poor credit, there are some challenges to consider. These loans often come with higher interest rates and fees, which can increase the overall cost of borrowing. Additionally, the repayment terms for bad credit business loans may be less favorable than those offered to borrowers with good credit.

It's important for business owners to carefully evaluate the terms and conditions of any loan offer and consider the potential impact on their business's financial health. Working with a trusted financial advisor or business consultant can help business owners make informed decisions about their borrowing options.

Unlocking Opportunities with Bad Credit Business Loans

Despite the challenges, bad credit business loans can open up new opportunities for entrepreneurs to achieve their business goals. By understanding the options available and taking proactive steps to improve their financial position, business owners with bad credit can access the funding they need to succeed.

Whether it's through traditional banks, alternative lenders, or specialized business loan programs, there are opportunities for individuals with bad credit to unlock the capital necessary to start or grow their business. With the right approach and a clear plan for success, bad credit does not have to be a barrier to accessing the funds needed to achieve business growth and prosperity.

Explore

Unlocking Opportunities: The Top HELOC Lenders of 2025 to Fuel Your Financial Goals

Top 2025: Cheapest Personal Loans for Bad Credit - Your Guide to Affordable Financing

Fast & Easy Payday Loans Online: Your 2025 Guide to Quick Financial Solutions

Luxury Living Made Easy: Mansions You Can Buy Now

Top Student Credit Cards for 2025: Unlock Financial Freedom and Build Credit Wisely

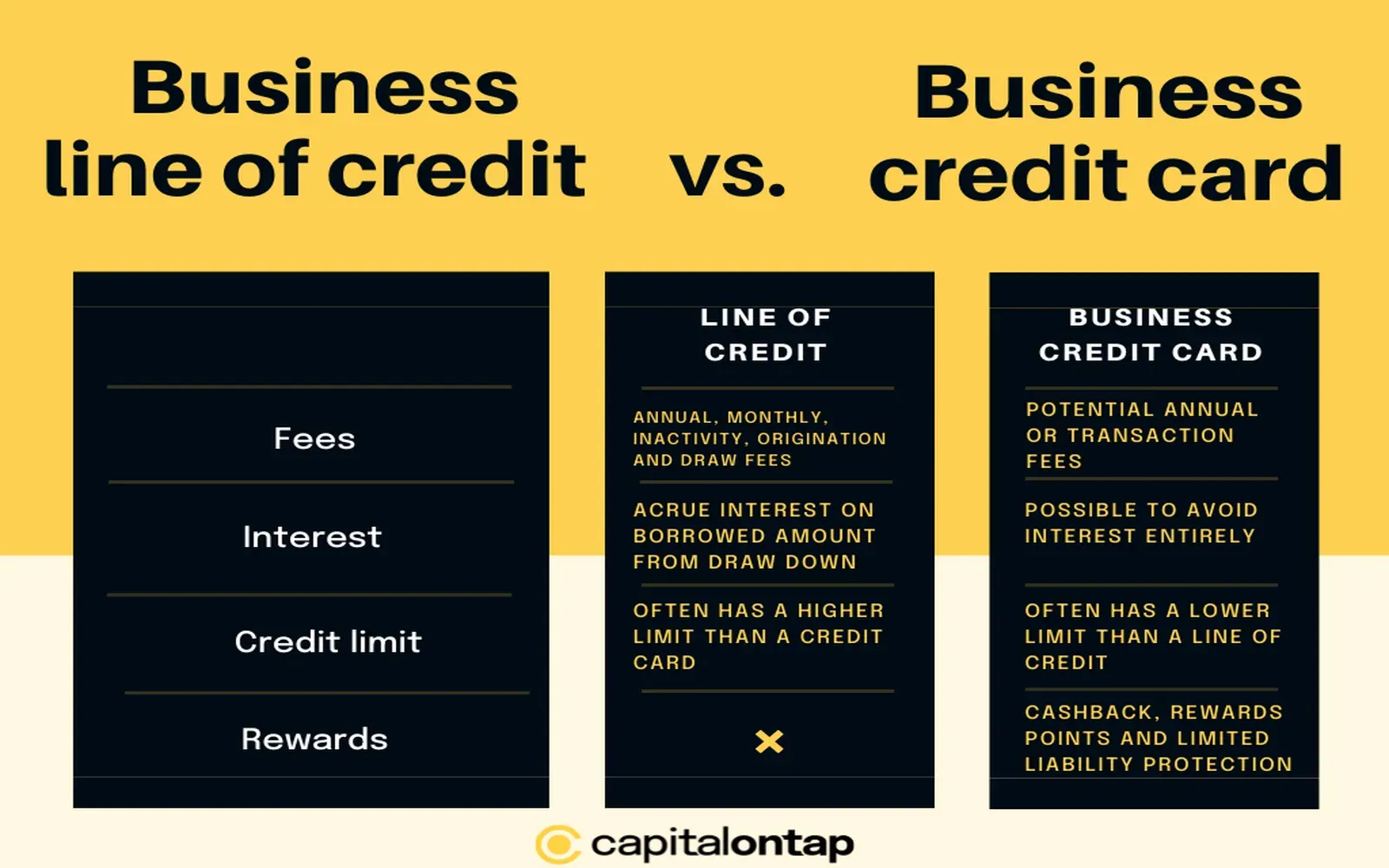

Top Business Lines of Credit for 2025: Unlocking Financial Flexibility for Your Enterprise

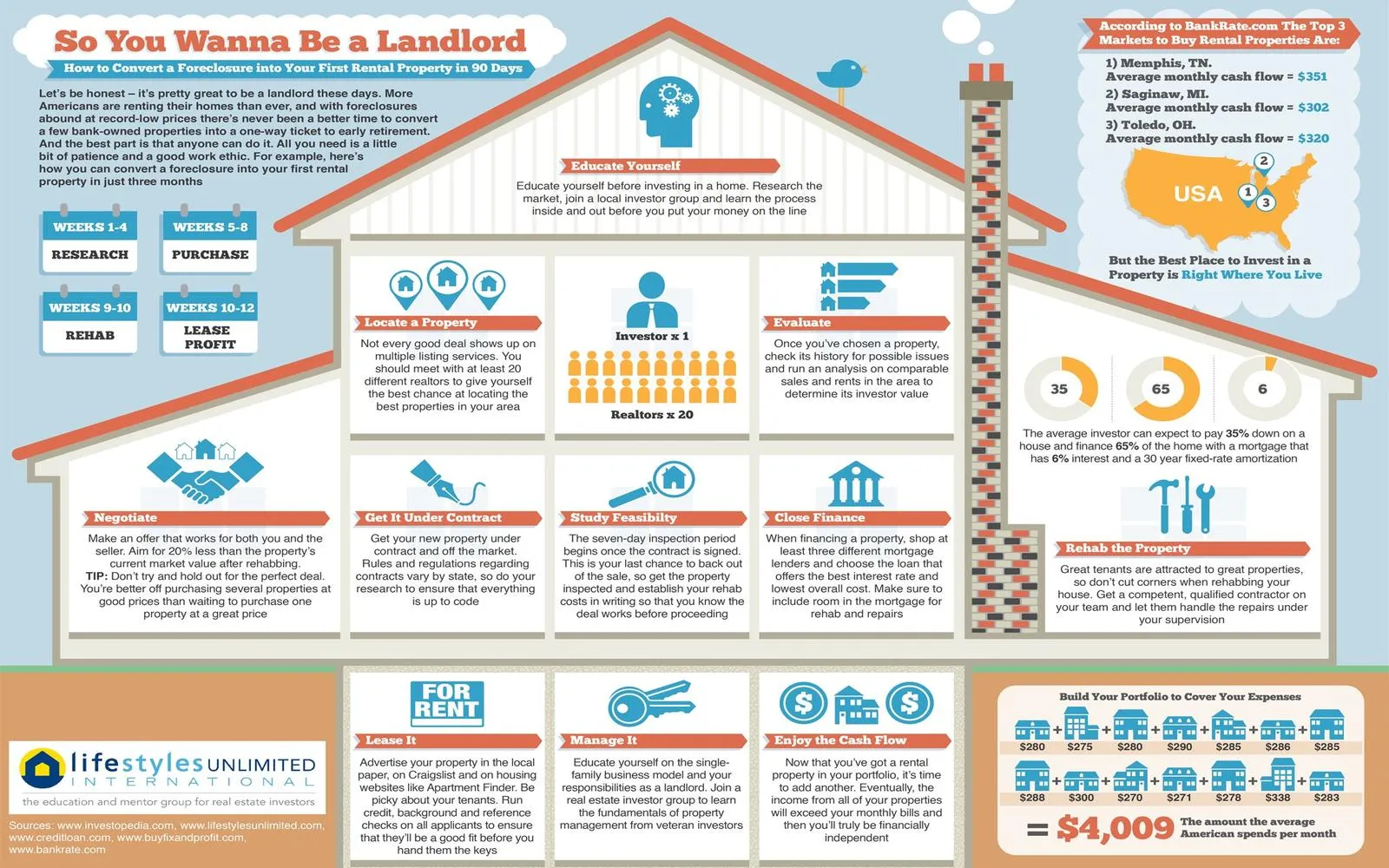

Top Real Estate Investment Opportunities in 2025: Your Guide to Profitable Ventures

Top Business Loans for Women Entrepreneurs in 2025: Unlock Your Potential and Grow Your Business